South Korea Data Center Colocation Market Size, Share, Trends and Forecast by Type, Organization Size, End-Use Industry, and Region, 2025-2033

South Korea Data Center Colocation Market Overview:

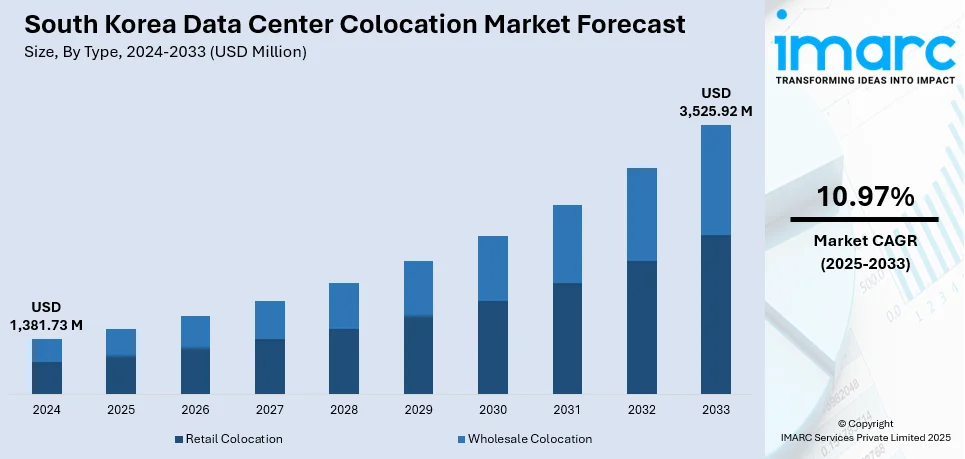

The South Korea data center colocation market size reached USD 1,381.73 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,525.92 Million by 2033, exhibiting a growth rate (CAGR) of 10.97% during 2025-2033. Rising demand for cost-effective printing, growing adoption of cloud-based services, increased security concerns, expanding IT infrastructure in SMEs, and government digitalization initiatives are some of the factors contributing to South Korea data center colocation market share. Vendors are also leveraging analytics and remote management to improve efficiency and reduce downtime.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,381.73 Million |

| Market Forecast in 2033 | USD 3,525.92 Million |

| Market Growth Rate 2025-2033 | 10.97% |

South Korea Data Center Colocation Market Trends:

Rising Demand for AI-Optimized Infrastructure

South Korea is seeing increased interest in data centers built to handle AI workloads. New deployments are expanding the country’s capacity for high-density computing, with facilities tailored to support large-scale GPU environments. This shift reflects a broader move toward infrastructure that can meet the needs of AI platforms operating at scale. Companies are choosing locations with strong connectivity and technical reliability, and South Korea’s urban centers offer both. These developments are not just about physical space but about positioning the country as a serious player in the AI infrastructure market. As more international providers enter, demand for colocation services that support machine learning, model training, and high-speed processing continues to grow. These factors are intensifying the South Korea data center colocation market growth. For instance, in August 2024, Lambda partnered with SK Telecom to deploy its AI Cloud platform at SK Broadband’s Gasan data center in South Korea, marking Lambda’s first international expansion. The facility, supporting up to 46MW IT load, would scale to host thousands of GPUs. This move strengthens South Korea’s data center colocation market by boosting AI infrastructure capacity and positioning the country as a hub for high-performance computing in Asia.

To get more information on this market, Request Sample

Expansion of Cloud-Backed AI Infrastructure

The push for stronger cloud and AI capabilities is driving new infrastructure builds in South Korea. A growing number of providers are expanding their presence with advanced data centers that support enterprise AI workloads and critical cloud functions. These facilities are helping improve network reliability, support disaster recovery, and enhance regional cloud performance. As businesses adopt AI at a faster pace, demand for scalable, secure, and high-performance environments is rising. This is encouraging further investment in colocation-ready facilities that offer proximity, connectivity, and energy efficiency. South Korea’s positioning as a technology-forward market is being reinforced by these developments, with its data center colocation market benefiting from a clear shift toward AI-integrated digital operations. For example, in June 2025, Alibaba Cloud launched its second data center in South Korea to meet rising demand for AI and cloud services. The new facility expands local infrastructure capacity, enhancing cloud resilience, network performance, and disaster recovery. This marks a key step in Alibaba Cloud’s investment in South Korea’s AI ecosystem, indirectly supporting the data center colocation market as enterprise AI adoption accelerates and infrastructure needs continue to grow.

South Korea Data Center Colocation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, organization size, and end-use industry.

Type Insights:

- Retail Colocation

- Wholesale Colocation

The report has provided a detailed breakup and analysis of the market based on the type. This includes retail colocation and wholesale colocation.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium enterprises and large enterprises.

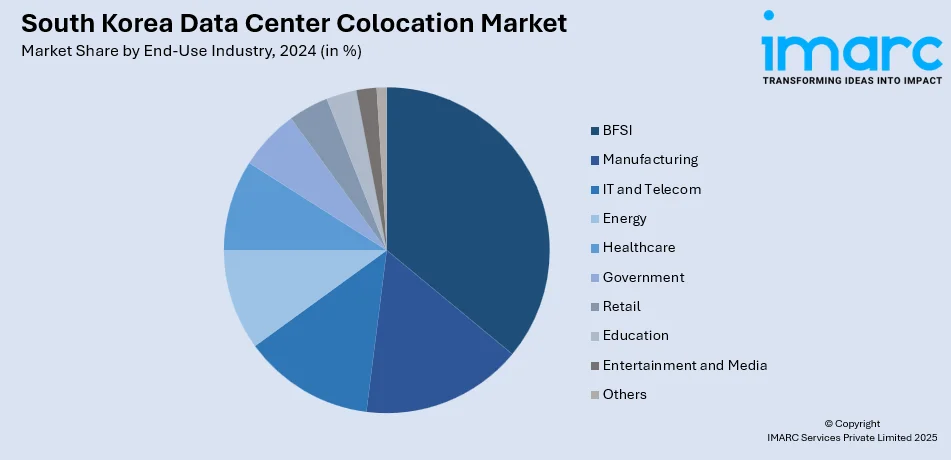

End-Use Industry Insights:

- BFSI

- Manufacturing

- IT and Telecom

- Energy

- Healthcare

- Government

- Retail

- Education

- Entertainment and Media

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes BFSI, manufacturing, IT and telecom, energy, healthcare, government, retail, education, entertainment and media, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Data Center Colocation Market News:

- In June 2025, Koramco Asset Management announced plans to invest KRW 10 Trillion (USD 7 Billion) in South Korea’s data center sector by 2032, targeting 1GW IT-load capacity. The firm aims to become the country’s largest data center operator, with funding via a KRW 5 trillion data center fund and debt financing. A REIT listing is also under consideration. This move is expected to significantly boost South Korea’s colocation capacity and infrastructure investment.

South Korea Data Center Colocation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Retail Colocation, Wholesale Colocation |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End-Use Industries Covered | BFSI, Manufacturing, IT and Telecom, Energy, Healthcare, Government, Retail, Education, Entertainment and Media, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea data center colocation market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea data center colocation market on the basis of type?

- What is the breakup of the South Korea data center colocation market on the basis of organization size?

- What is the breakup of the South Korea data center colocation market on the basis of end-use industry?

- What is the breakup of the South Korea data center colocation market on the basis of region?

- What are the various stages in the value chain of the South Korea data center colocation market?

- What are the key driving factors and challenges in the South Korea data center colocation market?

- What is the structure of the South Korea data center colocation market and who are the key players?

- What is the degree of competition in the South Korea data center colocation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea data center colocation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea data center colocation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea data center colocation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)