South Korea Digital Signature Market Size, Share, Trends and Forecast by Component, Deployment Model, Enterprise Size, Industry Vertical, and Region, 2025-2033

South Korea Digital Signature Market Overview:

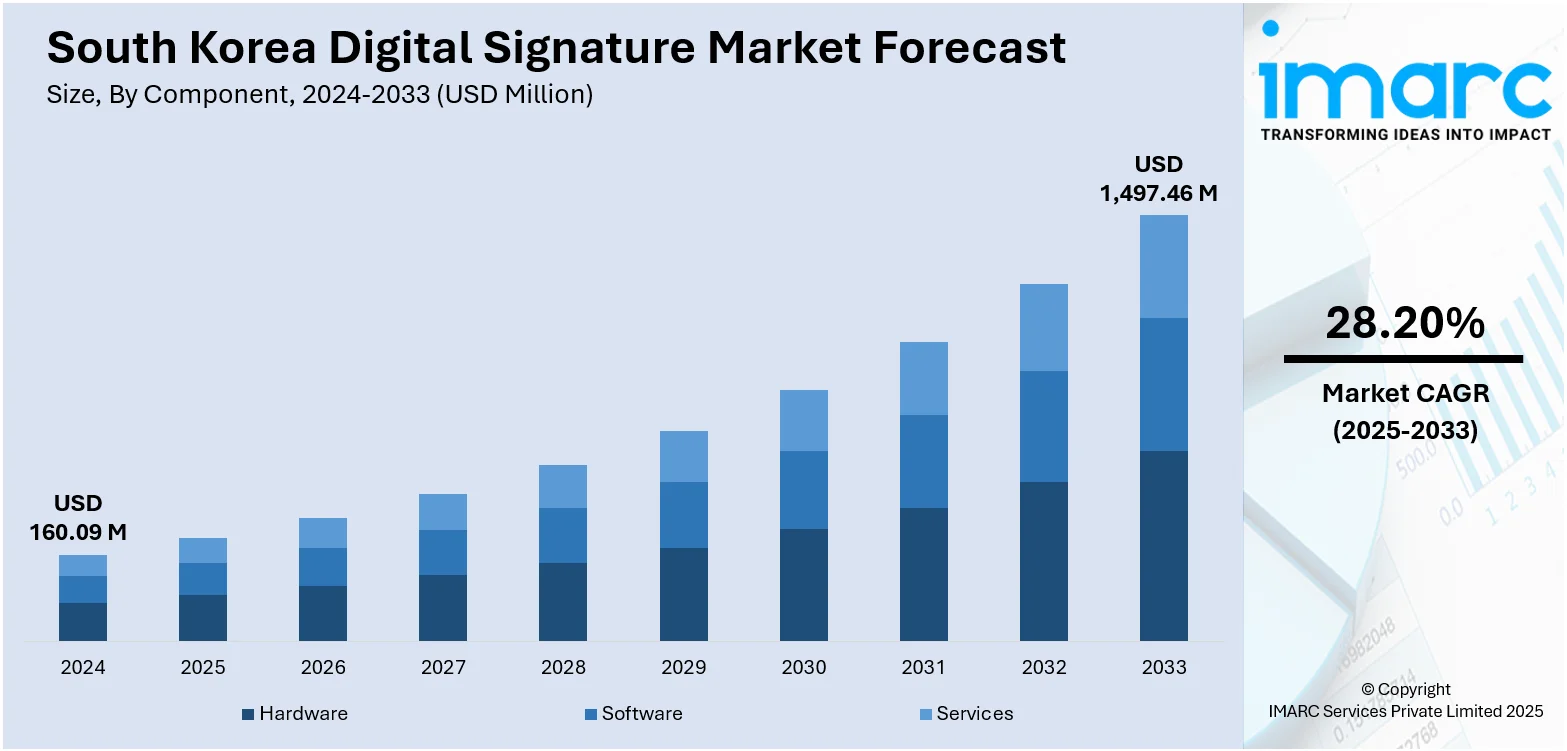

The South Korea digital signature market size reached USD 160.09 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,497.46 Million by 2033, exhibiting a growth rate (CAGR) of 28.20% during 2025-2033. The rise in dependence on electronic transactions, especially in e-commerce, banking, and government services, is impelling the market growth. Moreover, South Korea is enforcing numerous government regulations and programs that mandate the utilization of e-signatures. Additionally, technological developments, especially in the areas of cryptography and blockchain, are expanding the South Korea digital signature market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 160.09 Million |

| Market Forecast in 2033 | USD 1,497.46 Million |

| Market Growth Rate 2025-2033 | 28.20% |

South Korea Digital Signature Market Trends:

Increasing Need for Safe Online Transactions

The rise in dependence on electronic transactions, especially in e-commerce, banking, and government services, is one of the key drivers of the market. With rising cyber attacks and data breaches, companies and consumers are demanding secure, authenticated ways to conduct transactions online. Digital signatures add an extra layer of security since it can be guaranteed that documents do not get altered while being transmitted. In addition, they authenticate the identity of the signatory, producing a safe, legally enforceable agreement that is imperative to businesses and individuals. As more industries embrace digital transformation initiatives, demand for safe online solutions, such as digital signatures, will increase. Government initiatives, including digital ID systems and e-Government services, are also following this trend by making the use of digital signatures in official transactions mandatory.

To get more information on this market, Request Sample

Government Regulations and E-Government Initiatives

South Korea is enforcing numerous government regulations and programs that mandate the utilization of digital signatures, which contributes to the South Korea digital signature market growth. Advanced e-Government programs in the country are resulting in the broad use of digital technology for public services. South Korea's Electronic Signature Act, which was enacted to make digital signatures legal for official purposes, is an essential tool in promoting the use of such secure means of verification by businesses and citizens alike. The regulatory process guarantees that digital signatures are regarded as valid and legally binding within official circles, promoting their use in industries like finance, healthcare, and legal services. Additionally, the government has been making efforts to encourage the utilization of digital identity systems, which support digital signature functionality, allowing South Korean citizens to participate in public services and businesses online securely. For instance, in 2025, all citizens and foreign residents got the allowance to incorporate a digital version of their South Korean resident registration card onto their smartphones, allowing for the substitution of the physical identity card.

Advances in Cryptography and Blockchain

Technological developments, especially in the areas of cryptography and blockchain, are playing a crucial part in the development of the digital signature industry in South Korea. The formation of these technologies is improving the security and efficiency of digital signatures, rendering them more reliable and secure. Cryptographic algorithms like public key infrastructure (PKI) protect the confidentiality, integrity, and authenticity of digital signatures, supporting a sound basis for secure online transactions. In addition, blockchain technology is being more widely combined with digital signatures to create an immutable, transparent record of signed documents. Such a combination of technologies not only improves security but also aids in regulatory compliance by producing an auditable trail of digital transactions. As South Korea remains leading the way in terms of technological advancements, these developments can be anticipated to further increase the popularity of digital signatures, especially in sectors that demand safe, tamper-proof transactions, like finance, healthcare, and legal services. IMARC Group predicts that the South Korea cryptocurrency market is projected to exhibit a growth rate (CAGR) of 2.94% during 2025-2033. This will further drive the adoption of digital signature technology among the masses.

South Korea Digital Signature Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment model, enterprise size, and industry vertical.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Deployment Model Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment model have also been provided in the report. This includes on-premises and cloud-based.

Enterprise Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

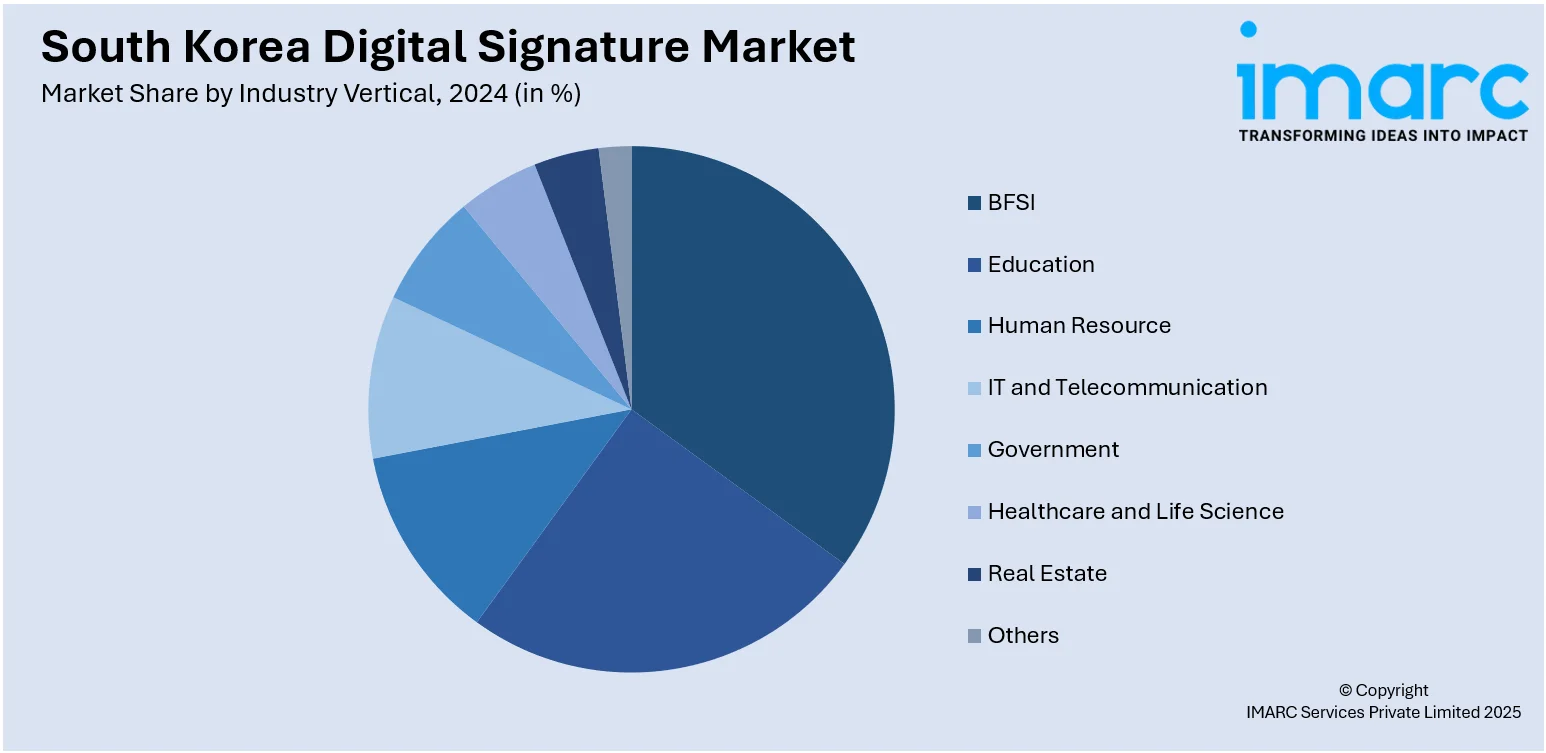

Industry Vertical Insights:

- BFSI

- Education

- Human Resource

- IT and Telecommunication

- Government

- Healthcare and Life Science

- Real Estate

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes BFSI, education, human resource, IT and telecommunication, government, healthcare and life science, real estate, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Digital Signature Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Deployment Models Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Industry Verticals Covered | BFSI, Education, Human Resource, IT and Telecommunication, Government, Healthcare and Life Science, Real Estate, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea digital signature market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea digital signature market on the basis of component?

- What is the breakup of the South Korea digital signature market on the basis of deployment model?

- What is the breakup of the South Korea digital signature market on the basis of enterprise size?

- What is the breakup of the South Korea digital signature market on the basis of industry vertical?

- What is the breakup of the South Korea digital signature market on the basis of region?

- What are the various stages in the value chain of the South Korea digital signature market?

- What are the key driving factors and challenges in the South Korea digital signature market?

- What is the structure of the South Korea digital signature market and who are the key players?

- What is the degree of competition in the South Korea digital signature market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea digital signature market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea digital signature market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea digital signature industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)