South Korea Crane Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

South Korea Crane Market Overview:

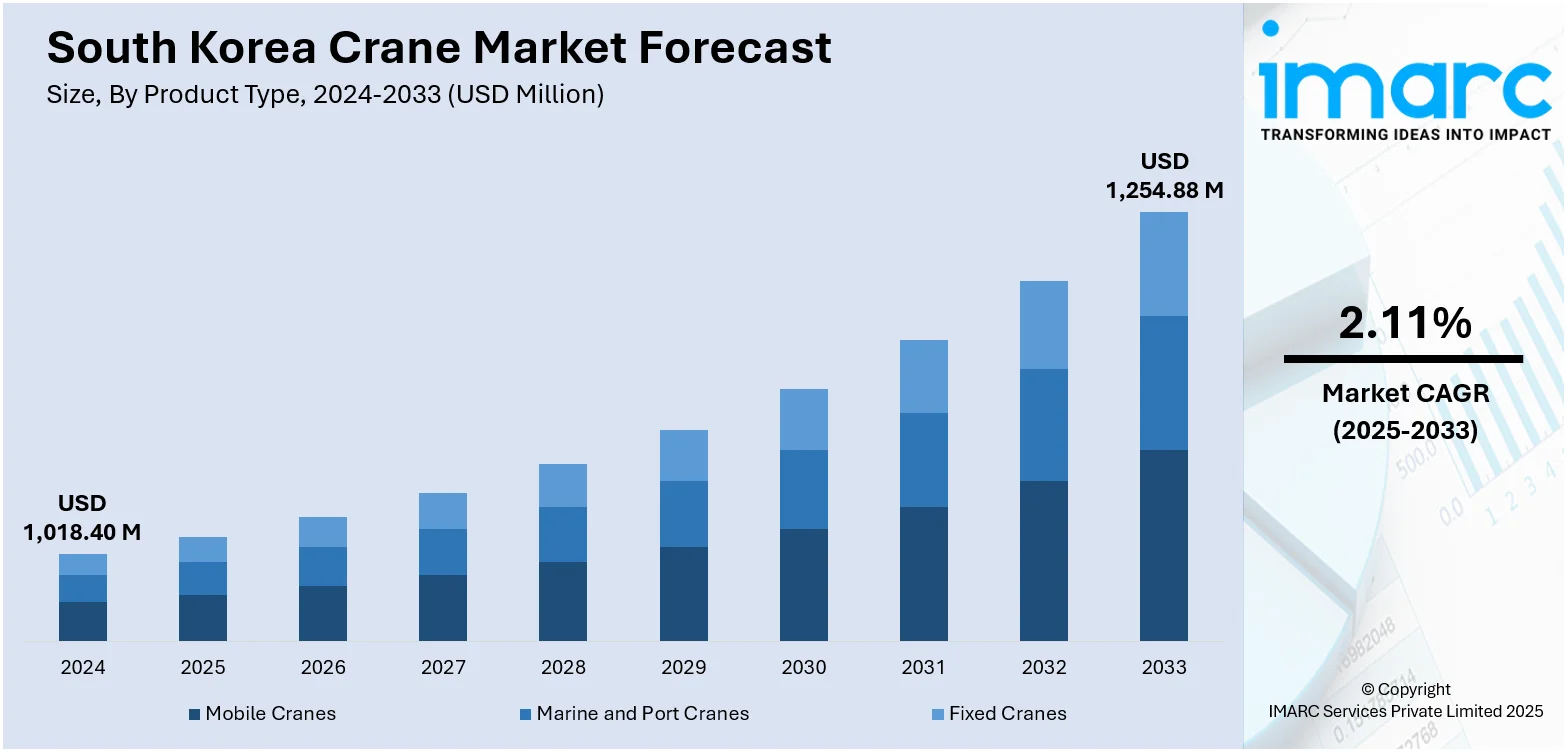

The South Korea crane market size reached USD 1,018.40 Million in 2024. Looking forward, the market is projected to reach USD 1,254.88 Million by 2033, exhibiting a growth rate (CAGR) of 2.11% during 2025-2033. The market is driven by rapid urbanization and infrastructure-led growth requiring heavy lifting equipment in shipbuilding, construction and industrial projects. Along with this, expanding smart crane technology adoption enhancing safety and efficiency, and flexible rental and service-based models offering scalable access to modern equipment are further augmenting the South Korea crane market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,018.40 Million |

| Market Forecast in 2033 | USD 1,254.88 Million |

| Market Growth Rate 2025-2033 | 2.11% |

South Korea Crane Market Trends:

Urbanization, Infrastructure Expansion and Heavy Industry Demand

South Korea’s ongoing urban densification, extensive infrastructure initiatives and leading heavy industries are significantly elevating crane deployment across construction and industrial sectors. Major urban regeneration programs, smart city development and port modernization projects in regions like Busan, Ulsan and metropolitan zones necessitate frequent use of tower, gantry, bridge and crawler cranes. Simultaneously, robust shipbuilding activity at Hyundai Heavy Industries, Samsung Heavy and other firms require high‑capacity cranes for offshore rigs, dry docks and vessel assembly. On February 25, 2025, South Korean shipbuilding giants HD Hyundai Heavy Industries and Hanwha Ocean signed a Memorandum of Understanding with the Defense Acquisition Program Administration (DAPA) to form a “One Team” alliance for naval ship export projects. Under the agreement, HD Hyundai will lead surface vessel exports while Hanwha Ocean will focus on submarines, enhancing operational efficiency and global competitiveness through joint resource use and technology sharing. Industrial facilities in petrochemicals, automotive and steel production continue to rely heavily on mechanized lifting equipment. This environment also draws demand for modular crane designs suited for constrained sites and intermittent use patterns. Manufacturers and rental providers are responding by expanding fleets and offering flexible rental services. Logistics automation initiatives further encourage capital injection into overhead and material handling cranes. As a result, infrastructure-led demand and industrial heavy lifting are substantial contributors to South Korea crane market growth.

To get more information on this market, Request Sample

Shift Toward Rental Models and Service-Oriented Business Structures

The high capital cost of crane procurement, combined with project-specific and seasonal demand, has led South Korean businesses to embrace equipment leasing and rental models. Rental services allow firms to access advanced crane types without the burden of ownership, making operations more flexible and cost-efficient. Crane designs that support modular assembly, hybrid power sources and battery-operated lift assist systems gain preference in urban zones. Rental providers also offer maintenance contracts, operator training and performance monitoring, reducing logistical complexity for end-users. This model supports contractors and logistics firms that manage variable demand across infrastructure, manufacturing and port handling. Cranes delivered on a rental basis also facilitate rapid deployment on short-term projects without long lead times or storage needs. The availability of modular and flexible crane designs further enhances the appeal of rental solutions. As firms increasingly prioritize operational agility and cost-control, the service-based equipment model becomes a strategic preference, enabling broader usage of modern crane technology across diverse industry segments. On August 13, 2024, John Crane was awarded a five-year Gas Seal Management Program (GSMP) maintenance contract by SK Advanced in Ulsan, South Korea. The agreement covers servicing and refurbishment of Dry Gas Seals used in propylene production, with major turnaround events scheduled in 2024 and 2028. This partnership supports ongoing industrial reliability and highlights growing service demand in South Korea's process and manufacturing sectors.

South Korea Crane Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and application.

Product Type Insights:

- Mobile Cranes

- Marine and Port Cranes

- Fixed Cranes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes mobile cranes, marine and port cranes, and fixed cranes.

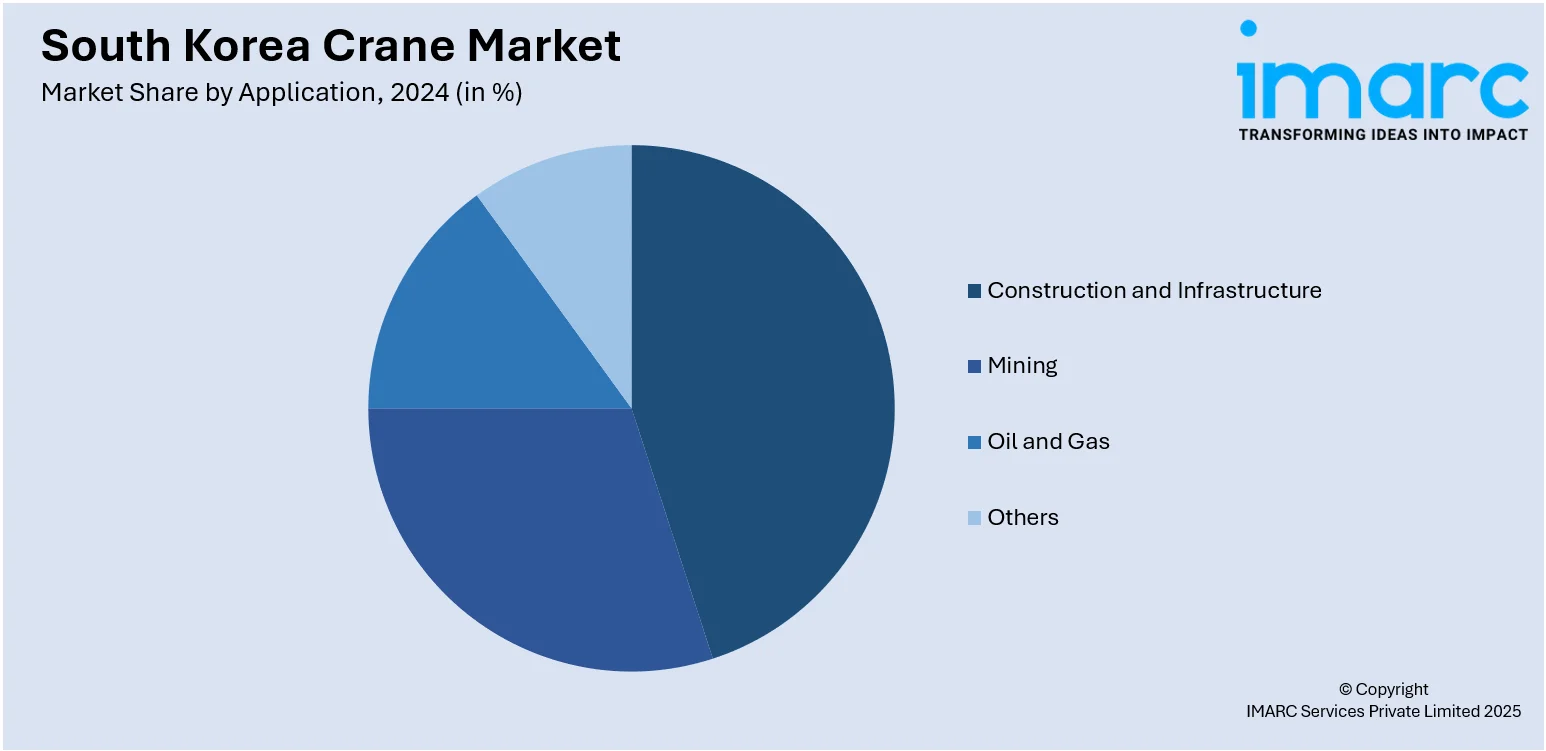

Application Insights:

- Construction and Infrastructure

- Mining

- Oil and Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes construction and infrastructure, mining, oil and gas, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Crane Market News:

- On January 10, 2025, South Korea-based Lee Gang Crane Rental Company acquired a Grove GMK5250XL-1 all-terrain crane to support local projects, including the construction of a new semiconductor plant. The crane features a 250-ton capacity and a 78.5-meter main boom, with a compact 7.8-meter outrigger width, offering high performance and maneuverability in constrained job sites. This purchase aligns with South Korea’s USD 19 Billion government-backed semiconductor expansion initiative and reflects growing demand for advanced lifting equipment in the country’s crane market.

South Korea Crane Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Mobile Cranes, Marine and Port Cranes, Fixed Cranes |

| Applications Covered | Construction and Infrastructure, Mining, Oil and Gas, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea crane market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea crane market on the basis of product type?

- What is the breakup of the South Korea crane market on the basis of application?

- What is the breakup of the South Korea crane market on the basis of region?

- What are the various stages in the value chain of the South Korea crane market?

- What are the key driving factors and challenges in the South Korea crane market?

- What is the structure of the South Korea crane market and who are the key players?

- What is the degree of competition in the South Korea crane market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea crane market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea crane market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea crane industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)