South Korea Forage Market Size, Share, Trends and Forecast by Crop Type, Product Type, Animal Type, and Region, 2025-2033

South Korea Forage Market Overview:

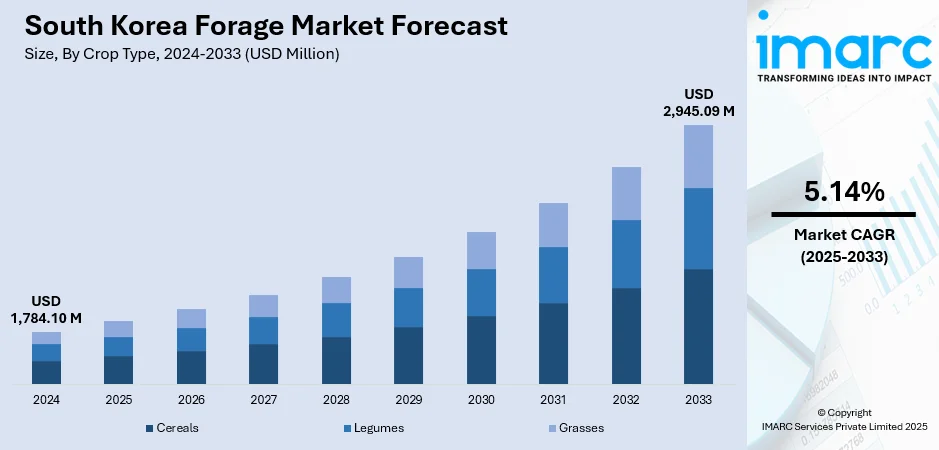

The South Korea forage market size reached USD 1,784.10 Million in 2024. The market is projected to reach USD 2,945.09 Million by 2033, exhibiting a growth rate (CAGR) of 5.14% during 2025-2033. As livestock and dairy farms are expanding to meet rising demand for animal products, the need for high-quality forage is increasing. Forage supports better animal health, productivity, and milk yield, making it essential in modern feeding practices. Besides this, the broadening of feed processing facilities is fueling the South Korea forage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,784.10 Million |

| Market Forecast in 2033 | USD 2,945.09 Million |

| Market Growth Rate 2025-2033 | 5.14% |

South Korea Forage Market Trends:

Growth of livestock farming

As the demand for meat, milk, and other animal-based products is rising among people, farmers are expanding livestock operations, particularly in dairy, beef, and poultry sectors. This broadening is directly creating the need for high-quality forage, which serves as a key component of animal feed. As per the IMARC Group, the South Korea animal feed market size is set to show a growth rate (CAGR) of 2.39% during 2025-2033. Forage provides essential nutrients that support animal health, weight gain, milk production, and overall productivity. South Korean farmers are becoming more aware about the benefits of feeding livestock with nutrient-rich forage, including improved digestion, better immunity, and reduced dependency on expensive concentrated feeds. This shift in feeding practices is contributing to a steady demand for crops like alfalfa, timothy hay, ryegrass, and silage. As livestock farms are scaling up, they are seeking consistent and reliable forage supply, driving both domestic production and imports. Limited arable land in South Korea often leads to increased reliance on imported forage from countries with surplus production. The livestock sector’s move towards more efficient, scientifically managed feeding systems is bolstering the growth of the market. Additionally, government initiatives that support livestock development are promoting farm modernization and higher output. Overall, the steady growth of livestock farming is significantly catalyzing the demand for forage across the country.

To get more information on this market, Request Sample

Broadening of feed processing facilities

The expansion of feed processing facilities is impelling the South Korea forage market growth. As more advanced processing plants are established, the efficiency and quality of forage production continue to improve significantly. These facilities allow better handling, drying, chopping, and packaging of forage crops like alfalfa, silage, and ryegrass, making them easier to store, transport, and use. Refined processing extends the shelf life of forage and maintains its nutritional value, which is essential for ensuring consistent and high-quality feed supply to livestock farms year-round. With enhanced infrastructure, the forage can also be customized to meet the specific dietary needs of different animals, boosting farm productivity and reducing feed waste. Moreover, processed forage is more convenient for farmers, especially small and medium-sized operations, who benefit from ready-to-use feed options. Rising import of forage is further creating the need for advanced processing units to manage volume and maintain quality standards. According to the OEC, in 2024, South Korea imported USD 384 Million worth of forage crops. As South Korea continues to modernize its agricultural sector, the role of processing facilities is becoming more prominent, enabling a stable, scalable, and efficient forage supply chain. This infrastructure development is ultimately strengthening the overall competitiveness of the forage market in the country.

South Korea Forage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on crop type, product type, and animal type.

Crop Type Insights:

- Cereals

- Legumes

- Grasses

The report has provided a detailed breakup and analysis of the market based on the crop type. This includes cereals, legumes, and grasses.

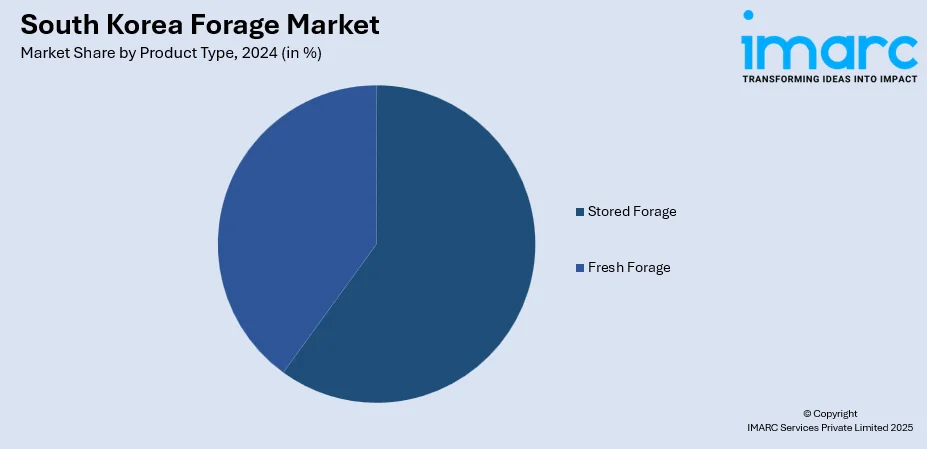

Product Type Insights:

- Stored Forage

- Fresh Forage

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes stored forage and fresh forage.

Animal Type Insights:

- Ruminants

- Swine

- Poultry

- Others

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes ruminants, swine, poultry, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Forage Market News:

- In November 2024, Gyeongju City in Gyeongbuk Province, South Korea, initiated a hay production system to generate 5,000 Tons of forage each year, targeting forage independence to aid livestock farms. Gyeongju set up hot air-dried forage production facilities, aiming to enhance drying and packaging techniques and generate self-sufficiency from 23% to 46%.

South Korea Forage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Crop Types Covered | Cereals, Legumes, Grasses |

| Product Types Covered | Stored Forage, Fresh Forage |

| Animal Types Covered | Ruminants, Swine, Poultry, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea forage market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea forage market on the basis of crop type?

- What is the breakup of the South Korea forage market on the basis of product type?

- What is the breakup of the South Korea forage market on the basis of animal type?

- What is the breakup of the South Korea forage market on the basis of region?

- What are the various stages in the value chain of the South Korea forage market?

- What are the key driving factors and challenges in the South Korea forage market?

- What is the structure of the South Korea forage market and who are the key players?

- What is the degree of competition in the South Korea forage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea forage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea forage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea forage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)