South Korea Dairy Ingredients Market Size, Share, Trends and Forecast by Product, Source, Form, Application, and Region, 2025-2033

South Korea Dairy Ingredients Market Overview:

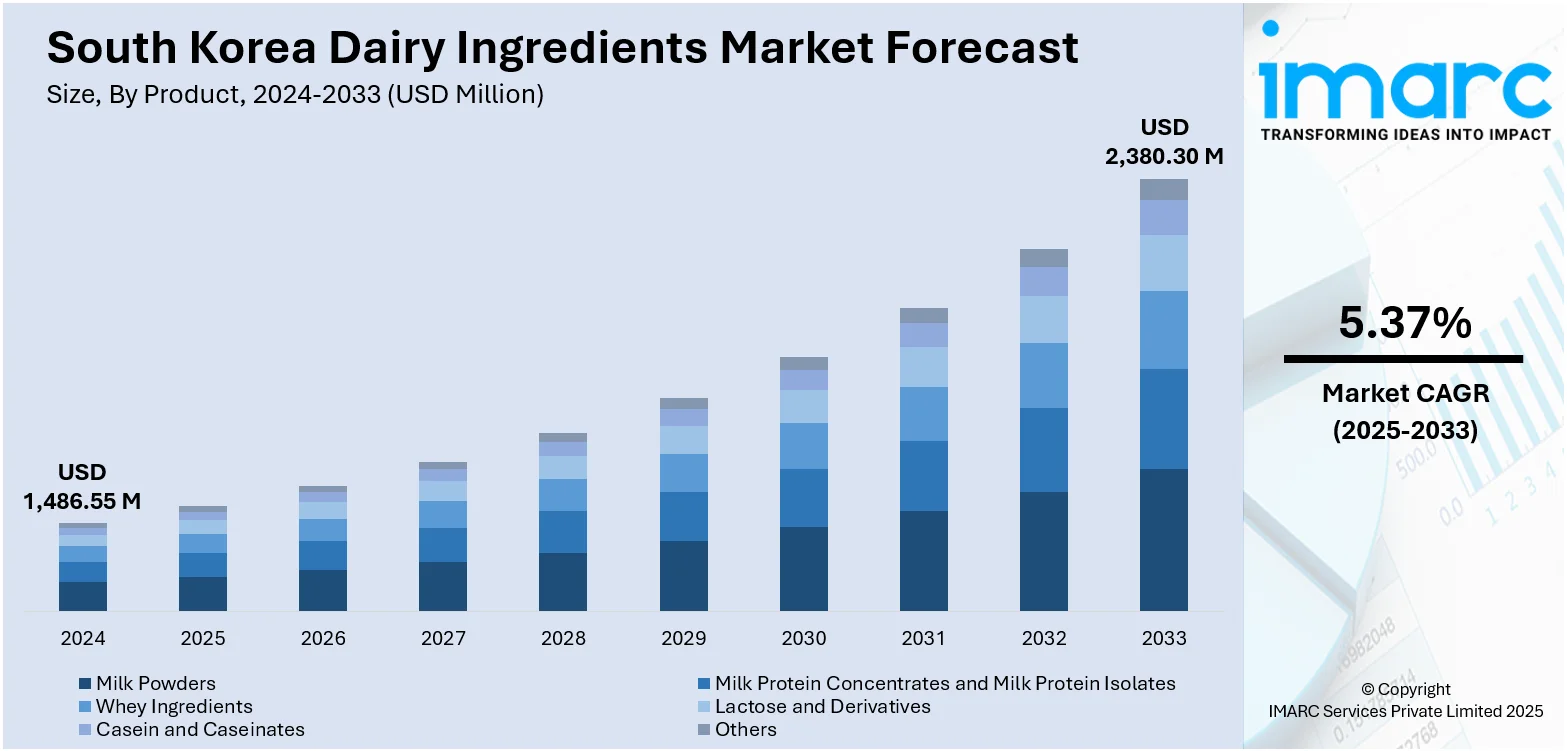

The South Korea dairy ingredients market size reached USD 1,486.55 Million in 2024. Looking forward, the market is expected to reach USD 2,380.30 Million by 2033, exhibiting a growth rate (CAGR) of 5.37% during 2025-2033. The market is expanding steadily, driven by rising health awareness, escalating demand for high-protein diets, and the growing popularity of functional and fortified foods. Increasing use in bakery, confectionery, and infant nutrition also fuels growth. Innovation in dairy processing technologies continues to support product diversification, further contributing to the rising South Korea dairy ingredients market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,486.55 Million |

| Market Forecast in 2033 | USD 2,380.30 Million |

| Market Growth Rate 2025-2033 | 5.37% |

South Korea Dairy Ingredients Market Trends:

Westernized Diets and Product Diversification

The growing influence of Western eating habits in South Korea is fueling the demand for a wider range of dairy-based foods and ingredients. Other products such as cheese, butter, and yogurt, which had originally been niche products, have now become a regular part of the Korean diet, particularly among the younger and urban generations. Such change is enhancing the demand for specialist dairy ingredients in fast food, ready-to-eat products, bakery products, and candy items. To cope with this changing demand, producers are adding to their product lines processed cheese powders, dairy-based sauces, flavored butter, and yogurt cultures. Furthermore, innovation is being created by the consumer demand for world foods and fusion foods. The nature of Western-style consumption is changing with new product formats and flavors being developed as dairy ingredient suppliers are seeking to target their expanding and more adventurous consumers.

To get more information on this market, Request Sample

Rising Health Awareness and Functional Nutrition Demand

A significant driver of the South Korea dairy ingredients market growth is the increasing demand for health-oriented and functional food products. Consumers are becoming more health-conscious and seeking dairy ingredients rich in protein, calcium, probiotics, and essential vitamins. The trend has contributed to the high demand for low-fat, lactose-free, and even fortified dairy products in health drinks, yogurts, and infant feeding. The functional dairy products, which improve immune health and gut health (i.e., whey protein, probiotic cultures are increasingly in vogue. On the innovation side, food manufacturers are working on fresh formulas and selling products such as protein-enriched dairy drinks, probiotic-dipped snacks, among others. With the Korean consumers shifting toward the values of wellness and nutritional superiority, the market for high-quality functional dairy ingredients will expand steadily across several food categories.

Technological Advancements and Improved Supply Chains

Technological progress in dairy processing and distribution is significantly supporting the growth of South Korea’s dairy ingredients market. Innovations such as ultra-high temperature (UHT) processing, microfiltration, and extended shelf-life packaging are enhancing the safety, efficiency, and versatility of dairy ingredients. These technologies ensure product stability and maintain nutritional value throughout the supply chain. Additionally, South Korea’s robust logistics infrastructure, including advanced cold chain systems and digital inventory management, enables timely and safe delivery across the country. E-commerce platforms and online grocery channels are also expanding consumer access to a variety of dairy-based products. Coupled with supportive food safety regulations and labeling standards, these advancements are improving consumer confidence and boosting the adoption of dairy ingredients across foodservice, retail, and industrial applications.

South Korea Dairy Ingredients Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, source, form, and application.

Product Insights:

- Milk Powders

- Skimmed Milk Powders

- Whole Milk Powders

- Milk Protein Concentrates and Milk Protein Isolates

- Whey Ingredients

- Whey Protein Concentrate (WPC)

- Whey Protein Isolate (WPI)

- Hydrolyzed Whey Protein (HWP)

- Lactose and Derivatives

- Casein and Caseinates

- Others

The report has provided a detailed breakup and analysis of the market based on product. This includes milk powders (skimmed milk powders and whole milk powders), milk protein concentrates and milk protein isolates, whey ingredients (whey protein concentrate (WPC), whey protein isolate (WPI), and hydrolyzed whey protein (HWP)), lactose and derivatives, casein and caseinates, and others.

Source Insights:

- Milk

- Whey

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes milk and whey.

Form Insights:

- Dry

- Liquid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes dry and liquid.

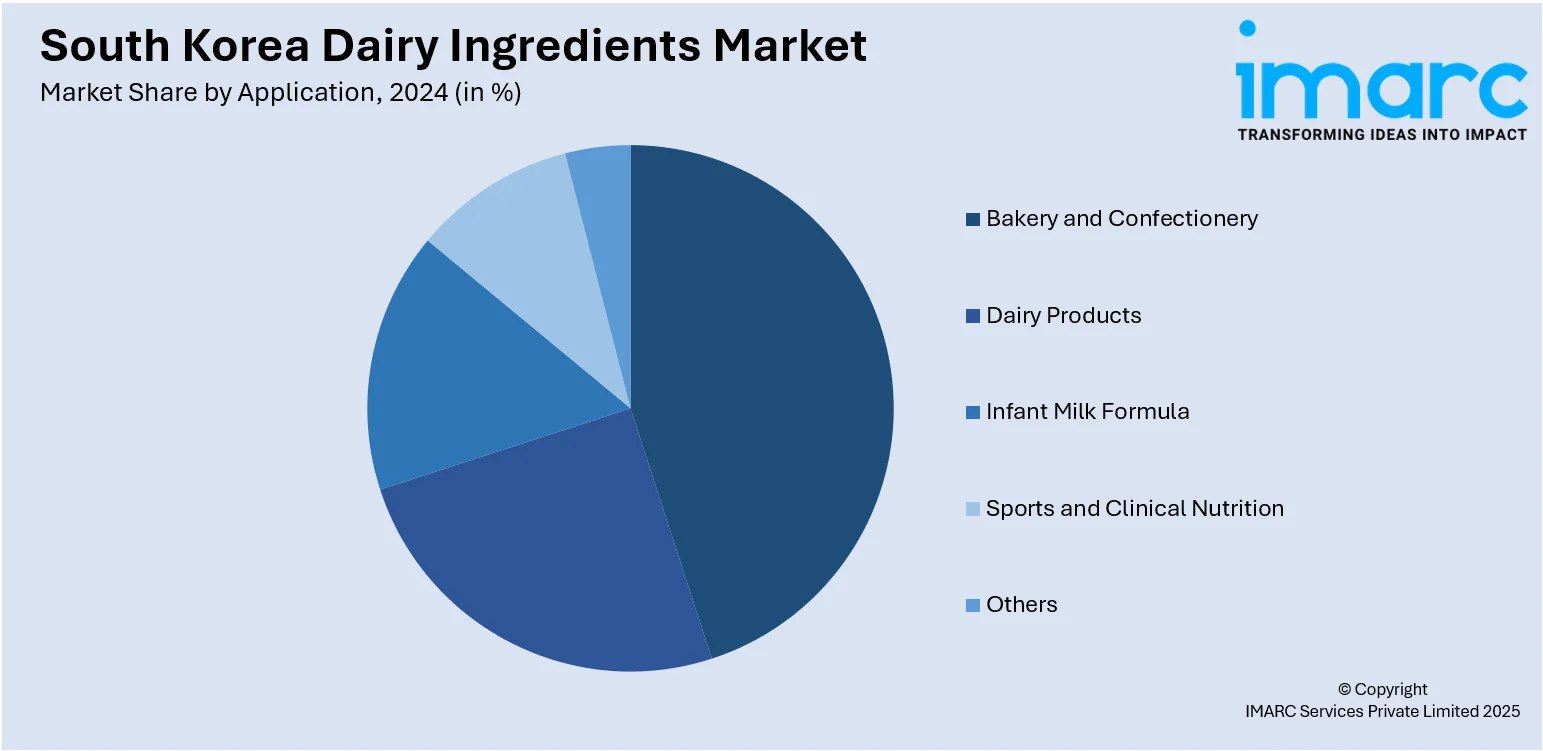

Application Insights:

- Bakery and Confectionery

- Dairy Products

- Infant Milk Formula

- Sports and Clinical Nutrition

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bakery and confectionery, dairy products, infant milk formula, sports and clinical nutrition, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Dairy Ingredients Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Sources Covered | Milk, Whey |

| Forms Covered | Dry, Liquid |

| Applications Covered | Bakery and Confectionery, Dairy Products, Infant Milk Formula, Sports and Clinical Nutrition, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea dairy ingredients market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea dairy ingredients market on the basis of product?

- What is the breakup of the South Korea dairy ingredients market on the basis of source?

- What is the breakup of the South Korea dairy ingredients market on the basis of form?

- What is the breakup of the South Korea dairy ingredients market on the basis of application?

- What is the breakup of the South Korea dairy ingredients market on the basis of region?

- What are the various stages in the value chain of the South Korea dairy ingredients market?

- What are the key driving factors and challenges in the South Korea dairy ingredients market?

- What is the structure of the South Korea dairy ingredients market and who are the key players?

- What is the degree of competition in the South Korea dairy ingredients market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea dairy ingredients market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea dairy ingredients market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea dairy ingredients industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)