South Korea Healthcare Asset Management Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2026-2034

South Korea Healthcare Asset Management Market Summary:

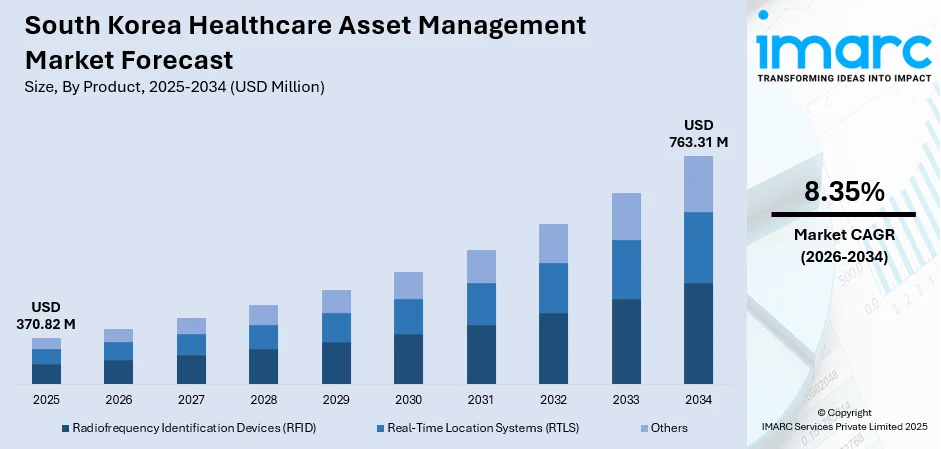

The South Korea healthcare asset management market size was valued at USD 370.82 Million in 2025 and is projected to reach USD 763.31 Million by 2034, growing at a compound annual growth rate of 8.35% from 2026-2034.

The South Korea healthcare asset management market is experiencing growth driven by the escalating demand for operational efficiency in healthcare facilities and rising focus on patient safety. Government initiatives promoting smart hospital development and digital healthcare transformation are accelerating the adoption of advanced asset tracking technologies in the country. The integration of real-time location systems and radio frequency identification solutions is enabling hospitals to optimize resource utilization, reduce equipment search times, and enhance clinical workflow efficiency, thereby strengthening the South Korea healthcare asset management market share.

Key Takeaways and Insights:

- By Product: Radiofrequency Identification Devices (RFID) dominate the market with a share of 55% in 2025, driven by cost-effectiveness, ease of deployment, and proven effectiveness in tracking medical equipment and pharmaceutical inventory across healthcare facilities.

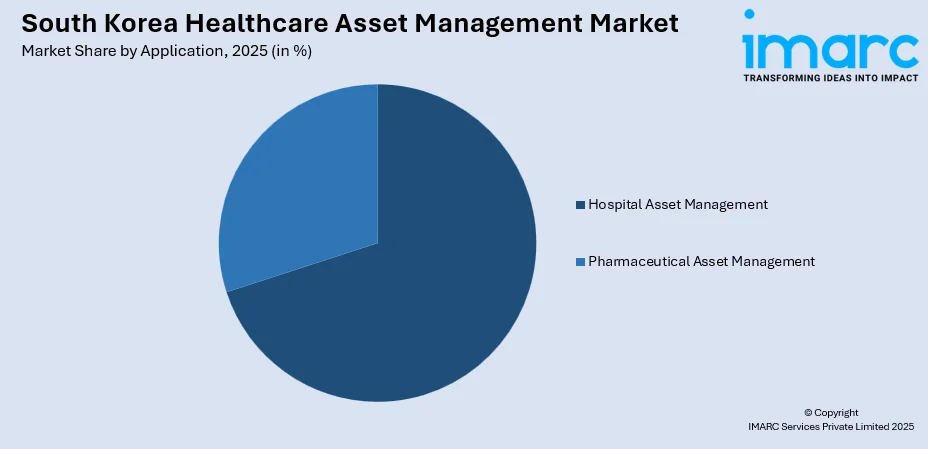

- By Application: Hospital asset management leads the market with a share of 70% in 2025, reflecting the critical need for efficient equipment tracking, staff management, and patient monitoring in complex hospital environments.

- By End User: Hospitals and clinics represent the largest segment with a market share of 62% in 2025, owing to extensive equipment inventories requiring systematic tracking and management solutions.

- Key Players: The South Korea healthcare asset management market exhibits moderate competitive intensity, with multinational technology corporations and domestic solution providers competing across product segments. Market participants focus on developing integrated platforms, forming strategic partnerships with healthcare institutions, and advancing real-time tracking capabilities to strengthen market positioning.

To get more information on this market Request Sample

The South Korea healthcare asset management market is progressing steadily as healthcare facilities across the country place greater emphasis on enhancing operational efficiency and strengthening patient safety protocols. The Government's Digital New Deal initiative has directed substantial funding toward smart hospital infrastructure development, establishing favorable conditions that encourage widespread technology adoption among medical institutions. Healthcare providers are actively deploying comprehensive asset tracking systems to overcome persistent challenges including equipment loss, asset underutilization, and inefficiencies within clinical workflows. The convergence of RFID, RTLS, and artificial intelligence technologies is unlocking advanced predictive maintenance capabilities and enabling data-driven decision-making across healthcare operations. These developments are collectively positioning South Korea as a prominent and rapidly evolving market for healthcare digitalization within the broader Asia-Pacific region.

South Korea Healthcare Asset Management Market Trends:

Integration of Real-Time Location Systems and RFID Technologies

Healthcare facilities in South Korea are increasingly implementing integrated RTLS and RFID platforms to achieve comprehensive asset visibility and operational optimization. These combined technologies enable real-time tracking of medical equipment, staff movements, and patient locations with enhanced accuracy. In December 2024, People and Technology announced its goal of achieving twenty Billion won in sales through its IndoorPlus SmartCare solution, which has been deployed in over fifty hospitals for RTLS-based tracking of patients and equipment, biometric data monitoring, and infectious disease management. This trend is significantly contributing to the South Korea healthcare asset management market growth.

Government-Led Smart Hospital Development Initiatives

The South Korean government has positioned smart hospital development as a national priority through comprehensive policy support and funding allocation. Under the Digital New Deal framework, substantial budgets have been earmarked for digital healthcare infrastructure improvements, including subsidies for hospitals implementing AI-based diagnostic systems and IoT-based patient monitoring equipment. The Ministry of Health and Welfare launched the Korean Advanced Research Projects Agency for Health initiative in 2024, announcing projects including AI-based emergency systems and integrated digital care solutions to enhance staff efficiency. These coordinated efforts are accelerating smart hospital adoption across the country.

Emphasis on Operational Efficiency and Cost Reduction

Healthcare providers in South Korea are facing mounting pressure to optimize operational expenditures while upholding exceptional standards of patient care delivery. Asset management solutions directly address these dual challenges by streamlining inventory management processes, preventing critical equipment shortages, and significantly reducing the burden of manual tracking efforts. The imperative for cost containment combined with quality improvement is driving healthcare administrators to seek technological solutions that enhance resource visibility and utilization efficiency. Real-time asset tracking capabilities enable facilities to maximize equipment availability, minimize redundant purchases, and allocate clinical resources more effectively across departments and care settings.

Market Outlook 2026-2034:

The South Korea healthcare asset management market is poised for sustained expansion, supported by continued government investment in healthcare digitalization and growing awareness of asset tracking benefits among healthcare administrators. The integration of artificial intelligence with existing RTLS and RFID infrastructure is expected to enable advanced predictive analytics and automated workflow optimization. The market generated a revenue of USD 370.82 Million in 2025 and is projected to reach a revenue of USD 763.31 Million by 2034, growing at a compound annual growth rate of 8.35% from 2026-2034.

South Korea Healthcare Asset Management Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Radiofrequency Identification Devices (RFID) | 55% |

| Application | Hospital Asset Management | 70% |

| End User | Hospitals and Clinics | 62% |

Product Insights:

- Radiofrequency Identification Devices (RFID)

- Real-Time Location Systems (RTLS)

- Others

Radiofrequency Identification Devices (RFID) dominate with a share of 55% of the total South Korea healthcare asset management market in 2025.

RFID technology has established itself as the preferred choice for healthcare asset management in South Korea due to its proven reliability, cost-effectiveness, and versatility in tracking diverse asset types. The technology enables healthcare facilities to track medical equipment, pharmaceutical inventory, and surgical instruments with high accuracy while requiring minimal infrastructure investment. Passive RFID tags offer particularly attractive economics for tracking high-volume consumables, while active RFID solutions provide real-time visibility for critical medical equipment requiring continuous monitoring. Healthcare institutions across South Korea are increasingly deploying RFID systems to address medication safety concerns and equipment utilization challenges. The technology supports automated inventory management, enabling hospitals to maintain optimal stock levels while reducing waste from expired supplies.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Hospital Asset Management

- Staff Management

- Equipment Tracking and Management

- Patient Management

- Others

- Pharmaceutical Asset Management

- Drug Anti-counterfeiting

- Supply Chain Management

Hospital asset management leads with a share of 70% of the total South Korea healthcare asset management market in 2025.

Hospital asset management dominates the market as healthcare facilities prioritize comprehensive solutions for managing complex equipment inventories and clinical workflows. Equipment tracking and management represents a critical component, enabling hospitals to locate wheelchairs, infusion pumps, defibrillators, and other mobile medical devices in real-time. Staff management applications support workflow optimization by monitoring personnel locations and enabling efficient task allocation across departments. Patient management capabilities have gained prominence as hospitals recognize the benefits of real-time patient tracking for safety and care coordination.

End User Insights:

- Hospitals and Clinics

- Laboratories

- Pharmaceutical Companies

- Others

Hospitals and clinics hold 62% share of the total South Korea healthcare asset management market in 2025.

Hospitals and clinics represent the primary adopters of healthcare asset management solutions due to their extensive equipment inventories, complex operational requirements, and stringent regulatory compliance obligations. Large tertiary hospitals in South Korea manage thousands of mobile medical assets requiring systematic tracking, routine maintenance scheduling, and lifecycle management. The implementation of comprehensive asset management systems enables these facilities to reduce equipment rental costs, prevent theft and unauthorized removal, and ensure critical devices are readily available when needed for patient care. These solutions also support better capital planning decisions and help healthcare administrators optimize procurement strategies based on actual utilization patterns.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

Seoul Capital Area dominates the market owing to its concentration of major tertiary hospitals, advanced healthcare infrastructure, and proximity to leading technology providers. The region's dense population and high healthcare service demand create favorable conditions for widespread asset management solution deployment.

Yeongnam (Southeastern Region) represents a significant market driven by established medical centers in Busan and Daegu metropolitan areas. Growing investments in healthcare modernization and increasing focus on operational efficiency are accelerating the adoption of asset tracking technologies across regional hospitals and clinics.

Honam (Southwestern Region) is witnessing gradual adoption of healthcare asset management solutions as regional hospitals seek to enhance operational capabilities. Government initiatives supporting healthcare infrastructure development in underserved areas are creating opportunities for technology providers to expand their presence in this market.

Hoseo (Central Region) is experiencing steady growth in healthcare asset management adoption driven by expanding medical facilities and rising healthcare service demands. Strategic geographic positioning and ongoing healthcare infrastructure investments are supporting the deployment of modern asset tracking systems across the region.

Market Dynamics:

Growth Drivers:

Why is the South Korea Healthcare Asset Management Market Growing?

Rising Demand for Operational Efficiency in Healthcare Facilities

Healthcare providers in South Korea face escalating pressure to enhance operational efficiency while managing costs and maintaining high standards of patient care. Asset management solutions directly address these challenges by optimizing the utilization of expensive medical equipment, streamlining inventory management, and minimizing manual tracking efforts. The implementation of advanced tracking systems enables healthcare facilities to prevent equipment shortages, reduce rental costs for temporarily unavailable assets, and improve workflow efficiency for clinical staff. Real-time visibility into asset location and status empowers administrators to make data-driven decisions regarding equipment procurement and deployment, ultimately supporting better resource allocation across departments and care settings.

Government Support for Smart Hospital Development

The Government has positioned smart hospital development as a strategic national priority, implementing comprehensive policies and funding mechanisms to accelerate healthcare digitalization. Under national digital transformation frameworks, substantial budgets have been allocated for digital healthcare improvements, including subsidies for hospitals adopting artificial intelligence-based diagnostic systems, assistive robotics, and IoT-based patient monitoring equipment. Various ministerial initiatives have announced projects encompassing regional emergency systems and integrated digital care solutions to enhance healthcare delivery. These government-led initiatives create favorable market conditions by reducing adoption barriers and encouraging healthcare institutions to invest in advanced asset management technologies that support operational excellence.

Increasing Focus on Patient Safety and Regulatory Compliance

Patient safety concerns and stringent regulatory requirements are driving healthcare institutions to implement comprehensive asset tracking solutions. The healthcare sector faces growing scrutiny regarding medication administration accuracy, medical device maintenance, and infection control procedures. RFID and RTLS technologies enable hospitals to ensure proper sterilization tracking for surgical instruments, maintain accurate medication dispensing records, and support contact tracing during infectious disease outbreaks. Research has demonstrated that real-time location systems can identify close contacts of infectious patients more effectively than conventional tracing methods. The integration of asset management systems with electronic health records supports regulatory compliance by providing auditable documentation of equipment usage and maintenance activities.

Market Restraints:

What Challenges the South Korea Healthcare Asset Management Market is Facing?

High Initial Investment and Implementation Costs

The deployment of comprehensive healthcare asset management systems requires significant capital investment in infrastructure, hardware, and software components. Smaller healthcare facilities and clinics in non-metropolitan areas often face budget constraints that limit their ability to adopt advanced tracking technologies. Implementation costs extend beyond initial hardware procurement to include system integration, staff training, and ongoing maintenance expenses. These financial barriers create disparities in technology adoption rates across different healthcare institution sizes and geographic locations.

Integration Challenges with Existing Hospital Systems

Healthcare facilities often operate legacy information systems that present compatibility challenges when implementing new asset management solutions. Integrating RFID and RTLS platforms with existing electronic health records, hospital information systems, and maintenance management software requires significant technical expertise and customization efforts. The complexity of healthcare IT environments and the need for seamless data exchange between multiple systems can extend implementation timelines and increase project costs.

Data Security and Privacy Concerns

The implementation of asset tracking systems that monitor patient and staff movements raises concerns regarding data security and privacy protection. Healthcare organizations must ensure that location data is collected, stored, and processed in compliance with applicable privacy regulations. The increasing connectivity of healthcare assets creates potential cybersecurity vulnerabilities that require robust security measures. Addressing these concerns demands ongoing investment in security infrastructure and staff awareness programs.

Competitive Landscape:

The South Korea healthcare asset management market exhibits moderate competitive intensity, characterized by the presence of multinational technology corporations alongside domestic solution providers. Market participants are focused on developing integrated platforms that combine RFID, RTLS, and analytics capabilities to address diverse healthcare facility requirements. Strategic partnerships between technology vendors and healthcare institutions are common, enabling collaborative development of specialized solutions tailored to clinical workflows. Domestic players leverage their understanding of local market dynamics and regulatory requirements to compete effectively against international entrants. Competition is also driven by investments in artificial intelligence integration, cloud-based deployment options, and interoperability enhancements that facilitate seamless data exchange across healthcare ecosystems.

South Korea Healthcare Asset Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Radiofrequency Identification Devices (RFID), Real-Time Location Systems (RTLS), Others |

| Applications Covered |

|

| End Users Covered | Hospitals and Clinics, Laboratories, Pharmaceutical Companies, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The South Korea healthcare asset management market size was valued at USD 370.82 Million in 2025.

The South Korea healthcare asset management market is expected to grow at a compound annual growth rate of 8.35% from 2026-2034 to reach USD 763.31 Million by 2034.

Radiofrequency Identification Devices (RFID), holding the largest revenue share of 55%, lead the market due to their cost-effectiveness, ease of deployment, and proven track record in tracking medical equipment and pharmaceutical inventory across healthcare facilities.

Key factors driving the South Korea healthcare asset management market include rising demand for operational efficiency, government support for smart hospital development, increasing focus on patient safety, regulatory compliance requirements, and growing adoption of integrated RFID and RTLS technologies.

Major challenges include high initial investment and implementation costs, integration difficulties with existing hospital information systems, data security and privacy concerns, technical complexity of deployment, and resource constraints at smaller healthcare facilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)