South Korea Candle Market Size, Share, Trends and Forecast by Product, Wax Type, Distribution Channel, and Region, 2025-2033

South Korea Candle Market Overview:

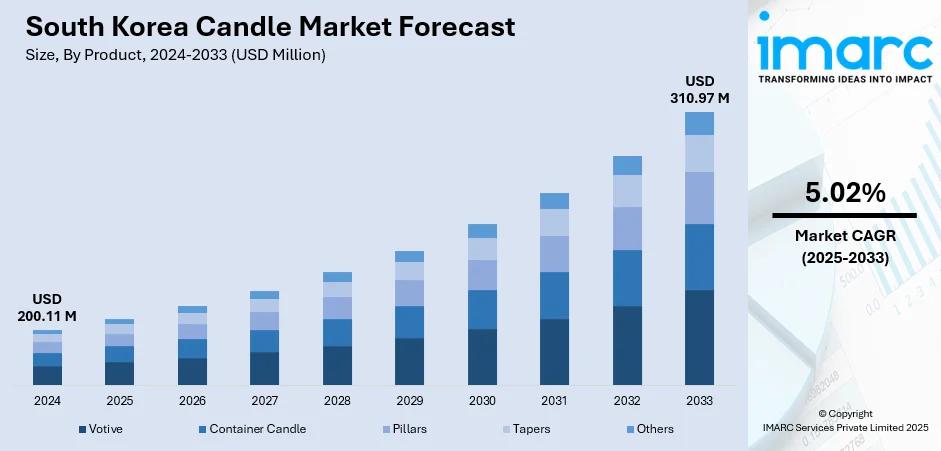

The South Korea candle market size reached USD 200.11 Million in 2024. Looking forward, the market is expected to reach USD 310.97 Million by 2033, exhibiting a growth rate (CAGR) of 5.02% during 2025-2033. The market is fueled by increasing consumer interest in wellness, aromatherapy, and home decor. Demand is also driven by their status as high-end gifts for cultural events and festive occasions. Local brands focus on distinctive Korean-scented fragrances and chic packaging, targeting design-driven consumers. Increased online sales and influencer advertising have also widened market coverage, particularly among younger generations, which cumulatively drive the growth of South Korea candle market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 200.11 Million |

| Market Forecast in 2033 | USD 310.97 Million |

| Market Growth Rate 2025-2033 | 5.02% |

South Korea Candle Market Trends:

Emergence of Aromatherapy and Wellness Culture

The candle market in South Korea is being shaped by an integrated wellness culture that values aromatherapy, mental wellness, and self-care practices. Candles are no longer just decorative; they are now used as stress relievers, atmosphere enhancers, and relaxation aids in households. Local brands personalize products with native Korean fragrances like green tea, bamboo, pine, and ginseng, linking consumers to tradition while providing modern wellness experiences. Boutique candle-makers also apply a minimalist design sensibility, perfectly in line with the trendy Korean interior aesthetic of clean lines, neutral color schemes, and soothing spaces. Candle-making and blending workshops have also appeared in cities such as Seoul and Busan, owing to specialty shops and lifestyle cafes, on the premise that making one's own candle is therapeutic. The fusion of locally inspired scents, conscious living habits, and experiential shopping turns candles into a marker of personal wellness in Korean households.

To get more information on this market, Request Sample

Premium Gifting and Packaging Innovation

South Korean candles are being positioned as luxury gift items, particularly for cultural festivities and social events. Brands create sophisticated packaging optimized for events such as Chuseok (harvest festival) and Lunar New Year through motifs drawn from Korean art, calligraphy, and heritage patterns. Candle manufacturers are many that partner with local designers and stationery companies to develop limited series, making candles collectible lifestyle gifts. This emphasis on packaging design is a testament to South Korean consumers' demand for well-designed, sharable gift products that are appealing both online and offline. Furthermore, candles are often packaged with complementary home decor items like ceramic holders, diffusers, or wooden trays, designing harmonious "wellness gift sets." These upscale products frequently become well-chosen presents in corporate gifts, weddings, and housewarming gifts, maintaining the symbolic value of candles as fashionable and social commodities in contemporary Korean culture, which further contributes to the South Korea candle market growth.

Digital-First Branding and Community Engagement

The South Korean candle industry makes extensive use of digital media, dipping into social networks, influencers, and online communities to construct brand identity and customer loyalty. Several candle brands run Instagram-led campaigns featuring candle-lit rooms with hashtags appealing to home décor fans, hygge lifestyle enthusiasts, and self-care practices supporters. Community-based content like fragrance pairing tutorials, user-generated "mood boards," and unboxing videos further extend the brand audience. Even small businesses selling candles leverage live workshops and Q&A sessions to cultivate customer relationships, showing behind-the-scenes insight into sourcing ingredients and making the products. E-commerce websites and mobile apps frequently provide subscription offerings, through which consumers can get seasonal fragrances tailored to shifting moods or periods of the year. This digital-first mindset enables brands to remain nimble, launching pop-up collections, limited releases, or crowd-sourced scent drops, to be responsive to consumer tastes and create ongoing buzz in a saturated lifestyle space.

South Korea Candle Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, wax type, and distribution channel.

Product Insights:

- Votive

- Container Candle

- Pillars

- Tapers

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes votive, container candle, pillars, tapers, and others.

Wax Type Insights:

- Paraffin

- Soy Wax

- Beeswax

- Palm Wax

- Others

The report has provided a detailed breakup and analysis of the market based on the wax type. This includes paraffin, soy wax, beeswax, palm wax, and others.

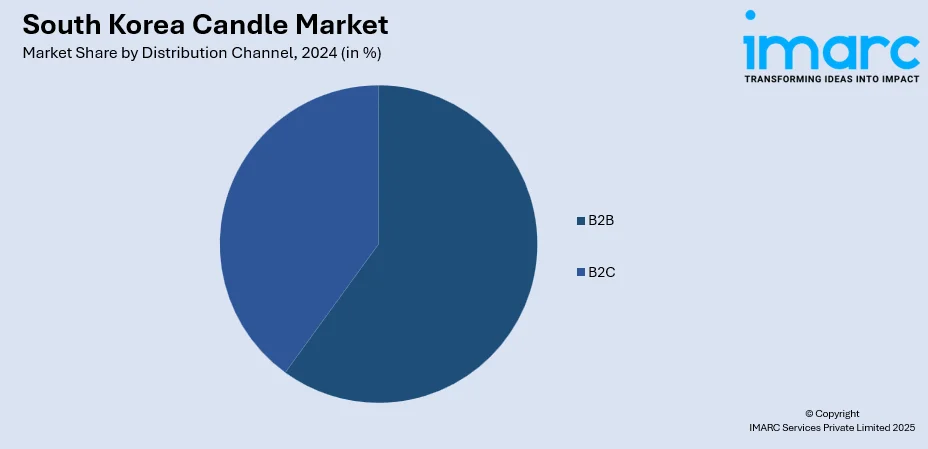

Distribution Channel Insights:

- B2B

- B2C

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes B2B and B2C.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Candle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Votive, Container Candle, Pillars, Tapers, Others |

| Wax Types Covered | Paraffin, Soy Wax, Beeswax, Palm Wax, Others |

| Distribution Channels Covered | B2B, B2C |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea candle market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea candle market on the basis of product?

- What is the breakup of the South Korea candle market on the basis of wax type?

- What is the breakup of the South Korea candle market on the basis of distribution channel?

- What is the breakup of the South Korea candle market on the basis of region?

- What are the various stages in the value chain of the South Korea candle market?

- What are the key driving factors and challenges in the South Korea candle market?

- What is the structure of the South Korea candle market and who are the key players?

- What is the degree of competition in the South Korea candle market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea candle market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea candle market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea candle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)