South Korea Dairy Alternatives Market Size, Share, Trends and Forecast by Source, Formulation, Nutrient, Distribution Channel, Product Type, and Region, 2025-2033

South Korea Dairy Alternatives Market Overview:

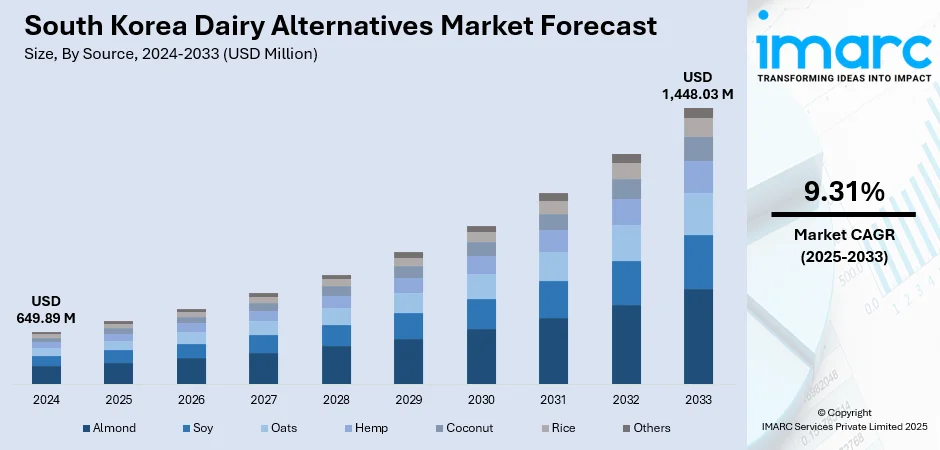

The South Korea dairy alternatives market size reached USD 649.89 Million in 2024. Looking forward, the market is expected to reach USD 1,448.03 Million by 2033, exhibiting a growth rate (CAGR) of 9.31% during 2025-2033. The market is expanding due to growing health awareness, rising lactose intolerance cases, and shifting consumer preferences toward plant-based diets. Increasing environmental concerns and ethical consumption habits further fuel demand. Widespread product availability across online and offline channels enhances market penetration. These dynamics continue to boost the South Korea dairy alternatives market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 649.89 Million |

| Market Forecast in 2033 | USD 1,448.03 Million |

| Market Growth Rate 2025-2033 | 9.31% |

South Korea Dairy Alternatives Market Trends:

Rising Health Awareness and Lactose Intolerance Concerns

South Korean consumers are increasingly focused on health, driven by concerns about lactose intolerance and the nutritional profile of dairy products. Many experience digestive discomfort with traditional milk, prompting them to adopt plant-based alternatives such as soy, almond, and oat milk. These substitutes are perceived as healthier due to lower saturated fats and calories, while providing essential nutrients. Additionally, a growing wellness mindset, emphasizing balanced diets and clean-label ingredients, is encouraging more consumers to explore non-dairy options. As health campaigns and dietary trends proliferate, both mainstream buyers and niche groups view dairy alternatives as smart substitutes, fueling greater adoption across households and prompting manufacturers to expand their product lines.

To get more information on this market, Request Sample

Sustainability and Ethical Dietary Preferences

Environmental concerns and ethical considerations are playing a pivotal role in shaping consumer behavior in South Korea. With growing awareness about the environmental footprint of animal agriculture, many consumers now favor plant-based alternatives for ethical and ecological reasons. Veganism and flexitarian lifestyles are on the rise, particularly among younger demographics, further driving demand for dairy-free options. Dairy substitutes made from plant sources like nuts, seeds, and legumes are perceived as sustainable and animal-friendly, aligning with broader shifts toward responsible consumption. This ethical stance is reinforcing consumer willingness to choose alternatives that reflect environmental values, thereby boosting the South Korea dairy alternatives market growth across urban and influenced populations.

Expanded Retail Channels and Digital Commerce

The proliferation of retail formats and digital platforms in South Korea has made dairy alternatives increasingly accessible. Supermarkets, hypermarkets, convenience stores, and specialty health food outlets are expanding their shelf space for plant-based products. Meanwhile, e-commerce platforms such as Kurly, Iidus, and JeongYookGak simplify the discovery and delivery of these options, especially for young, tech-savvy consumers. Online platforms offer convenience, variety, and user-friendly experiences enhanced by digital marketing and direct-to-consumer promotions. This omni-channel retail evolution, supported by strong internet penetration, is making it easier for consumers to explore and purchase diverse dairy alternatives, driving both growth and reach across local and regional markets.

South Korea Dairy Alternatives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source, formulation, nutrient, distribution channel, and product type.

Source Insights:

- Almond

- Soy

- Oats

- Hemp

- Coconut

- Rice

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes almond, soy, oats, hemp, coconut, rice, and others.

Formulation Insights:

- Plain

- Sweetened

- Unsweetened

- Flavored

- Sweetened

- Unsweetened

A detailed breakup and analysis of the market based on the formulation have also been provided in the report. This includes plain (sweetened and unsweetened) and flavored (sweetened and unsweetened).

Nutrient Insights:

- Protein

- Starch

- Vitamin

- Others

The report has provided a detailed breakup and analysis of the market based on the nutrient. This includes protein, starch, vitamin, and others.

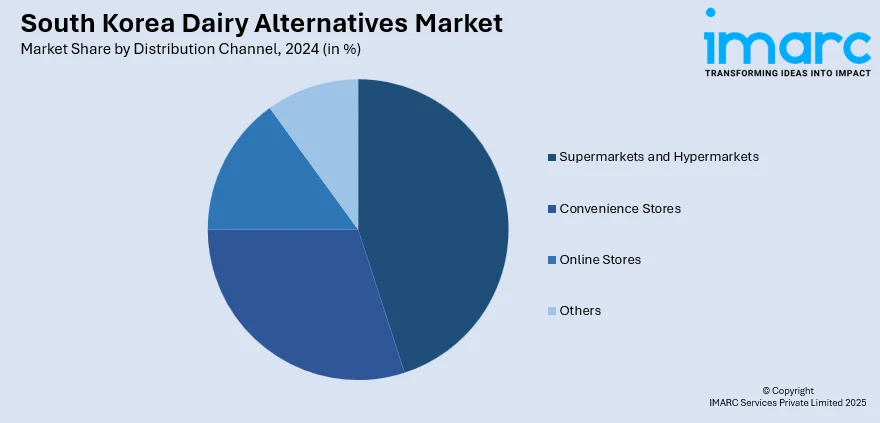

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online stores, and others.

Product Type Insights:

- Cheese

- Creamers

- Yogurt

- Ice Creams

- Milk

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cheese, creamers, yogurt, ice creams, milk, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Dairy Alternatives Market News:

- In January 2024, US-based biotechnology company Pureture, recognized for its development of functional, animal-free ingredients, formed a strategic alliance with Namyang Dairy Products, a top dairy producer in South Korea. With operations spanning 21 countries, Namyang produces a wide range of dairy goods such as milk, yogurt, cheese, cream, and butter. Through this collaboration, Namyang will utilize Pureture’s plant-based casein to launch a new range of eco-friendly, plant-based dairy alternatives. The initiative is designed to align with the rising consumer demand for sustainable and environmentally conscious food choices.

South Korea Dairy Alternatives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Almond, Soy, Oats, Hemp, Coconut, Rice, Others |

| Formulations Covered |

|

| Nutrients Covered | Protein, Starch, Vitamin, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Product Types Covered | Cheese, Creamers, Yogurt, Ice Creams, Milk, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea dairy alternatives market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea dairy alternatives market on the basis of source?

- What is the breakup of the South Korea dairy alternatives market on the basis of formulation?

- What is the breakup of the South Korea dairy alternatives market on the basis of nutrient?

- What is the breakup of the South Korea dairy alternatives market on the basis of distribution channel?

- What is the breakup of the South Korea dairy alternatives market on the basis of product type?

- What is the breakup of the South Korea dairy alternatives market on the basis of region?

- What are the various stages in the value chain of the South Korea dairy alternatives market?

- What are the key driving factors and challenges in the South Korea dairy alternatives market?

- What is the structure of the South Korea dairy alternatives market and who are the key players?

- What is the degree of competition in the South Korea dairy alternatives market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea dairy alternatives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea dairy alternatives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea dairy alternatives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)