South Korea Desktop Virtualization Market Size, Share, Trends and Forecast by Type, Component, Organization Size, Vertical, and Region, 2026-2034

South Korea Desktop Virtualization Market Summary:

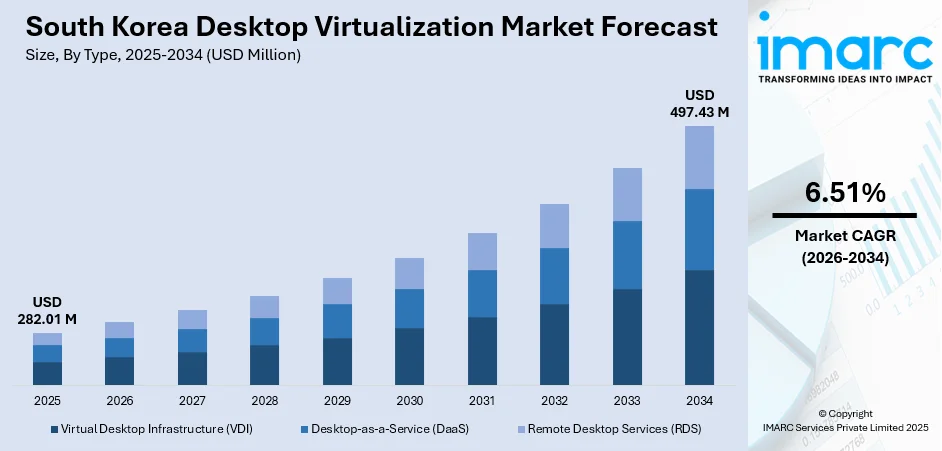

The South Korea desktop virtualization market size was valued at USD 282.01 Million in 2025 and is projected to reach USD 497.43 Million by 2034, growing at a compound annual growth rate of 6.51% from 2026-2034.

The South Korea desktop virtualization market is gaining traction as enterprises seek flexible, secure, and cost-efficient IT infrastructure solutions. Demand is driven by growing remote work adoption, the need for centralized data management, and heightened cybersecurity concerns. Organizations across sectors including finance, education, and government increasingly leverage virtual desktops to simplify operations, support hybrid work models, and reduce hardware costs, fueling steady market expansion.

Key Takeaways and Insights:

- By Type: Virtual desktop infrastructure (VDI) dominates the market with a share of 55% in 2025, driven by enterprise preference for on-premises control over virtual desktop environments and seamless integration with existing IT infrastructure.

- By Component: Software solutions lead the market with a share of 60% in 2025, reflecting strong demand for comprehensive virtualization platforms that enable centralized desktop management and security enforcement.

- By Organization Size: Large enterprises prevail the market with a share of 65% in 2025, owing to substantial IT budgets, complex operational requirements, and the need for scalable virtual desktop deployments.

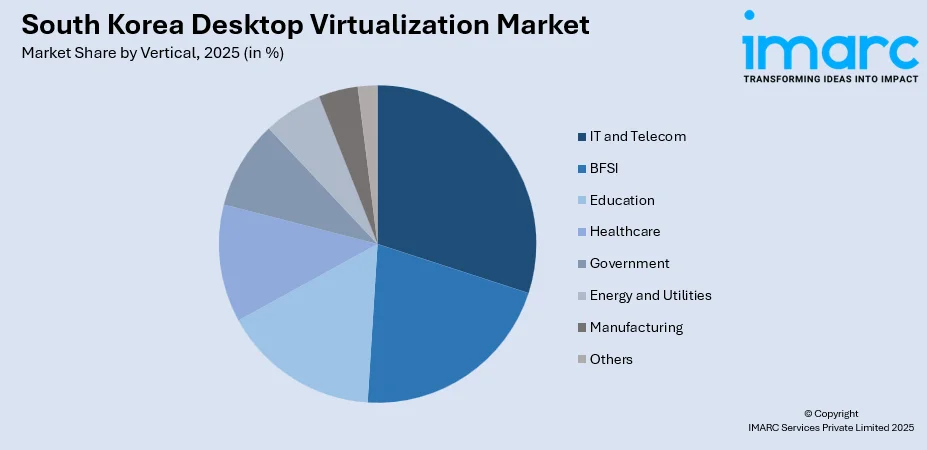

- By Vertical: IT and telecom represent the largest segment with a market share of 22% in 2025, benefiting from high technology adoption rates and the sector's inherent need for flexible, secure computing environments.

- Key Players: The South Korea desktop virtualization market features a competitive landscape with domestic technology leaders and global providers competing for market share. Major players focus on hybrid cloud solutions, AI integration, security enhancements, and industry-specific offerings to differentiate their virtual desktop services across diverse enterprise segments.

To get more information on this market Request Sample

The South Korea desktop virtualization market is experiencing strong growth as organizations prioritize flexible, secure, and scalable IT environments. With the South Korea healthcare IT market size reaching USD 6,922.0 Million in 2024 and projected to hit USD 14,248.3 Million by 2033, the country’s broader digital ecosystem is expanding rapidly, further supporting demand for virtualized solutions. The rapid adoption of remote and hybrid work models has accelerated the shift toward virtual desktop infrastructure, enabling centralized management, enhanced data protection, and workforce mobility. Key sectors such as BFSI, healthcare, government, and education are leveraging desktop virtualization to reduce hardware dependency, streamline software deployment, and strengthen business continuity. Rising cybersecurity threats are pushing enterprises to adopt controlled, policy-based access systems.

South Korea Desktop Virtualization Market Trends:

Growing Adoption of Remote and Hybrid Work

Remote and hybrid working models are accelerating the need for virtual desktop infrastructure and cloud-hosted desktops in South Korea. Organizations are prioritizing flexible access, device independence, and centralized IT management to support distributed teams. This shift is driving strong adoption of desktop virtualization to ensure productivity, secure connectivity, and seamless application delivery across locations.

Rising Focus on Cybersecurity and Data Protection

Enterprises are increasingly centralizing desktops to strengthen data security and mitigate cyber risks, supported by the rapid expansion of national cybersecurity investments. With the South Korea cybersecurity market size reaching USD 5.7 Billion in 2025, organizations are prioritizing advanced protection frameworks. Desktop virtualization enables tighter access controls, encrypted data handling, and reduced exposure from endpoint vulnerabilities. As threat environments become more complex, companies rely on VDI to safeguard sensitive information, maintain regulatory compliance, and enforce consistent security policies across all devices.

Increasing Migration to Cloud-Based Virtualization Platforms

Companies are shifting to cloud-enabled desktop virtualization to benefit from greater scalability, simplified deployment, and cost optimization. Cloud-based platforms reduce hardware dependencies while offering flexible resource allocation for growing workloads. This trend supports agile operations, easier software updates, and improved performance, making cloud virtualization an essential component of South Korea’s enterprise IT modernization.

Market Outlook 2026-2034:

South Korea’s desktop virtualization market is set for steady growth as enterprises accelerate digital transformation and embrace flexible work structures. Increasing adoption of virtual desktops, stronger emphasis on cybersecurity, and rising migration toward cloud-based VDI platforms are shaping long-term demand. Organizations are prioritizing scalability, centralized management, and cost-efficient IT operations, driving sustained investment across sectors such as BFSI, healthcare, manufacturing, and education. As hybrid work becomes mainstream, desktop virtualization will remain a core pillar of enterprise IT strategy. The market generated a revenue of USD 282.01 Million in 2025 and is projected to reach a revenue of USD 497.43 Million by 2034, growing at a compound annual growth rate of 6.51% from 2026-2034.

South Korea Desktop Virtualization Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Virtual Desktop Infrastructure (VDI) | 55% |

| Component | Software Solutions | 60% |

| Organization Size | Large Enterprises | 65% |

| Vertical | IT and Telecom | 22% |

Type Insights:

- Virtual Desktop Infrastructure (VDI)

- Desktop-as-a-Service (DaaS)

- Remote Desktop Services (RDS)

The virtual desktop infrastructure (VDI) dominates with a market share of 55% of the total South Korea desktop virtualization market in 2025.

Virtual desktop infrastructure dominates the South Korea desktop virtualization market, due to its leadership is driven by strong enterprise demand for secure, centralized, and customizable virtual desktop environments. Large organizations prefer VDI due to its ability to offer high control over data, applications, and user configurations, especially in regulated industries such as BFSI, healthcare, and government.

The segment continues to expand as enterprises accelerate digital transformation and hybrid workforce models. VDI delivers consistent performance, supports complex enterprise applications, and enhances data protection by keeping information within controlled server environments. Its compatibility with advanced cybersecurity frameworks and growing integration with AI-driven IT management tools further reinforces its position as the preferred desktop virtualization approach in South Korea.

Component Insights:

- Software Solutions

- Services

The software solutions lead with a share of 60% of the total South Korea desktop virtualization market in 2025.

Software solutions lead the component segment with a 60 percent share in 2025, supported by the expanding demand for advanced virtualization platforms, management consoles, and security layers. The strong momentum aligns with the South Korea software market, which is projected to grow at a CAGR of 4.92 percent during 2025 to 2033. Enterprises increasingly prioritize software ecosystems that ensure seamless provisioning, monitoring, access control, and policy enforcement across distributed workforces.

Demand continues to accelerate as organizations modernize legacy infrastructure and shift toward cloud-based desktop virtualization. Software-driven enhancements such as automated resource optimization, integrated cybersecurity tools, and real-time performance analytics are becoming essential for efficiency. With hybrid work models becoming standard across industries, enterprises continue investing in scalable and flexible software solutions that elevate user experience, strengthen security, and simplify IT management.

Organization Size Insights:

- Small and Medium-Sized Enterprises

- Large Enterprises

The large enterprises represent largest segment with a share of 65% of the total South Korea desktop virtualization market in 2025.

Large enterprises dominate the South Korea desktop virtualization market, driven by their extensive IT infrastructure, diverse workforce needs, and heightened security requirements. These organizations deploy VDI and DaaS at scale to centralize desktop management, streamline software updates, and strengthen governance. Their ability to invest in robust data centers and cloud platforms further accelerates adoption.

The segment benefits from growing digital transformation initiatives that prioritize mobility, automation, and centralized IT control. Large enterprises increasingly use virtualization to support multi-location operations, remote employees, and strict regulatory compliance. Enhanced performance, cybersecurity integration, and reduced device-dependency make desktop virtualization a strategic choice for long-term operational efficiency.

Vertical Insights:

Access the Comprehensive Market Breakdown Request Sample

- BFSI

- IT and Telecom

- Education

- Healthcare

- Government

- Energy and Utilities

- Manufacturing

- Others

The IT and telecom exhibit a clear dominance with a 22% share of the total South Korea desktop virtualization market in 2025.

The IT and telecom sector represents the largest share of the market at 22 percent in 2025, driven by its need for agile, scalable, and secure virtual environments. This aligns with the broader industry expansion, as the South Korea telecom market size reached USD 40.0 Billion in 2024 and is projected to reach USD 50.0 Billion by 2033, reflecting a CAGR of 4.3 percent during 2025 to 2033. Companies in this sector rely on virtualization to support large development, testing, and support teams requiring rapid provisioning, secure access, and consistent high performance.

Growing cloud adoption and increasing digital infrastructure complexity continue to accelerate the deployment of VDI, DaaS, and RDS across IT and telecom enterprises. Virtualization enhances operational flexibility, improves resource utilization, and supports hybrid workforces while reducing downtime. The integration of AI-driven monitoring, network automation, and advanced cybersecurity frameworks further strengthens the segment’s dominance, positioning it as a critical driver of desktop virtualization adoption in South Korea.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The Seoul Capital Area leads adoption due to its dense concentration of enterprises, financial institutions, and government agencies investing in scalable and secure virtualization solutions. Strong digital infrastructure and extensive cloud readiness further accelerate deployment across large organizations and technology-driven sectors.

The Yeongnam region shows steady growth supported by its strong industrial base and expanding IT ecosystem. Manufacturing, telecom, and logistics companies increasingly adopt virtualization to enhance operational efficiency, streamline IT management, and support remote work requirements across multi-site operations.

The Honam region experiences rising adoption as SMEs and public sector institutions modernize IT systems and prioritize cost-efficient desktop management. Growing interest in cloud-based virtualization and improving regional connectivity contribute to gradual but consistent market expansion.

The Hoseo region benefits from increasing technology upgrades across enterprises, universities, and research institutions. Organizations adopt desktop virtualization to improve security, reduce hardware dependence, and support flexible working environments, driven by stronger digital infrastructure development and expanding cloud service availability.

Market Dynamics:

Growth Drivers:

Why is the South Korea Desktop Virtualization Market Growing?

Rapid Expansion of SMEs

The growing number of small and medium-sized enterprises is accelerating demand for cost-effective and easily deployable desktop virtualization solutions. In October 2025, the Ministry of SMEs and Startups announced its 2025 work plan, focusing on revitalizing the local economy, fostering innovation, and addressing future challenges. Key initiatives include enhanced financial support for microenterprises, measures to combat high exchange rates, and initiatives to stimulate domestic consumption through large-scale consumer festivals. SMEs benefit from virtual desktops due to significantly lower upfront hardware investments, simplified IT administration, and strong support for hybrid work models. Virtualization also allows smaller firms to scale user environments quickly as they grow, while maintaining strong security and controlled access to business applications. These advantages make virtualization an increasingly preferred choice for resource-constrained but digitally ambitious SMEs.

Growth of Digital Transformation Initiatives

Digital transformation efforts across South Korea are encouraging organizations to upgrade legacy IT infrastructures and move toward more flexible, virtualized desktop environments. Companies are increasingly prioritizing scalable and secure systems that support remote access, faster application delivery, and centralized management. Desktop virtualization aligns with these goals by enhancing productivity, reducing device dependence, and enabling seamless collaboration across distributed teams. As enterprises modernize operations and integrate cloud technologies, virtualization becomes a critical enabler of long-term agility and performance.

Rising Adoption of AI-driven IT Management Tools

AI-powered IT management tools are transforming how virtual desktop environments are monitored and optimized in South Korea. In November 2024, SK Telecom announced plans to open an Nvidia GPU-based AI data center in Seoul next month, alongside a testbed in Pangyo. The facility will feature GPU virtualization solutions and advanced AI components to support a subscription-based AI cloud service, enhancing GPU access for domestic businesses and promoting AI infrastructure. Automated resource allocation, predictive performance analytics, and proactive maintenance capabilities help enterprises reduce downtime and streamline administrative workloads. These technologies enable IT teams to identify issues early, enhance user experience, and maintain consistent desktop performance across large, distributed workforces. As AI integration becomes more advanced, it strengthens the overall value proposition of virtualization and encourages broader adoption across industries.

Market Restraints:

What Challenges the South Korea Desktop Virtualization Market is Facing?

High Initial Setup and Integration Costs

High upfront spending on servers, storage systems, networking hardware, and software licenses continues to restrict adoption. Smaller enterprises or organizations with limited IT budgets often struggle to justify these investments, even though virtualization offers long-term savings. The complexity of integrating new infrastructure with existing systems further increases deployment costs and slows market expansion.

Performance Limitations for Resource-Intensive Applications

Graphics-intensive workloads, engineering design tools, and video-processing applications often experience latency or reduced responsiveness in virtual desktop environments. These performance gaps limit adoption among industries that rely heavily on high computing power. As a result, many organizations maintain physical desktops for demanding tasks, which reduces overall virtualization penetration despite ongoing improvements in GPU virtualization technologies.

Dependence on Strong and Reliable Network Infrastructure

Desktop virtualization requires continuous, high-bandwidth connectivity to deliver a seamless user experience. Any network instability, congestion, or downtime can disrupt sessions, reduce productivity, and hinder remote access. Organizations operating in regions with inconsistent or underdeveloped network infrastructure face significant limitations when scaling virtual desktop deployments, making reliability a critical barrier to broader adoption.

Competitive Landscape:

The competitive landscape of the South Korea desktop virtualization market is defined by a mix of global technology providers and regional IT solution integrators competing to deliver secure, scalable, and high-performance virtualization platforms. Vendors focus on enhancing user experience, strengthening endpoint security, and integrating advanced management tools to support hybrid and remote work models. Competition is intensifying as enterprises prioritize cloud-based VDI, driving providers to expand service portfolios and offer flexible subscription models. Strategic partnerships with telecom operators, data center providers, and cybersecurity firms further shape the market, enabling firms to deliver integrated, end-to-end virtualization solutions.

Recent Developments:

- In February 2025, Naver Cloud secured a contract for the Postal Service Headquarters’ Desktop as a Service (DaaS) business, targeting 33,000 former employees. The company’s innovative proposal, featuring custom AI and enhanced security, was key in winning against five competitors. This project aims to boost the public DaaS market significantly.

South Korea Desktop Virtualization Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Virtual Desktop Infrastructure (VDI), Desktop-as-a-Service (Daas), Remote Desktop Services (RDS) |

| Components Covered | Software Solutions, Services |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Verticals Covered | BFSI, IT and Telecom, Education, Healthcare, Government, Energy and Utilities, Manufacturing, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The South Korea desktop virtualization market size was valued at USD 282.01 Million in 2025.

The South Korea desktop virtualization market is expected to grow at a compound annual growth rate of 6.51% from 2026-2034 to reach USD 497.43 Million by 2034.

Virtual desktop infrastructure (VDI) held the largest market share, driven by strong enterprise adoption, enhanced data security needs, and the growing shift toward centralized management. Its ability to support remote and hybrid workforces further strengthens its leadership.

Key factors driving the South Korea desktop virtualization market include rising hybrid work adoption, increasing cybersecurity concerns, rapid cloud migration, and strong demand for scalable, cost-efficient IT infrastructure that enhances data control, workforce mobility, and operational resilience.

Major challenges include high initial setup costs, performance limitations for graphics-intensive workloads, and dependence on reliable, high-bandwidth networks. These issues restrict adoption among smaller enterprises and organizations with inadequate IT infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)