South Korea Cloud Professional Services Market Size, Share, Trends and Forecast by Service, Organization Size, Deployment Model, End Use Industry, and Region, 2026-2034

South Korea Cloud Professional Services Market Overview:

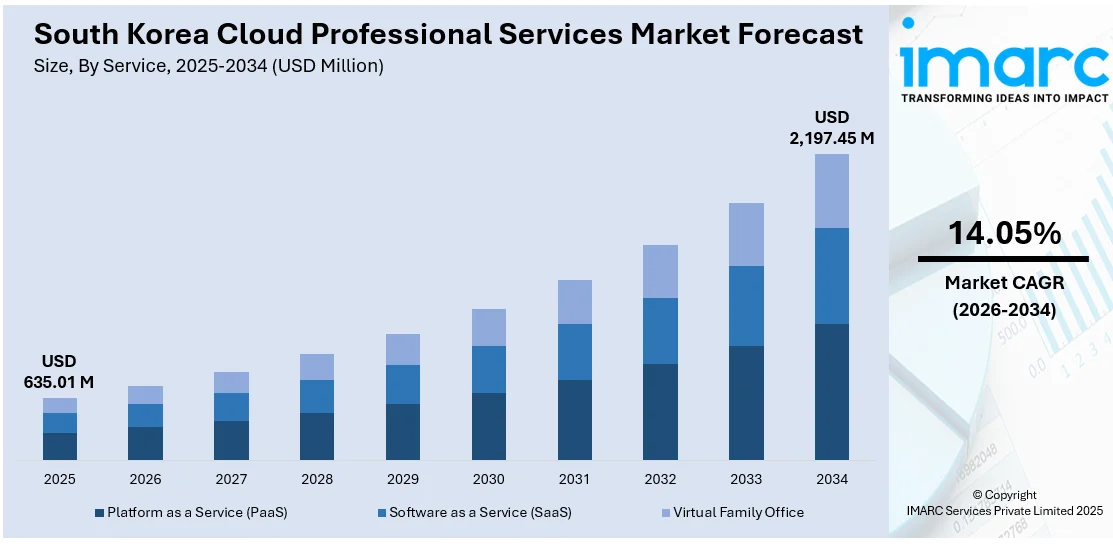

The South Korea cloud professional services market size reached USD 635.01 Million in 2025. The market is projected to reach USD 2,197.45 Million by 2034, exhibiting a growth rate (CAGR) of 14.05% during 2026-2034. Rising digital transformation across industries, increased adoption of hybrid and multi-cloud strategies, and strong government support for cloud-first initiatives are driving the South Korea Cloud Professional Services market. Demand for AI integration, cybersecurity, and scalable infrastructure solutions is further accelerating growth. Enterprises are increasingly relying on expert cloud partners to streamline operations and ensure compliance. These factors collectively contribute to the expanding South Korea Cloud Professional Services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 635.01 Million |

| Market Forecast in 2034 | USD 2,197.45 Million |

| Market Growth Rate 2026-2034 | 14.05% |

South Korea Cloud Professional Services Market Trends:

Government-Led Cloud Infrastructure Development

In March 2024, the South Korean government reinforced its commitment to expanding cloud infrastructure through the K-Cloud Project, which focuses on establishing secure, scalable cloud environments across public sectors. This initiative is a component of the broader Digital New Deal, aimed at accelerating digital transformation nationwide. The Ministry of Science and ICT is prioritizing cloud adoption to enhance public services and foster innovation while ensuring data privacy and cybersecurity compliance. Moreover, the Korea Internet & Security Agency (KISA) implements rigorous cloud security certification programs, boosting trust in cloud platforms across both government and private entities. These concerted efforts signify a strong public sector push towards cloud modernization, enabling efficient and flexible IT service delivery. With increasing cloud infrastructure maturity, South Korea is laying the groundwork to support emerging technologies. These strategic initiatives are expected to drive the South Korea cloud professional services market growth, underpinning the country’s ambitions to become a global digital economy leader. The government’s focus on secure cloud infrastructure remains pivotal in shaping the nation’s technology ecosystem.

To get more information on this market Request Sample

Expansion of Cloud Adoption Across Sectors

By April 2024, cloud adoption had gained significant momentum across South Korea's manufacturing, finance, and healthcare sectors. This can be largely attributed to government policies that are actively encouraging businesses to embrace digital innovation. Cloud solutions are being accessed by businesses to improve operational flexibility, boost efficiency, and harness automation and advanced analytics. Hybrid models of the cloud, specifically, are growing in popularity since they allow companies to remain regulatory compliant yet remain agile. In addition, coupling the cloud with big data and AI is enabling firms to make more informed, data-driven decisions and increase efficiency. These changes are driving the market towards more customized, industry-specific cloud offerings that address specific business requirements. Overall, the trends indicate a clear shift towards more advanced, adaptable cloud solutions as businesses strive to maintain competitive edge. This continued cloud growth across the major sectors indicates firm momentum towards South Korea's digital transformation and reinforces its position as an emerging tech leader.

Emphasis on AI-Enabled Cloud Infrastructure and the Future

Heading into June 2025, South Korea is intensifying its efforts to develop AI-enabled cloud infrastructure to keep pace with increasing demand for enhanced digital services. The government intends to establish cutting-edge AI computing facilities aimed at enhancing machine learning and data processing throughout the country. This drive seeks to make South Korea a world leader in AI cloud services, drive innovation and accommodate larger and more complex workloads. In addition, there is a push to ensure data centers are more energy-efficient and increase network capacity. There is also support from the government for collaborative efforts between public and private sectors to accelerate the integration AI in cloud platforms. These initiatives will have a significant effect on the South Korea cloud professional services market trends, keeping the nation competitive and innovative in the rapidly changing digital economy. It clearly signals that South Korea is committed to dominating the future of cloud and AI technology.

South Korea Cloud Professional Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on service, organization size, deployment model, and end use industry.

Service Insights:

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

- Infrastructure as a Service (IaaS)

The report has provided a detailed breakup and analysis of the market based on the service. This includes platform as a service (PaaS), software as a service (SaaS), and infrastructure as a service (IaaS).

Organization Size Insights:

- Small Enterprises

- Medium Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small enterprises, medium enterprises, and large enterprises.

Deployment Model Insights:

- Public Cloud

- Private Cloud

- Hybrid Cloud

The report has provided a detailed breakup and analysis of the market based on the deployment model. This includes public cloud, private cloud, and hybrid cloud.

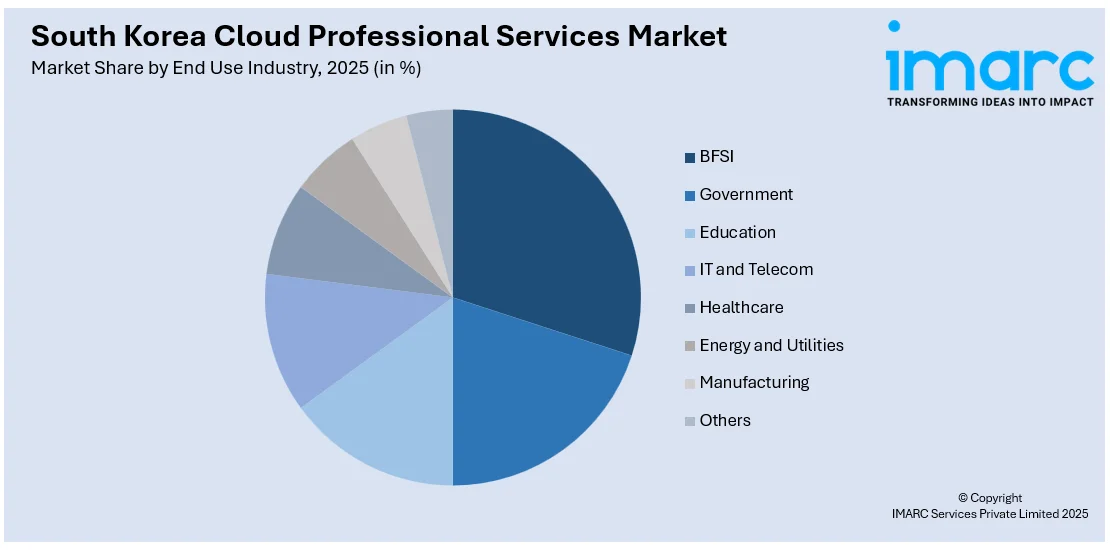

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- Government

- Education

- IT and Telecom

- Healthcare

- Energy and Utilities

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes BFSI, government, education, IT and telecom, healthcare, energy and utilities, manufacturing, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Cloud Professional Services Market News:

- June 2025: Alibaba Cloud is expanding its presence in South Korea by launching a second data center, aimed at supporting the increasing demand for cloud computing and AI services. This new facility will improve cloud reliability, network performance, and offer advanced cloud-native and big data products to local businesses. The expansion reflects Alibaba Cloud’s commitment to enhancing South Korea’s digital infrastructure and enabling innovation across various industries through generative AI and cloud technologies.

- June 2025: SK Group, along with Amazon Web Services (AWS), will build South Korea's largest artificial intelligence (AI) data center in the Mipo industrial complex of Ulsan. The center will accommodate 60,000 graphics processing units (GPUs) and possess a power capacity of 100 megawatts, which represents a great leap in the country's AI infrastructure. The move reflects South Korea's focus on the development of its technological prowess and its status as a driving force in the international AI sphere.

South Korea Cloud Professional Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Platform as a Service (PaaS), Software as a Service (SaaS), Infrastructure as a Service (IaaS) |

| Organization Sizes Covered | Small Enterprises, Medium Enterprises, Large Enterprises |

| Deployment Models Covered | Public Cloud, Private Cloud, Hybrid Cloud |

| End Use Industries Covered | BFSI, Government, Education, IT and Telecom, Healthcare, Energy and Utilities, Manufacturing, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea cloud professional services market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea cloud professional services market on the basis of service?

- What is the breakup of the South Korea cloud professional services market on the basis of organization size?

- What is the breakup of the South Korea cloud professional services market on the basis of deployment model?

- What is the breakup of the South Korea cloud professional services market on the basis of end use industry?

- What is the breakup of the South Korea cloud professional services market on the basis of region?

- What are the various stages in the value chain of the South Korea cloud professional services market?

- What are the key driving factors and challenges in the South Korea cloud professional services?

- What is the structure of the South Korea cloud professional services market and who are the key players?

- What is the degree of competition in the South Korea cloud professional services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea cloud professional services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea cloud professional services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea cloud professional services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)