South Korea Green Cement Market Size, Share, Trends and Forecast by Product Type, End Use Industry, and Region, 2025-2033

South Korea Green Cement Market Overview:

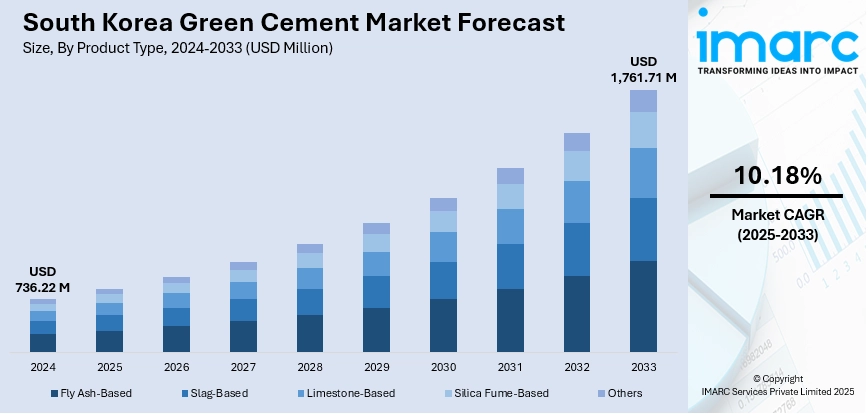

The South Korea green cement market size reached USD 736.22 Million in 2024. Looking forward, the market is projected to reach USD 1,761.71 Million by 2033, exhibiting a growth rate (CAGR) of 10.18% during 2025-2033. The market is driven by strict environmental regulations and public procurement reforms encouraging adoption of low-carbon cement technologies. Infrastructure renewal programs and industrial retrofits are creating strong demand for durable, sustainable construction materials. A growing shift toward alternative fuels and by-product integration is further augmenting the South Korea green cement market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 736.22 Million |

| Market Forecast in 2033 | USD 1,761.71 Million |

| Market Growth Rate 2025-2033 | 10.18% |

South Korea Green Cement Market Trends:

Regulatory Push and National Decarbonization Agenda

South Korea’s cement sector is undergoing rapid transformation as environmental regulations tighten and national decarbonization targets take precedence. The government’s commitment to net-zero emissions by 2050 has translated into mandates that compel cement producers to lower their carbon footprint by adopting more sustainable practices. These include minimizing clinker content, incorporating industrial by-products, and upgrading to cleaner kiln technologies. Incentives such as preferential procurement criteria and environmental certifications are reinforcing this shift, creating structural demand for cement products with reduced embodied carbon. Key stakeholders across public infrastructure, defense, and transportation sectors are increasingly aligning with carbon-reduction benchmarks, driving consistent orders for low-carbon materials. The adoption of environmental product declarations (EPDs) is also gaining traction, further validating sustainability claims in project tenders. Taken together, this regulatory and institutional environment has embedded sustainability as a procurement prerequisite, rather than a competitive differentiator. These intersecting trends, compliance-driven manufacturing and demand-side reform, form the backbone of South Korea green cement market growth.

To get more information on this market, Request Sample

Infrastructure Modernization and Retrofit Demand

A strong pipeline of infrastructure upgrades and redevelopment initiatives is contributing significantly to demand for sustainable construction inputs. Aging transport corridors, coastal defenses, and urban bridges are being reinforced or rebuilt using high-durability, corrosion-resistant cement blends. Public investment programs emphasize resilience and environmental compliance, integrating green cement as a core material in specification frameworks. Unlike residential construction, which may slow in saturated urban regions, large-scale civil works and flood mitigation efforts maintain steady demand across provinces. In retrofitting industrial estates and logistics hubs, specialized cement products designed to reduce thermal expansion and improve structural longevity are favored. These applications allow project owners to lower life-cycle emissions while meeting performance requirements under extreme conditions. This alignment of durability and sustainability standards is helping solidify market presence in both new-build and rehabilitation segments. Consequently, institutional commitment to infrastructure quality and climate resilience is securing long-term traction for advanced, eco-conscious materials.

Shift to Alternative Fuels and Industrial By-Products

The industry’s transition toward circular economy practices is accelerating the integration of low-impact raw materials and energy sources. Manufacturers are increasingly replacing conventional clinker with supplementary cementitious materials derived from blast furnace slag, fly ash, and calcined clay. These inputs not only reduce process emissions but also support waste minimization goals across multiple industries. In parallel, a growing portion of thermal energy in kilns is being derived from waste-based fuels, such as shredded plastics, biomass, and processed municipal refuse. The result is dual value creation—lowered carbon intensity and reduced reliance on imported fossil fuels. Collaboration between cement producers and municipalities is driving co-processing initiatives, transforming landfilled waste into useful kiln feedstock. Additionally, continuous investments in preprocessing infrastructure and emissions monitoring systems are helping to stabilize quality and meet environmental thresholds. This shift toward resource-efficient, alternative feedstocks is laying the foundation for a more economically and environmentally sustainable value chain.

South Korea Green Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and end use industry.

Product Type Insights:

- Fly Ash-Based

- Slag-Based

- Limestone-Based

- Silica Fume-Based

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fly ash-based, slag-based, limestone-based, silica fume-based, and others.

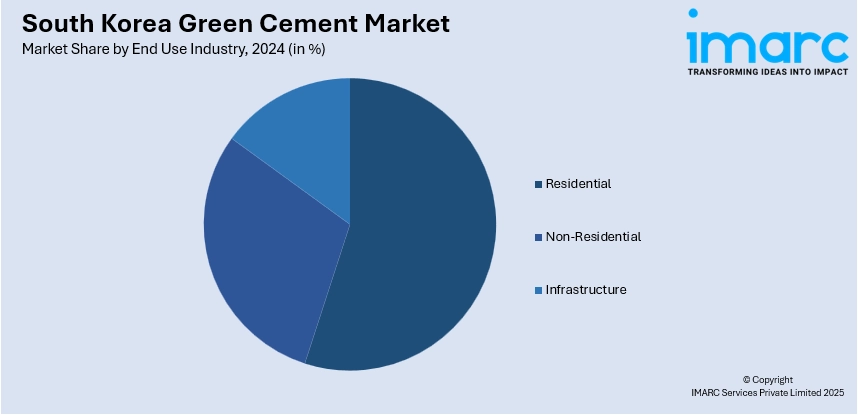

End Use Industry Insights:

- Residential

- Non-Residential

- Infrastructure

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes residential, non-residential, and infrastructure.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Green Cement Market News:

- On 11 July 2023, the Government of South Australia, Hallett Group, Korea Hydro and Nuclear Power, and Elecseed signed a cooperation agreement to develop green cement using fly ash and slag at Port Augusta. The USD 125 Million project, which includes a USD 20 Million grant from the Australian Federal Government, involves building a 6 MW hydrogen electrolyzer and is expected to create 50 permanent jobs and hundreds during construction.

South Korea Green Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fly Ash-Based, Slag-Based, Limestone-Based, Silica Fume-Based, Others |

| End Use Industries Covered | Residential, Non-Residential, Infrastructure |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea green cement market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea green cement market on the basis of product type?

- What is the breakup of the South Korea green cement market on the basis of end use industry?

- What is the breakup of the South Korea green cement market on the basis of region?

- What are the various stages in the value chain of the South Korea green cement market?

- What are the key driving factors and challenges in the South Korea green cement market?

- What is the structure of the South Korea green cement market and who are the key players?

- What is the degree of competition in the South Korea green cement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea green cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea green cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea green cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)