South Korea Carbon Black Market Size, Share, Trends and Forecast by Type, Grade, Application, and Region, 2025-2033

South Korea Carbon Black Market Overview:

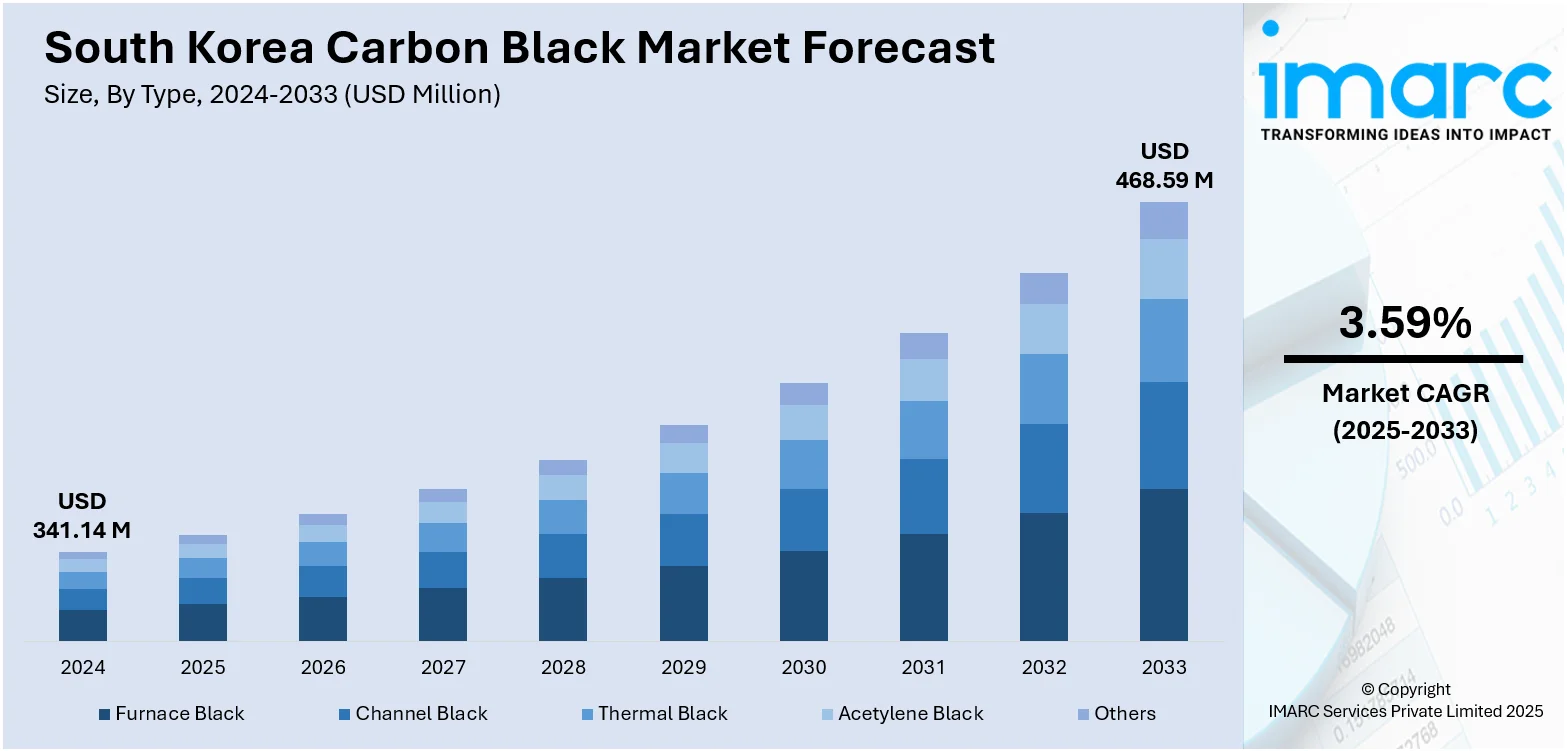

The South Korea carbon black market size reached USD 341.14 Million in 2024. Looking forward, the market is expected to reach USD 468.59 Million by 2033, exhibiting a growth rate (CAGR) of 3.59% during 2025-2033. The market is expanding steadily, fueled by strong demand from the automotive, tire, and industrial manufacturing sectors. Rising applications in plastics, coatings, and electronics are also supporting the market growth. Increasing focus on sustainability and clean production technologies are further strengthening the overall South Korea carbon black market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 341.14 Million |

| Market Forecast in 2033 | USD 468.59 Million |

| Market Growth Rate 2025-2033 | 3.59% |

South Korea Carbon Black Market Trends:

Strong Demand from Automotive and Tire Industries

South Korea's well-established automotive sector, led by major players like Hyundai and Kia, is a key driver of carbon black consumption. One of the initial necessary materials in manufacturing tires is carbon black, which improves durability, wear resistance, and provides UV protection. With the increasing output of electric vehicles (EV) production comes the demand to reduce the weight of tires, have longer life in tires, and require high-performance tires, which increasingly requires the use of specialty carbon black. Carbon black is also extensively utilized in most of the rubber products used in automobiles, like hoses, seals, and gaskets. Strength in EV innovation and car-making as an export leader makes this key to continued growth in carbon black demand in the country and has cemented its position as a component in the South Korean automarket supply chain.

To get more information on this market, Request Sample

Expanding Industrial and Infrastructure Applications

Beyond automotive use, carbon black plays a critical role in South Korea’s industrial, construction, and manufacturing sectors. It is widely utilized in producing plastics, paints, coatings, adhesives, sealants, and inks—adding color, UV stability, and conductivity. In infrastructure, carbon black improves the performance and durability of concrete and asphalt, supporting large-scale development projects. The country’s strong electronics and packaging industries also require specialty carbon black for antistatic and conductive applications. As South Korea continues to invest in smart manufacturing, urban infrastructure, and export-oriented production, the versatility of carbon black across industries ensures continued demand. This multi-sector reliance highlights carbon black’s importance beyond automotive use, securing its market relevance in both core and emerging applications.

Sustainability Focus and Regulatory Advancements

Environmental regulations and sustainability initiatives are driving the South Korea carbon black market growth. The government’s push to reduce carbon emissions and improve air quality is encouraging manufacturers to adopt cleaner, more energy-efficient production technologies. Increasing interest in circular economy practices has led to innovations such as recovered carbon black (rCB) sourced from waste tire pyrolysis. Companies are investing in low-emission facilities and exploring bio-based feedstocks to align with global sustainability standards. These shifts not only reduce environmental impact but also offer competitive advantages in global trade. As South Korea positions itself as a leader in green manufacturing, the adoption of sustainable practices in carbon black production is becoming a key market driver and differentiator in the years ahead.

South Korea Carbon Black Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, grade, and application.

Type Insights:

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

The report has provided a detailed breakup and analysis of the market based on type. This includes furnace black, channel black, thermal black, acetylene black, and others.

Grade Insights:

- Standard Grade

- Specialty Grade

A detailed breakup and analysis of the market based on the grades have also been provided in the report. This includes standard grade and specialty grade.

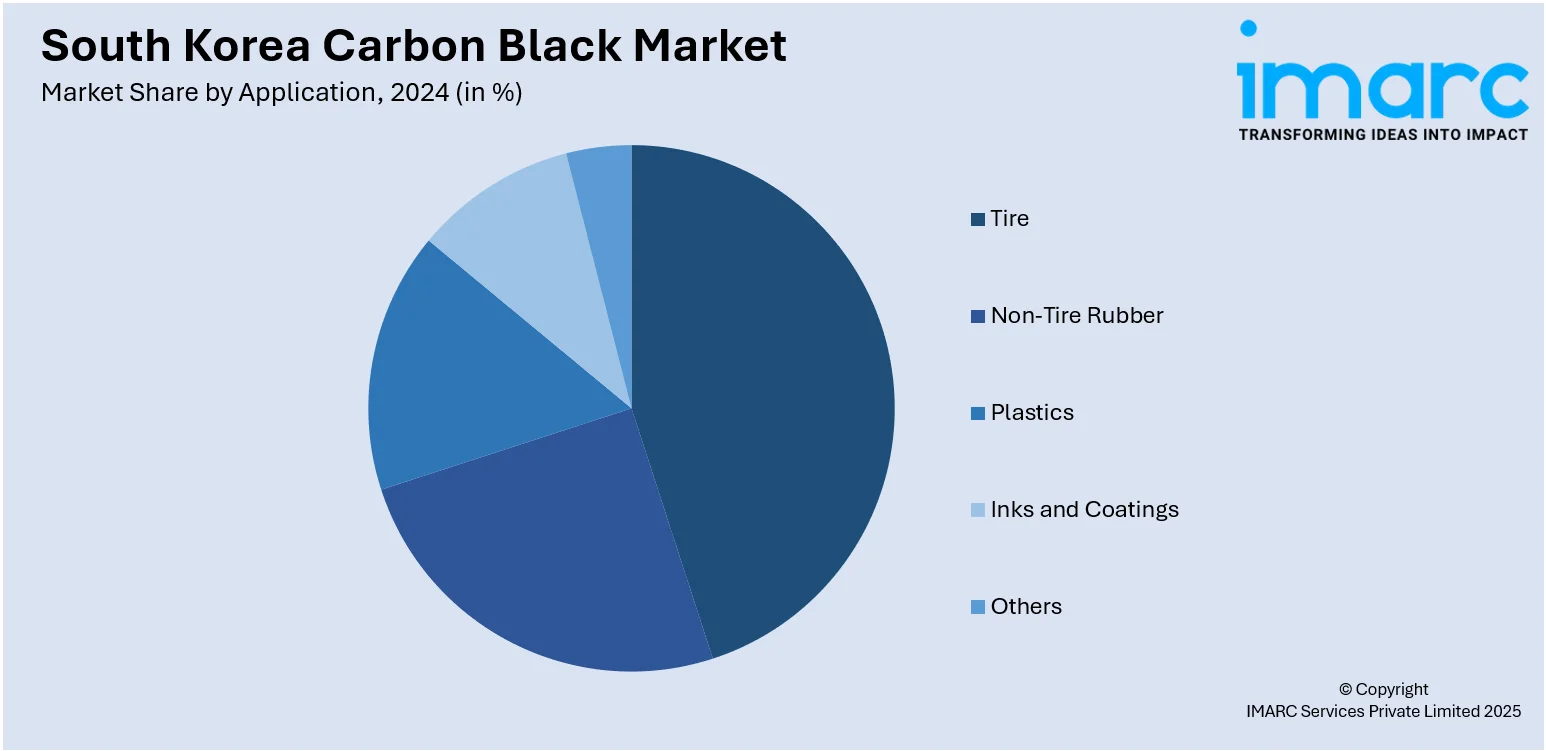

Application Insights:

- Tire

- Non-Tire Rubber

- Plastics

- Inks and Coatings

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes tire, non-tire rubber, plastics, inks and coatings, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Channel Black, Thermal Black, Acetylene Black, Others |

| Grades Covered | Standard Grade, Specialty Grade |

| Applications Covered | Tire, Non-Tire Rubber, Plastics, Inks and Coatings, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea carbon black market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea carbon black market on the basis of type?

- What is the breakup of the South Korea carbon black market on the basis of grade?

- What is the breakup of the South Korea carbon black market on the basis of application?

- What is the breakup of the South Korea carbon black market on the basis of region?

- What are the various stages in the value chain of the South Korea carbon black market?

- What are the key driving factors and challenges in the South Korea carbon black market?

- What is the structure of the South Korea carbon black market and who are the key players?

- What is the degree of competition in the South Korea carbon black market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea carbon black market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea carbon black market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)