South Korea Bus Market Size, Share, Trends and Forecast by Type, Fuel Type, Seat Capacity, Application, and Region, 2025-2033

South Korea Bus Market Overview:

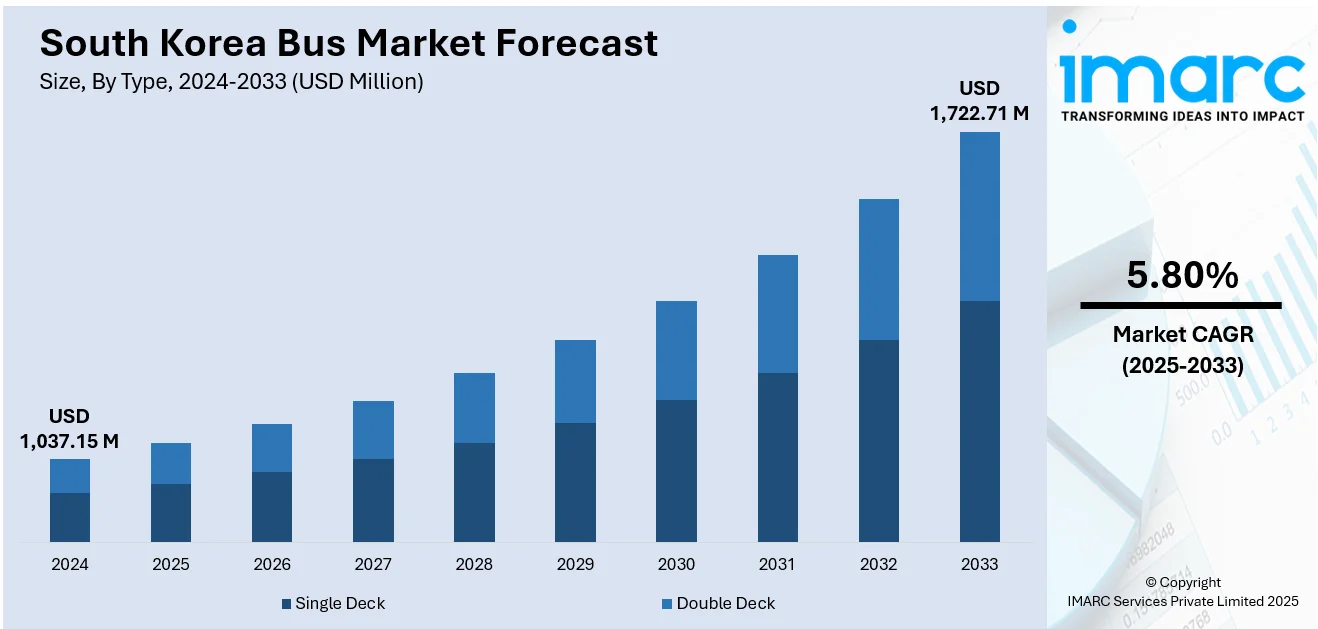

The South Korea Bus market size reached USD 1,037.15 Million in 2024. The market is projected to reach USD 1,722.71 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The industry is gaining momentum, fueled by increased demand for effective public transit and a definitive move toward cleaner energy options. Top manufacturers are putting money into electric, hybrid, and hydrogen buses to address environmental objectives as well as changing urban mobility demands. With smart city initiatives growing and mass transit upgrading, the push for next-generation buses is gaining pace. State support and infrastructure upgrading are playing a large part in this shift. This synergy is contributing to the continued rise of South Korea’s bus market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,037.15 Million |

| Market Forecast in 2033 | USD 1,722.71 Million |

| Market Growth Rate 2025-2033 | 5.80% |

South Korea Bus Market Trends:

Modernizing Public Transit Networks

In October 2024, Seoul restructured its bus routes for the first time in two decades, introducing neighborhood coverage within a five-minute walk for all residents and reforming subsidy mechanisms to improve cost efficiency. That overhaul supports a more connected and responsive service framework, enhancing bus travel in terms of accessibility and reliability. By reorganizing routes and better connecting high-density and underserved zones, planners are enhancing overall operational efficiency without increasing the number of buses. Efforts such as demand-responsive transit for seniors and double-deck buses for high-traffic corridors offer flexibility within existing infrastructure. The initiative illustrates how policy-driven transit redesign can optimize resource allocation while meeting evolving ridership expectations. As services become more accessible and tailored, trust in the public bus network is increasing and ridership is showing early signs of stabilization. Collectively, these reforms lay a solid foundation for sustained improvements in service quality and capacity planning. This renewed momentum signals clear potential for South Korea bus market growth.

To get more information on this market, Request Sample

Expansion of Zero-Emission Fleets

South Korea is also quickly moving forward with the adoption of zero-emission buses, particularly hydrogen fuel-cell and electric-powered vehicles. By mid-2024, the government announced plans to roll out 624 hydrogen fuel-cell buses across major cities and provinces by 2025, aided by generous subsidies and a growing network of refueling stations. Busan, Ulsan, and parts of Gyeongsang are experiencing concentrated investment in both infrastructure and vehicles to guarantee safe and efficient operation. The government's financial assistance is increasingly linked to performance indicators like driving range, fuel economy, and emissions reduction. This promotes ongoing innovation from manufacturers and transit operators aimed at ensuring service reliability while meeting sustainability targets. Such efforts reduce urban air pollution, which is essential in populous cities. Through the balance of infrastructure development and strategic subsidies, South Korea is building a clean and sustainable public transit framework that can withstand future challenges. These initiatives highlight major South Korea bus market trends as evidence of a strong emphasis on greener and more efficient transit networks.

Enhancing Operations through Technology Integration

South Korea’s bus market is also embracing digitalization to improve operational efficiency and passenger experience. In 2025, several municipal governments launched pilot programs using AI-driven scheduling, real-time vehicle tracking, and mobile ticketing systems all supported by national smart-city grants. These technology-enabled services allow dynamic timetable adjustments, demand-based dispatching, and seamless fare integration across modes. Real-time tracking tools, accessible via mobile apps, [help minimize waiting times while enhancing service transparency. Additionally, mobile payment and trip-planning platforms are simplifying travel for a growing commuter base that increasingly relies on connected experiences. Local agencies analyze usage data to fine-tune route planning and fleet maintenance schedules. While these upgrades require upfront investment and policy coordination, the long-term outcome is more resilient, responsive transit network capable of adapting to shifts in demand. This digital transition not only supports cleaner and more modern fleets but also reinforces passenger trust and service performance, laying the groundwork for continued innovation in service delivery.

South Korea Bus Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, fuel type, seat capacity, and application.

Type Insights:

- Single Deck

- Double Deck

The report has provided a detailed breakup and analysis of the market based on the type. This includes single deck and double deck.

Fuel Type Insights:

- Diesel

- Electric and Hybrid

- Others

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes diesel, electric and hybrid, and others

Seat Capacity Insights:

- 15-30 Seats

- 31-50 Seats

- More than 50 Seats

The report has provided a detailed breakup and analysis of the market based on the seat capacity. This includes 15-30 seats, 31-50 seats, and more than 50 seats.

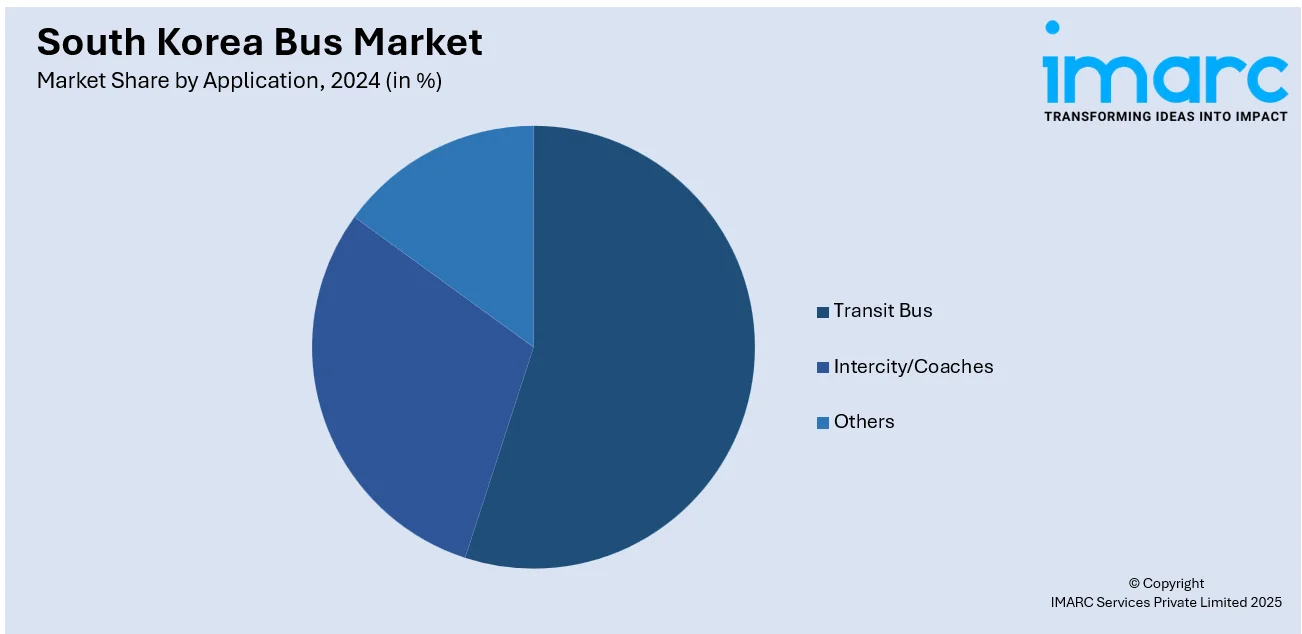

Application Insights:

- Transit Bus

- Intercity/Coaches

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes transit bus, intercity/coaches, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Bus Market News:

- May 2025: South Korea’s Hyundai Motor has surpassed 1,000 sales of its hydrogen-powered Elec City FCEV bus, with around 1,032 units sold. This milestone highlights Hyundai’s long-standing investment in hydrogen technology and its leadership in eco-friendly urban transportation. The company continues to expand domestic production and build partnerships to strengthen hydrogen mobility infrastructure across the country. These developments reflect South Korea’s growing commitment to sustainable transit solutions and clean energy innovation.

- February 2025: Doosan Fuel Cell, through its subsidiary HyAxiom Motors, is set to introduce two hydrogen-powered bus models in South Korea by mid‑year, pending government certification. The new lineup, including an 11-meter low‑floor city bus and a high‑floor intercity coach, positions Doosan as a second domestic hydrogen bus producer after Hyundai Motor Group. The strategic move aligns with South Korea’s broader push to expand hydrogen mobility infrastructure and accelerate adoption of zero-emission public transport solutions across the country

South Korea Bus Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Single Deck, Double Deck |

| Fuel Types Covered | Diesel, Electric and Hybrid, Others |

| Seat Capacities Covered | 15-30 Seats, 31-50 Seats, More than 50 Seats |

| Applications Covered | Transit Bus, Intercity/Coaches, Other |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea bus market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea bus market on the basis of type?

- What is the breakup of the South Korea bus market on the basis of fuel type?

- What is the breakup of the South Korea bus market on the basis of seat capacity?

- What is the breakup of the South Korea bus market on the basis of application?

- What is the breakup of the South Korea bus market on the basis of region?

- What are the various stages in the value chain of the South Korea bus market?

- What are the key driving factors and challenges in the South Korea bus market?

- What is the structure of the South Korea bus market and who are the key players?

- What is the degree of competition in the South Korea bus market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea bus market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea bus market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea bus industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)