South Korea Diagnostic Imaging Market Size, Share, Trends and Forecast by Modality, Application, End User, and Region, 2025-2033

South Korea Diagnostic Imaging Market Overview:

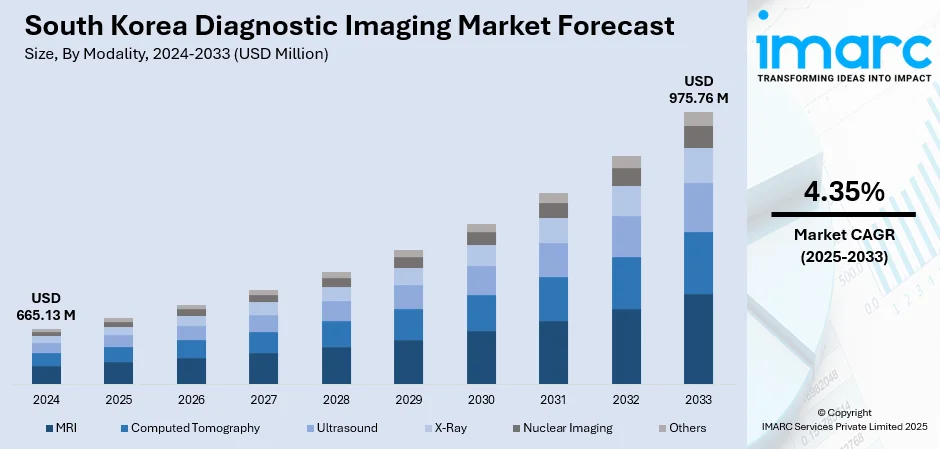

The South Korea diagnostic imaging market size reached USD 665.13 Million in 2024. The market is projected to reach USD 975.76 Million by 2033, exhibiting a growth rate (CAGR) of 4.35% during 2025-2033. The market is driven by a rapidly aging population and the increasing prevalence of chronic diseases such as cancer, cardiovascular, neurological, and orthopedic conditions, which elevate the demand for advanced imaging technologies including MRI, CT, and ultrasound. Continued government investment in healthcare infrastructure, along with progress in AI and digital imaging, supports innovation. Growth in medical tourism and private healthcare further enhances South Korea diagnostic imaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 665.13 Million |

| Market Forecast in 2033 | USD 975.76 Million |

| Market Growth Rate 2025-2033 | 4.35% |

South Korea Diagnostic Imaging Market Trends:

Broadening Public Access to Imaging

In September 2024, the Ministry of Health and Welfare and the Korea Health Industry Development Institute launched a pilot program enabling the electronic exchange of medical images across hospitals, including MRI scans and ultrasounds. This initiative included more than 445 facilities in the initial rollout, aimed at breaking down barriers between healthcare providers and simplifying access for patients. As a result, patients can now carry imaging data seamlessly across regions, reducing duplicate tests and improving diagnostic continuity. Clinics and hospitals have reported smoother workflows and reduced administrative load, helping radiologists focus more on analysis. This digital upgrade allows for quicker decisions and earlier detection of diseases, particularly when patients move between facilities. By empowering providers with immediate image access, the system supports timely care while enhancing patient experience. This step also promotes equitable access to advanced imaging in smaller cities and rural health centers. These efforts signal a purposeful integration of modern infrastructure into everyday healthcare, reinforcing the foundation for sustained South Korea diagnostic imaging market growth.

To get more information on this market, Request Sample

AI-Boosted Early Cancer Detection

In March 2025, a large-scale, prospective study showed that AI-integrated mammography screening significantly improved breast cancer detection in South Korea’s national program. This is a breakthrough for diagnostic imaging, allowing early interventions without increasing unnecessary callbacks. The research involved collaboration across multiple academic hospitals and validated that AI-assisted readings empowered radiologists to identify more cases with confidence, highlighting the impact of advanced algorithms on quality of care. National health authorities have begun sponsoring pilot deployments of these AI tools within screening clinics to evaluate their effectiveness in real-world workflows. These implementations are not only accelerating analysis but also enhancing diagnostic consistency across different sites. Patients benefit from more reliable and timely results, while healthcare teams experience reduced manual strain. This trend aligns with broader efforts to incorporate intelligent solutions into imaging pathways. As AI tools prove their worth in nationwide screening efforts, they’re establishing a new standard for intervention strategies. This shift plays a pivotal role in advancing South Korea diagnostic imaging market trends.

Seamless Image Exchange and Digital Integration

South Korea’s healthcare system is transforming the way diagnostic imaging data is shared and accessed. In late 2024, the Health Ministry and Korea Health Industry Development Institute launched a pilot to enable the digital exchange of medical images such as MRI and CT scans across hundreds of hospitals and clinics nationwide. The new system lets patients retrieve their imaging records anywhere, without relying on CDs or manually requested transfers. This is making a clear difference: patients report fewer repeat scans and smoother experiences when moving between care sites. On the provider side, clinicians gain instant access to prior images and reports, helping them make faster, more informed decisions. Radiology departments are seeing less administrative friction, which translates to quicker diagnoses and better care coordination across regions. Digital integration also supports continuity for chronic disease monitoring and follow-up, ensuring that each scan builds on prior insights. This shift marks a meaningful step toward a fully connected healthcare ecosystem one where diagnostic imaging tools are not just available but efficiently woven into patient care pathways.

South Korea Diagnostic Imaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on modality, application, and end user.

Modality Insights:

- MRI

- Low and Mid Field MRI Systems

- High Field MRI Systems

- Very High and Ultra High Field MRI Systems

- Computed Tomography

- Low-End Scanners

- Mid-Range Scanners

- High-End Scanners

- Ultrasound

- 2D Ultrasound

- 3D Ultrasound

- Others

- X-Ray

- Analog Systems

- Digital Systems

- Nuclear Imaging

- Positron Emission Tomography (PET)

- Single Photon Emission Computed Tomography (SPECT)

- Others

The report has provided a detailed breakup and analysis of the market based on the modality. This includes MRI (low and mid field MRI systems, high field MRI systems, and very high and ultra high field MRI systems), computed tomography (low-end scanners, mid-range scanners, and high-end scanners), ultrasound (2D ultrasound, 3D ultrasound, and others), X-ray (analog systems and digital systems), nuclear imaging (positron emission tomography (PET) and single photon emission computed tomography (SPECT)), and others.

Application Insights:

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Gastroenterology

- Gynecology

- Others

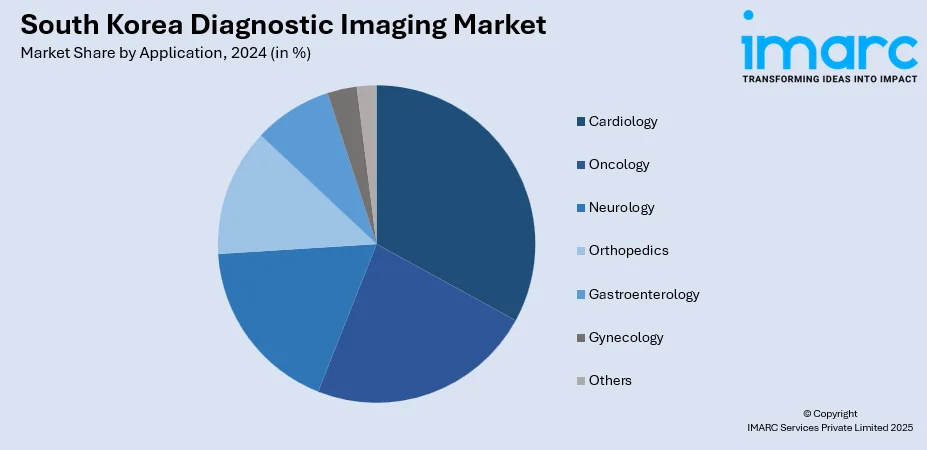

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cardiology, oncology, neurology, orthopedics, gastroenterology, gynecology, and others.

End User Insights:

- Hospitals

- Diagnostic Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, diagnostic centers, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Diagnostic Imaging Market News:

- November 2024: Neurophet, a South Korean AI company that specializes in medical imaging, has been granted FDA 510(k) clearance for its Neurophet Aqua software, which is intended for analyzing multiple sclerosis and white matter hyperintensities. This achievement validates the company's vision to grow on a global scale and increase diagnostic accuracy. South Korea remains at the forefront of medical imaging innovation, with companies creating sophisticated AI-driven solutions to enhance patient care. These developments showcase the nation's increasing position in the international healthcare technology industry and dedication to medical innovation.

South Korea Diagnostic Imaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Modalities Covered |

|

| Applications Covered | Cardiology, Oncology, Neurology, Orthopedics, Gastroenterology, Gynecology, Others |

| End Users Covered | Hospitals, Diagnostic Centers, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea diagnostic imaging market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea diagnostic imaging market on the basis of modality?

- What is the breakup of the South Korea diagnostic imaging market on the basis of application?

- What is the breakup of the South Korea diagnostic imaging market on the basis of end user?

- What is the breakup of the South Korea diagnostic imaging market on the basis of region?

- What are the various stages in the value chain of the South Korea diagnostic imaging market?

- What are the key driving factors and challenges in the South Korea diagnostic imaging market?

- What is the structure of the South Korea diagnostic imaging market and who are the key players?

- What is the degree of competition in the South Korea diagnostic imaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea diagnostic imaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea diagnostic imaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea diagnostic imaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)