South Korea Digital Diabetes Management Market Size, Share, Trends and Forecast by Product Type, Device Type, and Region, 2025-2033

South Korea Digital Diabetes Management Market Overview:

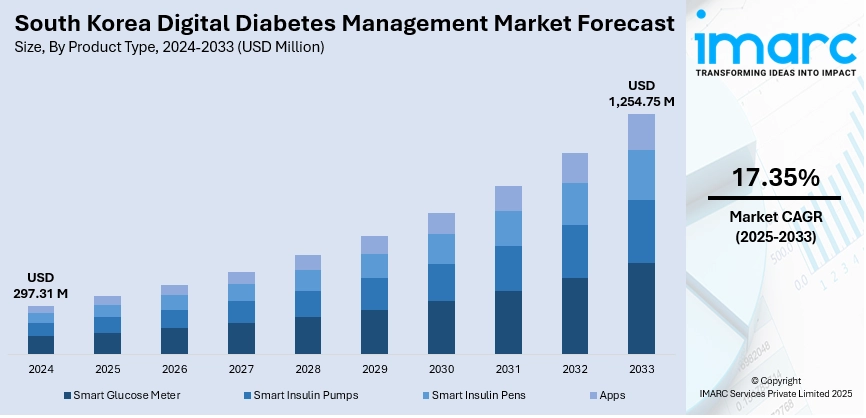

The South Korea digital diabetes management market size reached USD 297.31 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,254.75 Million by 2033, exhibiting a growth rate (CAGR) of 17.35% during 2025-2033. The government of South Korea is implementing a range of strategic policies to promote the use of digital technologies in the health sector to better manage chronic illnesses. Moreover, the growing diabetes prevalence and concomitant healthcare burden are offering a favorable market outlook. Additionally, digital infrastructure with high penetration rates of the internet is expanding the South Korea digital diabetes management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 297.31 Million |

| Market Forecast in 2033 | USD 1,254.75 Million |

| Market Growth Rate 2025-2033 | 17.35% |

South Korea Digital Diabetes Management Market Trends:

Growing Diabetes Prevalence and Concomitant Healthcare Burden

South Korea's growing prevalence of diabetes is one of the major driving forces behind the digital diabetes management market. Based on the Korea Disease Control and Prevention Agency (KDCA), the adult diabetes prevalence rate over 30 years old was over 13% in recent years, and the prevalence rate was higher in urban areas, according to lifestyle factors like sitting time and energy-dense diets. The chronic condition of diabetes requires ongoing surveillance and long-term treatment, which is costly for the conventional healthcare system. Digital resolutions for diabetes management, including mobile health applications, continuous glucose monitoring (CGM) devices, and telemedicine platforms, reduce this burden by facilitating real-time monitoring, early intervention, and customized care. These solutions enhance patient adherence and minimize rates of hospitalization, ultimately resulting in improved outcomes and decreased healthcare costs overall. The World Bank collection of development indicators indicated that diabetes in South Korea increased by 9.6% in 2024.

To get more information on this market, Request Sample

High Digital Literacy and Technological Advances

South Korea ranks among the world's top countries in digital infrastructure, with high penetration rates of the internet, advanced mobile connectivity, and extensive use of smart devices. This digital maturity offers a rich ground for the uptake of digital solutions to health, including those directed towards managing diabetes. Advances in wearable tech, artificial intelligence (AI)-powered analytics, and cloud storage have made it possible to create seamless diabetes care platforms that enable continuous monitoring of glucose, remote consultations, and automatic insulin delivery systems. The high level of digital literacy among South Koreans, also among the elderly, makes it easy to engage and stick to digital health platforms. South Korean health technology companies and healthcare organizations are working together to design user-friendly, secure, and effective diabetes care ecosystems. These innovations not only improve clinical results but also enable patients to become more active participants in maintaining their own well-being, which is in line with the national goal of encouraging preventive care and self-management for chronic conditions. In 2025, Health2Sync, Asia's top digital platform for chronic disease management, revealed the successful incorporation of Smart Cap Mallya® data for FlexTouch® Insulin Pens into SugarGenie, its diabetes management application for the Korean market. Mallya® allows for the automatic logging of insulin injection information.

Government Support and Policy Initiatives for Digital Health Integration

The government of South Korea is implementing a range of strategic policies to promote the use of digital technologies in the health sector to enhance accessibility, decrease inefficiencies within systems, and better manage chronic illnesses. The "Digital New Deal" and the "Smart Hospital" program are just a few examples of national initiatives pushing the use of digital health platforms. These policies offer grants, regulatory paradigms, and infrastructure to facilitate innovations like remote patient monitoring, telehealth, and mobile health applications. In diabetes care in particular, government agencies have promoted the application of remote monitoring devices and electronic health records to enhance coordination among primary care physicians and specialists. In addition, reimbursement mechanisms are incorporating digital therapeutics and telemedicine consultations into their schemes, thus supporting the South Korea digital diabetes management market growth.

South Korea Digital Diabetes Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and device type.

Product Type Insights:

- Smart Glucose Meter

- Smart Insulin Pumps

- Smart Insulin Pens

- Apps

The report has provided a detailed breakup and analysis of the market based on the product type. This includes smart glucose meter, smart insulin pumps, smart insulin pens, and apps.

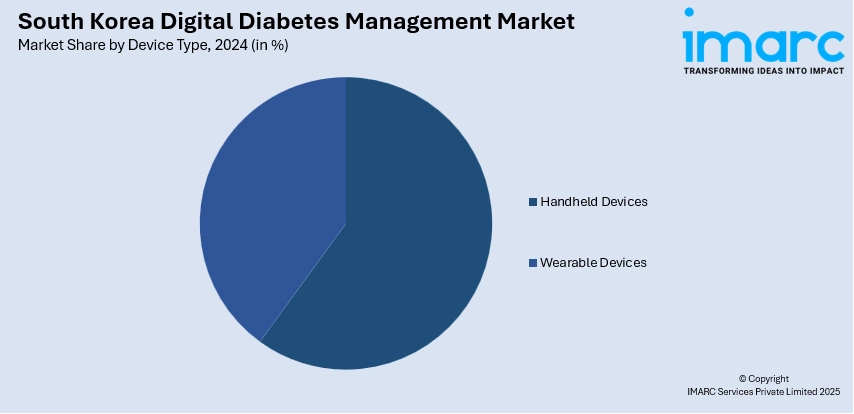

Device Type Insights:

- Handheld Devices

- Wearable Devices

A detailed breakup and analysis of the market based on the device type have also been provided in the report. This includes handheld devices and wearable devices.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Digital Diabetes Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Smart Glucose Meter, Smart Insulin Pumps, Smart Insulin Pens, Apps |

| Device Types Covered | Handheld Devices, Wearable Devices |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea digital diabetes management market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea digital diabetes management market on the basis of product type?

- What is the breakup of the South Korea digital diabetes management market on the basis of device type?

- What is the breakup of the South Korea digital diabetes management market on the basis of region?

- What are the various stages in the value chain of the South Korea digital diabetes management market?

- What are the key driving factors and challenges in the South Korea digital diabetes management market?

- What is the structure of the South Korea digital diabetes management market and who are the key players?

- What is the degree of competition in the South Korea digital diabetes management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea digital diabetes management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea digital diabetes management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea digital diabetes management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)