South Korea Battery Recycling Market Size, Share, Trends and Forecast by Type, Source, End Use, Material, and Region, 2025-2033

South Korea Battery Recycling Market Overview:

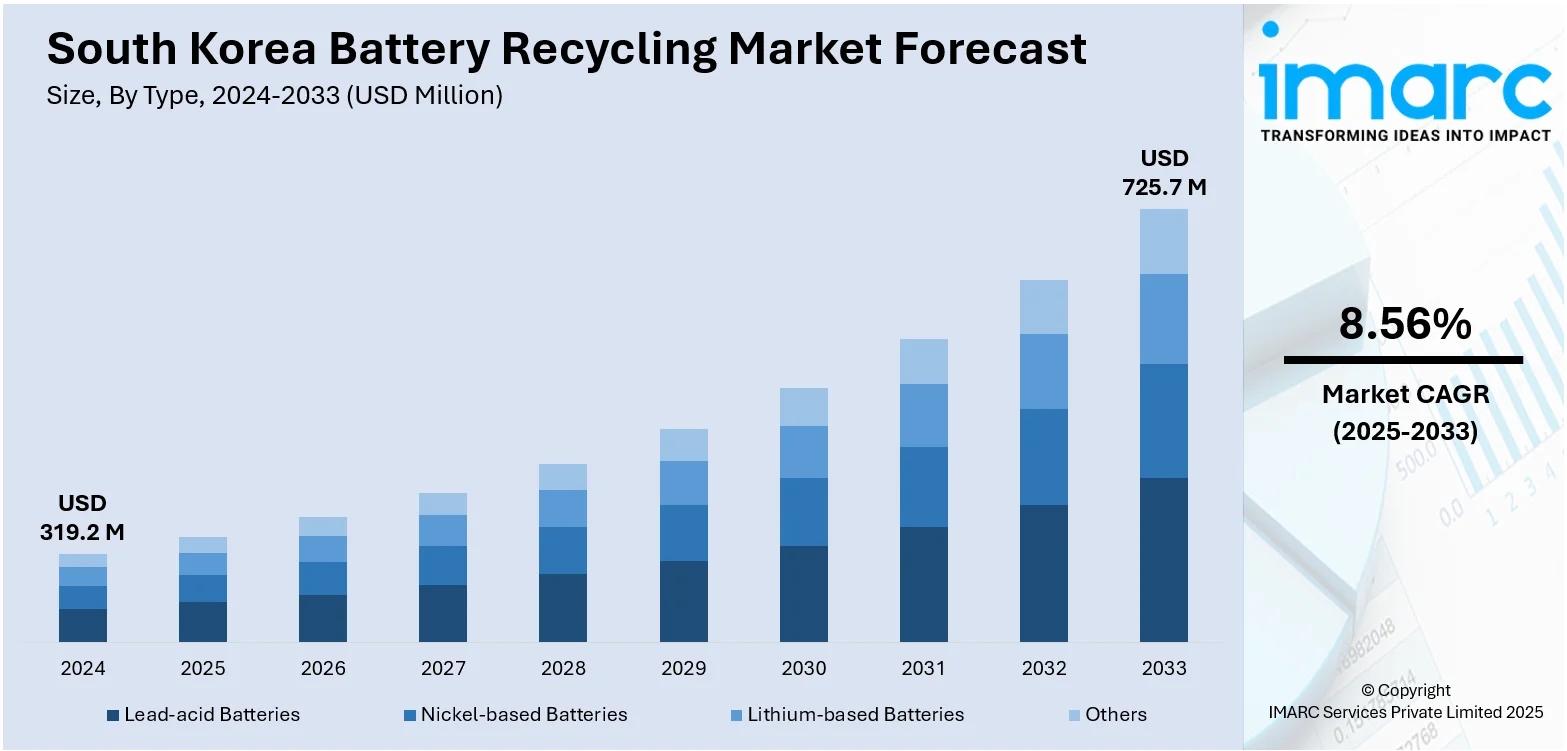

The South Korea battery recycling market size reached USD 319.2 Million in 2024. The market is projected to reach USD 725.7 Million by 2033, exhibiting a growth rate (CAGR) of 8.56% during 2025-2033. The market is expanding due to the increasing volume of end-of-life electric vehicle batteries and stronger environmental regulations. Additionally, advancements in material recovery technologies and growing industry partnerships continue to support South Korea battery recycling market share across both the automotive and energy storage sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 319.2 Million |

| Market Forecast in 2033 | USD 725.7 Million |

| Market Growth Rate 2025-2033 | 8.56% |

South Korea Battery Recycling Market Trends:

EV Expansion Fuels Recycling Demand

The rapid growth of electric vehicles (EVs) is reshaping the South Korea battery recycling market growth landscape. As more consumers and fleet operators switch to EVs, the volume of end-of-life batteries is increasing steadily. This shift is creating an urgent need for structured recycling systems that can handle lithium-ion batteries safely and efficiently. Manufacturers are also under rising pressure to reduce their reliance on imported raw materials such as lithium, cobalt, and nickel—metals that are critical for battery production. Recycling spent batteries helps recover these materials, lowering production costs and promoting supply chain stability. In response to this need, several Korean companies are expanding their recycling operations and investing in advanced technologies that improve recovery rates. For example, recent announcements include the construction of new hydrometallurgical facilities that can extract valuable metals more cleanly and with higher efficiency. Additionally, automotive firms are entering long-term partnerships with recyclers to build closed-loop systems that feed recovered materials back into new battery production. This trend not only supports economic goals but also aligns with South Korea’s environmental targets to reduce waste and greenhouse gas emissions. As EV adoption accelerates, battery recycling will play a central role in sustaining the industry’s growth.

To get more information on this market, Request Sample

Policies and Technology Shape the Sector

Stronger environmental regulations and advances in recycling methods are significantly shaping the battery recycling market in South Korea. Policymakers are enforcing stricter rules on the collection and processing of used batteries from both vehicles and electronic devices. These rules are encouraging businesses to adopt safer and more effective recycling practices. At the same time, innovations in recycling techniques—such as automation and chemical refinement—are making it possible to recover a greater percentage of critical materials. This has made battery recycling more appealing from both an environmental and economic standpoint. Companies are also finding new uses for retired batteries, especially in stationary energy storage systems. A recent trend involves using old EV batteries for solar power storage in remote or industrial areas, extending their lifespan and reducing waste. Meanwhile, South Korea’s goal to become a leader in global battery production is pushing local companies to secure raw materials domestically. This is boosting investments in research and development, particularly in next-generation recycling technologies. Collaborations between startups, universities, and major corporations are accelerating progress and helping commercialize new solutions. These developments are positioning South Korea as a strong player in the circular battery economy, while also supporting sustainability goals across sectors.

South Korea Battery Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, source, end use, and material.

Type Insights:

- Lead-acid Batteries

- Nickel-based Batteries

- Lithium-based Batteries

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes lead-acid batteries, nickel-based batteries, lithium-based batteries, and others.

Source Insights:

- Industrial

- Automotive

- Consumer Products

- Electronic Appliances

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes industrial, automotive, consumer products, electronic appliances, and others.

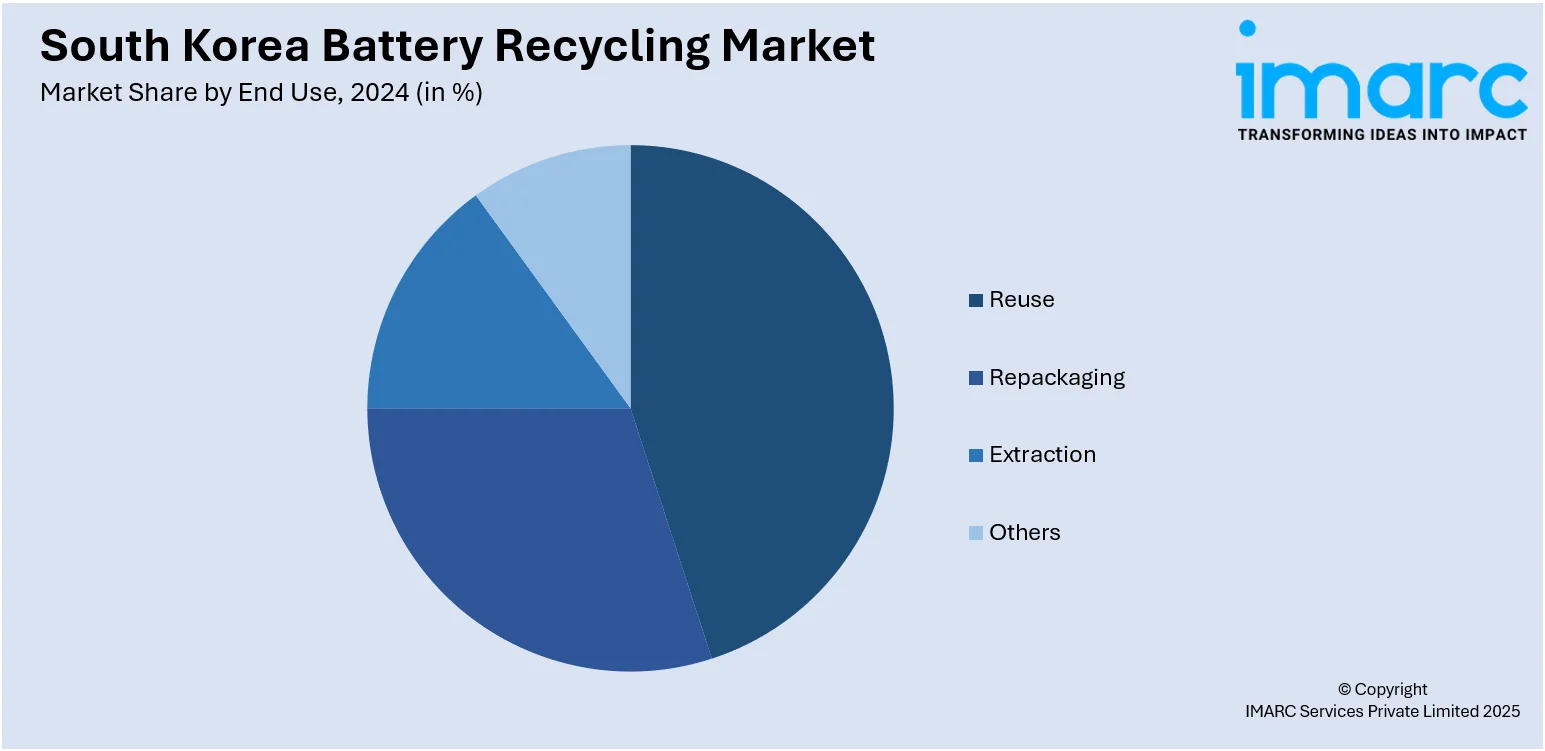

End Use Insights:

- Reuse

- Repackaging

- Extraction

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes reuse, repackaging, extraction, and others.

Material Insights:

- Manganese

- Iron

- Lithium

- Nickel

- Cobalt

- Lead

- Aluminium

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes manganese, iron, lithium, nickel, cobalt, lead, aluminium, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Battery Recycling Market News:

- April 2025: LG Energy Solution partnered with France’s Derichebourg to launch a battery recycling joint venture in Europe. This move expanded South Korea’s battery recycling reach, improved raw material recovery, and strengthened supply chain stability, positively influencing market development and regulatory readiness.

- July 2024: The South Korean government introduced a battery recycling policy mandating EV battery performance evaluations from 2027. This initiative promoted reuse, remanufacturing, and material recovery, significantly enhancing battery value chains and supporting affordability, sustainability, and compliance with upcoming global recycling standards.

South Korea Battery Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Lead-acid Batteries, Nickel-based Batteries, Lithium-based Batteries, Others |

| Sources Covered | Industrial, Automotive, Consumer Products, Electronic Appliances, Others |

| End Uses Covered | Reuse, Repackaging, Extraction, Others |

| Materials Covered | Manganese, Iron, Lithium, Nickel, Cobalt, Lead, Aluminium, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea battery recycling market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea battery recycling market on the basis of type?

- What is the breakup of the South Korea battery recycling market on the basis of source?

- What is the breakup of the South Korea battery recycling market on the basis of end use?

- What is the breakup of the South Korea battery recycling market on the basis of material?

- What is the breakup of the South Korea battery recycling market on the basis of region?

- What are the various stages in the value chain of the South Korea battery recycling market?

- What are the key driving factors and challenges in the South Korea battery recycling market?

- What is the structure of the South Korea battery recycling market and who are the key players?

- What is the degree of competition in the South Korea battery recycling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea battery recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea battery recycling market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea battery recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive type and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)