South Korea Encryption Software Market Size, Share, Trends and Forecast by Component, Deployment Model, Organization Size, Function, Industry Vertical, and Region, 2026-2034

South Korea Encryption Software Market Overview:

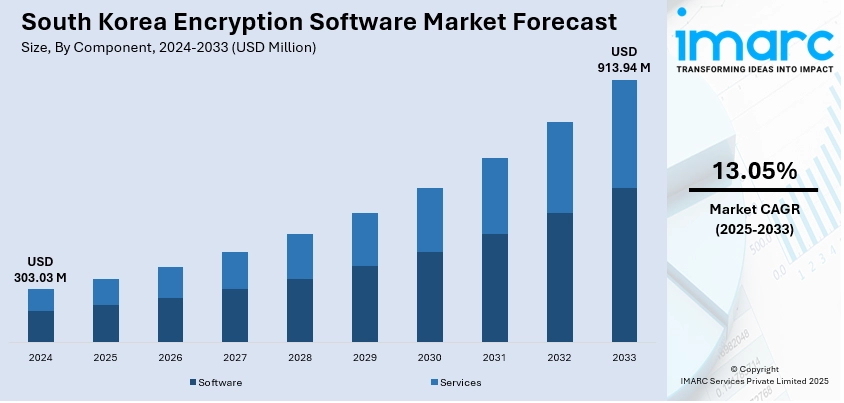

The South Korea encryption software market size reached USD 303.03 Million in 2025. Looking forward, the market is projected to reach USD 913.94 Million by 2034, exhibiting a growth rate (CAGR) of 13.05% during 2026-2034. The market is driven by regulatory mandates enforcing encryption across critical infrastructure, data privacy, and public projects. Rapid digitalization and cloud migration have elevated the need for robust, integrated encryption services. Escalating cyber threats and intelligence-led defense strategies are further augmenting the South Korea encryption software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 303.03 Million |

| Market Forecast in 2034 | USD 913.94 Million |

| Market Growth Rate 2026-2034 | 13.05% |

South Korea Encryption Software Market Trends:

National Cybersecurity Strategy and Regulatory Mandates

South Korea has implemented a comprehensive cybersecurity framework that mandates encryption across government, finance, healthcare, and critical infrastructure sectors. Organizations are required to use approved cryptographic protocols for data at rest and in transit, under guidelines set by bodies such as the Ministry of Science and ICT. Regulatory standards, including those targeting personal information protection, financial regulation, and industrial control systems, drive enterprise and public sector adoption of encryption software to ensure compliance. Firms operating in Seoul and regional smart-city zones must integrate encryption solutions from the ground up, especially as national projects involve IoT integration, cloud migration, and AI systems. Public procurement criteria often include encryption readiness as a baseline requirement. This regulatory landscape creates a stable baseline demand, encouraging encryption vendors to localize solutions, develop Korean-language key-management tools, and offer government-accredited algorithms. As compliance becomes a strategic imperative, encryption software adoption increasingly aligns with national resilience objectives, catalyzing sustained South Korea encryption software market growth.

To get more information on this market, Request Sample

Surge in Digital Transformation and Cloud Adoption

The accelerating shift to digital platforms across South Korean industries, particularly finance, telecom, retail, and public services, has significantly increased reliance on cloud infrastructure and remote work environments. Encryption software is becoming essential to secure sensitive data across hybrid and multi-cloud architectures. Enterprises demand end-to-end encryption for database storage, communications, and API interactions to protect against both external cyberattacks and insider threats. With remote access to corporate resources normalized, organizations prioritize zero-trust models, secure containers, and cryptographic key management systems. South Korean IT service integrators now offer managed encryption-as-a-service bundles that feature automated certificate rotation, hardware security module (HSM) integration, and compliance reporting. In high-stakes sectors such as e-commerce, fintech, and digital healthcare, encryption tools are viewed as essential to maintaining consumer trust and meeting audit requirements. As cloud-first transformation continues, encryption software takes on a central role in securing operational continuity and data sovereignty in South Korea.

Rising Sophistication of Cyber Threats and Intelligence-Driven Defense

South Korea faces advanced cyber threats, from state-sponsored attacks to ransomware, that specifically target data exfiltration and cryptographic vulnerabilities. These evolving threat dynamics have prompted organizations to adopt proactive encryption strategies that include dynamic key rotation, file-level encryption, and homomorphic encryption in sensitive environments. Defense-grade encryption solutions are increasingly deployed by enterprises engaged in intellectual property management, technology R&D, and smart manufacturing. Private and public sector entities are investing in encryption analytics platforms that detect anomalies in cryptographic usage and report suspicious key-access events. Government-backed cybersecurity awareness campaigns encourage companies to adopt robust encryption architectures that resist lateral movement attacks and ransomware encryption bypasses.

South Korea Encryption Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component, deployment model, organization size, function, and industry vertical.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Deployment Model Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment model. This includes on-premises and cloud-based.

Organization Size Insights:

- Large Enterprises

- Small and Medium Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises and small and medium enterprises.

Function Insights:

- Disk Encryption

- Communication Encryption

- File and Folder Encryption

- Cloud Encryption

The report has provided a detailed breakup and analysis of the market based on the function. This includes disk encryption, communication encryption, file and folder encryption, and cloud encryption.

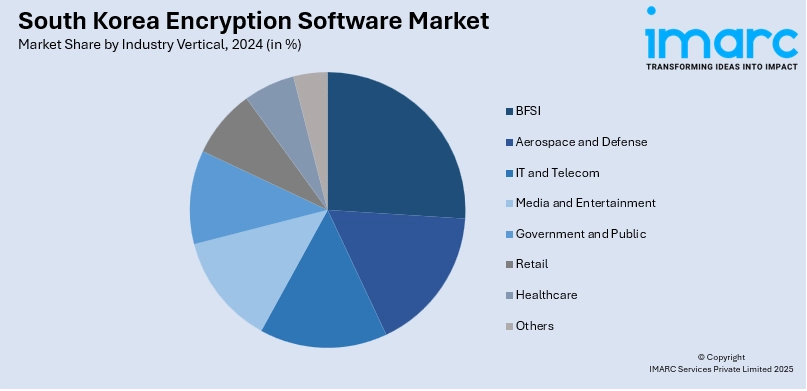

Industry Vertical Insights:

- BFSI

- Aerospace and Defense

- IT and Telecom

- Media and Entertainment

- Government and Public

- Retail

- Healthcare

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes BFSI, aerospace and defense, IT and telecom, media and entertainment, government and public, retail, healthcare, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Encryption Software Market News:

- On April 16, 2024, South Korea–based CryptoLab signed a three-year contract with Macrogen, the country’s largest genetic data analysis firm, to supply fully homomorphic encryption (FHE) technology for genomic data privacy. The partnership will integrate CryptoLab’s HEaaN Genome Analysis Solution, based on the CKKS scheme, into Macrogen’s services, enabling encrypted data analysis without decryption. This move aligns with South Korea’s updated healthcare data utilization guidelines and highlights the growing role of advanced encryption software in securing sensitive medical data.

South Korea Encryption Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Models Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| Functions Covered | Disk Encryption, Communication Encryption, File and Folder Encryption, Cloud Encryption |

| Industry Verticals Covered | BFSI, Aerospace and Defense, IT and Telecom, Media and Entertainment, Government and Public, Retail, Healthcare, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea encryption software market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea encryption software market on the basis of component?

- What is the breakup of the South Korea encryption software market on the basis of deployment model?

- What is the breakup of the South Korea encryption software market on the basis of organization size?

- What is the breakup of the South Korea encryption software market on the basis of function?

- What is the breakup of the South Korea encryption software market on the basis of industry vertical?

- What is the breakup of the South Korea encryption software market on the basis of region?

- What are the various stages in the value chain of the South Korea encryption software market?

- What are the key driving factors and challenges in the South Korea encryption software market?

- What is the structure of the South Korea encryption software market and who are the key players?

- What is the degree of competition in the South Korea encryption software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea encryption software market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea encryption software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea encryption software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)