South Korea Fraud Detection and Prevention Market Size, Share, Trends and Forecast by Component, Application, Organization Size, Vertical, and Region, 2025-2033

South Korea Fraud Detection and Prevention Market Overview:

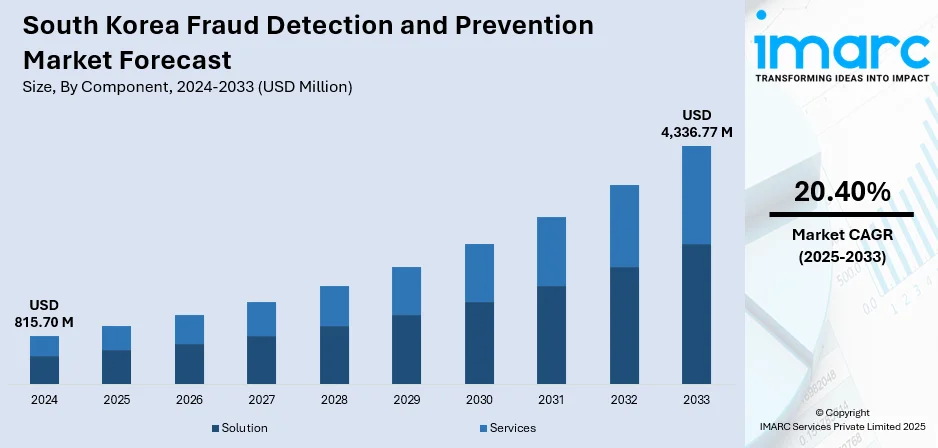

The South Korea fraud detection and prevention market size reached USD 815.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,336.77 Million by 2033, exhibiting a growth rate (CAGR) of 20.40% during 2025-2033. The growth of the market is driven by increasing instances of financial fraud, heightened regulatory pressures, and the rise of digital transactions. Additionally, the adoption of advanced technologies such as AI and machine learning, along with greater awareness among organizations, significantly contributes to the South Korea fraud detection and prevention market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 815.70 Million |

| Market Forecast in 2033 | USD 4,336.77 Million |

| Market Growth Rate 2025-2033 | 20.40% |

South Korea Fraud Detection and Prevention Market Trends:

Integration of Artificial Intelligence and Machine Learning

The growth of the fraud detection and prevention market in South Korea is being revolutionized by the combination of Artificial Intelligence (AI) and Machine Learning (ML). By evaluating enormous volumes of data in real-time and spotting trends and abnormalities that would be challenging for conventional systems to pick up, AI and ML algorithms have improved fraud detection systems. These technologies assist government authorities, retailers, and financial institutions in staying ahead of fraud efforts by continuously learning from new data. AI is a crucial instrument in the fight against fraud because of its capacity to anticipate and stop fraud before it occurs, which considerably lowers the chance of monetary losses. AI and ML are anticipated to become key factors driving the South Korean fraud detection and prevention market as more businesses incorporate these technologies into their daily operations. For instance, SK Telecom's recent data breach, which exposed personal and financial data of 23 million users, involved malware that remained undetected for nearly two years. The company discovered 25 strains of malware and quarantined 23 infected servers. As a precaution, SK Telecom implemented SIM replacements, a new fraud detection system, and triple-layer verification. The malware, BPFdoor, is believed to be linked to Chinese hacker groups.

To get more information on this market, Request Sample

Regulatory Pressures and Compliance Requirements

The regulatory landscape in South Korea is a major factor influencing the fraud detection and prevention market. With increasing financial fraud and cybercrime incidents, regulatory bodies have enforced stricter compliance standards, pushing businesses to adopt advanced fraud prevention measures. For instance, in December 2024, South Korean authorities dismantled a large-scale fraud network that extorted USD 6.3 Million using fake online trading platforms. Dubbed "Operation Midas," the investigation, involving K-FSI and law enforcement, uncovered 125 fraudulent home trading systems. The perpetrators, impersonating South Korean financial firms, manipulated real-time stock data to steal money. The operation led to the seizure of 20 servers and 32 arrests, revealing criminal activities and security lapses that facilitated the scam. Regulations such as the Personal Information Protection Act (PIPA) and various industry-specific guidelines have increased the demand for solutions that ensure both fraud detection and compliance. Financial institutions, e-commerce platforms, and other sectors are under pressure to maintain compliance while minimizing risks. As a result, compliance with stringent regulations is not only a necessity but a driving force behind the adoption of fraud detection technologies in South Korea. This regulatory environment plays a crucial role in the South Korea fraud detection and prevention market growth.

South Korea Fraud Detection and Prevention Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, application, organization size, and vertical.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

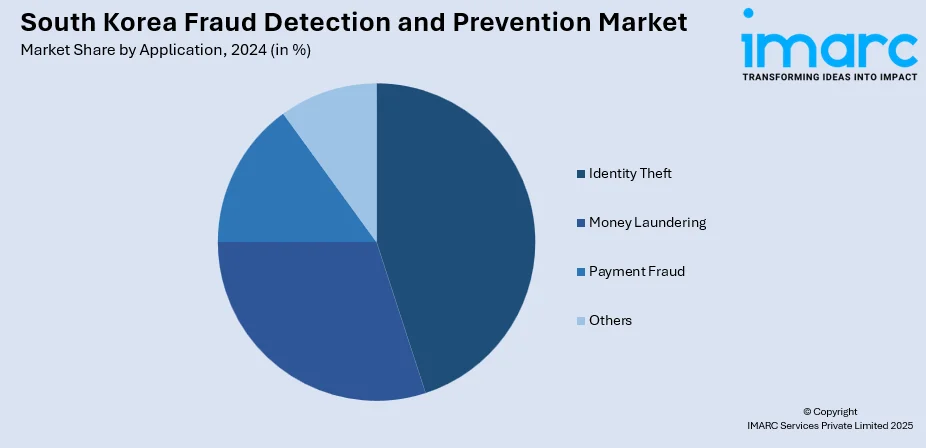

Application Insights:

- Identity Theft

- Money Laundering

- Payment Fraud

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes identity theft, money laundering, payment fraud, and others.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium-sized enterprises and large enterprises.

Vertical Insights:

- BFSI

- Government and Defense

- Healthcare

- IT and Telecom

- Manufacturing

- Retail and E-Commerce

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes BFSI, government and defense, healthcare, IT and telecom, manufacturing, retail and e-commerce, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Fraud Detection and Prevention Market News:

- In February 2025, South Korea’s Financial Security Institute (FSI) rolled out advanced AI-driven initiatives to bolster fraud detection among financial firms. The program includes adversarial attack simulations to test model defenses and a federated-learning proof‑of‑concept that enables banks to collaboratively train secure, decentralized AI systems. FSI is also promoting open‑source AI frameworks and updating sector-wide AI guidelines. Aimed at enhancing cybersecurity readiness and trust in digital finances, this initiative signals a strategic investment in AI safety, expertise, and regulatory reform.

- In May 2024, Mastercard announced that it is enhancing its card fraud detection by utilizing generative AI technology to double the speed of detecting compromised cards. This advancement helps predict full card details and allows banks to block compromised cards faster. The technology also reduces false positives, increases the speed of identifying at-risk merchants, and improves overall cybersecurity, making transactions more secure and trustworthy for users. This development is part of Mastercard's ongoing efforts to protect cardholders and strengthen the digital payment ecosystem.

South Korea Fraud Detection and Prevention Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solutions, Services |

| Applications Covered | Identity Theft, Money Laundering, Payment Fraud, Others |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Verticals Covered | BFSI, Government and Defense, Healthcare, IT and Telecom, Manufacturing, Retail and E-Commerce, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea fraud detection and prevention market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea fraud detection and prevention market on the basis of component?

- What is the breakup of the South Korea fraud detection and prevention market on the basis of application?

- What is the breakup of the South Korea fraud detection and prevention market on the basis of organization size?

- What is the breakup of the South Korea fraud detection and prevention market on the basis of vertical?

- What is the breakup of the South Korea fraud detection and prevention market on the basis of region?

- What are the various stages in the value chain of the South Korea fraud detection and prevention market?

- What are the key driving factors and challenges in the South Korea fraud detection and prevention market?

- What is the structure of the South Korea fraud detection and prevention market and who are the key players?

- What is the degree of competition in the South Korea fraud detection and prevention market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea fraud detection and prevention market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea fraud detection and prevention market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea fraud detection and prevention industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)