South Korea Biopesticides Market Size, Share, Trends and Forecast by Type, Source, Mode of Application, Crop Type, and Region, 2026-2034

South Korea Biopesticides Market Overview:

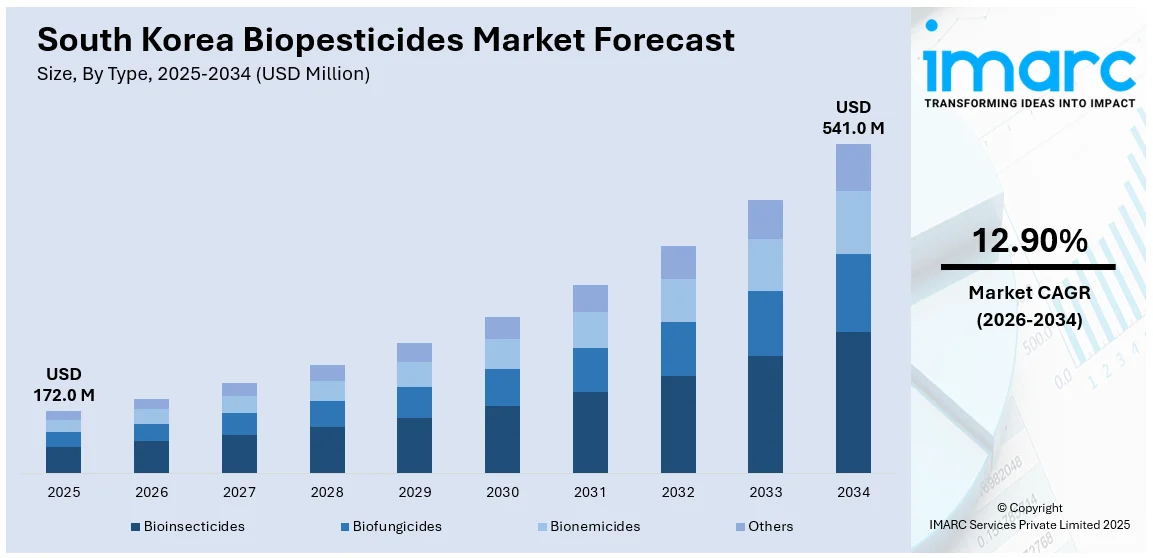

The South Korea biopesticides market size reached USD 172.0 Million in 2025. Looking forward, the market is projected to reach USD 541.0 Million by 2034, exhibiting a growth rate (CAGR) of 12.90% during 2026-2034. The market is driven by national regulations favoring residue-free pest control and government-backed GAP compliance measures. The integration of biopesticides with smart farming technologies, including AI-powered diagnostics and precision spraying, is increasing operational efficiency. Rising consumer and export demand for chemical-free produce is further augmenting the South Korea biopesticides market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 172.0 Million |

| Market Forecast in 2034 | USD 541.0 Million |

| Market Growth Rate 2026-2034 | 12.90% |

South Korea Biopesticides Market Trends:

Regulatory Framework Promoting Sustainable Crop Protection

The South Korean government has introduced stringent policies to reduce the dependency on synthetic pesticides, reinforcing a national commitment to environmental sustainability and food safety. These policies support the integration of biopesticides into conventional farming practices, particularly through initiatives under the Good Agricultural Practices (GAP) certification program. Farmers are increasingly encouraged to transition toward residue-free pest control methods to meet both domestic and international market requirements. Registration procedures for biopesticides have been streamlined, and financial support is extended to encourage adoption. In addition, the Ministry of Agriculture, Food and Rural Affairs (MAFRA) actively promotes eco-friendly alternatives through technical training, public awareness, and demonstration projects. These reforms are particularly relevant to high-risk crops such as fruits and leafy vegetables, where chemical residue regulations are most stringent. The domestic agriculture sector is undergoing a systemic change as compliance standards prioritize long-term soil health, pollinator safety, and minimal ecological disruption. This transition is driving a gradual yet consistent shift from synthetic chemicals to biological agents in pest control. These developments are central to the current trajectory of South Korea biopesticides market growth.

To get more information on this market Request Sample

Integration with Smart Farming and Digital Agriculture Systems

South Korea’s national strategy for agricultural innovation centers on smart farming, a sector that is inherently aligned with the application logic of biopesticides. Precision agriculture systems, encompassing satellite imaging, drone spraying, IoT-based environmental monitoring, and AI-based pest forecasting, optimize the use of targeted biological control agents. These technologies are particularly well-suited to the time-sensitive and condition-specific requirements of microbial pesticides, biofungicides, and pheromone-based insect disruptors. As biopesticides are often more effective under specific climatic or pest-pressure conditions, digital platforms offer real-time diagnostics and application recommendations to maximize their performance. Government investments in smart agriculture pilot zones and automation subsidies have made these solutions increasingly accessible to commercial farms and greenhouse operators. Integration of smart tools is especially prevalent in protected cultivation environments such as vertical farms and high-tech greenhouses, where pest outbreaks can be quickly isolated and controlled. This digitization of farming enhances product traceability, compliance, and operational efficiency. The compatibility of biopesticides with smart systems reduces misapplication risks and improves economic feasibility, reinforcing their role in modern pest management strategies. This synergy between digital technologies and biopesticide deployment is reshaping value propositions and long-term scalability in the market.

Rising Demand for Residue-Free Produce in Domestic and Export Markets

South Korean consumers are increasingly prioritizing food safety and environmental transparency, which has driven demand for agricultural products cultivated without chemical residues. This shift is mirrored by a corresponding rise in biopesticide usage, particularly among fruit and vegetable producers supplying high-end retail, school lunch programs, and export markets such as Japan and China. Supermarkets and organic retailers now require stricter certification standards, creating supply chain pressure on farmers to use biological inputs. Additionally, export-oriented growers face stringent Maximum Residue Limits (MRLs), and biopesticides help ensure compliance without compromising yield. Greenhouse-grown produce, a segment with strong export orientation, is seeing rapid biopesticide adoption due to its enclosed, high-input nature, where pest control precision is critical. Consumer education campaigns, certification programs, and traceability initiatives have also expanded public awareness of the environmental and health benefits of biopesticide-treated crops. These factors have encouraged agro-input suppliers to scale production of biological solutions, while startups and cooperatives are emerging to meet niche demand. Market responsiveness to residue-free produce is a powerful driver that is helping biopesticides evolve from alternative inputs to essential agricultural tools across key value chains.

South Korea Biopesticides Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, source, mode of application, and crop type.

Type Insights:

- Bioinsecticides

- Biofungicides

- Bionemicides

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bioinsecticides, biofungicides, bionemicides, and others.

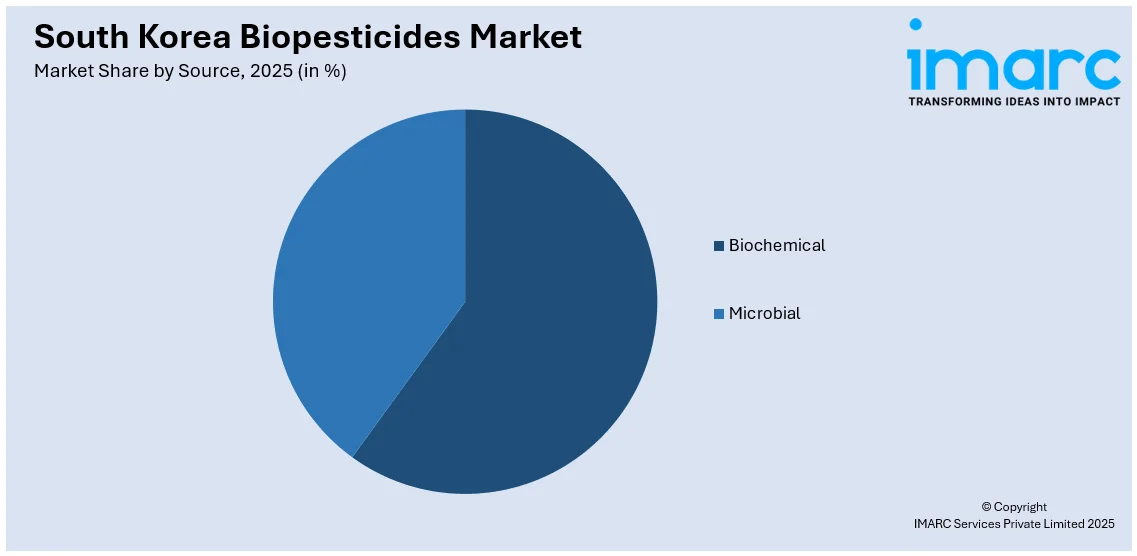

Source Insights:

Access the comprehensive market breakdown Request Sample

- Biochemical

- Microbial

The report has provided a detailed breakup and analysis of the market based on the source. This includes biochemical and microbial.

Mode of Application Insights:

- Foliar Application

- Seed Treatment

- Soil Treatment

The report has provided a detailed breakup and analysis of the market based on the mode of application. This includes foliar application, seed treatment, and soil treatment.

Crop Type Insights:

- Cereals

- Oilseeds

- Fruits and Vegetables

- Others

The report has provided a detailed breakup and analysis of the market based on the crop type. This includes cereals, oilseeds, fruits and vegetables, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Biopesticides Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bioinsecticides, Biofungicides, Bionemicides, Others |

| Sources Covered | Biochemical, Microbial |

| Mode of Applications Covered | Foliar Application, Seed Treatment, Soil Treatment |

| Crop Types Covered | Cereals, Oilseeds, Fruits and Vegetables, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea biopesticides market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea biopesticides market on the basis of type?

- What is the breakup of the South Korea biopesticides market on the basis of source?

- What is the breakup of the South Korea biopesticides market on the basis of mode of application?

- What is the breakup of the South Korea biopesticides market on the basis of crop type?

- What is the breakup of the South Korea biopesticides market on the basis of region?

- What are the various stages in the value chain of the South Korea biopesticides market?

- What are the key driving factors and challenges in the South Korea biopesticides market?

- What is the structure of the South Korea biopesticides market and who are the key players?

- What is the degree of competition in the South Korea biopesticides market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea biopesticides market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea biopesticides market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea biopesticides industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)