South Korea Health and Wellness Market Report by Product Type (Functional Foods and Beverages, Beauty and Personal Care Products, Preventive and Personalized Medicinal Products, and Others), Functionality (Nutrition and Weight Management, Heart and Gut Health, Immunity, Bone Health, Skin Health, and Others), and Region 2026-2034

South Korea Health and Wellness Market:

South Korea health and wellness market size reached USD 74.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 90.2 Billion by 2034, exhibiting a growth rate (CAGR) of 2.19% during 2026-2034. The development of targeted products and services for several demographic groups, coupled with the increasing awareness among individuals towards the importance of preventive healthcare and wellness, is augmenting the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 74.2 Billion |

| Market Forecast in 2034 | USD 90.2 Billion |

| Market Growth Rate 2026-2034 | 2.19% |

Access the full market insights report Request Sample

South Korea Health and Wellness Market Analysis:

- Major Market Drivers: The growing popularity of traditional Korean medicines and natural remedies is bolstering the overall market. Additionally, the escalating demand for health and wellness programs, as they offer weight management regimes, nutritional counseling, non-pharmacological interventions, etc., is also acting as another significant growth-inducing factor.

- Key Market Trends: Advancements in infrastructures, including state-of-the-art medical facilities and wellness centers, are among the key trends stimulating the market across the country. Apart from this, the introduction of fitness programs, personalized diet plans, and genetic testing for tailored health recommendations is further strengthening the market.

- Challenges and Opportunities: One of the key challenges hindering the market is the high degree of competition among prominent players. However, the launch of numerous innovations, personalized solutions, and advanced technologies to meet evolving consumer demands are projected to augment the market in the country over the foreseeable future.

South Korea Health and Wellness Market Trends:

Government Regulations

The implementation of stringent regulations by domestic authorities in the country for labeling, product approvals, and improving the trust of users in health and wellness brands and products is propelling the market. In South Korea, food and dietary supplements, also referred to as health/functional foods (HFF), rules are governed by the Ministry of Food and Drug Safety (MFDS). Additionally, government bodies are focusing on offering comprehensive health solutions, which is acting as another significant growth-inducing factor. For example, in November 2022, the World Health Organization (WHO) announced that the Ministry of Food and Drug Safety in South Korea achieved maturity level four (ML4), the highest level in the WHO’s classification of regulatory authorities for medical products. Apart from this, key entities are further emphasizing on the usage of sustainable practices, which is positively influencing the market. According to the article published by an e-magazine, Agrospecial, in June 2023, the government in South Korea announced a five-year plan to promote eco-friendly agriculture practices under the Eco-friendly Agriculture Promotion Act. Moreover, the emerging trend of medical tourism is expected to stimulate the South Korea health and wellness market outlook over the forecasted period. As per the findings showcased by the Statista Research Department in December 2023, the cumulative number of patients who visited South Korea for medical purposes exceeded three million. Among them, visitors from the United States and China accounted for the largest share.

Adoption of Functional Supplements

The rising health consciousness among individuals across the country is bolstering the market. An online survey conducted by NZTE’s Asia team in March 2022 revealed that consumers between the ages of 20-59 in South Korea prefer eating plant-based food. In line with this, they are incorporating functional foods and dietary supplements into their daily routines to improve digestion, boost immunity, enhance overall well-being, etc. As per the Korean Health Functional Food Association (KHFF), around 51.8 million individuals in South Korea consume health supplements. Apart from this, the increasing prevalence of chronic ailments, including heart disease, diabetes, obesity, etc., is propelling the demand for non-pharmacological interventions, which, in turn, is elevating the South Korea health and wellness market revenue. For example, in April 2024, an Amorepacific-owned brand based in South Korea, Vital Beautie, launched a novel jelly product that aids in managing blood sugar levels for people who have difficulty in controlling carbohydrate intake. Similarly, in April 2024, Kolmar BNH, one of the providers of health supplements in South Korea, introduced Hemohim, which received approval from the Korean Ministry of Food and Drug Safety as the nation’s first individually approved health supplement product designed to enhance immune function. Furthermore, the inflating popularity of targeted products and services for different demographic groups is expected to fuel the market in the coming years. For example, in March 2024, Herbalife developed Herbalife Korea's Pycno Plus, a functional food for women experiencing menopause.

Expanding Wearable Technology

The rising technology integration in health monitoring is revolutionizing the way individuals manage their well-being. Moreover, wearable devices provide features, such as sleep tracking, heart rate monitoring, fitness activity logging, etc. These devices sync with health apps, enabling users to monitor their health metrics in real-time. For example, in April 2024, one of the health and beauty retailers in South Korea, CJ Olive Young, launched Health+, a wellness-focused feature within its mobile app, to strengthen product curation and offer customized recommendations. Apart from this, the increasing adoption of big data analytics and AI in these platforms enhances their ability to suggest preventive measures, which is propelling the South Korea health and wellness market demand. For instance, in February 2024, Kakao Healthcare, one of the digital healthcare businesses in South Korea, developed an AI-powered mobile diabetes app, Seegene, that displays details about the blood sugar levels of users in real time via Bluetooth. It also allows individuals to record their meals, exercise, medication, insulin doses, etc. In addition to this, Kakao Healthcare further introduced Pasta Connect Pro, a dashboard for doctors where they can check their patients' blood sugar trends and lifestyle changes. This technological advancement is not only empowering individuals to take control of their health but also aiding healthcare providers in offering more precise and timely care.

South Korea Health and Wellness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the South Korea health and wellness market forecast at the country and regional levels for 2026-2034. Our report has categorized the market based on the product type and functionality.

Breakup by Product Type:

To get detailed segment analysis of this market Request Sample

- Functional Foods and Beverages

- Beauty and Personal Care Products

- Preventive and Personalized Medicinal Products

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes functional foods and beverages, beauty and personal care products, preventive and personalized medicinal products, and others.

Functional foods and beverages, such as Korea Ginseng Corporation's red ginseng products and Maeil Dairies' probiotics-enriched drinks, are gaining extensive traction across the country. Additionally, the emerging holistic beauty trends are driving the usage of beauty and personal care products that focus on wellness, which is acting as another significant growth-inducing factor. For instance, in May 2024, one of the consumer goods providers in South Korea, LG Household & Healthcare, introduced a body care brand with products featuring well-known skincare ingredients like low-molecular-weight collagen, peptides, niacinamide, and polyhydroxy acids (PHA). Apart from this, preventive and personalized medicinal products, including customized vitamin packs, are gaining traction, which is elevating the South Korea health and wellness market's recent price.

Breakup by Functionality:

- Nutrition and Weight Management

- Heart and Gut Health

- Immunity

- Bone Health

- Skin Health

- Others

The report has provided a detailed breakup and analysis of the market based on the functionality. This includes nutrition and weight management, heart and gut health, immunity, bone health, skin health, and others.

Nutrition and weight management products are highly sought after, with items like Herbalife's meal replacement shakes and Slimfast gaining popularity among those aiming for balanced diets and effective weight control. Heart and gut health are also significant concerns among individuals, leading to a surge in products like probiotics from brands such as Korea Yakult and heart-healthy supplements containing omega-3 fatty acids. According to the South Korea health and wellness market statistics, immunity-boosting products have seen increased demand, as consumers are turning to functional foods like ginseng-based drinks and vitamin C supplements from leading brands like CJ CheilJedang. Bone health is addressed through calcium and vitamin D-enriched products, while skin health is a major focus in the beauty-centric culture of South Korea, driving sales of collagen supplements and topical treatments from companies like Amorepacific. Additionally, other areas, such as mental wellness, are gaining traction, with products designed to alleviate stress and improve sleep quality becoming more prevalent. This diverse functionality in health and wellness products underscores the holistic approach consumers in the country take towards maintaining and improving their overall health, which is bolstering the South Korea health and wellness market share.

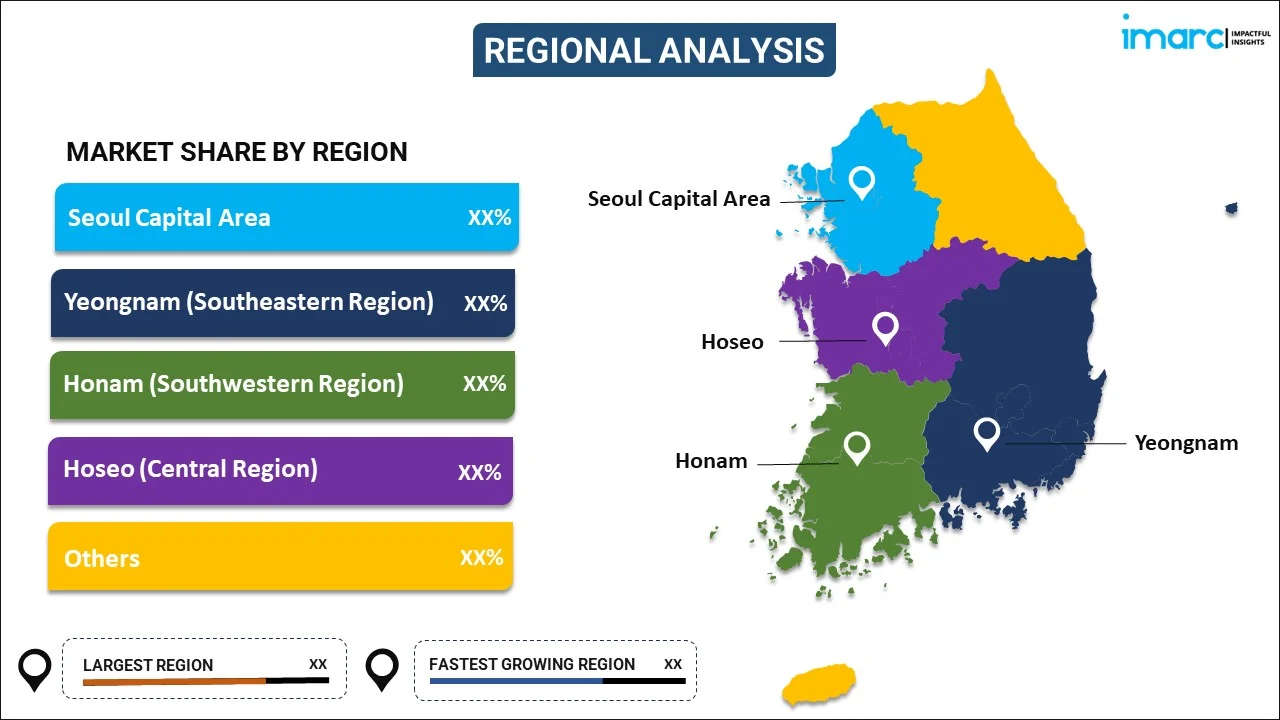

Breakup by Region:

To get detailed regional analysis of this market Request Sample

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

The Seoul Capital Area, being the most urbanized and affluent region, leads in innovation, with a high concentration of fitness centers, wellness spas, and health-focused retailers. In the Yeongnam region, cities like Busan and Daegu show a growing demand for health supplements and functional foods, driven by the expanding health-conscious population. As per the South Korea health and wellness market overview, the Honam region, with areas, including Gwangju, emphasizes natural and organic health products, reflecting its rich agricultural heritage. Hoseo, which is the central region, is witnessing a rise in wellness tourism and preventive health services, supported by the region's robust healthcare infrastructure. Other regions, although less urbanized, are catching up rapidly, with local governments promoting wellness initiatives and the private sector expanding its reach into rural areas. This regional analysis highlights the varied but converging trends, driven by socioeconomic factors.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major South Korea health and wellness market companies have been provided.

- Key entities are collaborating with international brands to enhance their product offerings and leverage expertise in herbal supplements. Moreover, they are partnering with research institutions and biotech firms to develop advanced skincare products that integrate cutting-edge technology with various natural ingredients which represents one of the South Korea health and wellness market's recent opportunities. Apart from this, companies are working closely with healthcare providers and tech startups to enhance their health monitoring devices, incorporating AI and big data analytics to provide more accurate health insights. Additionally, they are teaming up with digital health platforms to offer personalized nutrition solutions that are easily accessible to consumers. These collaborations enable companies to combine their strengths, share knowledge, and create comprehensive health and wellness solutions that cater to the evolving needs of consumers.

South Korea Health and Wellness Market Recent Developments:

- May 2024: Banaras Hindu University in India and Yeongdeok Culture & Tourism Foundation, Republic of South Korea, signed a Memorandum of Understanding (MoU) to promote health and wellness tourism in both countries.

- February 2024: Therme Group partnered with GWI to explore the unique wellness landscape in South Korea.

- January 2024: Boston-based plant cell tech company Ayana Bio signed a seven-figure joint development agreement with South Korea’s Wooree Green Science to develop plant cell-derived saffron and other important bioactive ingredients.

South Korea Health and Wellness Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Functional Foods and Beverages, Beauty and Personal Care Products, Preventive and Personalized Medicinal Products, Others |

| Functionalities Covered | Nutrition and Weight Management, Heart and Gut Health, Immunity, Bone Health, Skin Health, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea health and wellness market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea health and wellness market on the basis of product type?

- What is the breakup of the South Korea health and wellness market on the basis of functionality?

- What are the various stages in the value chain of the South Korea health and wellness market?

- What are the key driving factors and challenges in the South Korea health and wellness?

- What is the structure of the South Korea health and wellness market and who are the key players?

- What is the degree of competition in the South Korea health and wellness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea health and wellness market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea health and wellness market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea health and wellness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)