South Korea Bancassurance Market Size, Share, Trends and Forecast by Product Type, Model Type, and Region, 2025-2033

South Korea Bancassurance Market Overview:

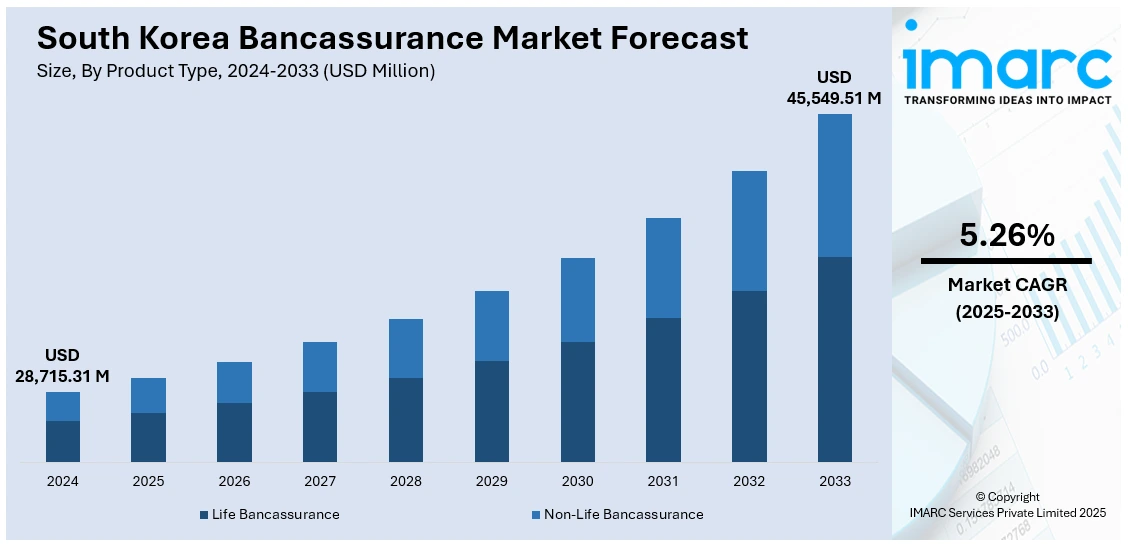

The South Korea bancassurance market size reached USD 28,715.31 Million in 2024. Looking forward, the market is projected to reach USD 45,549.51 Million by 2033, exhibiting a growth rate (CAGR) of 5.26% during 2025-2033. The market is driven by regulatory reforms and structured distribution frameworks. Aging demographics and rising healthcare costs are fueling demand for retirement, life, and health products, strengthening bancassurance’s role in financial security. Digital innovation is reshaping distribution, with AI-driven platforms and mobile-first solutions enhancing accessibility and personalization, further augmenting the South Korea bancassurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 28,715.31 Million |

| Market Forecast in 2033 | USD 45,549.51 Million |

| Market Growth Rate 2025-2033 | 5.26% |

South Korea Bancassurance Market Trends:

Regulatory Support and Structured Distribution Channels

South Korea’s bancassurance market has developed under a strong regulatory framework that ensures transparency, consumer protection, and balanced growth between banks and insurers. The Financial Supervisory Service (FSS) has progressively expanded bancassurance permissions, enabling banks to distribute an increasingly wide range of insurance products. The Financial Services Commission (FSC) and Financial Supervisory Service (FSS) decided in January 2025 to relax long-standing sales ratio restrictions for bancassurance products. Life insurance can now comprise up to 33% of bancassurance sales (previously 25%) and non-life to 50% or 75% depending on provider participation. A new regulatory sandbox allows this change for at least two years, aiming to boost consumer choice and bancassurance competitiveness. Leading banks such as KB Kookmin, Shinhan, and Woori have built sophisticated distribution networks with insurers like Samsung Life, Hanwha Life, and Kyobo Life. This structured approach has ensured that bancassurance does not operate merely as a sales channel but as a comprehensive service integrated into financial planning. By setting clear guidelines on disclosures, product suitability, and customer service, regulators have helped banks strengthen customer trust and improve adoption rates. The channel now supports diverse offerings, including life insurance, health coverage, retirement products, and wealth management-linked policies. With South Korea’s population characterized by a high degree of financial literacy, customers increasingly value the credibility and accessibility of bancassurance solutions. As a result, bancassurance has secured a pivotal role within the broader financial ecosystem, reinforcing the outlook for sustained South Korea bancassurance market growth in the years ahead.

To get more information on this market, Request Sample

Aging Demographics and Retirement-Oriented Demand

South Korea has one of the fastest-aging population globally, with declining birth rates and increasing life expectancy fueling demand for retirement and health-focused financial solutions. This demographic shift has made bancassurance an essential channel for distributing life insurance, annuities, and long-term healthcare products. Banks play a critical role in this dynamic by leveraging their existing customer relationships to provide tailored solutions that address retirement preparedness and medical expense management. Given that older consumers often trust banks more than independent insurance agents, bancassurance has become a preferred distribution model for this group. At the same time, younger professionals are also engaging with bancassurance products, particularly savings-linked insurance policies that combine protection with wealth accumulation. This dual generational demand strengthens the resilience of bancassurance, ensuring continued expansion across different customer segments. In addition, government initiatives that emphasize retirement savings and healthcare security further align with bancassurance’s offerings, making it a critical partner in addressing demographic challenges. These demographic drivers are positioning bancassurance as an indispensable pillar of South Korea’s financial planning landscape.

Digital Banking Ecosystem and Consumer Innovation

South Korea’s advanced digital infrastructure has created fertile ground for innovations in bancassurance. Banks and insurers are leveraging mobile platforms, AI-driven analytics, and big data to deliver personalized and user-friendly insurance solutions. Consumers, who are highly accustomed to digital banking, now expect insurance products to be equally seamless, transparent, and accessible through mobile apps and online banking portals. Insurers like Samsung Life and Hanwha Life have partnered with banks to launch integrated platforms that allow real-time policy management, claims processing, and premium payments. These innovations are particularly appealing to tech-savvy millennials and younger demographics, who prefer convenience-driven financial solutions. By using predictive analytics, banks can tailor product recommendations to customer lifestyles, enhancing conversion rates and loyalty. Furthermore, digital bancassurance reduces operational costs while broadening accessibility to underserved segments, creating a more inclusive financial ecosystem. The combination of South Korea’s technological readiness, consumer sophistication, and collaborative innovation between banks and insurers is reshaping the market, ensuring that digital transformation remains a key driver of competitiveness and expansion.

South Korea Bancassurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and model type.

Product Type Insights:

- Life Bancassurance

- Non-Life Bancassurance

The report has provided a detailed breakup and analysis of the market based on the product type. This includes life bancassurance and non-life bancassurance.

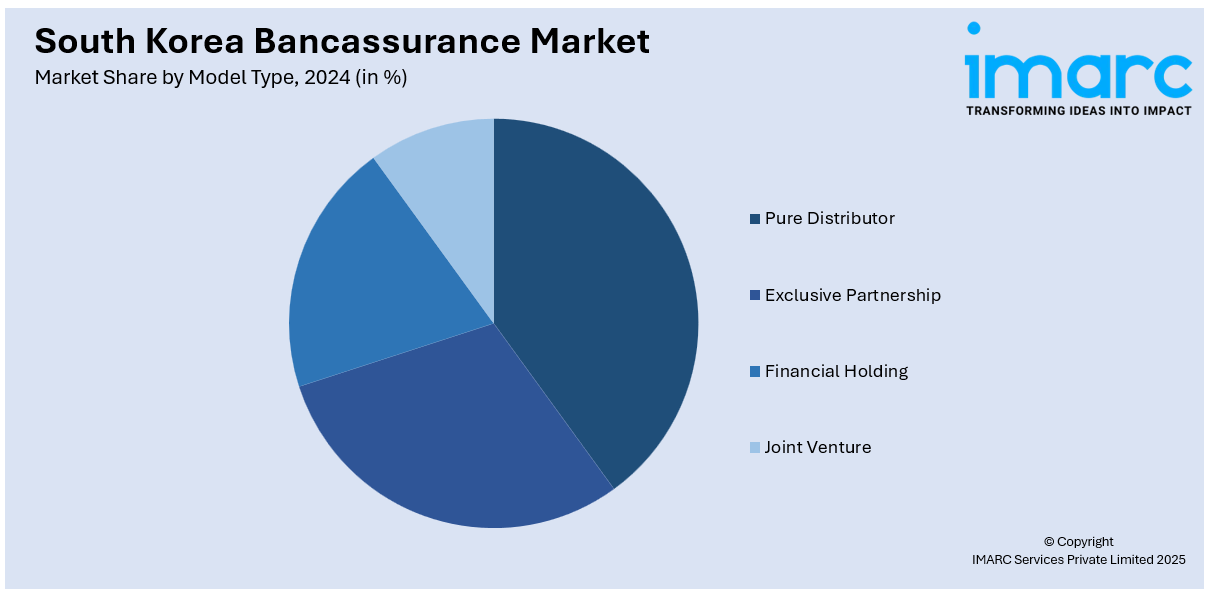

Model Type Insights:

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

The report has provided a detailed breakup and analysis of the market based on the model type. This includes pure distributor, exclusive partnership, financial holding, and joint venture.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Bancassurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Life Bancassurance, Non-Life Bancassurance |

| Model Types Covered | Pure Distributor, Exclusive Partnership, Financial Holding, Joint Venture |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea bancassurance market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea bancassurance market on the basis of product type?

- What is the breakup of the South Korea bancassurance market on the basis of model type?

- What is the breakup of the South Korea bancassurance market on the basis of region?

- What are the various stages in the value chain of the South Korea bancassurance market?

- What are the key driving factors and challenges in the South Korea bancassurance market?

- What is the structure of the South Korea bancassurance market and who are the key players?

- What is the degree of competition in the South Korea bancassurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea bancassurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea bancassurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea bancassurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)