South Korea Construction Chemicals Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

South Korea Construction Chemicals Market Overview:

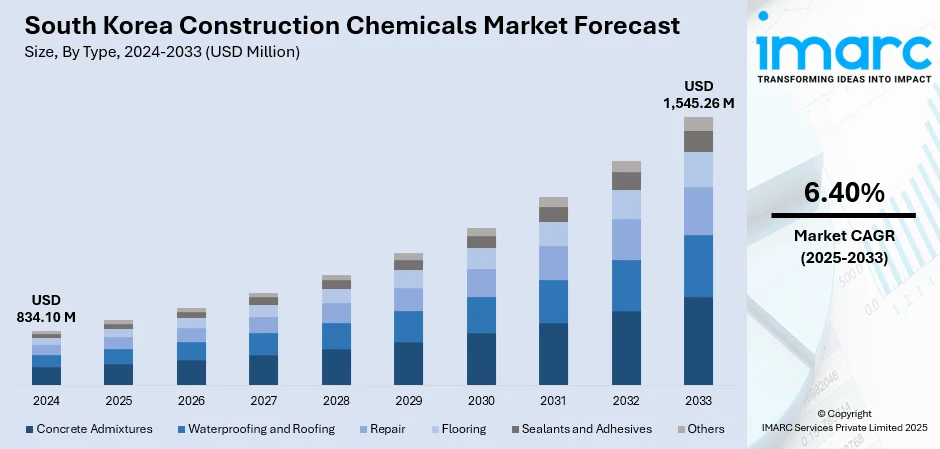

The South Korea construction chemicals market size reached USD 834.10 Million in 2025. The market is projected to reach USD 1,545.26 Million by 2034, exhibiting a growth rate (CAGR) of 6.40% during 2026-2034. The market is driven by major government infrastructure investments, alongside rapid urbanization and strong real estate development. Demand for concrete admixtures, waterproofing agents, adhesives, sealants, and protective coatings is rising across residential, commercial, industrial, and infrastructure projects. Technological innovation in sustainable high performance formulations fuels growth, further supported by active public private collaborations and R&D. These trends are boosting South Korea construction chemicals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 834.10 Million |

| Market Forecast in 2034 | USD 1,545.26 Million |

| Market Growth Rate 2026-2034 | 6.40% |

South Korea Construction Chemicals Market Trends:

Strategic Infrastructure Investment

In April 2024, South Korea’s Ministry of Land, Infrastructure and Transport began rolling out expanded funding under the Green New Deal to back public resilience projects, such as flood prevention systems and railway modernization. This strategic spending is directly impacting on the country’s construction chemicals sector by reinforcing foundational demand for specialized products like high-durability cement mixes, sealants, and protective coatings. As infrastructure takes priority over new housing, chemicals that can withstand environmental pressures are becoming core components of these projects. Government-backed megaprojects are encouraging suppliers to pivot toward sustainable, performance-oriented formulations, with R&D efforts increasingly focused on new materials that meet evolving safety and climate standards. Industry insiders note that this shift is stabilizing the sector and enabling innovation, particularly for chemicals designed for longevity and eco-performance. This approach not only supports national development goals but also helps local suppliers scale up efficiently and competitively. The market is being redefined as infrastructure resilience and environmental responsibility lead to demand. These trends are central to the broader South Korea construction chemicals market growth.

To get more information on this market, Request Sample

Market Scaling Through Urbanization

Urbanization is reshaping the landscape for South Korea’s construction chemicals industry. In 2024, market volumes hit thousands, reflecting how high-density development is steadily fueling demand for advanced chemical inputs. Major cities continue to expand upward and outward, pushing developers to source high-performance admixtures, weatherproof coatings, and sealants that meet evolving construction codes and sustainability benchmarks. These materials are critical for structures that must be resilient, efficient, and certified under green building standards. As urban planners prioritize energy-efficient construction and smart technologies, contractors are responding with an increased reliance on chemicals that enhance performance while minimizing environmental impact. These patterns are especially clear in projects that integrate smart housing, transit-oriented developments, and modular builds each demanding custom chemical solutions. The market’s steady rise is more than a matter of volume; it’s a signal that performance and sustainability are now basic requirements. Suppliers are adapting by offering more versatile, eco-conscious solutions. This consistent shift reflects one of the most defining South Korea construction chemicals market trends.

Private-Sector R&D Momentum

There is a growing momentum in South Korea's commercial building sector where private builders and contractors are increasing investment in environmentally friendly, high-performance products. In December 2024, the national environmental reported growth in the deployment of low-emission and recyclable building materials in non-government projects. The trend is fueled by an increasing need for energy-efficient and longer-lived structures, which is spurring manufacturers to produce specialty admixtures, sealants, and coatings that not only meet but exceed regulatory standards. What's significant about this trend is the extent to which it's embedded in c collaborations among academic institutions, private laboratories, and construction companies are jointly developing new chemical compounds that minimize energy consumption during use and extend structural life. Materials such as solar-reflective paints or low-VOC water repellents are becoming the norm in high-spec projects. The pipeline for innovation is growing fast as private industry players seek differentiation through material functionality and green credentials. It represents an overt shift from reactive conformity to proactive innovation.

South Korea Construction Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Concrete Admixtures

- Waterproofing and Roofing

- Repair

- Flooring

- Sealants and Adhesives

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes concrete admixtures, waterproofing and roofing, repair, flooring, sealants and adhesives, and others.

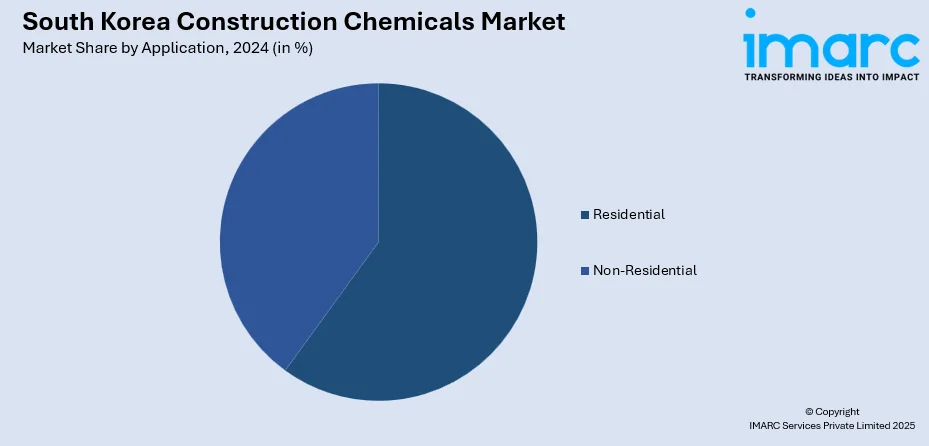

Application Insights:

- Residential

- Non-Residential

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and non-residential.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Construction Chemicals Market News:

- May 2025: Sumitomo Chemical is investing in its South Korean subsidiary, Dongwoo Fine‑Chem, to strengthen semiconductor chemicals capabilities. The company will build a new cleanroom and expand process‑verification lines at the Iksan Research Laboratory to enhance the quality of advanced materials and accelerate product development. This move supports enhanced manufacturing of ultra‑high‑purity and functional chemicals vital for complex semiconductor processes. Sequential operations are planned to begin in fiscal 2026.

- January 2025: Wacker Chemie has expanded its operations in South Korea with a new silicone production facility in Jincheon, strengthening its presence in the Asian market. The site focuses on manufacturing silicone sealants tailored for the region’s construction sector, supporting growing demand for high-performance materials. This move underscores South Korea’s strategic role in Wacker’s regional growth plans. By localizing production, the company enhances supply reliability and responsiveness, reinforcing its commitment to customers and industry development in South Korea.

South Korea Construction Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Concrete Admixtures, Waterproofing and Roofing, Repair, Flooring, Sealants and Adhesives, Others |

| Applications Covered | Residential, Non-Residential |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea construction chemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea construction chemicals market on the basis of type?

- What is the breakup of the South Korea construction chemicals market on the basis of application?

- What is the breakup of the South Korea construction chemicals market on the basis of region?

- What are the various stages in the value chain of the South Korea construction chemicals market?

- What are the key driving factors and challenges in the South Korea construction chemicals market?

- What is the structure of the South Korea construction chemicals market and who are the key players?

- What is the degree of competition in the South Korea construction chemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea construction chemicals market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea construction chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea construction chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)