South Korea Big Data Security Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Technology, End Use Industry, and Region, 2026-2034

South Korea Big Data Security Market Overview:

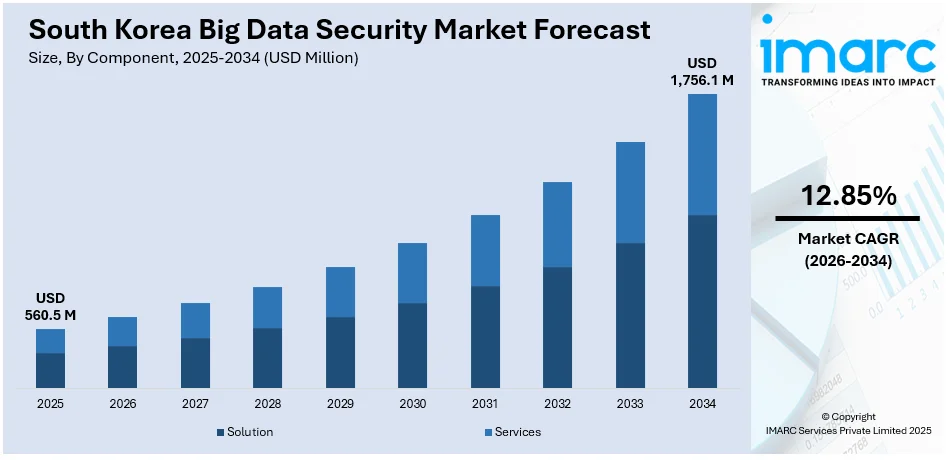

The South Korea big data security market size reached USD 560.5 Million in 2025. The market is projected to reach USD 1,756.1 Million by 2034, exhibiting a growth rate (CAGR) of 12.85% during 2026-2034. The market is propelled by the rising volume of sensitive data generated across sectors such as finance, healthcare, and government, necessitating robust security frameworks. Additionally, the increasing frequency and sophistication of cyberattacks have compelled organizations to invest heavily in advanced big data security solutions to safeguard digital assets and ensure regulatory compliance. Moreover, the nation's strong digital infrastructure and government-led initiatives to enhance cybersecurity resilience are further augmenting the South Korea big data security market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 560.5 Million |

| Market Forecast in 2034 | USD 1,756.1 Million |

| Market Growth Rate 2026-2034 | 12.85% |

South Korea Big Data Security Market Trends:

Rise in Adoption of Cloud-Based Big Data Security

Increased movement of South Korean businesses towards cloud infrastructure has had a major influence on the adoption of cloud-based big data security. With organizations moving their workloads and data storage to public and hybrid cloud environments, securing intricate data streams and dynamic access points has become essential. Cloud providers are increasingly incorporating sophisticated encryption, identity and access management (IAM), and behavioral analytics into their platforms to mitigate emerging security threats. Furthermore, the nation's robust 5G infrastructure and digital transformation programs facilitate the speedy deployment of scalable cloud security solutions. Besides, adherence to regional data protection legislation, like the Personal Information Protection Act (PIPA), requires tight controls on sensitive data held or processed in cloud environments. The shift towards remote work and distributed teams post-pandemic also increases data breach concerns, making cloud-native security an integral part of enterprise cybersecurity strategies. This trend is supported by growing partnerships among South Korean companies and international cybersecurity vendors, which propel the use of sophisticated, AI-driven, and automated cloud security architectures.

To get more information on this market Request Sample

Artificial Intelligence and Machine Learning Integration in Security Architectures

The integration of artificial intelligence (AI) and machine learning (ML) technologies for improving threat detection and response is positively impacting the South Korea big data security market growth. As cyberattacks become more targeted and complex, traditional rule-based security systems are proving insufficient to keep pace with sophisticated attack vectors. AI and ML-driven systems enable real-time monitoring, pattern recognition, and anomaly detection across vast and diverse datasets, helping organizations to identify and mitigate potential threats proactively. Moreover, in industries like finance and telecommunications, where data transactions in high volumes are the norm, AI-powered security platforms provide predictive analytics and automated threat response that minimize incident response time and human error. Also, the government has been vigorously promoting AI innovation through initiatives such as the Digital New Deal, which encourages local cybersecurity vendors to invest in smart security technologies even more. This trend also follows international practices in adaptive security architecture, thereby making South Korean businesses more agile and secure against evolving cyber threats.

Increased Focus on Data Privacy and Regulatory Compliance

The regulatory landscape of South Korea has also tightened around data privacy and cybersecurity. With the enforcement of revised Personal Information Protection Act (PIPA) and sector-specific rules, organizations must establish end-to-end encryption, data masking, consent management, and ongoing risk assessments for all personal and sensitive information processed through big data platforms. Failure to comply can result in heavy fines, brand damage, and business disruptions, which is making businesses invest significantly in compliance-based security infrastructure. Notably, on July 4, 2025, South Korea’s Ministry of Science and ICT fined SK Telecom and mandated enhancements to its data security systems after a malware-driven breach exposed nearly 27 Million user record. Additionally, South Korea's alignment with global data protection standards like GDPR and ISO/IEC 27001 has spurred multinational firms operating in the nation to enhance their data security infrastructures. The focus on privacy-by-design principles has also fueled the incorporating of secure development practices and privacy-enhancing technologies into the lifecycle of big data. This regulatory push is making suppliers develop compliance-focused security products that are suited to the South Korean market environment.

South Korea Big Data Security Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component, deployment mode, organization size, technology, and end use industry.

Component Insights:

- Solution

- Data Discovery and Classification

- Data Authorization and Access

- Data Encryption, Tokenization and Masking

- Data Auditing and Monitoring

- Data Governance and Compliance

- Data Security Analytics

- Data Backup and Recovery

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution (data discovery and classification, data authorization and access, data encryption, tokenization and masking, data auditing and monitoring, data governance and compliance, data security analytics, and data backup and recovery) and services.

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium-sized enterprises and large enterprises.

Technology Insights:

- Identity and Access Management

- Security Information and Event Management

- Intrusion Detection System

- Unified Threat Management

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes identity and access management, security information and event management, intrusion detection system, unified threat management, and others.

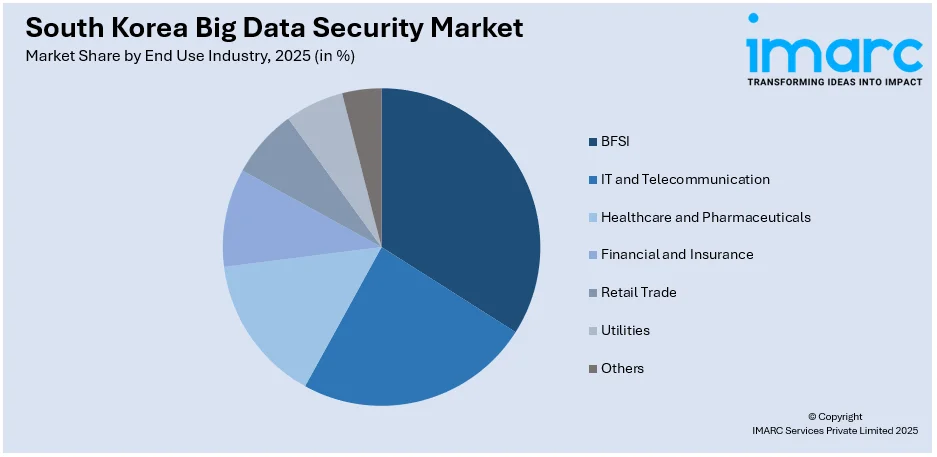

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- IT and Telecommunication

- Healthcare and Pharmaceuticals

- Financial and Insurance

- Retail Trade

- Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes BFSI, IT and telecommunication, healthcare and pharmaceuticals, financial and insurance, retail trade, utilities, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Big Data Security Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Technologies Covered | Identity and Access Management, Security Information and Event Management, Intrusion Detection System, Unified Threat Management, Others |

| End Use Industries Covered | BFSI, IT and Telecommunication, Healthcare and Pharmaceuticals, Financial and Insurance, Retail Trade, Utilities, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea big data security market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea big data security market on the basis of component?

- What is the breakup of the South Korea big data security market on the basis of deployment mode?

- What is the breakup of the South Korea big data security market on the basis of organization size?

- What is the breakup of the South Korea big data security market on the basis of technology?

- What is the breakup of the South Korea big data security market on the basis of end use industry?

- What is the breakup of the South Korea big data security market on the basis of region?

- What are the various stages in the value chain of the South Korea big data security market?

- What are the key driving factors and challenges in the South Korea big data security market?

- What is the structure of the South Korea big data security market and who are the key players?

- What is the degree of competition in the South Korea big data security market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea big data security market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea big data security market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea big data security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)