South Korea Buy Now Pay Later Market Size, Share, Trends and Forecast by Channel, Enterprise Size, End Use, and Region, 2025-2033

South Korea Buy Now Pay Later Market Overview:

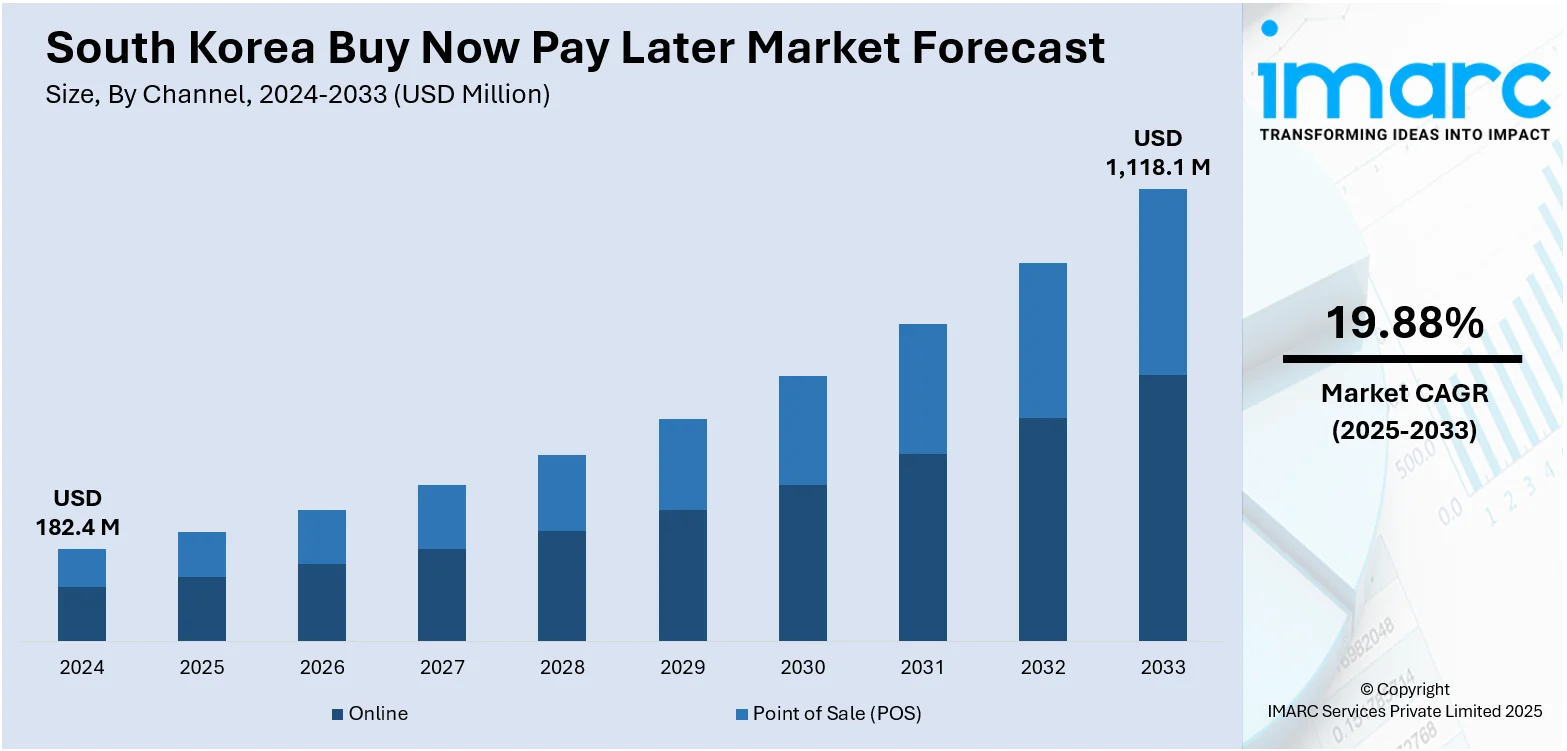

The South Korea buy now pay later market size reached USD 182.4 Million in 2024. Looking forward, the market is expected to reach USD 1,118.1 Million by 2033, exhibiting a growth rate (CAGR) of 19.88% during 2025-2033. The market is growing rapidly, supported by rising digital payments, evolving consumer preferences, and demand for flexible financing options. Fintech advancements and seamless platform integration are enhancing accessibility and user experience. Regulatory efforts are also strengthening consumer confidence, contributing to overall market expansion. This upward trend is reflected in the rising South Korea buy now pay later market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 182.4 Million |

| Market Forecast in 2033 | USD 1,118.1 Million |

| Market Growth Rate 2025-2033 | 19.88% |

South Korea Buy Now Pay Later Market Trends:

Growth of E-Commerce and Digital Consumer Behavior

South Korea’s BNPL market is largely driven by the country’s booming e-commerce sector and tech-savvy consumer base. Through one of the largest internet and smartphone reaches in the world, consumers are increasingly turning to buying online, and they are demanding flexible, interest-free payment arrangements. The integration of BNPL services is made throughout well-known digital platforms, such as Coupang, Naver, and Kakao, offering a smooth checkout process that improves customer retention and spending. Some of these solutions are particularly popular with millennials and Gen Z, who prefer alternatives to travelling credit cards. The ease and quick decision-making that come with the BNPL platforms are also alleviating the rate of cart abandonment. Due to the ongoing success of online retail, BNPL is quickly becoming an accepted payment option that has catapulted its development in a vast number of digital commerce conversion channels.

To get more information on this market, Request Sample

Fintech Innovation and Strategic Ecosystem Partnerships

The rapid development of South Korea’s fintech ecosystem is a key driver of the South Korea buy now pay later market growth. Leading players like Kakao Pay, Toss, and Naver Financial are introducing AI-based credit scoring, seamless mobile interfaces, and real-time approval systems that improve accessibility and user experience. Strategic collaborations between fintech firms, e-commerce platforms, and traditional financial institutions are strengthening market reach and product offerings. These partnerships enable BNPL providers to tap into broader customer bases and create integrated financial ecosystems. Moreover, strong investment inflows and supportive IPO activity have given fintech companies the capital needed to innovate and scale quickly. As the competition intensifies, these alliances foster greater technological advancement and ensure BNPL services are tailored to the evolving needs of modern Korean consumers.

Regulatory Clarity and Rising Consumer Confidence

The South Korean government’s efforts to regulate the BNPL sector have significantly boosted consumer confidence and market credibility. Updated financial regulations now require providers to increase transparency around fees, interest rates, and repayment terms, while also promoting responsible lending practices. These measures are particularly important in protecting younger consumers from over-borrowing and ensuring financial stability. The formalization of BNPL within the broader financial regulatory framework is reducing risk and making services more trustworthy in the eyes of both users and investors. Clear guidelines also encourage healthy competition among providers and open doors for more traditional financial institutions to participate in the BNPL space. As a result, a more secure, consumer-focused environment is helping drive sustainable market growth in South Korea.

South Korea Buy Now Pay Later Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on channel, enterprise size, and end use.

Channel Insights:

- Online

- Point of Sale (POS)

The report has provided a detailed breakup and analysis of the market based on channel. This includes online and point of sale (POS).

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprises and small and medium-sized enterprises.

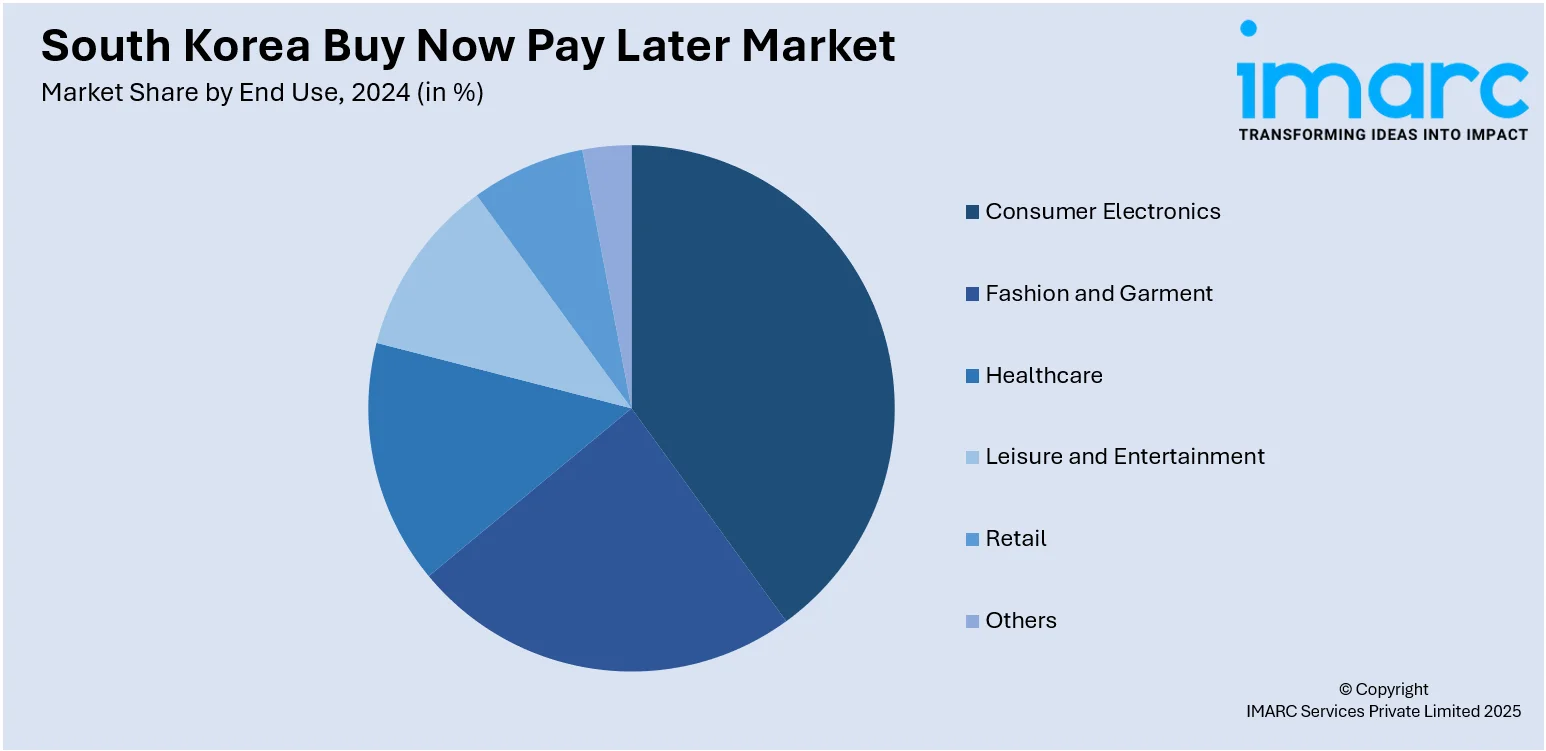

End Use Insights:

- Consumer Electronics

- Fashion and Garment

- Healthcare

- Leisure and Entertainment

- Retail

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes consumer electronics, fashion and garment, healthcare, leisure and entertainment, retail, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Buy Now Pay Later Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | Online, Point of Sale (POS) |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| End Uses Covered | Consumer Electronics, Fashion and Garment, Healthcare, Leisure and Entertainment, Retail, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea buy now pay later market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea buy now pay later market on the basis of channel?

- What is the breakup of the South Korea buy now pay later market on the basis of enterprise size?

- What is the breakup of the South Korea buy now pay later market on the basis of end use?

- What is the breakup of the South Korea buy now pay later market on the basis of region?

- What are the various stages in the value chain of the South Korea buy now pay later market?

- What are the key driving factors and challenges in the South Korea buy now pay later market?

- What is the structure of the South Korea buy now pay later market and who are the key players?

- What is the degree of competition in the South Korea buy now pay later market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea buy now pay later market from2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea buy now pay later market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea buy now pay later industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)