South Korea Game Based Learning Market Size, Share, Trends and Forecast by Platform, Revenue Type, End-User, and Region, 2025-2033

South Korea Game Based Learning Market Overview:

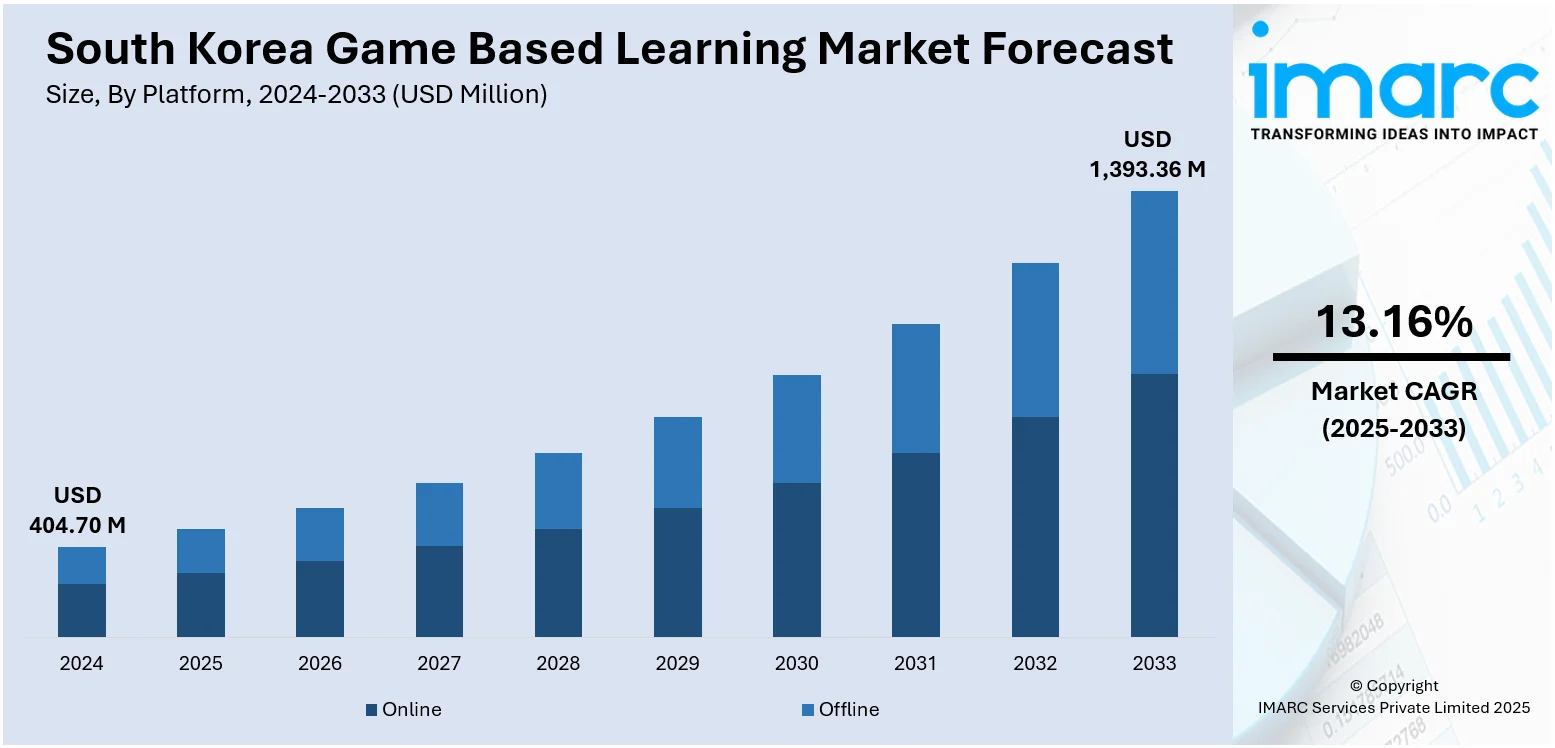

The South Korea game based learning market size reached USD 404.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,393.36 Million by 2033, exhibiting a growth rate (CAGR) of 13.16% during 2025-2033. At present, the widespread support of government agencies and education authorities for digital education is impelling the market growth. Moreover, South Korea's state-of-the-art technology infrastructure and high digital literacy percentages are contributing to the market growth. Apart from this, the heightened focus on student-centric and experiential learning models is expanding the South Korea game-based learning market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 404.70 Million |

| Market Forecast in 2033 | USD 1,393.36 Million |

| Market Growth Rate (2025-2033) | 13.16% |

South Korea Game Based Learning Market Trends:

Government Support and Digital Education Programs

The major driver of the market in South Korea is the widespread support of government agencies and education authorities for digital education. The Ministry of Education in South Korea has introduced various programs to bring smart learning tools, including game-based platforms, into the classroom. The initiatives of the "Smart Education Strategy" seek to encourage creativity and problem-solving abilities by utilizing digital tools. The government's investments in upgrading digital infrastructure, including internet speeds in schools and access to digital devices, complement this growth. The efforts are also in line with the country's overall national agenda of developing a technologically skilled workforce that is geared towards an economy based on knowledge. Finally, edtech funding from the government and pilot programs for edtech solutions continue to offer stimuli for domestic creators to develop educational games to meet curricular requirements. This congruence of policy leadership and technological innovation is propelling the use of game-based learning at primary, secondary, and tertiary levels of education. IMARC Group predicts that the South Korea edtech market is projected to attain USD 10.0 Billion by 2033.

To get more information on this market, Request Sample

High Technology Penetration and Digital Literacy

South Korea's state-of-the-art technology infrastructure and high digital literacy percentages are contributing to the South Korea game-based learning market growth. The nation has one of the highest rates of internet penetration in the world, where access to high-speed internet and mobile devices is highly prevalent even in remote areas. As per DataReportal, in early 2025, South Korea had 69.2 million active cellular mobile connections, representing 134 percent of the country's total population. Such a setup is extremely supportive of the use of digital learning devices, such as gamified learning platforms. Students in South Korea are extremely used to the application of digital devices at an early stage, which supports interactive learning processes further. In addition, cultural gaming popularity, demonstrated by a strong gaming industry and e-sports community, inherently fosters the move of learning materials into game-based presentations. Game developers are taking advantage of this digital maturity to design engaging, curriculum-specific games that resonate with digital-native students. Moreover, infusing educational games with artificial intelligence and data analytics deepens personalization, rendering game-based learning more efficient and appealing to teachers and students alike in digitally advanced settings.

Move Towards Student-Centric and Experiential Learning Models

The increasing focus on student-centric and experiential learning models is impelling the market growth. The conventional method of rote learning is being increasingly substituted by pedagogic models emphasizing active engagement, critical thinking, and co-operative problem-solving. Game-based learning is aligned with these goals through offering interactive and immersive spaces for learners to acquire knowledge through experience and experimentation. The approach accommodates multiple learning styles and encourages deeper learning through in-the-moment feedback and dynamic challenges. South Korean teachers are finding these approaches valuable in enhancing student motivation and retention rates. As a result, schools and universities are incorporating educational games into their teaching strategies, particularly in science, technology, engineering, and mathematics (STEM) and language education. The focus on current skills, such as creativity and digital fluency, further incentivizes the use of gamified content that promotes exploration, strategic thinking, and collaborative learning outcomes. In 2024, Duolingo, the top mobile learning platform globally, revealed a new collaboration with Netflix's Squid Game to enhance Korean language learning via a unique, immersive campaign, featuring an update to its Korean course. Named Learn Korean or Else, the initiative merges Duolingo’s witty method of encouraging education with the intense atmosphere of Netflix’s Squid Game to inspire fans to complete their Korean lessons.

South Korea Game Based Learning Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on platform, revenue type, and end-user.

Platform Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the platform. This includes online and offline.

Revenue Type Insights:

- Game Purchase

- Advertising

- Others

A detailed breakup and analysis of the market based on the revenue type have also been provided in the report. This includes game purchase, advertising, and others.

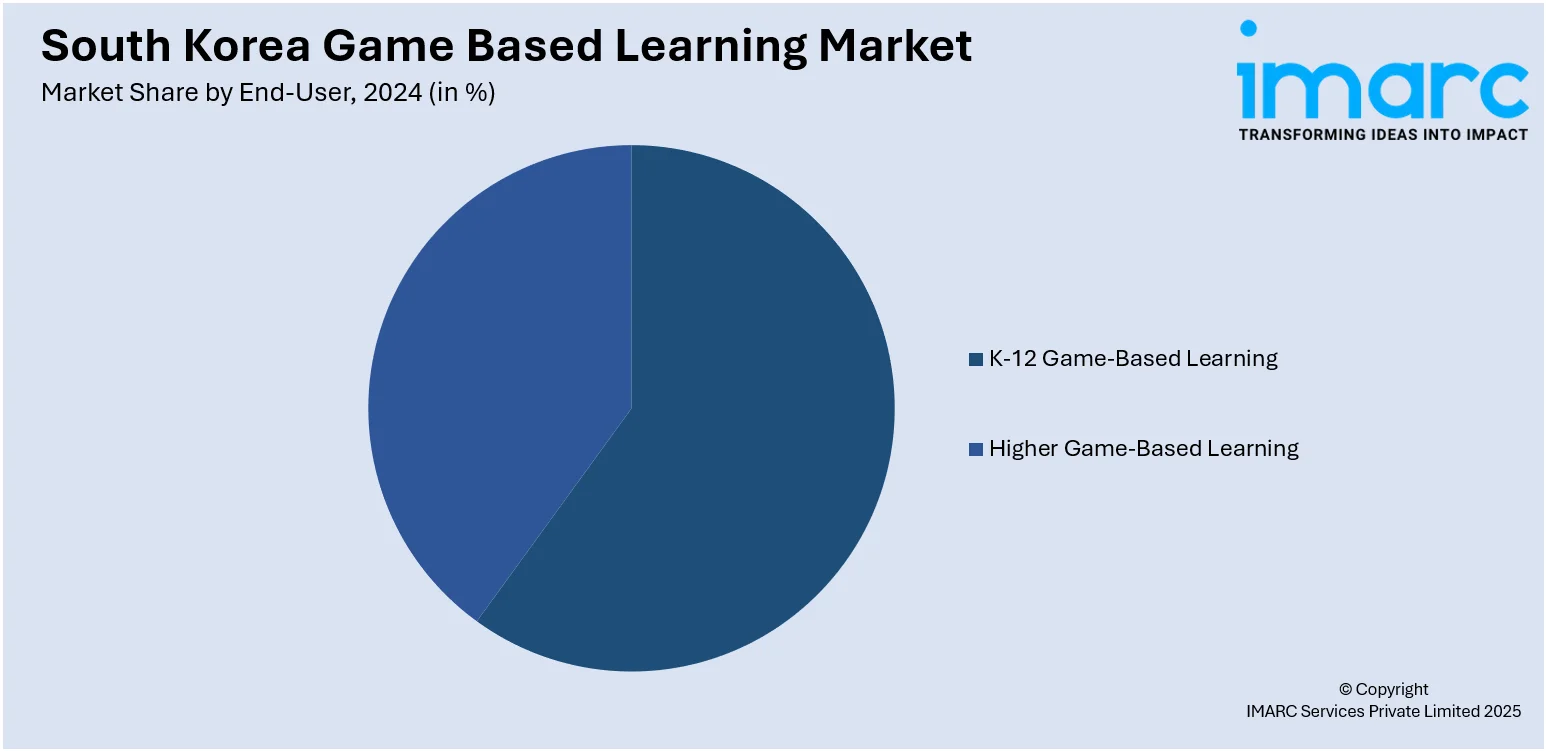

End-User Insights:

- K-12 Game-Based Learning

- Higher Game-Based Learning

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes K-12 game-based learning and higher game-based learning.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Game Based Learning Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platforms Covered | Online, Offline |

| Revenue Types Covered | Game Purchase, Advertising, Others |

| End-Users Covered | K-12 Game-Based Learning, Higher Game-Based Learning |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea game based learning market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea game based learning market on the basis of platform?

- What is the breakup of the South Korea game based learning market on the basis of revenue type?

- What is the breakup of the South Korea game based learning market on the basis of end-user?

- What is the breakup of the South Korea game based learning market on the basis of region?

- What are the various stages in the value chain of the South Korea game based learning market?

- What are the key driving factors and challenges in the South Korea game based learning market?

- What is the structure of the South Korea game based learning market and who are the key players?

- What is the degree of competition in the South Korea game based learning market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea game based learning market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea game based learning market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea game based learning industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)