South Korea Feed Additives Market Size, Share, Trends and Forecast by Source, Product Type, Livestock, Form, and Region, 2025-2033

South Korea Feed Additives Market Overview:

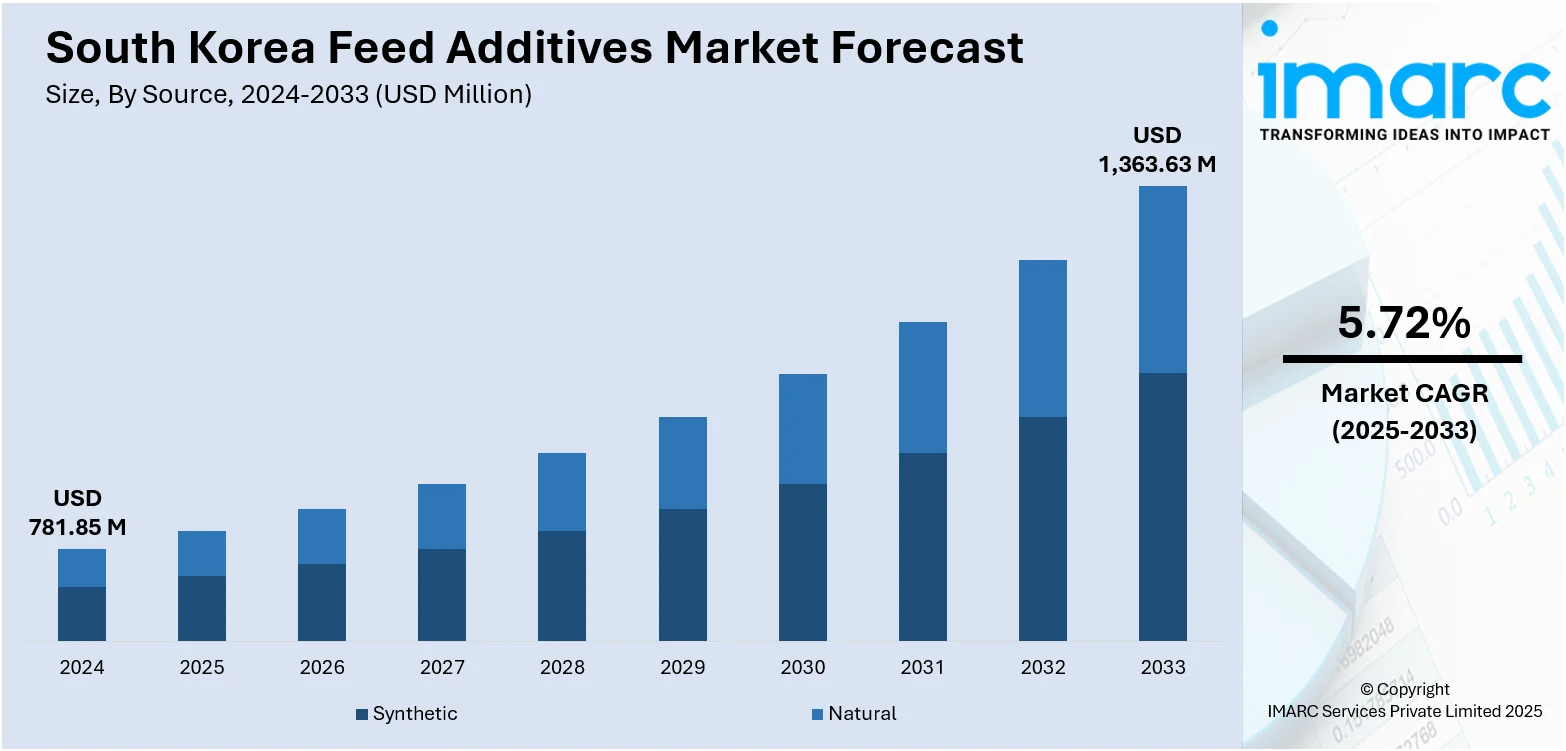

The South Korea Feed additives market size reached USD 781.85 Million in 2024. The market is projected to reach USD 1,363.63 Million by 2033, exhibiting a growth rate (CAGR) of 5.72% during 2025-2033. The market is fueled by increasing demand for high-quality animal protein, growing use of precision nutrition technologies, and mounting regulatory support for sustainable agriculture. Consumers are looking for safer, healthier meat and dairy, encouraging producers to improve animal health and feed efficiency. Enzyme, probiotic, and natural growth promoter innovations enable this transition, while government policies discourage antibiotic usage and encourage environmentally friendly substitutes. Additionally, advances in those technologies enable the development of targeted microbe-based solutions. Collectively, these are driving South Korea Feed additives share and development in the nation's feed additives market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 781.85 Million |

| Market Forecast in 2033 | USD 1,363.63 Million |

| Market Growth Rate 2025-2033 | 5.72% |

South Korea Feed Additives Market Trends:

Rising Demand for Animal Protein

South Korea is facing an increasing demand for premium animal-derived products like meat, milk, and eggs. This change in consumption patterns is affecting livestock farmers to focus on efficiency, animal well-being, and product quality. Faced with these changing demands, producers are looking towards feed additives as key drivers. Vitamins, enzymes, and amino acids are some of the additives that enhance digestion, protect against disease, and boost growth performance. As people become more discerning and concerned with the origin of what they eat, there is mounting pressure on the livestock sector to provide consistent and secure production. Feed additives allow farmers to respond to these needs while minimizing feed expense and waste. The demand for traceable, high-quality protein continues to be a dominant driver pushing the South Korea Feed additives market growth.

To get more information on this market, Request Sample

Technological Advancements & Precision Nutrition

The adoption of modern technologies is transforming livestock feeding in South Korea. Farmers and feed manufacturers are rapidly embracing precision nutrition, customizing feed formulations to meet the exact nutritional needs of animals. This shift relies on advanced feed additives such as enzymes, probiotics, and organic acids that enhance digestion, gut health, and animal performance. In parallel, smart farming tools and data-driven platforms allow real-time monitoring of animal health and feed efficiency, enabling timely adjustments that reduce waste and costs. Supporting this trend, South Korea’s smart farm exports—including livestock technologies—surged by 115.9% year-on-year in 2023, reaching USD 296 million. This growth underscores rising domestic capabilities in precision agriculture. As farming becomes more sophisticated, the demand for specialized, high-efficiency feed additives continues to expand, positioning them as a cornerstone of sustainable and profitable animal production in South Korea.

Regulatory Support & Sustainability Push

Environmental issues and food safety are becoming priorities in South Korean feed additives trends. As a response, the industry and government are encouraging a shift toward sustainable agriculture and use fewer conventional antibiotics. This movement has generated intense demand for natural and environmentally friendly feed additives such as probiotics, phytogenics, and fermented products. They assist in sustaining animal productivity and health without compromising safety. Regulatory action and incentives also aid the shift towards cleaner production systems, pushing farms to incorporate these additives in their everyday practices. The requirement for transparency and traceability within the food supply chain is also encouraging producers to select additives that meet these requirements. With sustainability fast outgrowing a trend—now a requirement—the South Korean feed additives market is picking up speed as a key contributor to sustainable and future-driven livestock production.

South Korea Feed Additives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source, product type, livestock, and form.

Source Insights:

- Synthetic

- Natural

A detailed breakup and analysis of the market based on source have also been provided in the report. This includes synthetic and natural.

Product Type Insights:

- Amino Acids

- Lysine

- Methionine

- Threonine

- Tryptophan

- Phosphates

- Monocalcium Phosphate

- Dicalcium Phosphate

- Mono-Dicalcium Phosphate

- Defluorinated Phosphate

- Tricalcium Phosphate

- Others

- Vitamins

- Fat-Soluble

- Water-Soluble

- Acidifiers

- Propionic Acid

- Formic Acid

- Citric Acid

- Lactic Acid

- Sorbic Acid

- Malic Acid

- Acetic Acid

- Others

- Carotenoids

- Astaxanthin

- Canthaxanthin

- Lutein

- Beta-Carotene

- Enzymes

- Phytase

- Protease

- Others

- Mycotoxin Detoxifiers

- Binders

- Modifiers

- Flavors and Sweetener

- Flavors

- Sweeteners

- Antibiotics

- Tetracycline

- Penicillin

- Others

- Minerals

- Potassium

- Calcium

- Phosphorus

- Magnesium

- Sodium

- Iron

- Zinc

- Copper

- Manganese

- Others

- Antioxidants

- BHA

- BHT

- Ethoxyquin

- Others

- Non-Protein Nitrogen

- Urea

- Ammonia

- Others

- Preservatives

- Mold Inhibitors

- Anticaking Agents

- Phytogenics

- Essential Oils

- Herbs and Spices

- Oleoresin

- Others

- Probiotics

- Lactobacilli

- Streptococcus Thermophilus

- Bifidobacteria

- Yeast

The report has provided a detailed breakup and analysis of the market based on the product type. This includes amino acids (lysine, methionine, threonine, and tryptophan), phosphates (monocalcium phosphate, dicalcium phosphate, mono-dicalcium, phosphate, defluorinated phosphate, tricalcium phosphate, and others), vitamins (fat-soluble and water-soluble), acidifiers (propionic acid, formic acid, citric acid, lactic acid, sorbic acid, malic acid, acetic acid, and others), carotenoids (astaxanthin, canthaxanthin, lutein, and beta-carotene), enzymes (phytase, protease, and others), mycotoxin detoxifiers (binders and modifiers), flavors and sweeteners, (flavors and sweeteners), antibiotics (tetracycline, penicillin, and others), minerals (potassium, calcium, phosphorus, magnesium, sodium, iron, zinc, copper, manganese, and others), antioxidants (BHA, BHT, ethoxyquin, and others), non-protein nitrogen (urea, ammonia, and others), preservatives (mold inhibitors and anticaking agents), Phytogenics (essential oils, herbs and spices, oleoresin, and others), and probiotics (lactobacilli, streptococcus thermophilus, bifidobacteria, and yeast).

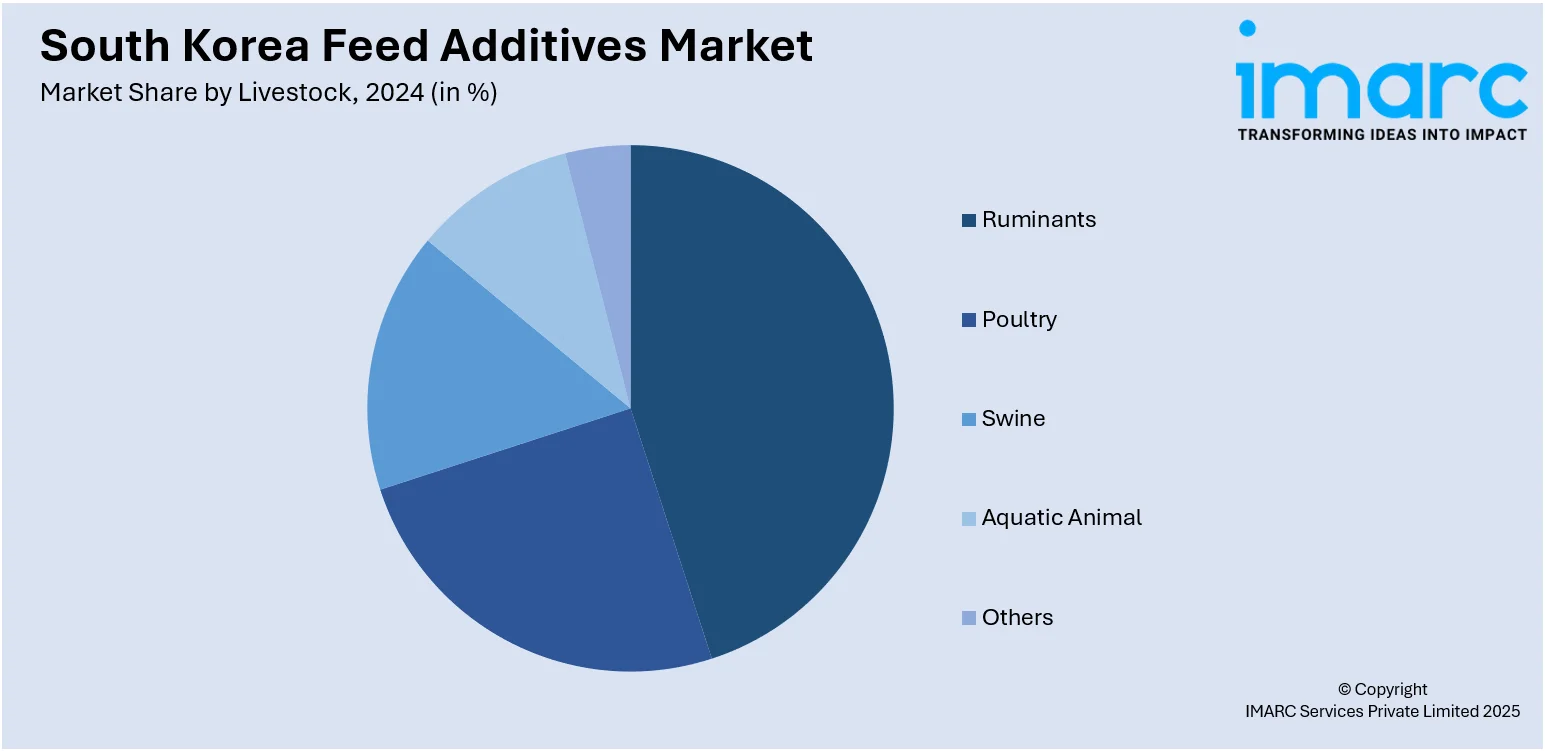

Livestock Insights:

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- Breeders

- Swine

- Starters

- Growers

- Sows

- Aquatic Animal

- Others

A detailed breakup and analysis of the market based on the livestock have also been provided in the report. This includes ruminants (calves, dairy cattle, beef cattle, and others), poultry (broilers, layers, and breeders), swine (starters, growers, and sows), aquatic animal, and others.

Form Insights:

- Dry

- Liquid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes dry and liquid.

Region Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Feed Additives Market News:

- In September 2024, Novus International partnered with Ginkgo Bioworks to develop advanced, cost-effective feed additives using Ginkgo’s Enzyme Services. The collaboration focuses on creating efficient enzymes to enhance livestock health, performance, and sustainability amid rising feed costs and industry volatility. Targeting chickens, pigs, and cows, the partnership aims to deliver innovative solutions that support consistent production outcomes, helping producers offer nutritious, affordable animal products while meeting modern agricultural and economic challenges.

- In February 2024, South Korea’s EASY BIO has acquired U.S.-based Devenish Nutrition to expand its feed additive and premix business in North America. The acquisition, completed via EASY BIO USA, brings together Devenish’s strong research capabilities and market presence with EASY BIO’s global expertise in sustainable animal nutrition. The move aims to create synergies, enhance competitiveness, and deliver diverse, technology-driven solutions for livestock health across global markets.

South Korea Feed Additives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Synthetic, Natural |

| Product Types Covered |

|

| Livestocks Covered |

|

| Forms Covered | Dry, Liquid |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea Feed additives market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea feed additives market on the basis of source?

- What is the breakup of the South Korea feed additives market on the basis of product type?

- What is the breakup of the South Korea feed additives market on the basis of livestock?

- What is the breakup of the South Korea feed additives market on the basis of form?

- What is the breakup of the South Korea feed additives market on the basis of region?

- What are the various stages in the value chain of the South Korea feed additives market?

- What are the key driving factors and challenges in the South Korea feed additives market?

- What is the structure of the South Korea feed additives market and who are the key players?

- What is the degree of competition in the South Korea feed additives market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea feed additives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea feed additives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea feed additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)