South Korea Cloud Managed Services Market Size, Share, Trends and Forecast by Service Type, Deployment Model, Organization Size, Vertical, and Region, 2025-2033

South Korea Cloud Managed Services Market Overview:

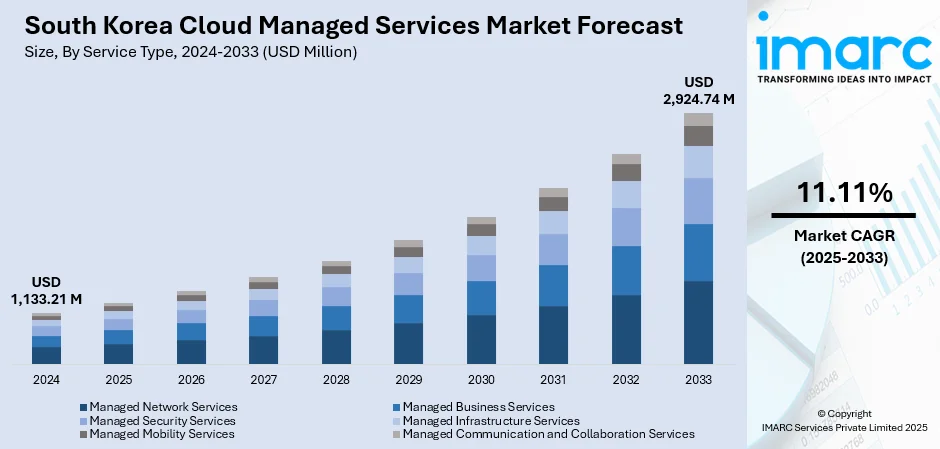

The South Korea cloud managed services market size reached USD 1,133.21 Million in 2024. The market is projected to reach USD 2,924.74 Million by 2033, exhibiting a growth rate (CAGR) of 11.11% during 2025-2033. The market is fueled by the rapid digitalization and increasing dependence on cloud-native applications and IT infrastructure. Additionally, escalating needs for efficient management of IT at low costs, better cybersecurity, and regulatory compliance are inspiring organizations to use cloud-managed services to optimize operations and maintain business continuity. Also, government initiatives in favor of smart city formation and the expansion of 5G networks are further augmenting the South Korea cloud managed services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,133.21 Million |

| Market Forecast in 2033 | USD 2,924.74 Million |

| Market Growth Rate 2025-2033 | 11.11% |

South Korea Cloud Managed Services Market Trends:

Surge in AI-Driven Cloud Management Solutions

Artificial intelligence (AI) and machine learning (ML) are essentially revolutionizing cloud-managed services in South Korea by increasing operational intelligence, automation, and scalability. Companies are increasingly using AI-based cloud management platforms to anticipate system irregularities, automate response to incidents, and dynamically assign resources according to real-time demand patterns. This evolution is also complemented by the rapid expansion of the South Korea artificial intelligence market, which stands at USD 3.12 Billion in 2024 and is expected to grow to USD 30.00 Billion by 2033 with a CAGR of 26.60% during the period of 2025 to 2033. The adoption of AI in cloud management is gaining increasing popularity in the logistics, e-commerce, and financial services sectors, which are based on continuous digital services and data-driven processes. Apart from this, South Korean managed service providers are integrating AI functionality into their services, such as self-healing infrastructure, AI-enabled service desks, and automated compliance testing. Furthermore, government initiatives like the Digital New Deal also complement this trend by promoting an innovation-led ecosystem, driving enterprises to deploy AI-based solutions as part of their overall digital plans.

To get more information on this market, Request Sample

Enhanced Focus on Cybersecurity and Regulatory Compliance

The growing complexity of digital infrastructure and rising threat landscape have intensified the focus on cybersecurity and regulatory compliance within the market. In 2024, cyberattacks in the country surged by 48%, increasing from 1,277 to 1,887 incidents, underscoring the critical need for advanced, preventive cybersecurity frameworks. This alarming rise has prompted organizations, particularly in high-risk sectors like banking, telecommunications, and healthcare, to turn to managed service providers for robust, round-the-clock security management. MSPs are now offering integrated solutions such as real-time threat detection, zero-trust network access (ZTNA), encryption protocols, and endpoint protection to ensure secure cloud operations. Concurrently, adherence to evolving regulations, including the Personal Information Protection Act (PIPA) and international standards like ISO/IEC 27001, has become a strategic priority. Compliance capabilities are now a competitive differentiator for MSPs, especially as enterprises face increasing pressure to maintain data integrity and demonstrate audit readiness. The convergence of regulatory mandates and rising cyber risk is reinforcing demand for tailored, end-to-end managed security services across South Korea’s enterprise landscape.

Rising Adoption of Multi-Cloud and Hybrid Cloud Strategies

The shift toward multi-cloud and hybrid cloud environments is positively impacting the South Korea cloud managed services market growth. This trend is driven by the need for greater flexibility, cost optimization, and business continuity. Managed service providers (MSPs) are playing a critical role in orchestrating these complex architectures, ensuring seamless integration, workload distribution, and security compliance across multiple platforms. Enterprises in sectors such as manufacturing, finance, and retail are utilizing managed services to eliminate cloud silos and optimize performance. The approach also addresses latency issues and data sovereignty regulations by enabling regional or on-premises data storage. Furthermore, government-backed digital infrastructure projects and growing demand for data localization have accelerated the adoption of hybrid models. As the need for agility and resource optimization intensifies, organizations in the country are relying more heavily on MSPs to manage workloads, monitor service performance, and enable real-time decision-making across distributed environments.

South Korea Cloud Managed Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type, deployment model, organization size, and vertical.

Service Type Insights:

- Managed Network Services

- Managed Business Services

- Managed Security Services

- Managed Infrastructure Services

- Managed Mobility Services

- Managed Communication and Collaboration Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes managed network services, managed business services, managed security services, managed infrastructure services, managed mobility services, and managed communication and collaboration services.

Deployment Model Insights:

- Private Cloud

- Public Cloud

A detailed breakup and analysis of the market based on the deployment model have also been provided in the report. This includes private cloud and public cloud.

Organization Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises and small and medium-sized enterprises.

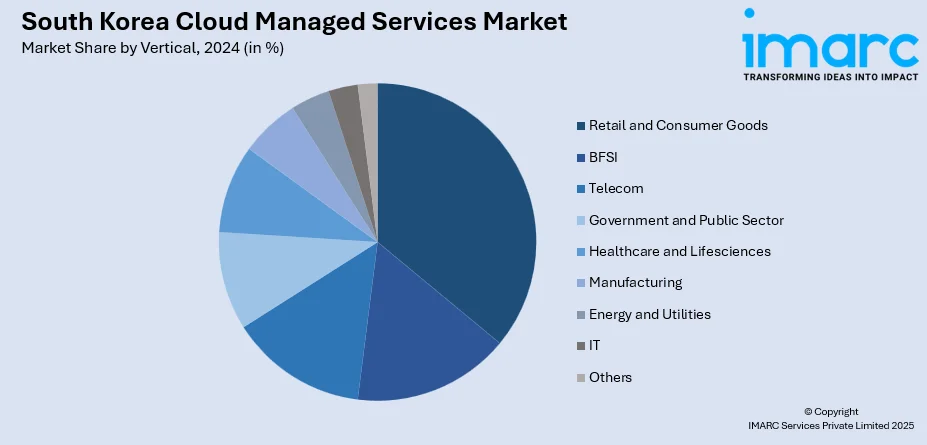

Vertical Insights:

- Retail and Consumer Goods

- BFSI

- Telecom

- Government and Public Sector

- Healthcare and Lifesciences

- Manufacturing

- Energy and Utilities

- IT

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes retail and consumer goods, BFSI, telecom, government and public sector, healthcare and lifesciences, manufacturing, energy and utilities, IT, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Cloud Managed Services Market News:

- On June 24, 2025, Alibaba Cloud announced the launch of its second data center in South Korea to be operational by the end of the month, aiming to meet growing local demand for cloud and AI services. The new facility will enhance cloud resilience, support disaster recovery, and offer expanded services including cloud-native, database, and big data solutions.

South Korea Cloud Managed Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Managed Network Services, Managed Business Services, Managed Security Services, Managed Infrastructure Services, Managed Mobility Services, Managed Communication and Collaboration Services |

| Deployment Models Covered | Private Cloud, Public Cloud |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Verticals Covered | Retail and Consumer Goods, BFSI, Telecom, Government and Public Sector, Healthcare and Lifesciences, Manufacturing, Energy and Utilities, IT, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea cloud managed services market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea cloud managed services market on the basis of service type?

- What is the breakup of the South Korea cloud managed services market on the basis of deployment model?

- What is the breakup of the South Korea cloud managed services market on the basis of organization size?

- What is the breakup of the South Korea cloud managed services market on the basis of vertical?

- What is the breakup of the South Korea cloud managed services market on the basis of region?

- What are the various stages in the value chain of the South Korea cloud managed services market?

- What are the key driving factors and challenges in the South Korea cloud managed services market?

- What is the structure of the South Korea cloud managed services market and who are the key players?

- What is the degree of competition in the South Korea cloud managed services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea cloud managed services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea cloud managed services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea cloud managed services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)