South Korea Fiberglass Market Size, Share, Trends and Forecast by Glass Product Type, Glass Fiber Type, Resin Type, Application, End User, and Region, 2025-2033

South Korea Fiberglass Market Overview:

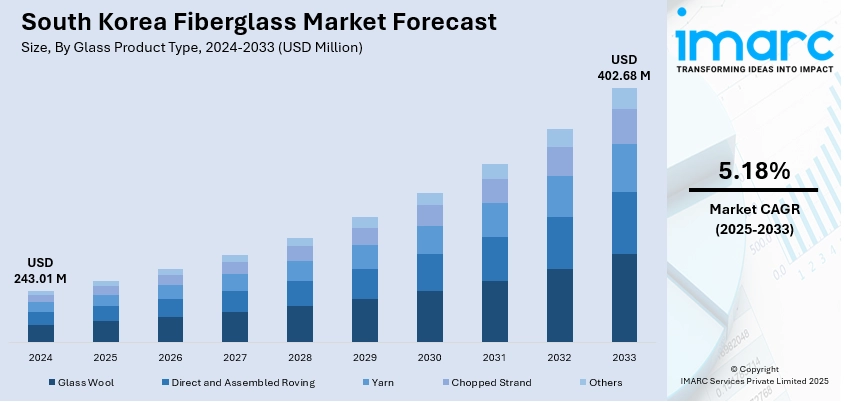

The South Korea fiberglass market size reached USD 243.01 Million in 2024. Looking forward, the market is projected to reach USD 402.68 Million by 2033, exhibiting a growth rate (CAGR) of 5.18% during 2025-2033. The market is driven by demand across automotive, electronics, and infrastructure sectors, where strength, weight reduction, and thermal resistance are key. Renewable energy development, especially wind, requires corrosion-resistant, structural fiberglass components in offshore and land-based installations. Export-oriented manufacturing and adherence to international performance standards are further augmenting the South Korea fiberglass market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 243.01 Million |

| Market Forecast in 2033 | USD 402.68 Million |

| Market Growth Rate 2025-2033 | 5.18% |

South Korea Fiberglass Market Trends:

High Demand Across Automotive, Electronics, and Infrastructure Sectors

Fiberglass continues to gain traction as a versatile, lightweight, and durable material across key South Korean industries such as automotive manufacturing, consumer electronics, and construction. In automotive applications, fiberglass-reinforced composites are widely adopted for underbody shields, paneling, and insulation due to their strength-to-weight ratio and corrosion resistance. Similarly, the electronics sector incorporates fiberglass into circuit boards and thermal insulators for semiconductors and mobile devices. Public and private infrastructure projects further integrate fiberglass-based rebar, insulation, and cladding due to its low maintenance and longevity. As industrial design shifts towards lightweight engineering and improved performance efficiency, demand for fiberglass products intensifies across B2B value chains. Moreover, government-supported R&D in material science and manufacturing automation continues to enhance domestic fiberglass output and cost efficiency. The convergence of material innovation and application diversity is driving sustained South Korea fiberglass market growth.

To get more information on this market, Request Sample

Renewable Energy Expansion and Environmental Adaptability

South Korea’s expansion of renewable energy projects, particularly wind energy, is creating new opportunities for fiberglass materials in turbine blade manufacturing and structural support. The non-conductive, weather-resistant nature of fiberglass makes it an ideal solution for offshore installations where reliability under harsh conditions is essential. Wind turbine blades made with fiberglass offer a balance between weight reduction and aerodynamic performance, improving operational efficiency and lifespan. In addition, fiberglass is increasingly used in solar infrastructure as mounting components and frames. Environmental considerations, such as resistance to saltwater corrosion, thermal degradation, and chemical exposure, are reinforcing fiberglass’s appeal in renewable project design. As South Korea seeks to transition from fossil fuels, the deployment of durable, adaptable materials in renewable platforms becomes critical. This transition has contributed to increasing procurement of fiberglass-based components and is expected to deepen as government targets for clean energy adoption accelerate.

Export-Oriented Manufacturing and Global Integration

South Korea’s export-focused industrial base relies on advanced materials like fiberglass to meet international standards across end-use segments. Domestic producers are scaling up production capacity with automated fiber drawing, weaving, and resin impregnation technologies to cater to OEMs and tier-1 suppliers worldwide. Key export segments include automotive components, marine panels, sporting goods, and precision electronics that demand stringent strength and insulation properties. Fiberglass producers are forming long-term contracts with global clients, leveraging South Korea’s high-quality production capabilities and logistical efficiency. Furthermore, alignment with international safety, thermal performance, and environmental certifications has enabled South Korean fiberglass to penetrate competitive overseas markets. Collaborative R&D programs and vertical integration strategies help reduce dependence on raw imports and ensure consistent quality. These competitive manufacturing advantages position South Korea as a reliable global supplier, driving foreign demand and long-term sustainability in fiberglass production and exports.

South Korea Fiberglass Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on glass product type, glass fiber type, resin type, application, and end user.

Glass Product Type Insights:

- Glass Wool

- Direct and Assembled Roving

- Yarn

- Chopped Strand

- Others

The report has provided a detailed breakup and analysis of the market based on the glass product type. This includes glass wool, direct and assembled roving, yarn, chopped strand, and others.

Glass Fiber Type Insights:

- E-Glass

- A-Glass

- S-Glass

- AR-Glass

- C-Glass

- R-Glass

- Others

The report has provided a detailed breakup and analysis of the market based on the glass fiber type. This includes E-glass, A-glass, S-glass, AR-glass, C-glass, R-glass, and others.

Resin Type Insights:

- Thermoset Resin

- Thermoplastic Resin

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes thermoset resin and thermoplastic resin.

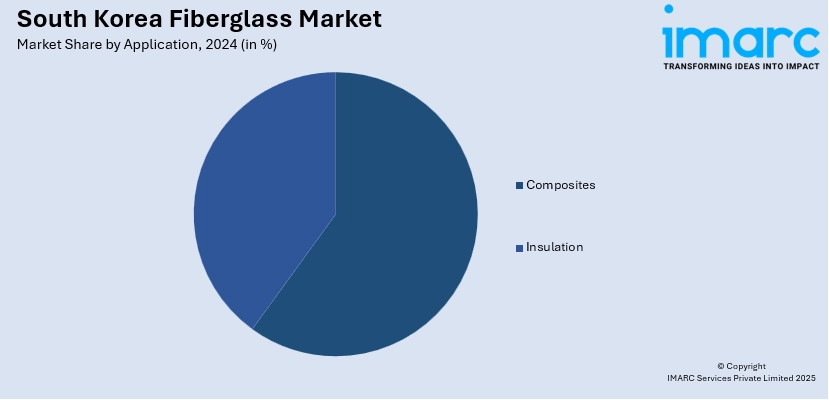

Application Insights:

- Composites

- Insulation

The report has provided a detailed breakup and analysis of the market based on the application. This includes composites and insulation.

End User Insights:

- Construction

- Automotive

- Wind Energy

- Aerospace and Defense

- Electronics

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes construction, automotive, wind energy, aerospace and defense, electronics, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Fiberglass Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Glass Product Types Covered | Glass Wool, Direct and Assembled Roving, Yarn, Chopped Strand, Others |

| Glass Fiber Types Covered | E-Glass, A-Glass, S-Glass, AR-Glass, C-Glass, R-Glass, Others |

| Resin Types Covered | Thermoset Resin, Thermoplastic Resin |

| Applications Covered | Composites, Insulation |

| End Users Covered | Construction, Automotive, Wind Energy, Aerospace and Defense, Electronics, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea fiberglass market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea fiberglass market on the basis of glass product type?

- What is the breakup of the South Korea fiberglass market on the basis of glass fiber type?

- What is the breakup of the South Korea fiberglass market on the basis of resin type?

- What is the breakup of the South Korea fiberglass market on the basis of application?

- What is the breakup of the South Korea fiberglass market on the basis of end user?

- What is the breakup of the South Korea fiberglass market on the basis of region?

- What are the various stages in the value chain of the South Korea fiberglass market?

- What are the key driving factors and challenges in the South Korea fiberglass market?

- What is the structure of the South Korea fiberglass market and who are the key players?

- What is the degree of competition in the South Korea fiberglass market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea fiberglass market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea fiberglass market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea fiberglass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)