South Korea eDiscovery Market Size, Share, Trends and Forecast by Component, Deployment Type, End User, Vertical, and Region, 2025-2033

South Korea eDiscovery Market Overview:

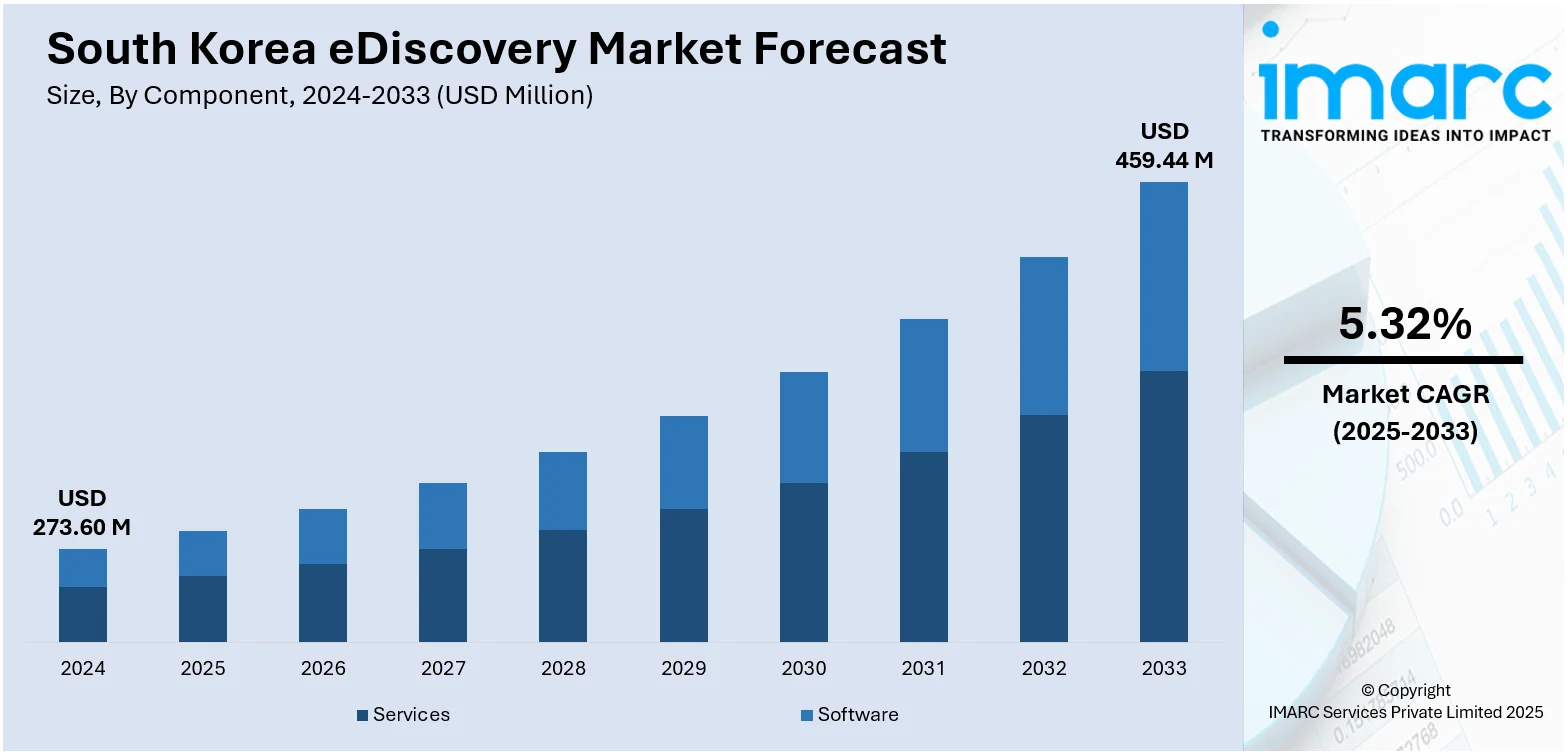

The South Korea eDiscovery market size reached USD 273.60 Million in 2024. Looking forward, the market is projected to reach USD 459.44 Million by 2033, exhibiting a growth rate (CAGR) of 5.32% during 2025-2033. The market is driven by stringent regulatory mandates requiring robust data governance, compelling enterprises to adopt advanced digital solutions. Rapid expansion in enterprise data, especially from cloud and communication tools, has increased complexity in electronic information management, prompting the shift to scalable AI-powered platforms. The integration of artificial intelligence and machine learning is enabling cost-efficient, multilingual, and accurate discovery operations, further augmenting the South Korea eDiscovery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 273.60 Million |

| Market Forecast in 2033 | USD 459.44 Million |

| Market Growth Rate 2025-2033 | 5.32% |

South Korea eDiscovery Market Trends:

Rise in Regulatory Compliance Obligations

In South Korea, the increasing complexity of legal and regulatory environments has compelled corporations and law firms to adopt advanced digital discovery tools. With frequent revisions in data privacy legislation, including the Personal Information Protection Act (PIPA) and its alignment with global frameworks such as the GDPR, organizations are under pressure to maintain rigorous information governance. For instance, on February 11, 2025, OpenText announced an expanded investment in the Asia-Pacific region, focusing on Cloud, Security, and AI infrastructure in countries including South Korea. The company plans to hire an additional 2,500 employees over the next three years to support its 5,000+ customers and 500+ partners across the region. This investment is part of OpenText's broader effort to enhance data governance, ensuring digital trust and regulatory compliance. Regulatory bodies are enforcing stricter guidelines for data retention, classification, and access controls, particularly in sectors handling sensitive consumer or financial information. As legal risks expand in scope, the demand for secure and auditable solutions that support legal holds, early case assessment, and data mapping has increased. Legal departments are no longer treating eDiscovery as a reactive measure but are integrating it into compliance workflows for real-time monitoring and control. These developments are also influencing domestic firms to strengthen internal controls, driving long-term adoption of cloud-based and AI-powered discovery platforms. By minimizing legal exposure and operational risk, these solutions have become a strategic asset, contributing significantly to South Korea eDiscovery market growth.

To get more information on this market, Request Sample

Proliferation of Digitally Stored Information Across Enterprises

The exponential growth in enterprise data volumes is another central driver of demand for digital legal tools in the South Korean market. As corporate communications increasingly span cloud storage, mobile platforms, and collaboration tools such as Slack or Microsoft Teams, identifying and processing electronically stored information (ESI) during litigation or investigation has become significantly more intricate. In South Korea, where litigation often involves large volumes of multilingual documentation, AI-based tools offer a considerable advantage in cost reduction and time management. To manage these effectively, innovations in legal technology are playing a pivotal role in streamlining the process of handling electronically stored information (ESI). For instance, on July 7, 2025, Relativity announced the expansion of its generative AI solutions, Relativity aiR for Review and Relativity aiR for Privilege, to five additional countries in Asia, including South Korea. This expansion will provide legal, investigation, and compliance teams in these regions with enhanced capabilities to manage large volumes of data more efficiently, addressing challenges in litigation, regulatory responses, and internal investigations. The expansion of remote work and digital workflows has intensified the need for scalable, automated platforms that can collect, preserve, and analyze unstructured and semi-structured data efficiently. Legal teams must now handle larger datasets and search across fragmented systems without compromising chain of custody or evidentiary integrity. Traditional methods of document review and forensic collection have proven inadequate, both in speed and cost-effectiveness, prompting a transition toward AI-driven analytics and predictive coding. Furthermore, industry-specific compliance norms, especially in finance, manufacturing, and healthcare, demand greater transparency in data handling. These challenges are pushing South Korean organizations to invest in platforms capable of intelligent filtering, multilingual processing, and secure cross-border data transfer to meet both domestic and international discovery demands.

South Korea eDiscovery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment type, end user, and vertical.

Component Insights:

- Services

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes services and software.

Deployment Type Insights:

- On-premises

- Cloud-based

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes on-premises, cloud-based, and hybrid.

End User Insights:

- Government/Federal Agencies, Legal and Regulatory Firms

- Enterprises

The report has provided a detailed breakup and analysis of the market based on the end user. This includes government/federal agencies, legal and regulatory firms and enterprises.

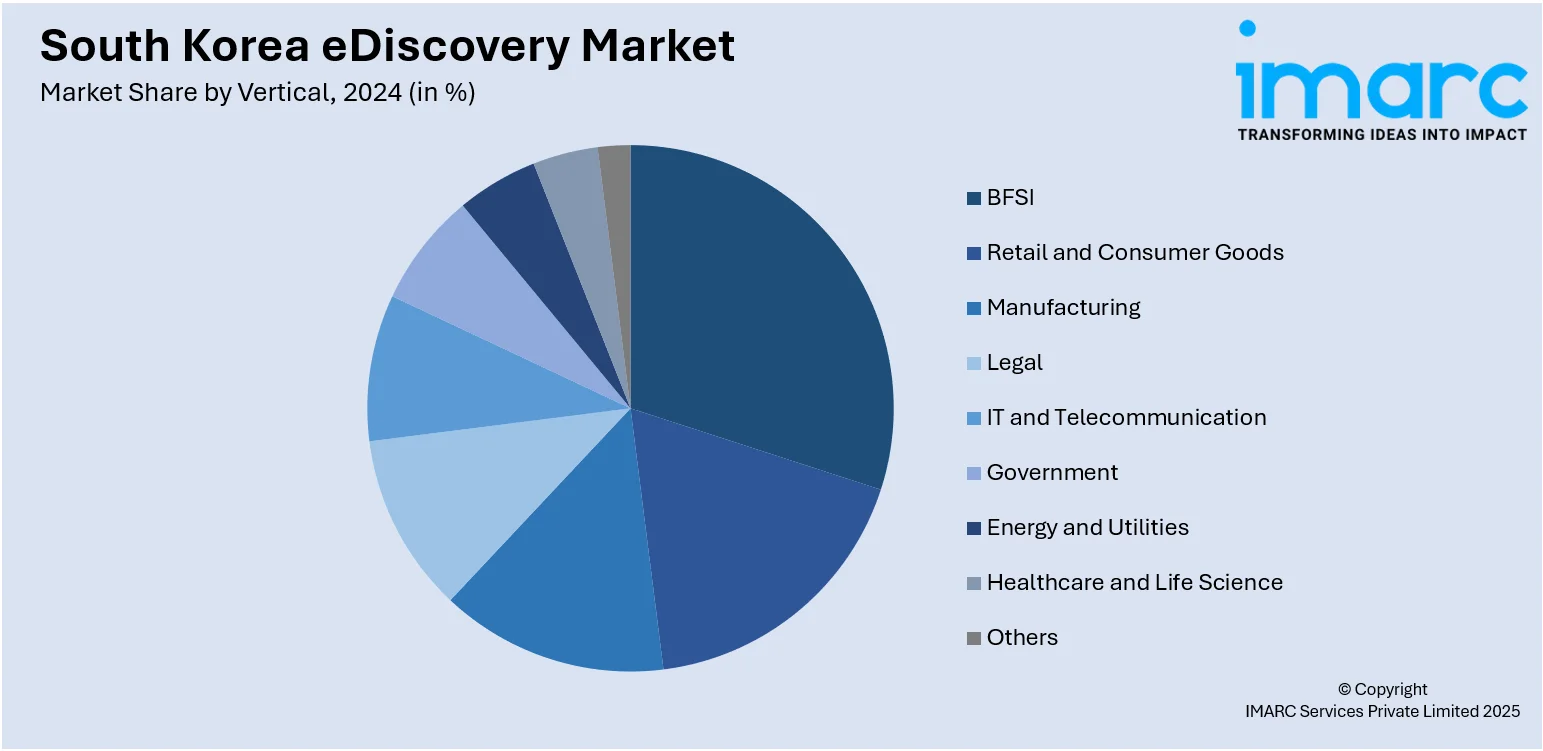

Vertical Insights:

- BFSI

- Retail and Consumer Goods

- Manufacturing

- Legal

- IT and Telecommunication

- Government

- Energy and Utilities

- Healthcare and Life Science

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes BFSI, retail and consumer goods, manufacturing, legal, IT and telecommunication, government, energy and utilities, healthcare and life science, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea eDiscovery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Services, Software |

| Deployment Types Covered | On-premises, Cloud-based, Hybrid |

| End Users Covered | BFSI, Retail and Consumer Goods, Manufacturing, Legal, IT and Telecommunication, Government, Energy and Utilities, Healthcare and Life Science, Others |

| Verticals Covered | Government/Federal Agencies, Legal and Regulatory Firms, Enterprises |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea eDiscovery market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea eDiscovery market on the basis of component?

- What is the breakup of the South Korea eDiscovery market on the basis of deployment type?

- What is the breakup of the South Korea eDiscovery market on the basis of end user?

- What is the breakup of the South Korea eDiscovery market on the basis of vertical?

- What is the breakup of the South Korea eDiscovery market on the basis of region?

- What are the various stages in the value chain of the South Korea eDiscovery market?

- What are the key driving factors and challenges in the South Korea eDiscovery market?

- What is the structure of the South Korea eDiscovery market and who are the key players?

- What is the degree of competition in the South Korea eDiscovery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea eDiscovery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea eDiscovery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea eDiscovery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)