South Korea Fleet Management Market Size, Share, Trends and Forecast by Component, Vehicle Type, End-Use Sector, Technology, Deployment Type, and Region, 2025-2033

South Korea Fleet Management Market Overview:

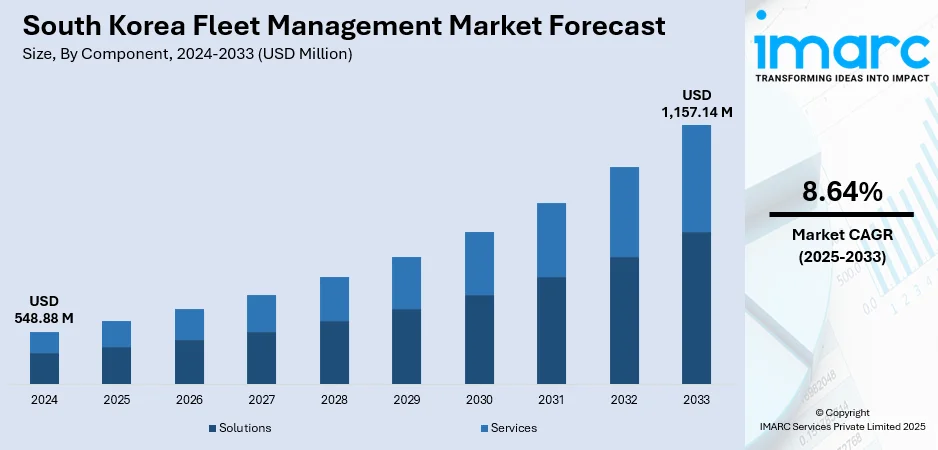

The South Korea fleet management market size reached USD 548.88 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,157.14 Million by 2033, exhibiting a growth rate (CAGR) of 8.64% during 2025-2033. Rising e-commerce and growing corporate fleets are encouraging businesses in South Korea to adopt advanced fleet management systems. These tools improve delivery speed, vehicle oversight, and cost efficiency, while supporting real-time tracking, shared vehicle access, and data-driven operations across increasingly complex logistics networks, contributing to the expansion of South Korea fleet management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 548.88 Million |

| Market Forecast in 2033 | USD 1,157.14 Million |

| Market Growth Rate 2025-2033 | 8.64% |

South Korea Fleet Management Market Trends:

Rising Demand for Logistics and E-Commerce Services

With the expansion of online retail, companies are under mounting pressure to handle logistics operations with enhanced speed, precision, and cost-effectiveness. The need for swift and dependable delivery services, especially in heavily populated city regions, encourages businesses to implement advanced fleet management systems that enable real-time vehicle tracking, adaptive route optimization, and proactive fleet oversight. The increasing focus on last-mile delivery is catalyzing the demand for sophisticated technologies that guarantee on-time arrivals, minimize delivery failures, and enhance client satisfaction. Traditional approaches are no longer effective in addressing these intricate operational needs. Businesses now need comprehensive visibility and management of their delivery networks to stay competitive. This transition is firmly backed by the magnitude of the e-commerce sector in South Korea, which according to the IMARC Group, reached USD 510 Billion in 2024. This figure indicates both the number of transactions occurring and the extent of logistical infrastructure needed to facilitate such operations. As a result, investing in fleet management technology is becoming crucial for operational efficiency, cost management, and fulfilling client expectations in a competitive delivery landscape. With these evolving demands and market conditions, the adoption of intelligent logistics solutions continues to be a key factor supporting the South Korea fleet management market growth.

To get more information on this market, Request Sample

Corporate Fleet Expansion and Management Needs

The increasing scale and intricacy of corporate vehicle fleets in South Korea is driving the need for sophisticated fleet management solutions. With businesses in various sectors growing their operations and transportation requirements, overseeing substantial numbers of vehicles is becoming increasingly difficult. Businesses are looking for unified platforms that provide real-time data tracking, utilization monitoring, and remote management of fleet resources to enhance supervision and optimize operations. There is a rise in the demand to minimize inefficiencies stemming from vehicle underutilization, disorganized scheduling, and manual reporting. Fleet management systems enabling digital booking, driver verification, maintenance monitoring, and cost evaluation are becoming vital for organizations to uphold operational discipline and transparency. As corporate vehicles are utilized throughout various departments and locations, cloud-based solutions providing mobile access and scalable integration are becoming more popular. The move towards remote work and adaptable business models is also catalyzing the demand for systems that facilitate shared vehicle access and mobile coordination. With the goal of reducing expenses, minimizing fuel usage, and decreasing idle periods, companies are increasingly adopting fleet management solutions. This trend indicates a larger shift towards automation and decision-making based on data within corporate transportation plans. In line with this trend, in March 2024, Socar launched Socar FMS, a cloud-based B2B car-sharing and fleet management solution targeting Korea’s 3.44 million corporate vehicles. The system enabled companies to manage vehicle usage via smartphone, track real-time data, and improve efficiency while cutting costs.

South Korea Fleet Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, vehicle type, end-use sector, technology, and deployment type.

Component Insights:

- Solutions

- Fleet Telematics

- Driver Information Management

- Vehicle Maintenance

- Safety and Compliance Management

- Others

- Services

- Installation and Integration Services

- After-Sales Support Services

- Consulting Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions (fleet telematics, driver information management, vehicle maintenance, safety and compliance management, and others) and services (installation and integration services, after-sales support services, and consulting services).

Vehicle Type Insights:

- Commercial Vehicles

- Passenger Cars

- Aircrafts

- Watercrafts

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes commercial vehicles, passenger cars, aircrafts, and watercrafts.

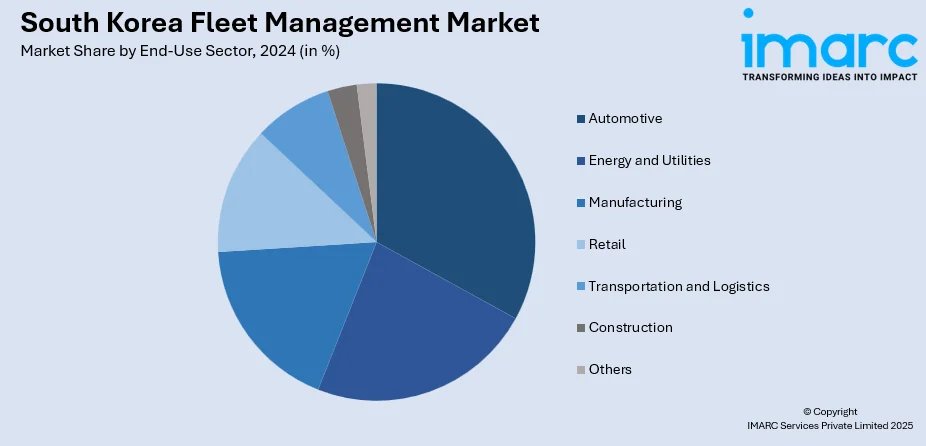

End-Use Sector Insights:

- Automotive

- Energy and Utilities

- Manufacturing

- Retail

- Transportation and Logistics

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use sector. This includes automotive, energy and utilities, manufacturing, retail, transportation and logistics, construction, and others.

Technology Insights:

- GNSS

- Cellular Systems

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes GNSS and cellular systems.

Deployment Type Insights:

- Cloud-based

- On-premises

- Hybrid

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes cloud-based, on-premises, and hybrid.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Fleet Management Market News:

- In May 2025, South Korea's Korail used PTV Visum to model and optimize its high-speed rail fleet, aiming to replace aging KTX-1 trains. The analysis showed that increasing trainsets from 46 to 51 is needed to support expanded service and reduce overbooking. Key tools included time-space diagrams, line blocking, and block diagram analysis for scheduling and fleet optimization.

- In February 2025, South Korea’s T’way Air strengthens its fleet management by acquiring spare CFM Leap-1B engines to support the expansion of its Boeing 737 Max fleet from 2 to 20 aircraft by 2027. This enhances maintenance readiness and minimizes operational disruptions. The airline also plans new in-house maintenance facilities at Incheon Airport by 2028 to improve fleet reliability and efficiency.

South Korea Fleet Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Vehicle Types Covered | Commercial Vehicles, Passenger Cars, Aircrafts, Watercrafts |

| End-Use Sectors Covered | Automotive, Energy and Utilities, Manufacturing, Retail, Transportation and Logistics, Construction, Others |

| Technologies Covered | GNSS, Cellular Systems |

| Deployment Types Covered | Cloud-based, On-premises, Hybrid |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea fleet management market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea fleet management market on the basis of component?

- What is the breakup of the South Korea fleet management market on the basis of vehicle type?

- What is the breakup of the South Korea fleet management market on the basis of end-use sector?

- What is the breakup of the South Korea fleet management market on the basis of technology?

- What is the breakup of the South Korea fleet management market on the basis of deployment type?

- What is the breakup of the South Korea fleet management market on the basis of region?

- What are the various stages in the value chain of the South Korea fleet management market?

- What are the key driving factors and challenges in the South Korea fleet management market?

- What is the structure of the South Korea fleet management market and who are the key players?

- What is the degree of competition in the South Korea fleet management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea fleet management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea fleet management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea fleet management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)