South Korea Electric Two-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Battery Type, Voltage Type, Peak Power, Battery Technology, Motor Placement, and Region, 2025-2033

South Korea Electric Two-Wheeler Market Overview:

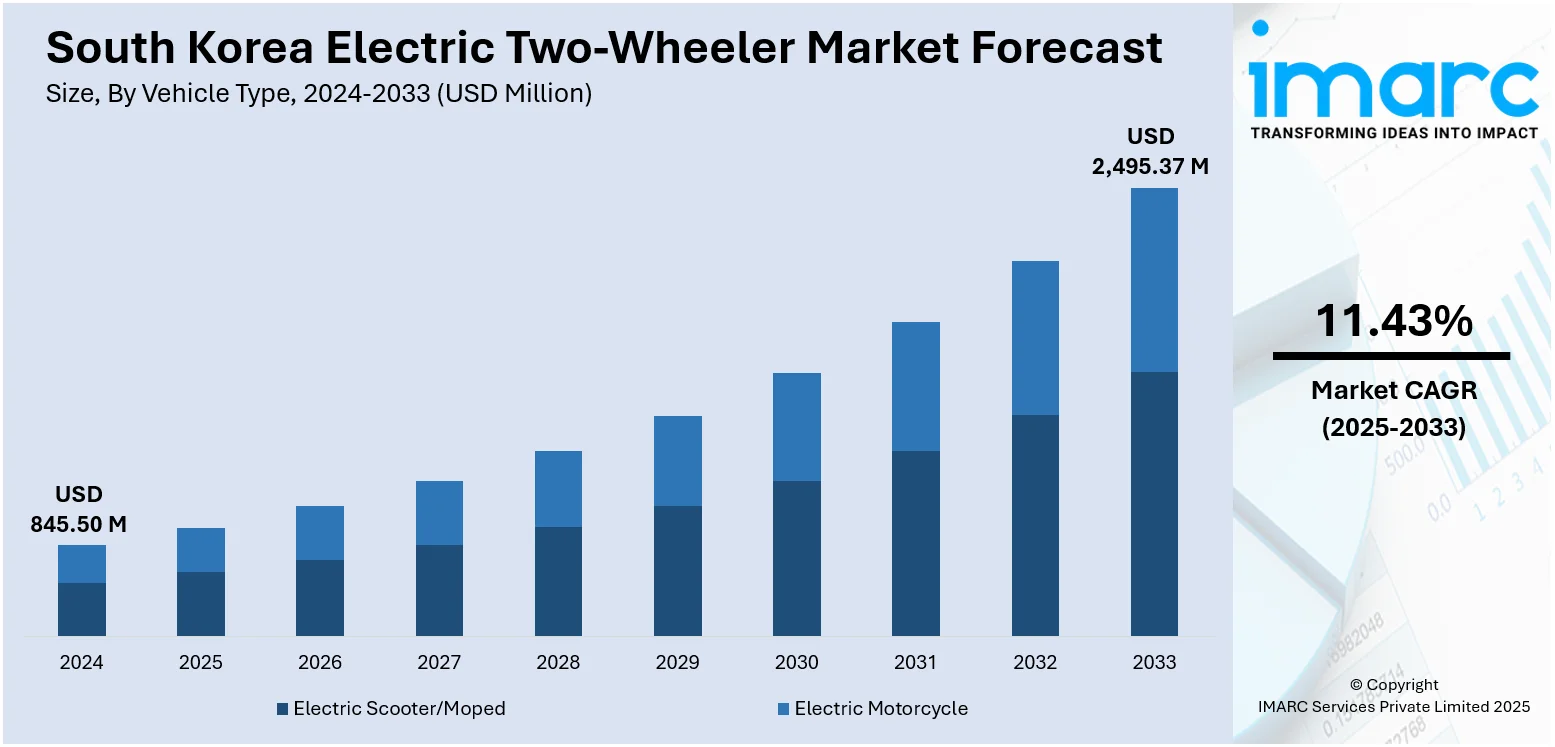

The South Korea electric two-wheeler market size reached USD 845.50 Million in 2024. The market is projected to reach USD 2,495.37 Million by 2033, exhibiting a growth rate (CAGR) of 11.43% during 2025-2033. The market is driven by rising environmental concerns, government incentives for electric vehicle (EV) adoption, and strict emission regulations encouraging a shift from conventional to electric vehicles. Increasing fuel prices and growing urban traffic congestion boost demand for cost-effective, efficient mobility solutions. Advancements in battery technology, expanding charging infrastructure, and investments from leading manufacturers further accelerate adoption. Additionally, rising consumer preference for eco-friendly, low-maintenance transportation options supports the South Korea electric two-wheeler market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 845.50 Million |

| Market Forecast in 2033 | USD 2,495.37 Million |

| Market Growth Rate 2025-2033 | 11.43% |

South Korea Electric Two-Wheeler Market Trends:

Government Support and Regulations

The South Korean government plays a significant South Korea electric two-wheeler market trends through favorable policies, subsidies, and tax incentives. Initiatives such as financial support for electric scooter and bike purchases, reduced registration fees, and investments in charging infrastructure make EV adoption more attractive to consumers. Moreover, stringent emission norms and urban clean air policies encourage the transition from internal combustion engine (ICE) vehicles to electric alternatives. Local governments are also promoting eco-friendly mobility in metropolitan areas, offering additional subsidies and dedicated parking zones for EVs. These supportive frameworks significantly lower the total cost of ownership for electric two-wheelers, making them an appealing choice for individuals and businesses. As regulatory pressure to reduce carbon emissions intensifies, government intervention remains a strong catalyst for market expansion, ensuring sustained growth of electric two-wheelers in South Korea.

To get more information on this market, Request Sample

Rising Fuel Costs and Urban Congestion

Rising fuel costs in South Korea have increased consumer demand for affordable transport options, and electric two-wheelers are seen as a viable alternative to gasoline-powered vehicles. With lower energy costs and reduced maintenance requirements, electric two-wheelers significantly reduce operating costs compared to conventional scooters or motorcycles. Additionally, commuters have resorted to compact and effective mobility solutions as a result of chronic traffic congestion brought on by high-speed urbanization and growing population density in places like Seoul and Busan. Electric two-wheelers provide quicker travel along the congested urban roads, lesser commuting time, and less parking problem, so they are well suited for use in a city. Their silent running and lack of tailpipe emissions also solve environmental and noise pollution issues in the densely populated urban regions. Therefore, with economic savings, convenience, and environmental gains, the demand for electric two-wheelers is high in South Korea's metropolitan areas.

Technological Advancements and Infrastructure Development

Advancements in battery technology and infrastructure development are accelerating South Korea’s electric two-wheeler market growth. High-performance lithium-ion batteries now offer longer ranges, faster charging, and greater durability, making electric scooters and bikes more practical for everyday use. The nation’s charging infrastructure is expanding rapidly, with public EV chargers rising from ~34,000 in 2023 to ~47,000 in 2024 and plans for 4,400 additional fast chargers in 2025, supported by a 40% budget increase (KRW 620 Million, ~USD 425M), with 60% is allocated for fast/DC chargers. Innovations like battery swapping stations and portable chargers enhance convenience, effectively reducing range anxiety. Leading manufacturers are also integrating IoT connectivity, GPS tracking, and app-based controls, improving the overall riding experience. These advancements, combined with robust infrastructure growth, are boosting consumer confidence and making electric two-wheelers an increasingly attractive and viable mobility solution across South Korea.

South Korea Electric Two-Wheeler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on vehicle type, battery type, voltage type, peak power, battery technology, and motor placement.

Vehicle Type Insights:

- Electric Scooter/Moped

- Electric Motorcycle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes electric scooter/moped and electric motorcycle.

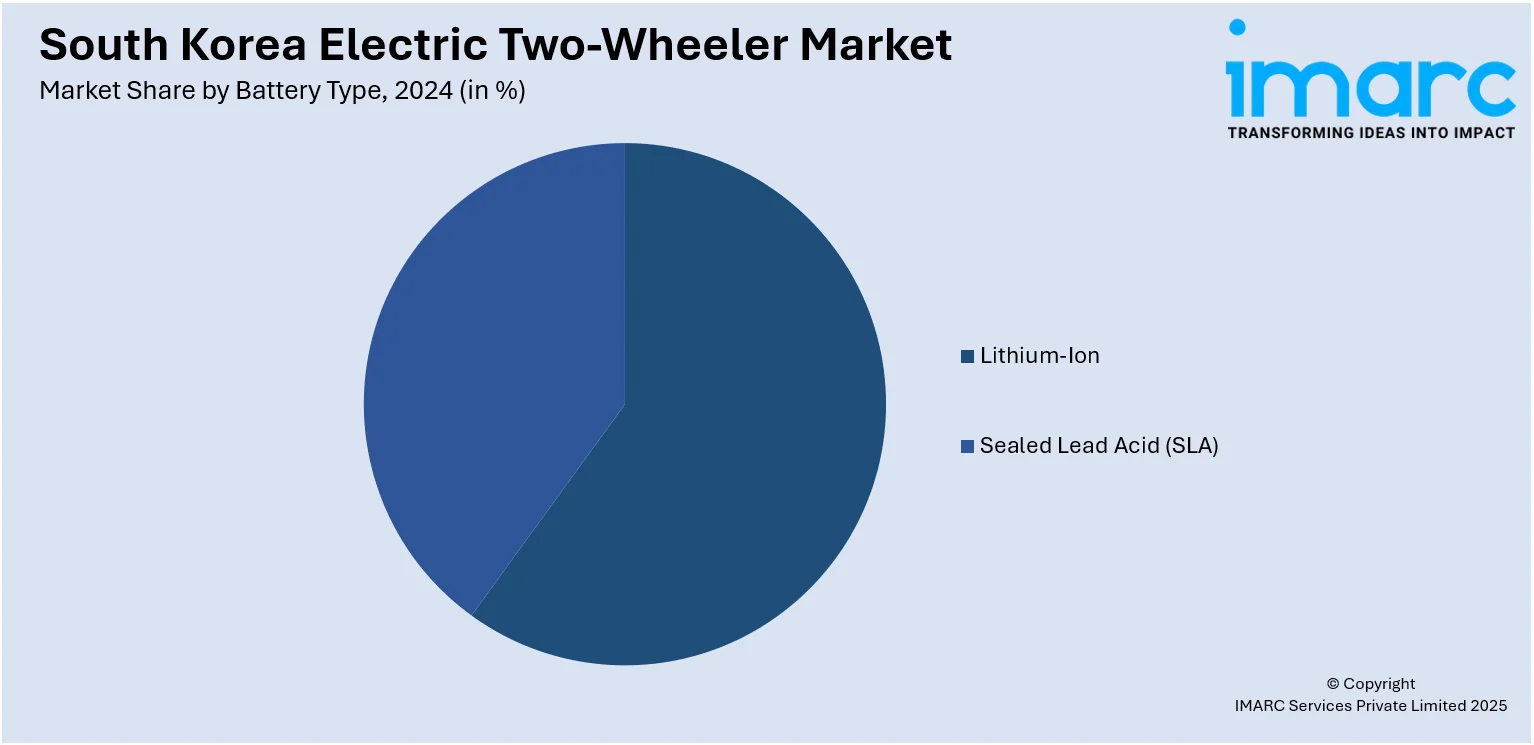

Battery Type Insights:

- Lithium-Ion

- Sealed Lead Acid (SLA)

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion and sealed lead acid (SLA).

Voltage Type Insights:

- <48V

- 48-60V

- 61-72V

- 73-96V

- >96V

A detailed breakup and analysis of the market based on the voltage type have also been provided in the report. This includes <48V, 48-60V, 61-72V, 73-96V, and >96V.

Peak Power Insights:

- <3 kW

- 3-6 kW

- 7-10 kW

- >10 kW

A detailed breakup and analysis of the market based on the peak power have also been provided in the report. This includes <3 kW, 3-6 kW, 7-10 kW, and >10 kW.

Battery Technology Insights:

- Removable

- Non-Removable

A detailed breakup and analysis of the market based on the battery technology have also been provided in the report. This includes removable and non-removable.

Motor Placement Insights:

- Hub Type

- Chassis Mounted

A detailed breakup and analysis of the market based on the motor placement have also been provided in the report. This includes hub type and chassis mounted.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Electric Two-Wheeler Market News:

- In August 2025, South Korea’s LG Energy Solution (LGES) plans to invest in an electric motorbike manufacturing plant and charging stations in Vietnam’s Phu Tho province using ODA funding, senior manager Lee Jin Woo announced. At a meeting with provincial leaders, Lee expressed LGES’s goal to build a local electric two-wheeler ecosystem and cut greenhouse gas emissions. Authorities pledged support for the project. LGES, founded in 1999, is the world’s second-largest EV battery supplier.

- In April 2025, South Korea’s Ministry of Environment launched an eight-month study to explore converting old gas-powered scooters to electric. Scooters are vital for urban mobility, especially in delivery services, but older models emit up to 279 times more hydrocarbons than cars and contribute to rising noise complaints. The project aims to assess the feasibility, cost-effectiveness, and scalability of retrofitting. Despite subsidies since 2018, electric scooter adoption remains below targets, prompting new approaches to boost electrification.

South Korea Electric Two-Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Electric Scooter/Moped, Electric Motorcycle |

| Battery Types Covered | Lithium-Ion, Sealed Lead Acid (SLA) |

| Voltage Types Covered | <48V, 48-60V, 61-72V, 73-96V, >96V |

| Peak Powers Covered | <3 kW, 3-6 kW, 7-10 kW, >10 kW |

| Battery Technologies Covered | Removable, Non-Removable |

| Motor Placements Covered | Hub Type, Chassis Mounted |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea electric two-wheeler market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea electric two-wheeler market on the basis of vehicle type?

- What is the breakup of the South Korea electric two-wheeler market on the basis of battery type?

- What is the breakup of the South Korea electric two-wheeler market on the basis of voltage type?

- What is the breakup of the South Korea electric two-wheeler market on the basis of peak power?

- What is the breakup of the South Korea electric two-wheeler market on the basis of battery technology?

- What is the breakup of the South Korea electric two-wheeler market on the basis of motor placement?

- What is the breakup of the South Korea electric two-wheeler market on the basis of region?

- What are the various stages in the value chain of the South Korea electric two-wheeler market?

- What are the key driving factors and challenges in the South Korea electric two-wheeler market?

- What is the structure of the South Korea electric two-wheeler market and who are the key players?

- What is the degree of competition in the South Korea electric two-wheeler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea electric two-wheeler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea electric two-wheeler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea electric two-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)