South Korea Data Center Market Report by Data Center Size (Large, Massive, Medium, Mega, Small), Tier Type (Tier 1 and 2, Tier 3, Tier 4), Absorption (Non-Utilized, Utilized), and Region 2026-2034

South Korea Data Center Market Overview:

South Korea data center market size reached USD 4.40 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 9.30 Billion by 2034, exhibiting a growth rate (CAGR) of 8.69% during 2026-2034. The increasing demand for cloud computing services is stimulating the market across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 4.40 Billion |

|

Market Forecast in 2034

|

USD 9.30 Billion |

| Market Growth Rate 2026-2034 | 8.69% |

Access the full market insights report Request Sample

South Korea Data Center Market Analysis:

- Major Market Drivers: The rising number of smart cities is propelling the market. Moreover, transformation initiatives by government entities and private enterprises are acting as significant growth-inducing factors.

- Key Market Trends: The expanding telecommunications infrastructure, generally characterized by high-speed internet connectivity, is augmenting the overall market.

- Competitive Landscape: The report has also provided a comprehensive analysis of the competitive landscape in the market. Also, detailed profiles of all major companies have been provided.

- Geographical Trends: The inflating need for creating a conducive environment for data center investment is bolstering the market in the Seoul Capital Area. Moreover, the increasing popularity of energy-efficient designs is also augmenting the overall market across the Yeongnam (Southeastern Region). Besides this, the growing adoption of eco-friendly practices is further propelling the market in Honam (Southwestern Region).

- Challenges and Opportunities: The increasing concerns about managing high energy consumption are hampering the market. However, the widespread integration of renewable energy sources will continue to augment the market in the coming years.

South Korea Data Center Market Trends:

Expansion of High-Density Data Centers

The growing need for data processing power is stimulating the market. It is specifically designed to handle more data within smaller physical spaces, which is augmenting the market. This generally involves using advanced cooling and energy management technologies. In September 2024, Empyrion Digital signed a binding agreement with “one of Japan’s largest diversified financial services groups” to develop a 25MW AI-ready data center. This is escalating the South Korea data center market outlook.

Introduction of Hybrid Solutions

The rising cloud adoption is fueling the market. Businesses across the globe are widely moving to cloud platforms for flexibility and scalability while maintaining hybrid systems to manage sensitive data and comply with regulatory standards. In August 2024, South Korea Investment Real Asset Management Co. and Indonesian conglomerate Sinar Mas set up a joint venture to build a hyperscale data center in a central business district of Jakarta in a US$300 Million project. This is expanding the South Korea data center market share.

Emphasis on Sustainability

One prominent trend is the focus on sustainability and green initiatives. With the increasing environmental awareness and stringent regulations, data centers are extensively adopting renewable energy sources and energy-efficient technologies. These efforts aim to minimize carbon footprints and operating costs, aligning with local regulatory requirements and global sustainability goals. In February 2024, the regulatory authorities in South Korea unveiled plans for a 1-gigawatt (GW) data center hub near Donghae and Gangneung cities, capable of accommodating up to 50 data centers with an average capacity of 20 megawatts (MW) each. It is renowned for its nuclear and coal-fired power plants.

South Korea Data Center Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the South Korea data center market forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on data center size, tier type, and absorption.

Breakup by Data Center Size:

To get detailed segment analysis of this market Request Sample

- Large

- Massive

- Medium

- Mega

- Small

The report has provided a detailed breakup and analysis of the market based on data center size. This includes large, massive, medium, mega, and small.

Large and massive data centers typically serve major corporations and cloud service providers, offering extensive computing power and storage capabilities. Medium-sized data centers cater to regional enterprises and service providers. Mega data centers establish facilities in South Korea to support the elevating demand for digital content and cloud services. They generally incorporate cutting-edge technologies for cooling and energy efficiency. On the other end of the spectrum, small data centers are generally used by specific industries or local businesses, thereby providing specialized services with a focus on low latency and proximity. This is expanding the South Korea data center market outlook report.

Breakup by Tier Type:

- Tier 1 and 2

- Tier 3

- Tier 4

The report has provided a detailed breakup and analysis of the market based on the tier type. This includes tier 1 and 2, tier 3, and tier 4.

Tier 1 and Tier 2 data centers are widely used by smaller businesses or for less critical applications. They provide limited redundancy and lower uptime guarantees. Tier 3 data centers are more prevalent in South Korea, providing a balance between reliability and cost. These facilities offer multiple paths for power and cooling, which is crucial for enterprises requiring consistent performance. Tier 4 data centers represent the highest level of security and reliability, with fully redundant infrastructure and fault-tolerant systems designed for zero downtime.

Breakup by Absorption:

- Non-Utilized

- Utilized

- Colocation Type

- Hyperscale

- Retail

- Wholesale

- End User

- BFSI

- Cloud

- E-Commerce

- Government

- Manufacturing

- Media and Entertainment

- Telecom

- Others

- Colocation Type

The report has provided a detailed breakup and analysis of the market based on the absorption. This includes non-utilized, utilized [colocation type, (hyperscale, retail, and wholesale), end user (BFSI, cloud, e-commerce, government, manufacturing, media and entertainment, telecom, and others).

Non-utilized spaces represent areas within data centers that have not yet been leased or activated. In terms of colocation types, the market includes retail, hyperscale, and wholesale offerings. Hyperscale data centers cater to tech giants and large-scale cloud providers, thereby providing vast capacity and scalability. Retail colocation serves smaller enterprises looking for cost-effective and flexible solutions. Wholesale colocation offers a middle ground, appealing to medium-sized businesses.

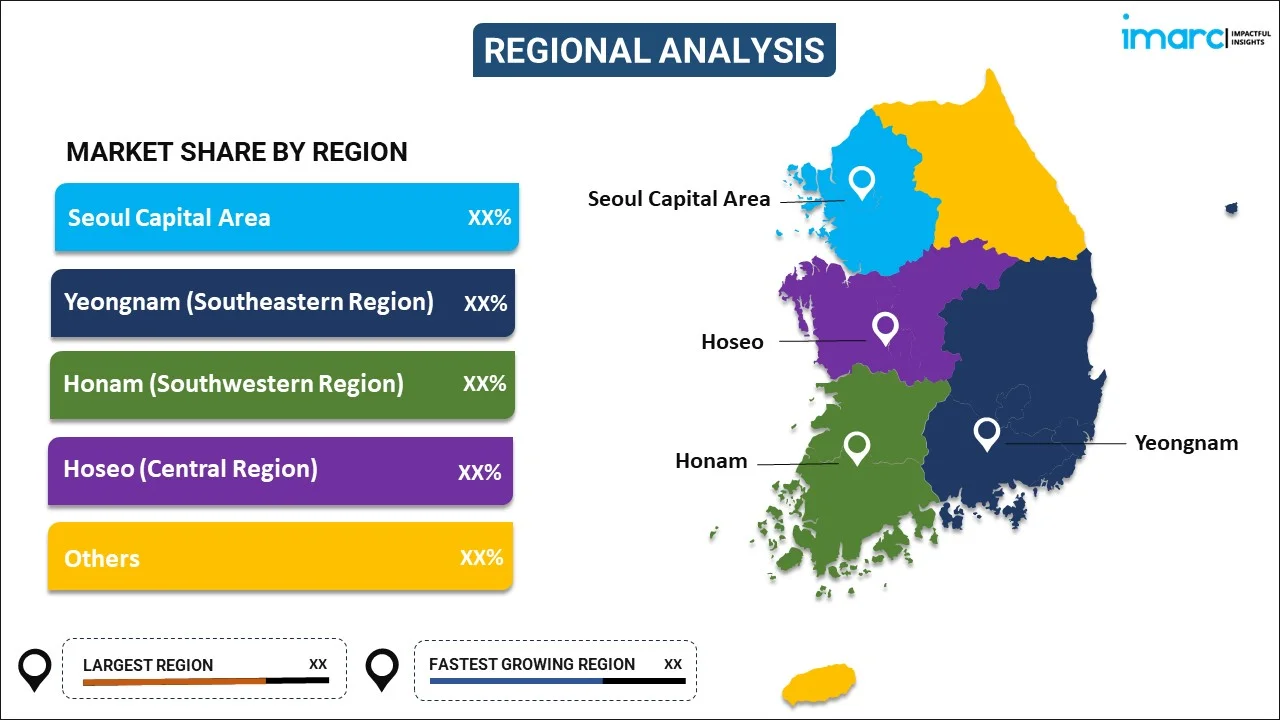

Breakup by Region:

To get detailed regional analysis of this market Request Sample

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The South Korea data center market research report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

The advanced infrastructures are augmenting the market. Yeongnam (Southeastern Region), including cities like Daegu and Busan, is also a key area, with its strategic location near industrial zones. Honam (Southwestern Region) is emerging as an attractive location for data centers. Hoseo (Central Region), encompassing areas like Sejong and Daejeon, is becoming a focal point for research institutions. This is escalating the South Korea data center market demand.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive market price analysis, such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant, has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Data Center Market News:

- September 2024: Empyrion Digital signed a binding agreement with “one of Japan’s largest diversified financial services groups” to develop a 25MW AI-ready data center.

- August 2024: South Korea Investment Real Asset Management Co. and Indonesian conglomerate Sinar Mas set up a joint venture to build a hyperscale data center in a central business district of Jakarta in a US$300 Million project.

- February 2024: The regulatory authorities in South Korea unveiled plans for a 1-gigawatt (GW) data center hub near Donghae and Gangneung cities, capable of accommodating up to 50 data centers with an average capacity of 20 megawatts (MW) each.

South Korea Data Center Market Report:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Data Center Sizes Covered | Large, Massive, Medium, Mega, Small |

| Tier Types Covered | Tier 1 and 2, Tier 3, Tier 4 |

| Absorptions Covered |

|

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea data center market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the South Korea data center market growth?

- What is the breakup of the South Korea data center market on the basis of data center size?

- What is the breakup of the South Korea data center market on the basis of tier type?

- What is the breakup of the South Korea data center market on the basis of absorption?

- What are the various stages in the value chain of the South Korea data center market?

- What are the key driving factors and challenges in the South Korea data center?

- What is the structure of the South Korea data center market, and who are the key players?

- What is the degree of competition in the South Korea data center market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea data center market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea data center market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea data center industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)