South Korea Data Center Construction Market Size, Share, Trends and Forecast by Construction Type, Data Center Type, Tier Standards, Vertical, and Region, 2025-2033

South Korea Data Center Construction Market Overview:

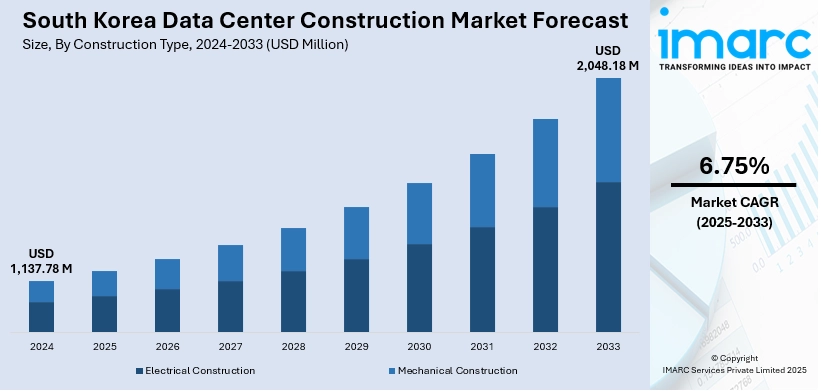

The South Korea data center construction market size reached USD 1,137.78 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,048.18 Million by 2033, exhibiting a growth rate (CAGR) of 6.75% during 2025-2033. Government-backed initiatives and rising institutional investment are driving the data center construction market in South Korea. Policy support, financial backing, and public-private partnerships (PPP) are catalyzing the demand for large-scale infrastructure. Additionally, investors view data centers as stable, high-return assets, which is boosting development, contributing to the expansion of the South Korea data center construction market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,137.78 Million |

| Market Forecast in 2033 | USD 2,048.18 Million |

| Market Growth Rate 2025-2033 | 6.75% |

South Korea Data Center Construction Market Trends:

Increasing Institutional Investment

Asset managers, pension funds, and infrastructure investors are progressively acknowledging data centers as high-return, low-risk assets, particularly as the demand from artificial intelligence (AI), cloud computing, and digital platforms rises. Investment strategies from these institutions facilitate extensive, multi-phase projects that correspond with national digital objectives and changing business requirements. These investments not only offer the financial support needed for building hyperscale facilities, but also promote advancements in design, energy efficiency, and automation. Additionally, the establishment of specialized data center investment funds and the possible introduction of real estate investment trusts (REITs) indicates an evolving market that provides varied, adaptable financial options for participants. This increasing financial investment reduces entry obstacles for operators and speeds up project implementation in both urban and suburban areas. Institutional support also fosters standardization, adherence to regulations, and sustainability, enhancing South Korea's credibility and attractiveness as a regional center for digital infrastructure. In 2025, Koramco Asset Management announced plans to invest ₩10 trillion ($7 billion) in South Korean data centers by 2032, aiming to become the nation's largest data center operator. It will raise ₩5 trillion through a dedicated fund by 2028 and may launch a data center-backed REIT. The strategy includes building a 1GW IT-load capacity portfolio amid rising demand from AI and cloud computing.

To get more information on this market, Request Sample

Government-Backed Mega Projects

Government-backed data center initiatives on a large scale is a critical factor impelling the South Korea data center construction market growth. In 2025, South Korea announced plans to build one of the world’s largest AI data centers, led by Fir Hills (SFR) in partnership with the Jeollanam-do provincial government. The 3GW facility, expected to be completed by 2028, aims to generate $3.5 billion annually and create over 10,000 jobs. It will support hyperscalers and AI developers, advancing Korea’s position in global AI infrastructure. These efforts demonstrate a robust national dedication to the advancement of digital infrastructure and indicate enduring policy consistency and investment backing for both domestic and international stakeholders. Government participation offers essential facilitators including land distribution, expedited regulatory approvals, power supply assurances, and access to public-private financing structures. This establishes a conducive setting for implementing high-capacity, advanced facilities aimed at supporting emerging technologies, such as AI, quantum computing, and hyperscale cloud computing. Moreover, these large-scale projects aid in job generation, local economic progress, and industrial variety, which subsequently draw more investments from international technology companies and infrastructure investment funds. The magnitude and aspirations of these initiatives also contribute to establishing new industry standards related to capacity, sustainability, and energy efficiency.

South Korea Data Center Construction Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on construction type, data center type, tier standards, and vertical.

Construction Type Insights:

- Electrical Construction

- Mechanical Construction

The report has provided a detailed breakup and analysis of the market based on the construction type. This includes electrical construction and mechanical construction.

Data Center Type Insights:

- Mid-Size Data Centers

- Enterprise Data Centers

- Large Data Centers

A detailed breakup and analysis of the market based on the data center type have also been provided in the report. This includes mid-size data centers, enterprise data centers, and large data centers.

Tier Standards Insights:

- Tier I and II

- Tier III

- Tier IV

The report has provided a detailed breakup and analysis of the market based on the tier standards. This includes tier I and II, tier III, and tier IV.

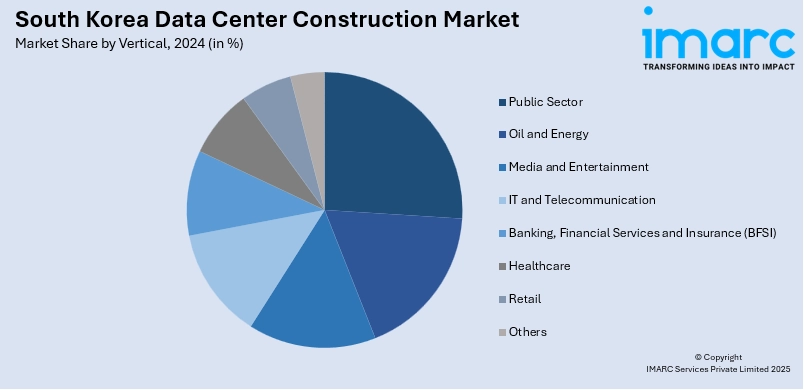

Vertical Insights:

- Public Sector

- Oil and Energy

- Media and Entertainment

- IT and Telecommunication

- Banking, Financial Services and Insurance (BFSI)

- Healthcare

- Retail

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes public sector, oil and energy, media and entertainment, IT and telecommunication, banking, financial services and insurance (BFSI), healthcare, retail, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Data Center Construction Market News:

- In June 2025, Alibaba Cloud confirmed it will launch its second data center in South Korea by the end of June to meet rising demand for cloud and AI services. The expansion supports local businesses like Univa and Lala Station and aims to boost AI innovation and digital infrastructure.

- In June 2025, SK Group announced plans to build South Korea’s largest AI data center in Ulsan, in partnership with Amazon Web Services (AWS). The facility will feature 60,000 GPUs and begin construction in August 2025, aiming to scale to 1GW capacity by 2029.

South Korea Data Center Construction Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Construction Types Covered | Electrical Construction, Mechanical Construction |

| Data Center Types Covered | Mid-Size Data Centers, Enterprise Data Centers, Large Data Centers |

| Tier Standards Covered | Tier I and II, Tier III, Tier IV |

| Verticals Covered | Public Sector, Oil and Energy, Media and Entertainment, IT and Telecommunication, Banking, Financial Services and Insurance (BFSI), Healthcare, Retail, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea data center construction market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea data center construction market on the basis of construction type?

- What is the breakup of the South Korea data center construction market on the basis of data center type?

- What is the breakup of the South Korea data center construction market on the basis of tier standards?

- What is the breakup of the South Korea data center construction market on the basis of vertical?

- What is the breakup of the South Korea data center construction market on the basis of region?

- What are the various stages in the value chain of the South Korea data center construction market?

- What are the key driving factors and challenges in the South Korea data center construction market?

- What is the structure of the South Korea data center construction market and who are the key players?

- What is the degree of competition in the South Korea data center construction market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea data center construction market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea data center construction market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea data center construction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)