South Korea Ground Support Equipment Market Size, Share, Trends and Forecast by Type, Power Source, Application, and Region, 2026-2034

South Korea Ground Support Equipment Market Summary:

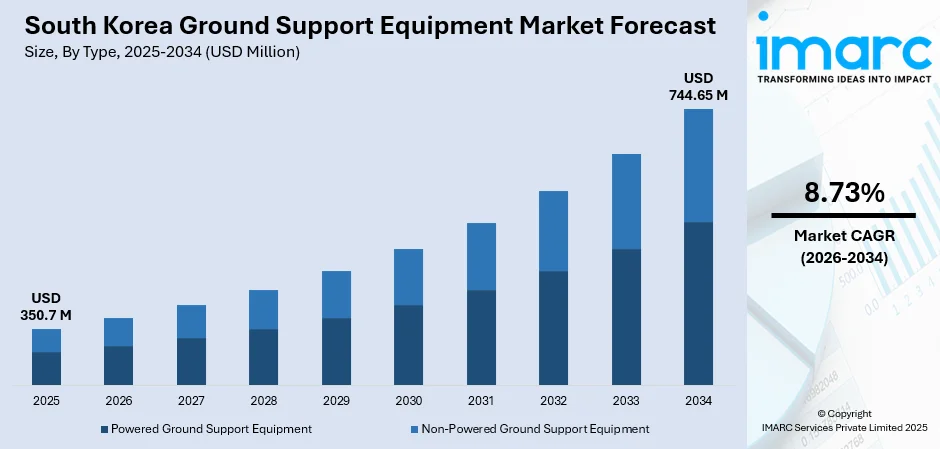

The South Korea ground support equipment market size was valued at USD 350.7 Million in 2025 and is projected to reach USD 744.65 Million by 2034, growing at a compound annual growth rate of 8.73% from 2026-2034.

The market is driven by efforts to modernize airport operations, enhance turnaround efficiency, and support the transition toward cleaner and smarter ground-handling systems. Increased focus on digitalization, electrified platforms, and operational reliability is encouraging broader adoption of advanced technologies across airside processes. These developments are collectively strengthening competitiveness and contributing to the steady expansion of South Korea ground support equipment market share.

Key Takeaways and Insights:

- By Type: Powered ground support equipment dominates the market with a share of 65% in 2025, supported by airports’ preference for advanced, reliable, and high-capacity machinery that enhances operational efficiency and accelerates aircraft servicing processes.

- By Power Source: Non-electric leads the market with a share of 60% in 2025, driven by its extensive availability, established usage patterns, and suitability for diverse airport functions requiring dependable performance without complex power infrastructure.

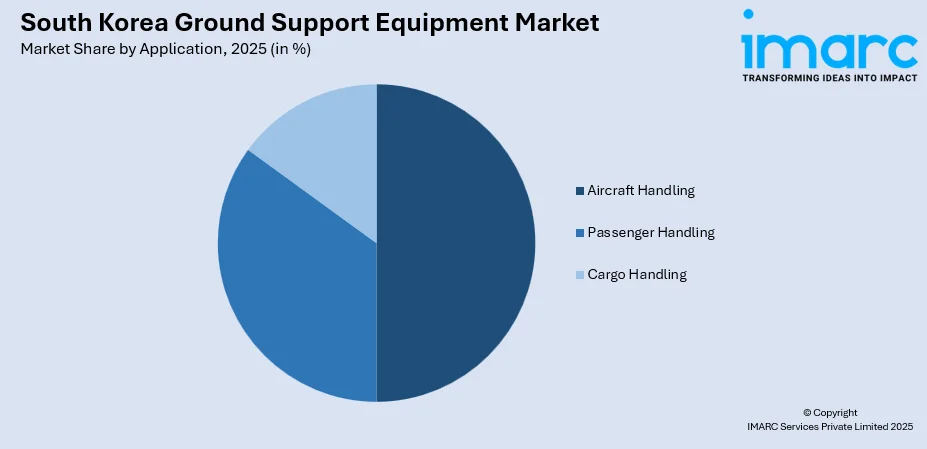

- By Application: Aircraft handling represents the largest segment with a market share of 45% in 2025, reflecting its critical importance in ensuring smooth ground operations, efficient aircraft turnaround, and consistent support for both scheduled and non-scheduled air traffic.

- Key Players: The competitive landscape features technologically progressive manufacturers focusing on improved design, operational reliability, and performance optimization. Key players strengthen market presence through product enhancements, after-sales support, and adaptation to evolving airport requirements across domestic and global markets.

To get more information on this market, Request Sample

The South Korea ground support equipment market is propelled by rising efforts to modernize airport infrastructure, expand airside efficiency, and support increasingly complex aircraft operations. Growing emphasis on electrification, digital integration, and environmentally aligned technologies is reshaping equipment standards, encouraging airports to adopt smarter and cleaner platforms that align with long-term sustainability goals. Moreover, continuous growth in passenger and cargo traffic is further increasing the need for reliable, high-performance systems that enhance turnaround speed and operational consistency. As airports implement advanced mobility solutions, automated handling tools, and real-time monitoring capabilities, demand for upgraded equipment is strengthening across all key segments. These combined drivers are reinforcing the country’s shift toward an optimized and technology-enhanced airport ecosystem supported by robust ground support equipment solutions.

South Korea Ground Support Equipment Market Trends:

Expansion of Autonomous and Sensor-Driven Airside Operations

South Korea is experiencing a steady rise in autonomous systems designed to streamline ground movements and reduce manual dependence across airside functions. Equipment enabled with advanced sensing, obstacle detection, and guided navigation is being integrated to enhance precision during towing, loading, and aircraft positioning. In August 2024, Hyundai Motor and Incheon International Airport Corporation signed an MOU to deploy autonomous vehicles, robotics, hydrogen mobility, and smart logistics, advancing South Korea’s future mobility ecosystem. These systems support smoother coordination between ground crews and digital platforms, improving operational flow. As airports emphasize predictability and consistency in turnarounds, adoption of integrated, self-regulating solutions continues to advance across major hubs.

Strong Shift Toward Eco-Aligned Electrified Equipment Adoption

Growing environmental priorities are prompting airports to accelerate the shift toward cleaner ground handling solutions. Electrified tugs, loaders, and transport units are being introduced to reduce emissions and support greener airside environments. In May 2025, Hyundai Motor and Kia partnered with Incheon International Airport to pilot AI-powered automatic charging robots for electric airport vehicles, supporting Korea’s shift toward smart, electrified GSE. This trend includes broader deployment of charging stations, compatibility upgrades, and improved energy management practices that enable continuous equipment readiness. As sustainability becomes a central operational goal, infrastructure planning increasingly incorporates electrified alternatives, reshaping procurement strategies and advancing a more eco-conscious airport ecosystem.

Integration of Predictive Maintenance and Connected Service Ecosystems

Airports are adopting digital platforms that connect ground support equipment to centralized monitoring systems, enabling continuous performance insights and timely servicing. Predictive maintenance tools rely on condition tracking, component health analysis, and automated alerts to minimize unplanned downtime. In October 2025, Korean Air signed with Airbus to adopt Skywise Fleet Performance Plus, a data-driven predictive maintenance system, aimed at reducing aircraft groundings, cutting costs, and boosting operational efficiency. These capabilities allow operators to optimize fleet availability and extend equipment life cycles through targeted interventions. By linking operational workflows with maintenance intelligence, airports are shifting toward data-driven management models that elevate reliability and streamline support processes across airside activities.

Market Outlook 2026-2034:

The market is expected to progress steadily as airports prioritize modernization, sustainability, and greater automation across ground-handling operations. Increasing adoption of connected systems, electrified platforms, and digitally managed fleets is expected to elevate performance standards while supporting long-term environmental goals. Continued growth in passenger and cargo movements will encourage airports to strengthen operational efficiency through advanced mobility solutions and optimized equipment workflows. These developments collectively position the market for sustained advancement supported by technological evolution and expanding airside requirements. The market generated a revenue of USD 350.7 Million in 2025 and is projected to reach a revenue of USD 744.65 Million by 2034, growing at a compound annual growth rate of 8.73% from 2026-2034.

South Korea Ground Support Equipment Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Powered Ground Support Equipment | 65% |

| Power Source | Non-Electric | 60% |

| Application | Aircraft Handling | 45% |

Type Insights:

- Powered Ground Support Equipment

- Non-Powered Ground Support Equipment

The powered ground support equipment dominates with a market share of 65% of the total South Korea ground support equipment market in 2025.

Powered ground support equipment remains the leading segment as airports increasingly prioritize reliable machinery capable of managing intensive, fast-paced aircraft operations. Its ability to support diverse airside activities with consistent performance strengthens its role across major hubs. Continuous improvements in design, safety, and operational responsiveness further reinforce its dominance, enabling smoother workflows and enhanced coordination during turnaround processes.

Powered systems also offer greater adaptability to evolving airport requirements, making them essential for modernized ground-handling environments. Their compatibility with advanced control features and efficiency-focused technologies supports long-term operational planning. As airports transition toward more integrated mobility solutions, powered equipment continues to serve as the foundational component of airside operations, shaping procurement decisions and reinforcing standardized performance expectations across the sector.

Power Source Insights:

- Electric

- Non-Electric

- Hybrid

The non-electric leads with a share of 60% of the total South Korea ground support equipment market in 2025.

Non-electric equipment leads the market due to its widespread use across various airside activities and its suitability for environments requiring dependable, easily maintained systems. Its operational flexibility makes it a preferred choice for airports balancing routine handling needs with diverse aircraft service demands. This segment is further supported by consistent performance across fluctuating weather conditions and intensive workloads.

Its long-established presence within airport ecosystems ensures streamlined training, simpler integration, and smoother coordination with existing fleets. Non-electric equipment remains essential where continuous operation, rapid deployment, and minimal complexity are prioritized. As airports gradually incorporate newer technologies, non-electric platforms continue to provide stable support for core functions, maintaining relevance within both traditional and transitional operational models.

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Aircraft Handling

- Passenger Handling

- Cargo Handling

The aircraft handling exhibits a clear dominance with a 45% share of the total South Korea ground support equipment market in 2025.

Aircraft handling holds the leading position as it forms the core of ground operations, supporting critical tasks that directly influence turnaround efficiency and schedule reliability. This segment encompasses essential functions such as positioning, servicing, and preparing aircraft for subsequent flights, making it indispensable for maintaining smooth airside workflows. Its importance grows as airports manage increasing traffic volumes and more complex operational requirements.

The centrality of aircraft handling encourages ongoing adoption of advanced tools that enhance precision, coordination, and safety. In May 2025, IATA emphasized at the Ground Handling Conference (IGHC) in Nairobi that embedding safety, standardization, and digitalized weight and balance enhances aircraft handling efficiency and reliability. Further, airports continually refine these processes to reduce delays and maintain consistent service levels. As integrated systems, smarter mobility solutions, and enhanced monitoring tools expand across airside environments, the aircraft handling segment remains the focal point of operational investment and strategic planning.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The Seoul Capital Area benefits from extensive airport infrastructure and sustained modernization efforts that enhance airside efficiency. Continuous upgrades in equipment capabilities, workflow integration, and operational coordination support rising traffic volumes. The region’s strategic role in national and international mobility strengthens demand for advanced systems that optimize handling processes across major airport environments.

Yeongnam’s growing network of aviation facilities supports expanding passenger and cargo movements, prompting steady adoption of improved equipment for smoother ground operations. In March 2024, construction for the Daegu-Gyeongbuk New Airport was announced, aiming for a 2030 opening. The project will serve both civilian and military operations, boosting regional air connectivity. Emphasis on enhancing turnaround quality, strengthening operational reliability, and integrating smarter mobility tools drives consistent investment. The region’s increasing connectivity reinforces the need for dependable, well-coordinated ground support systems.

Honam experiences rising interest in airside development supported by regional connectivity projects and expanding airport activities. Improvements in workflow standardization, fleet readiness, and operational planning contribute to stronger equipment utilization. As regional travel demand evolves, emphasis on upgrading handling capabilities and coordinated ground procedures continues to guide infrastructure alignment across airports.

Hoseo demonstrates consistent progress in optimizing airside operations through targeted enhancements in equipment availability and support systems. Strengthened coordination between ground teams and centralized management platforms enables smoother service flow. Expansion in domestic travel patterns further influences regional priorities toward more efficient, adaptable airport handling solutions.

Other regions contribute to the market through incremental improvements in airside functions and growing support for localized airport development. Focus on strengthening reliability, improving ground processes, and adopting modern handling tools enhances operational readiness. These regions continue to align with broader national objectives aimed at creating a cohesive and technologically forward airport ecosystem.

Market Dynamics:

Growth Drivers:

Why is the South Korea Ground Support Equipment Market Growing?

Rising Focus on Streamlined Aircraft Movement and Service Efficiency

Growth in the South Korea ground support equipment market is supported by increasing emphasis on ensuring smoother aircraft movement and more efficient servicing processes. In March 2025, Incheon Airport became fully operational with Indra’s advanced instrument landing systems on all four runways, enhancing aircraft approach, landing, and ground-movement coordination under all weather conditions. Airports are further enhancing coordination between operational teams and upgrading handling procedures to reduce delays and maintain consistent workflow quality. This shift encourages wider adoption of equipment that supports rapid positioning, precise maneuvering, and timely aircraft servicing. As demand for dependable turnaround processes grows, airports are prioritizing machinery that delivers predictable performance and strengthens overall airside efficiency, contributing to sustained market expansion.

Expansion of Airport Infrastructure and Regional Connectivity Improvements

Ongoing development of airport facilities and expanded regional connectivity are key contributors to market growth. As new routes and improved terminal capacities emerge, the need for advanced equipment becomes more pronounced across diverse operational zones. In October 2024, Incheon International Airport’s Terminal 2 expansion added 75 aircraft docks, increased passenger capacity by 29 million annually, and extended apron and baggage systems, enhancing operational efficiency and connectivity. Airports are aligning procurement strategies with evolving infrastructure upgrades to support enhanced passenger and cargo flows. This expansion drives the adoption of versatile and durable equipment capable of managing broader airside demands. Strengthened regional mobility further reinforces the requirement for reliable systems that maintain operational fluidity across expanding aviation networks.

Increasing Integration of Smart Operational Management Systems

The market is also growing due to stronger integration of intelligent management systems that elevate coordination and real-time decision-making. Airports are implementing tools that connect equipment fleets with centralized platforms to support smoother scheduling and resource allocation. In June 2025, Siemens commissioned a high-performance baggage handling system at Incheon Airport Terminal 2, enabling peak throughput of nearly 20,000 bags per hour and enhancing operational efficiency. This digital alignment enhances visibility of ground operations and helps maintain optimal readiness levels. By improving the synchronization of equipment usage, monitoring conditions, and enhancing response times, these systems create a more structured and efficient operating environment. The shift toward interconnected workflows continues to promote demand for technologically adaptable ground support equipment.

Market Restraints:

What Challenges the South Korea Ground Support Equipment Market is Facing?

High Upfront Investment Requirements for Modern Equipment

The market faces restraints due to significant initial costs associated with acquiring advanced ground support equipment. Airports must allocate substantial budgets for technology-enhanced machinery, upgraded systems, and specialized units. These financial pressures can delay procurement cycles, especially for facilities managing moderate traffic volumes. The need for long-term planning and phased investment often slows adoption, creating hesitation among operators seeking to balance modernization goals with constrained capital resources.

Complex Integration with Existing Operational Frameworks

Introducing new equipment requires careful alignment with established airport procedures, which can restrict rapid transition. Ground operations rely on synchronized workflows, and integrating unfamiliar systems may demand extensive testing, operational adjustments, and additional training. This complexity can create temporary disruptions and reduce the pace of adoption. Airports often proceed cautiously to maintain consistency, making integration challenges a meaningful restraint to broader deployment of upgraded ground support solutions.

Limited Adaptability of Older Infrastructure to Advanced Technologies

Some airports encounter constraints when aligning newer ground support technologies with legacy infrastructure. Older layouts, outdated utility networks, and limited space for equipment staging can reduce compatibility with modernized systems. This mismatch can slow facility upgrades and restrict the implementation of innovative tools. As airports prioritize maintaining uninterrupted operations, structural and logistical limitations often hinder the seamless introduction of advanced equipment, thereby tempering overall market progression.

Competitive Landscape:

The competitive landscape of the South Korea ground support equipment market is shaped by manufacturers and suppliers focusing on technology-driven enhancements, operational reliability, and broader customization to meet evolving airport requirements. Market participants are strengthening their portfolios by introducing equipment that supports smoother workflows, improved coordination, and greater consistency in airside performance. Emphasis on durability, safety features, and integration with digital management systems is becoming increasingly important as airports seek equipment compatible with long-term modernization goals. Companies also prioritize maintenance support, training services, and continuous product refinement to reinforce customer confidence and maintain strong engagement across domestic and regional aviation networks.

Recent Developments:

- In November 2025, Korea Airports Corporation finalized the development of electric vehicle chargers for airport ground handling equipment, reducing dependence on imports. The chargers entered full-scale commercialization, enabling airports to adopt eco-friendly operations, enhance equipment readiness, and support South Korea’s broader sustainability and electrification initiatives across airside ground support systems.

South Korea Ground Support Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Powered Ground Support Equipment, Non-Powered Ground Support Equipment |

| Power Sources Covered | Electric, Non-Electric, Hybrid |

| Applications Covered | Aircraft Handling, Passenger Handling, Cargo Handling |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The South Korea ground support equipment market size was valued at USD 350.7 Million in 2025.

The South Korea ground support equipment market is expected to grow at a compound annual growth rate of 8.73% from 2026-2034 to reach USD 744.65 Million by 2034.

Powered ground support equipment held the largest share due to its ability to support intensive airside operations, deliver consistent performance, and accommodate evolving airport requirements. Its reliability and versatility make it the preferred option across major ground-handling activities.

Key factors driving the South Korea ground support equipment market include increasing modernization of airport operations, rising demand for smoother aircraft servicing, growing integration of digital management systems, and expanding regional connectivity that strengthens the need for efficient, reliable airside support solutions.

Major challenges include high initial investment needs for advanced equipment, integration complexities associated with existing operational frameworks, and limitations within older infrastructure that restrict seamless adoption of modern technologies, collectively slowing the pace of widespread equipment upgrades.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)