South Korea Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End-Use Industry, and Region, 2026-2034

South Korea Drones Market Size Overview:

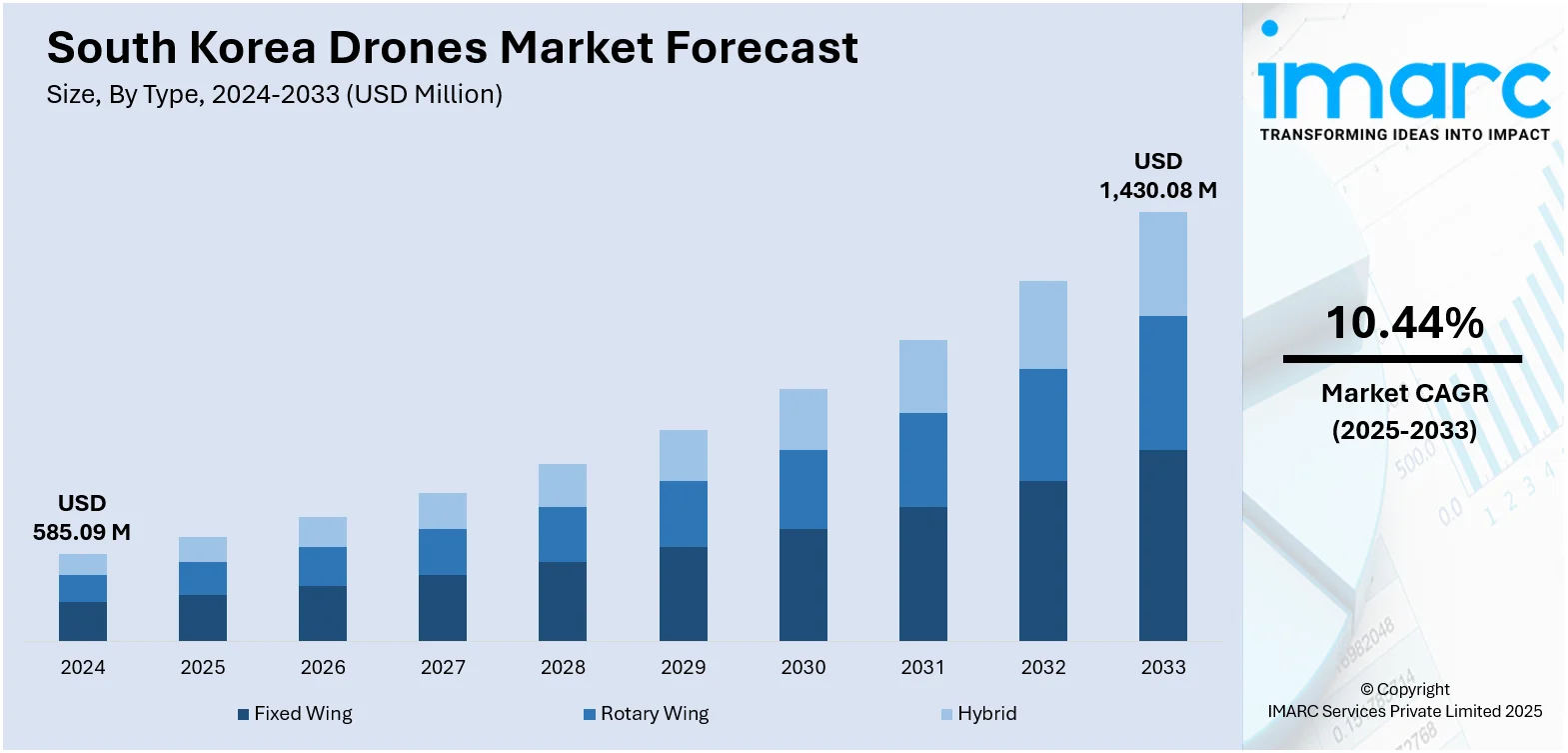

The South Korea drones market size reached USD 585.09 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,430.08 Million by 2034, exhibiting a growth rate (CAGR) of 10.44% during 2026-2034. The market is fueled by government support, sophisticated technology infrastructure, and increased demand from various sectors. Government policies encouraging drone innovation through testbed cities, regulatory encouragement, and investment in urban air mobility is also escalating product demand. The extensive use of drones in smart cities for inspections, delivery, and surveillance and for supporting precision agriculture and industrial maintenance, is supporting the growing South Korea drones market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 585.09 Million |

| Market Forecast in 2034 | USD 1,430.08 Million |

| Market Growth Rate 2026-2034 | 10.44% |

South Korea Drones Market Trends:

Government Support and National Drone Strategy

One of the primary drivers for the South Korea drones market is strong government backing supported by an extensive national drone strategy. South Korea has also identified multiple areas as testbeds for drones wherein startups and businesses can test urban air mobility, delivery, inspection, and surveillance technologies in welcome regulatory environments. These efforts encompass simplified certification procedures, drone corridors, and capital investments in vertiports and test facilities. The administration's pledge to develop a homegrown drone ecosystem, covering research centers, industrial parks, and public-private collaborations, inspires local and overseas players to innovate within the country. By nurturing domestic drone production and localization, South Korea hopes to lower dependence on imports and enhance its role as a regional leader in aerospace technology. This integrated policy environment drives drone adoption in various industries and enables supply chain expansion from component manufacturers to complete drone integrators, which also supports the South Korea drones market growth.

To get more information on this market, Request Sample

Intelligent Cities, Infrastructure Planning, and Urban Applications

Urban centers in South Korea, especially urban cities such as Seoul, Busan, and Incheon, are leading the way as intelligent city innovators, utilizing drones for a broad range of applications. In smart city areas, drones are used to support traffic monitoring, air quality reconnaissance, infrastructure inspections, and emergency response management. Densely populated urban communities and sophisticated infrastructure in South Korea are supported by airborne inspections of bridges, high-rise buildings, and utility cables that minimize dependence on manual or scaffold-based surveys. Drone delivery pilots for medical equipment, e-commerce parcels, and essential items are being tested in island and remote metropolitan environments. In addition, drones aid planning and development through precise mapping and real-time site inspection. Synergies between city-scale digital infrastructure (IoT, high-speed 5G connectivity) and drone deployment fuel adoption and are distinctive to South Korea's urban development environment.

Precision Agriculture, Industrial Inspection, and Commercial Expansion

South Korea's farming industry, while smaller in scale relative to giant grain producers, is increasingly utilizing drone technology to cope with labor shortages, maximize land use efficiency, and enhance yield quality. Drones enable precision farming through precise crop spraying, field mapping, and real-time monitoring. Specialty farmers like those growing ginseng, tea, or high-value horticulture, use drones to identify early plant stress and control microclimates, both improving quality and sustainability. At the same time, industrial inspection applications, particularly at shipyards, offshore facilities, and factories are expanding fast. Inspections using drones minimize downtime, enhance worker safety, and offer high-resolution imagery for maintenance purposes. Local firms and Korean startups are partnering with major manufacturers to create models suited to these domestic use cases, such as drones that can fly in hot humid coastal weather or unpredictable mountainous environments. For example, in February 2025, similar to services offered by multinational agricultural machinery companies like John Deere, Daedong launched a new precision farming service in Korea. As the only Korean firm to commercialize its precision agricultural solution service, Daedong (co-CEOs Kim Jun-sik and Won Yu-hyun), a leader in future agriculture, revealed on February 27 that it has inked its first contracts with local rice farmers this year. This overlap of requirements in agriculture, industry, and commerce is driving the South Korea drone market ahead through diversified, locally applicable uses.

South Korea Drones Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, component, payload, point of sale, and end-use industry.

Type Insights:

- Fixed Wing

- Rotary Wing

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the type. This includes fixed wing, rotary wing, and hybrid.

Component Insights:

- Hardware

- Software

- Accessories

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and accessories.

Payload Insights:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

A detailed breakup and analysis of the market based on the payload have also been provided in the report. This includes <25 kilograms, 25-170 kilograms, and >170 kilograms.

Point of Sale Insights:

- Original Equipment Manufacturers (OEM)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the point of sale. This includes original equipment manufacturers (OEM) and aftermarket.

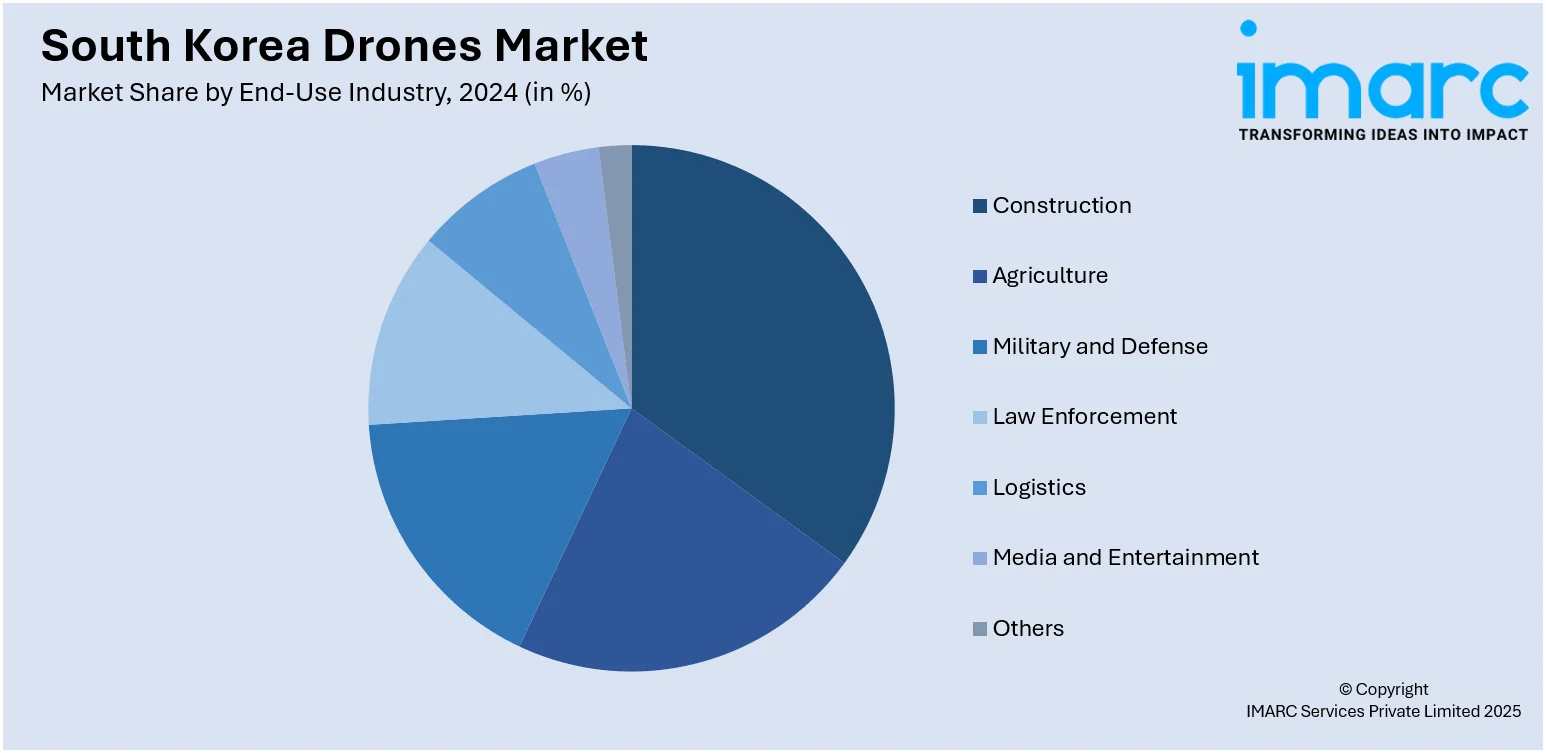

End-Use Industry Insights:

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes construction, agriculture, military and defense, law enforcement, logistics, media and entertainment, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Drones Market News:

- In March 2025, South Korea’s military, despite a recent incident involving an Israeli-developed drone, kept making strides in unmanned technology, including a faithful and covert wingman designed to help the air force's new KF-21 Boramae fighters.

South Korea Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Points of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End-Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea drones market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea drones market on the basis of type?

- What is the breakup of the South Korea drones market on the basis of component?

- What is the breakup of the South Korea drones market on the basis of payload?

- What is the breakup of the South Korea drones market on the basis of point of sale?

- What is the breakup of the South Korea drones market on the basis of end-use industry?

- What is the breakup of the South Korea drones market on the basis of region?

- What are the various stages in the value chain of the South Korea drones market?

- What are the key driving factors and challenges in the South Korea drones market?

- What is the structure of the South Korea drones market and who are the key players?

- What is the degree of competition in the South Korea drones market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea drones market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea drones market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)