South Korea Electronic Warfare Market Size, Share, Trends and Forecast by Product, Equipment, Capacity, Platform, and Region, 2025-2033

South Korea Electronic Warfare Market Overview:

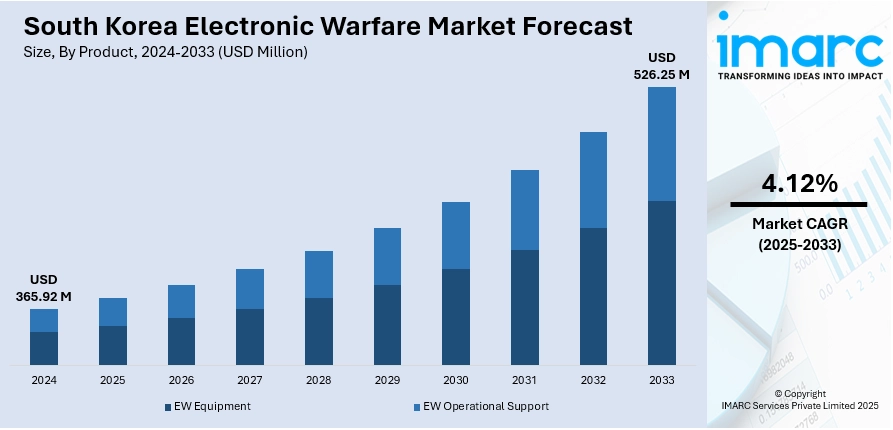

The South Korea electronic warfare market size reached USD 365.92 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 526.25 Million by 2033, exhibiting a growth rate (CAGR) of 4.12% during 2025-2033. The market is driven by evolving geopolitical tensions, a heightened need for advanced surveillance and self-protection capabilities, and continuous military modernization efforts. Rapid technological advancements, particularly in AI and signal processing, also propel the South Korea electronic warfare market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 365.92 Million |

| Market Forecast in 2033 | USD 526.25 Million |

| Market Growth Rate 2025-2033 | 4.12% |

South Korea Electronic Warfare Market Trends:

Integration of Artificial Intelligence and Machine Learning

A significant trend in the South Korea electronic warfare market is the increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) into EW systems. These advanced algorithms enable faster and more efficient decision-making by facilitating real-time threat analysis, signal identification, and adaptive jamming techniques. AI-driven EW systems can learn from evolving electronic threats, allowing for more precise and rapid responses in complex electromagnetic environments. This technological advancement is crucial for maintaining a competitive edge and enhancing situational awareness, thereby contributing significantly to the South Korea electronic warfare market growth. For instance, in January 2025, South Korea's LIG Nex1 signed a USD 10.5M deal with DRATRI to develop next-generation mobile ad hoc network (MANET) systems for the Republic of Korea Army (RoKA). The systems will equip drones, troops, and combat vehicles, supporting uncrewed operations. The project aligns with RoKA’s Army Tiger 4.0 modernization program, transforming soldiers into sensor nodes in an AI-driven network. Completion is expected by 2027, reinforcing South Korea's push for advanced, hyperconnected battlefield communications amid evolving defense strategies.

To get more information on this market, Request Sample

Focus on Self-Protection and Counter-Drone Capabilities

The escalating sophistication of electronic warfare threats, including the proliferation of unmanned aerial vehicles (UAVs) and advanced cyber-physical attacks, is driving a strong focus on self-protection and counter-drone capabilities within the South Korean military. Modern EW systems are increasingly designed to detect, counter, and neutralize these emerging threats, ensuring the survivability of platforms and personnel. This involves investments in sophisticated electronic countermeasure pods, radar jamming systems, and signal spoofing technologies. The imperative to safeguard critical assets against diverse electronic attacks is a key factor driving the South Korea electronic warfare market growth. For instance, the recent partnership between Northrop Grumman and LIG Nex1 aims to develop airborne electronic warfare (EW) and targeting systems for South Korea. The collaboration includes advanced EW technologies like the ALQ-257 system and LITENING targeting pod, which enhance situational awareness, survivability, and precision targeting. This partnership leverages Northrop Grumman's global defense expertise and supports the Republic of Korea’s military modernization efforts, strengthening domestic EW capabilities through cutting-edge, mission-focused solutions for F-16s and other platforms.

South Korea Electronic Warfare Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional level for 2025-2033. Our report has categorized the market based on product, equipment, capacity, and platform.

Product Insights:

- EW Equipment

- EW Operational Support

The report has provided a detailed breakup and analysis of the market based on the product. This includes EW equipment and EW operational support.

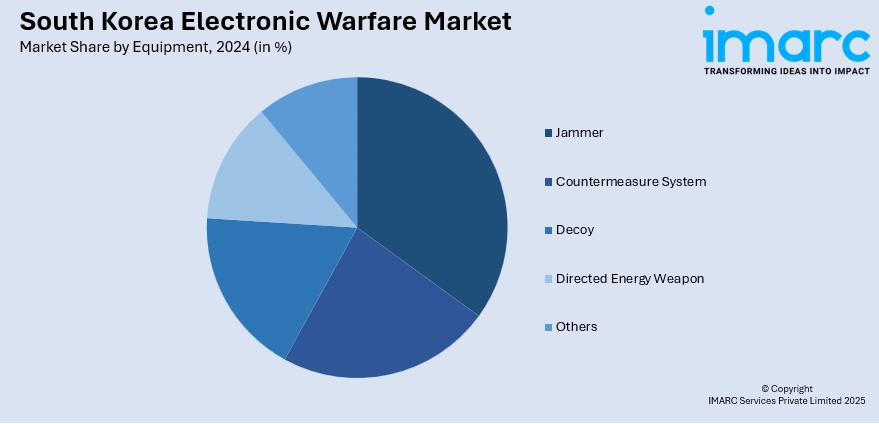

Equipment Insights:

- Jammer

- Countermeasure System

- Decoy

- Directed Energy Weapon

- Others

A detailed breakup and analysis of the market based on the equipment have also been provided in the report. This includes jammer, countermeasure system, decoy, directed energy weapon, and others.

Capacity Insights:

- Electronic Protection

- Electronic Support

- Electronic Attack

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes electronic protection, electronic support, and electronic attack.

Platform Insights:

- Land

- Naval

- Airborne

- Space

The report has provided a detailed breakup and analysis of the market based on the platform. This includes land, naval, airborne, and space.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Electronic Warfare Market News:

- In June 2025, BAE Systems and South Korea’s Hanwha Systems signed an MoU to jointly develop a multi-sensor surveillance satellite system. The project will integrate BAE’s ultra-wideband RF sensor technology with Hanwha’s small SAR satellite capabilities, aiming to deliver advanced space-based ISR solutions. Using machine learning to fuse RF and SAR data, the system will enhance situational awareness and intelligence.

- In May 2025, South Korea’s KF-21 Boramae fighter jet entered final assembly, marking a milestone in its defense advancement. Developed by Korea Aerospace Industries with over 65% indigenous systems, including an AESA radar and electronic warfare suite, the multirole aircraft enhances air superiority and strike capabilities. Set to complement the F-35 fleet, 120 units are planned by 2032. The KF-21 reflects South Korea’s push for defense self-reliance and has attracted international interest from partners like Indonesia, UAE, and Poland.

South Korea Electronic Warfare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | EW Equipment, EW Operational Support |

| Equipments Covered | Jammer, Countermeasure System, Decoy, Directed Energy Weapon, Others |

| Capacities Covered | Electronic Protection, Electronic Support, Electronic Attack |

| Platforms Covered | Land, Naval, Airborne, Space |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea electronic warfare market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea electronic warfare market on the basis of product?

- What is the breakup of the South Korea electronic warfare market on the basis equipment?

- What is the breakup of the South Korea electronic warfare market on the basis of capacity?

- What is the breakup of the South Korea electronic warfare market on the basis of platform?

- What is the breakup of the South Korea electronic warfare market on the basis of region?

- What are the various stages in the value chain of the South Korea electronic warfare market?

- What are the key driving factors and challenges in the South Korea electronic warfare market?

- What is the structure of the South Korea electronic warfare market and who are the key players?

- What is the degree of competition in the South Korea electronic warfare market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various Korea market segments, historical and current market trends, market forecasts, and dynamics of the South Korea electronic warfare market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea electronic warfare market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea electronic warfare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)