South Korea Catheters Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

South Korea Catheters Market Overview:

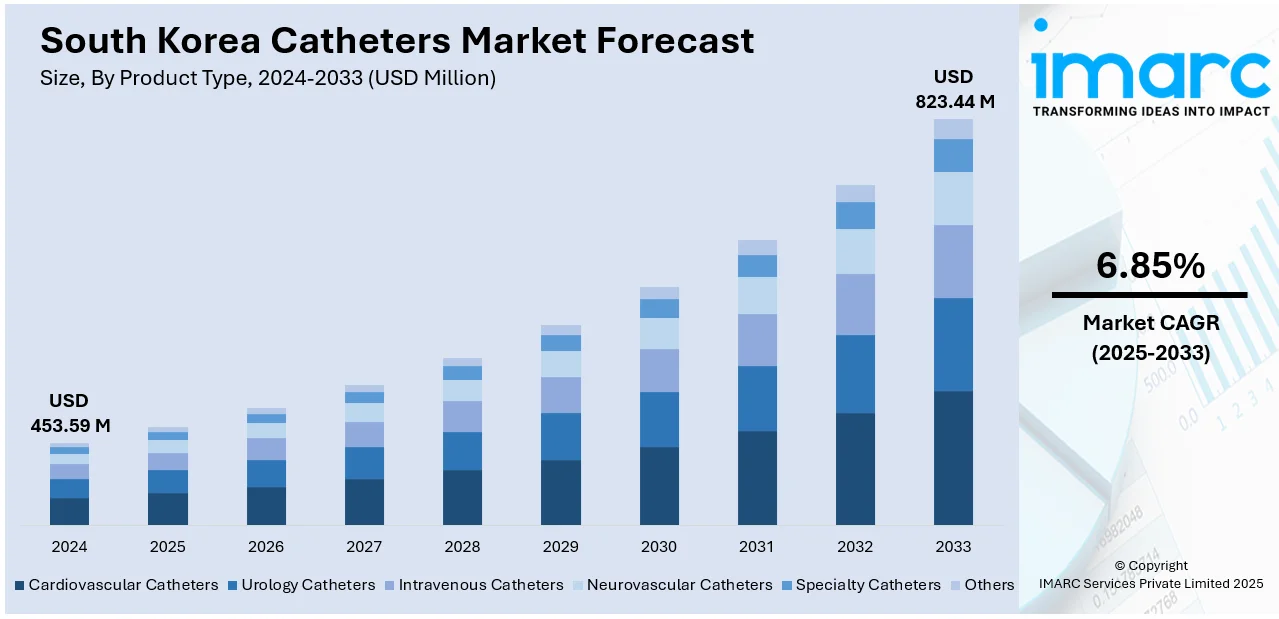

The South Korea catheters market size reached USD 453.59 Million in 2024. The market is projected to reach USD 823.44 Million by 2033, exhibiting a growth rate (CAGR) of 6.85% during 2025-2033. The market is evolving due to rising demand for minimally invasive (MI) interventions, technology, and improved delivery of health care. Encouraged by growing support from health care professionals, product segments such as urinary, cardiovascular, and specialty catheters are finding growing support. The largest end-users include hospitals, diagnostic facilities, and specialty clinics. Local health trends and rising focus on patient-centered care continue to foster product use and development, and therefore South Korea catheters market share growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 453.59 Million |

| Market Forecast in 2033 | USD 823.44 Million |

| Market Growth Rate 2025-2033 | 6.85% |

South Korea Catheters Market Trends:

Expansion in Balloon Catheter Usage

A recent analysis from late 2024 highlights growing reliance on percutaneous transluminal coronary angioplasty (PTCA) balloon catheters in South Korea, reflecting significant changes in interventional cardiology practices. The usage of these devices has expanded considerably across both public and private hospital settings, with clinicians recognizing their role in minimally invasive heart procedures. The increasing complexity of coronary interventions and rising patient volumes have led cardiology teams to adopt advanced balloon catheter technologies, which permit gradual vessel dilation and reduce risks compared to older-generation tools. Enhanced catheter designs now incorporate improved flexibility and controlled inflation, supporting precise deployment even in complex vascular cases. Alongside greater device use, hospitals are investing in operator training and updated catheterization lab workflows, promoting safer procedures and better patient recovery. Patients benefit through shorter hospital stays and faster return to daily activities following these less invasive interventions. These developments underscore a wider transformation within the country’s cardiovascular treatment landscape, illustrating how improved device choices are influencing clinical protocols. Together, these changes demonstrate how evolving clinical practices and device preferences reflect South Korea catheters market trends.

To get more information on this market, Request Sample

Innovating Catheter Design to Fight Cancer

In April 2024, South Korean scientists announced the development of a novel photodynamic therapy (PDT) catheter to enhance the treatment of oesophageal cancer. It is an integration of light-emitting unit and inbuilt stent where targeted therapy is provided while retaining the structural support necessary in constricted regions of the oesophagus. Designed through a joint research initiative between universities and funded by the National Research Foundation, the catheter is designed for accuracy in targeted cancer treatment with less trauma to the adjacent healthy tissue. It also minimizes the requirement of frequent endoscopic procedures, greatly improving patient comfort and clinical effectiveness. The novel structure of the catheter facilitates continuous illumination of the tumor area, which renders the catheter an effective tool in minimally invasive treatment. Hospitals and cancer centers have shown interest in incorporating such next-generation devices in treatment regimens, particularly for surgery-unfit patients. This development emphasizes South Korea's efforts towards technology-based health care solutions and illustrates how research-driven progress is contributing to device innovation. The entry of such focused systems are contributing in the South Korea catheters market growth.

Adoption of Safety-Engineered Catheters

Recent clinical reports from 2024 reveal a clear shift in hospital procurement policies toward safety-engineered catheters designed to reduce both patient and clinician risk. One study conducted across multiple tertiary care facilities in South Korea indicates that incidents involving device-related complications have become noticeably rare since the introduction of catheter models featuring integrated needle guards and enhanced antimicrobial hubs. These devices help prevent accidental needlestick injuries and lower infection risks, supporting safer clinical environments. Hospitals have responded by incorporating these products into standard operating procedures, emphasizing thorough training for nursing and interventional teams on their correct handling and insertion. As clinicians become more familiar with these advanced catheter systems, they report improved procedural efficiency and fewer instances of device-related workflow interruptions. This transition also reflects evolving regulatory guidelines, which increasingly favor devices with added safety mechanisms. With these protocols and product innovations in place, patient trust in invasive procedures is rising and staff confidence in device use is growing. These shifts underscore a strengthening market preference for safety-centered catheter solutions.

South Korea Catheters Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Cardiovascular Catheters

- Urology Catheters

- Intravenous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cardiovascular catheters, urology catheters, intravenous catheters, neurovascular catheters, specialty catheters, and others.

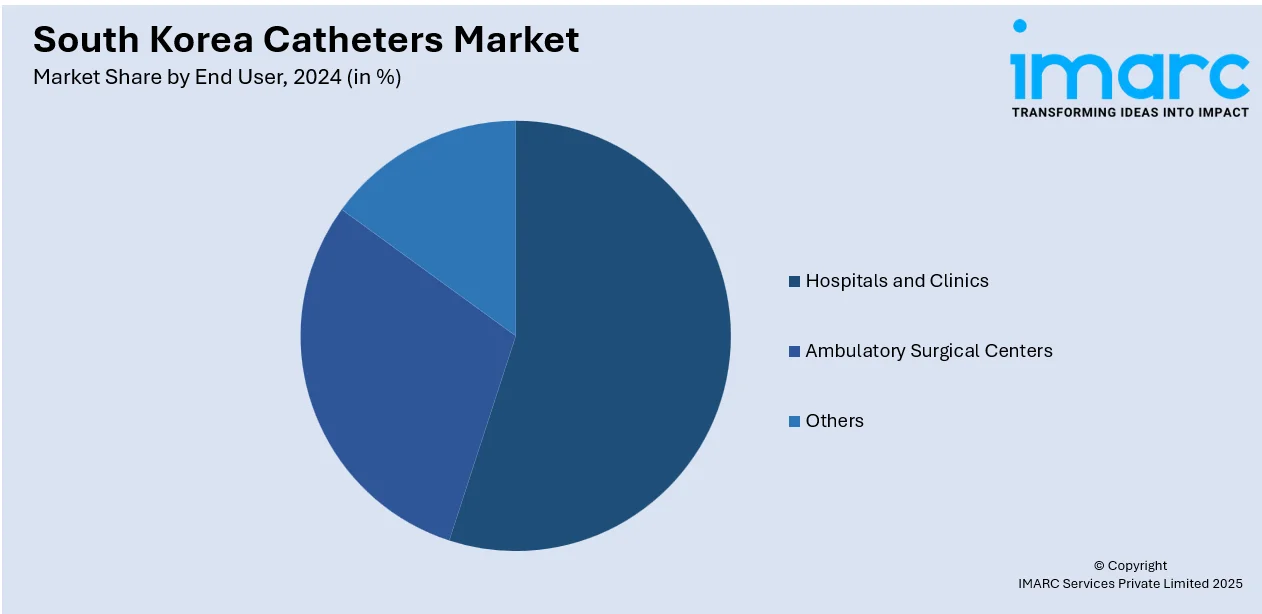

End User Insights:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, ambulatory surgical centers, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Catheters Market News:

- June 2024: Seoul‑based DeepQure has secured FDA approval for an Investigational Device Exemption to launch an early feasibility study in the U.S. for its HyperQure extravascular renal denervation system. This laparoscopic, energy‑based device wraps the renal artery to target sympathetic nerves without damaging vessel lining. The first‑in‑human study is underway in Korea, with global expansion planned across multiple U.S. university hospitals. DeepQure’s advancement highlights South Korea’s growing presence in cutting‑edge medical device innovation.

South Korea Catheters Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cardiovascular Catheters, Urology Catheters, Intravenous Catheters, Neurovascular Catheters, Specialty Catheters, Others |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgical Centers, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea catheters market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea catheters market on the basis of product type?

- What is the breakup of the South Korea catheters market on the basis of end user?

- What is the breakup of the South Korea catheters market on the basis of region?

- What are the various stages in the value chain of the South Korea catheters market?

- What are the key driving factors and challenges in the South Korea catheters market?

- What is the structure of the South Korea catheters market and who are the key players?

- What is the degree of competition in the South Korea catheters market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea catheters market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea catheters market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea catheters industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)