South Korea Biosimilar Market Size, Share, Trends and Forecast by Molecule, Indication, Manufacturing Type, and Region, 2025-2033

South Korea Biosimilar Market Overview:

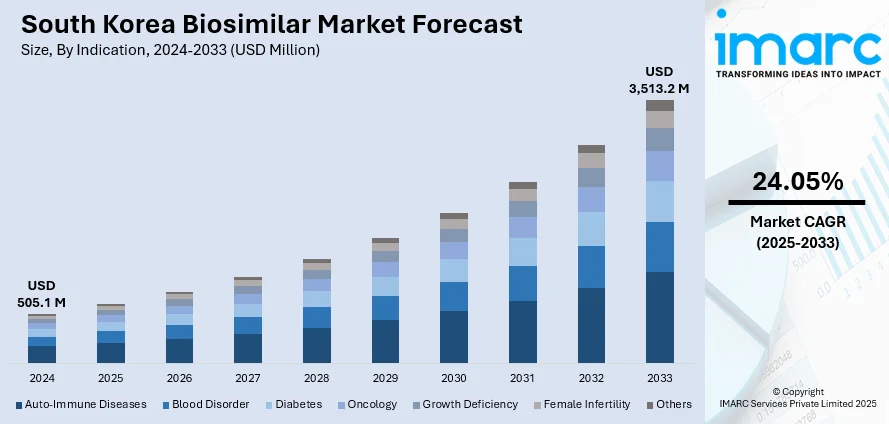

The South Korea biosimilar market size reached USD 505.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,513.2 Million by 2033, exhibiting a growth rate (CAGR) of 24.05% during 2025-2033. The market is driven by supportive government policies and streamlined regulatory regimes enabling biosimilar access. Robust domestic R&D and GMP-ready manufacturing capacity strengthen local development and export potential. The increasing acceptance of biosimilars among clinicians, payers, and patients is further augmenting the South Korea biosimilar market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 505.1 Million |

| Market Forecast in 2033 | USD 3,513.2 Million |

| Market Growth Rate 2025-2033 | 24.05% |

South Korea Biosimilar Market Trends:

Government Initiatives and Policy Support

South Korea’s government has established a structured policy framework to promote biosimilars as a means to enhance healthcare affordability and sustainability. Incentive programs encourage local manufacturers to develop biosimilar versions of high-cost biologics nearing patent expiration. Regulatory pathways have been optimized for faster, cost-effective market entry, with streamlined approval processes based on reference product comparability and clinical bridging studies. Public hospitals and insurance schemes actively include biosimilars in their formularies, enabled by reimbursement mechanisms that favor equivalent biosimilar pricing tiers. The Ministry of Food and Drug Safety (MFDS) has published clear guidelines for quality, safety, and interchangeability, helping producers align with international standards and build clinician confidence. By mandating substitution protocols and incentivizing hospital use, policy drivers ensure market penetration. Government-funded R&D grants, biocluster development programs, and public–private partnerships further support localized manufacturing capability. On December 10, 2024, South Korea granted approval to Celltrion’s denosumab biosimilars, Stavoklone and Oseni Belt, which reference Prolia and Xgeva for treating osteoporosis and cancer-related bone metastasis. These biosimilars, backed by phase 3 clinical trial results, are the first of their kind approved in the country and are expected to enhance South Korea's position in the global biosimilar market. These initiatives reduce entry barriers and foster a competitive landscape. The result is a well-coordinated policy ecosystem that propels the South Korea biosimilar market growth by making biosimilars both viable for producers and accessible to patients.

To get more information on this market, Request Sample

Expanding Local R&D and Domestic Manufacturing Capacity

South Korea has invested substantially in domestic biopharmaceutical infrastructure, facilitating the rise of biosimilar innovation capabilities. Leading Korean companies and universities are collaborating to develop biosimilars across therapeutic classes, such as oncology, autoimmune and endocrine, leveraging advanced bioprocessing platforms and manufacturing technology transfers. Production facilities are compliant with global Good Manufacturing Practice (GMP) standards, enabling both domestic use and export potential. Local firms are rapidly scaling capacity, adopting single-use bioreactors, intensified fermentation techniques, and automation to drive cost efficiencies and increase batch consistency. The ecosystem includes contract development and manufacturing organizations (CDMOs), analytical contract research organizations (CROs), and biosimilarity testing service providers, creating a full value chain capable of rapid development cycles. Companies increasingly build global partnerships to co-develop and co-promote biosimilars in overseas markets. On October 11, 2024, South Korea-based Dong-A ST received FDA approval for Imuldosa (ustekinumab-srlf/DMB-3115), a biosimilar referencing Johnson & Johnson's Stelara, used to treat autoimmune diseases such as Crohn's disease and psoriatic arthritis. These internal assets reduce dependency on foreign licensing and catalyze homegrown innovation. As a result, South Korea’s manufacturing readiness and integrated R&D pipelines underpin a competitive edge, ensuring market growth driven by capacity, quality, and technological capability.

South Korea Biosimilar Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on molecule, indication, and manufacturing type.

Molecule Insights:

- Infliximab

- Insulin Glargine

- Epoetin Alfa

- Etanercept

- Filgrastim

- Somatropin

- Rituximab

- Follitropin Alfa

- Adalimumab

- Pegfilgrastim

- Trastuzumab

- Bevacizumab

- Others

The report has provided a detailed breakup and analysis of the market based on the molecule. This includes infliximab, insulin glargine, epoetin alfa, etanercept, filgrastim, somatropin, rituximab, follitropin alfa, adalimumab, pegfilgrastim, trastuzumab, bevacizumab, and others.

Indication Insights:

- Auto-Immune Diseases

- Blood Disorder

- Diabetes

- Oncology

- Growth Deficiency

- Female Infertility

- Others

The report has provided a detailed breakup and analysis of the market based on the indication. This includes auto-immune diseases, blood disorder, diabetes, oncology, growth deficiency, female infertility, and others.

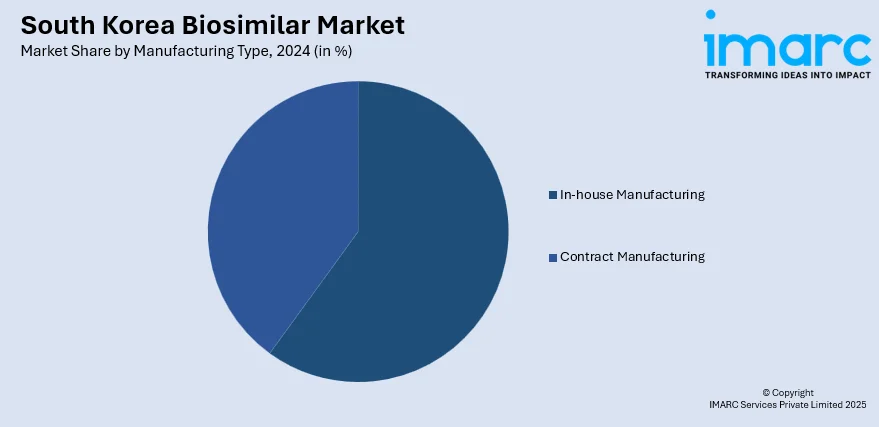

Manufacturing Type Insights:

- In-house Manufacturing

- Contract Manufacturing

The report has provided a detailed breakup and analysis of the market based on the manufacturing type. This includes in-house manufacturing and contract manufacturing.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Biosimilar Market News:

- On June 8, 2023, Samsung Biologics and Pfizer announced a strategic collaboration for the long-term commercial manufacturing of Pfizer’s multi-product biosimilars portfolio, including treatments for oncology, inflammation, and immunology. Under the agreement, Samsung Biologics was to utilize its newly completed Plant 4 in Incheon, South Korea, for large-scale manufacturing. The partnership aims to improve global access to medicines, with both companies emphasizing the potential to address emerging health challenges through this collaboration.

South Korea Biosimilar Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Molecules Covered | Infliximab, Insulin Glargine, Epoetin Alfa, Etanercept, Filgrastim, Somatropin, Rituximab, Follitropin Alfa, Adalimumab, Pegfilgrastim, Trastuzumab, Bevacizumab, Others |

| Indications Covered | Auto-Immune Diseases, Blood Disorder, Diabetes, Oncology, Growth Deficiency, Female Infertility, Others |

| Manufacturing Types Covered | In-house Manufacturing, Contract Manufacturing |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea biosimilar market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea biosimilar market on the basis of molecule?

- What is the breakup of the South Korea biosimilar market on the basis of indication?

- What is the breakup of the South Korea biosimilar market on the basis of manufacturing type?

- What is the breakup of the South Korea biosimilar market on the basis of region?

- What are the various stages in the value chain of the South Korea biosimilar market?

- What are the key driving factors and challenges in the South Korea biosimilar?

- What is the structure of the South Korea biosimilar market and who are the key players?

- What is the degree of competition in the South Korea biosimilar market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea biosimilar market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea biosimilar market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea biosimilar industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)