South Korea Gas Turbine Market Size, Share, Trends and Forecast by Technology, Design Type, Rated Capacity, End User, and Region, 2025-2033

South Korea Gas Turbine Market Overview:

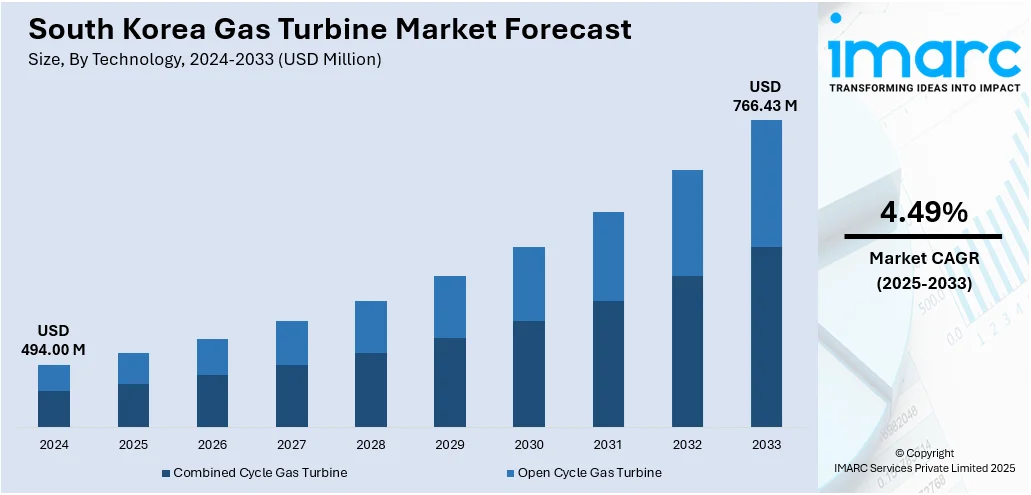

The South Korea gas turbine market size reached USD 494.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 766.43 Million by 2033, exhibiting a growth rate (CAGR) of 4.49% during 2025-2033. Government push for energy diversification, rising electricity demand, and focus on reducing carbon emissions are some of the factors contributing to South Korea gas turbine market share. Aging thermal plants are being replaced with efficient gas turbines. LNG import capacity and combined cycle projects are expanding. Technological upgrades and grid stability goals also support deployment.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 494.00 Million |

| Market Forecast in 2033 | USD 766.43 Million |

| Market Growth Rate 2025-2033 | 4.49% |

South Korea Gas Turbine Market Trends:

Expanding Role in Global Gas Turbine Development

The South Korea gas turbine sector is seeing increasing involvement in large-scale international power projects, particularly in regions prioritizing reliable baseload capacity. Local firms are being tapped for engineering and procurement roles in multi-gigawatt installations abroad, reflecting growing confidence in their technical capabilities. These developments are backed by collaborations with global utilities and manufacturers, often involving complex cross-border supply chains. The projects typically feature advanced turbine systems aimed at grid stability and long-term performance. With demand rising for efficient, high-capacity generation, South Korean participation is broadening beyond domestic installations. This shift is not only enhancing the country’s presence in global energy infrastructure but also reinforcing its position as a key contributor to modern power generation initiatives worldwide. These factors are intensifying the South Korea gas turbine market growth. For example, in April 2025, Mitsubishi Generator received orders to supply six gas turbine generators for two upcoming power plants in Saudi Arabia, i.e., Rumah-1 and Al-Nairyah-1, totaling 3,600MW, about 2.5% of the country’s grid. Mitsubishi Heavy Industries provides the turbines, with Doosan Enerbility handling engineering and procurement. The plants, backed by SEC, ACWA Power, and KEPCO, are set to begin operations in 2028 and will serve as key baseload stations for grid stability.

To get more information on this market, Request Sample

Advancing Gas Turbine Deployment with Hydrogen-Ready Projects

Power generation is moving away from coal toward cleaner natural gas systems designed with future hydrogen use in mind. New facilities are being built to allow partial hydrogen blending, aligning with efforts to reduce emissions while maintaining stable energy supply. Local engineering and construction firms are taking on key roles in these developments, reinforcing domestic capabilities. These projects are not limited to current demands; they’re structured for flexibility as hydrogen infrastructure expands. The shift reflects a broader focus on cleaner energy, long-term adaptability, and reduced reliance on carbon-heavy fuels. As these systems come online, they signal a clear move toward more sustainable and technologically advanced approaches to electricity generation, with room to evolve as energy needs and resources change. For instance, in April 2024, GE Vernova’s Gas Power unit secured an order from Korea Western Power (KOWEPO) to supply a 7HA.02 gas turbine and H65 generator for a new 500 MW natural gas plant in Gongju-si. Replacing an aging coal facility, the project supports hydrogen readiness (up to 30% blend) and involves Daewoo E&C as the EPC partner. The shift highlights South Korea’s move toward cleaner energy infrastructure and diversified fuel options.

South Korea Gas Turbine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, design type, rated capacity, and end user.

Technology Insights:

- Combined Cycle Gas Turbine

- Open Cycle Gas Turbine

The report has provided a detailed breakup and analysis of the market based on the technology. This includes combined cycle gas turbine and open cycle gas turbine.

Design Type Insights:

- Heavy Duty (Frame) Type

- Aeroderivative Type

The report has provided a detailed breakup and analysis of the market based on the design type. This includes heavy duty (frame) type and aeroderivative type.

Rated Capacity Insights:

- Above 300 MW

- 120-300 MW

- 40-120 MW

- Less Than 40 MW

The report has provided a detailed breakup and analysis of the market based on the rated capacity. This includes above 300 MW, 120-300 MW, 40-120 MW, and less than 40 MW.

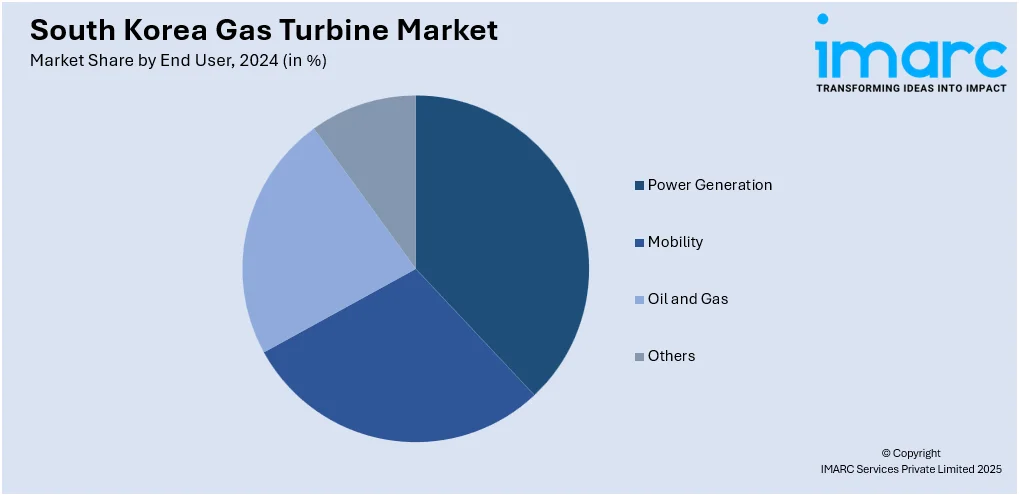

End User Insights:

- Power Generation

- Mobility

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes power generation, mobility, oil and gas, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Gas Turbine Market News:

- In May 2025, Rolls-Royce’s MT30 marine gas turbine was selected again for South Korea’s Ulsan-class FFX Batch IV frigates. Built by Hanwha Ocean, these ships continue the Navy’s shift to hybrid propulsion, using a single MT30 and four mtu diesel generator sets assembled locally by STX-Engines. With 20 MT30 turbines now deployed across three frigate programs, South Korea gains long-term support, spare part commonality, and localized manufacturing with HD Hyundai Heavy Industries.

South Korea Gas Turbine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Combined Cycle Gas Turbine, Open Cycle Gas Turbine |

| Design Types Covered | Heavy Duty (Frame) Type, Aeroderivative Type |

| Rated Capacities Covered | Above 300 MW, 120-300 MW, 40-120 MW, Less Than 40 MW |

| End Users Covered | Power Generation, Mobility, Oil and Gas, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea gas turbine market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea gas turbine market on the basis of technology?

- What is the breakup of the South Korea gas turbine market on the basis of design type?

- What is the breakup of the South Korea gas turbine market on the basis of rated capacity?

- What is the breakup of the South Korea gas turbine market on the basis of end user?

- What is the breakup of the South Korea gas turbine market on the basis of region?

- What are the various stages in the value chain of the South Korea gas turbine market?

- What are the key driving factors and challenges in the South Korea gas turbine market?

- What is the structure of the South Korea gas turbine market and who are the key players?

- What is the degree of competition in the South Korea gas turbine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea gas turbine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea gas turbine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea gas turbine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)