South Korea Heat Exchanger Market Size, Share, Trends and Forecast by Type, Material, End Use Industry, and Region, 2025-2033

South Korea Heat Exchanger Market Overview:

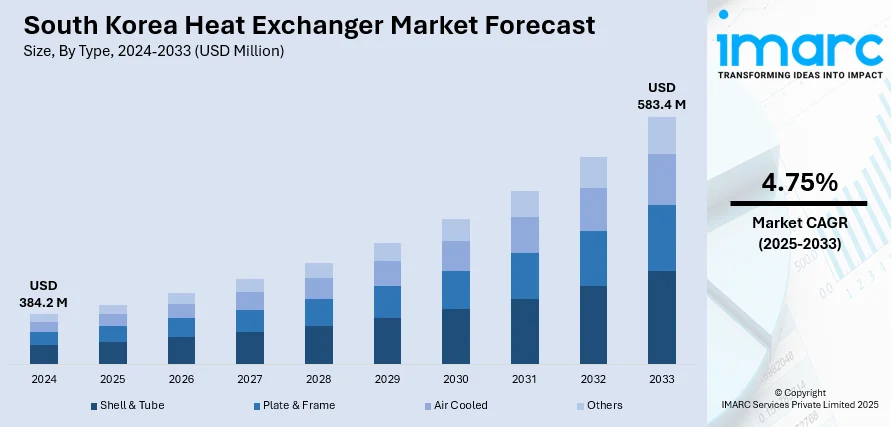

The South Korea heat exchanger market size reached USD 384.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 583.4 Million by 2033, exhibiting a growth rate (CAGR) of 4.75% during 2025-2033. The market is driven by industrial modernization and energy efficiency regulations prompting widespread retrofits. Expansion of LNG import and cryogenic infrastructure fuels demand for specialized exchanger solutions. Accelerated renewable energy investment in solar, biomass, and geothermal projects is further augmenting the South Korea heat exchanger market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 384.2 Million |

| Market Forecast in 2033 | USD 583.4 Million |

| Market Growth Rate 2025-2033 | 4.75% |

South Korea Heat Exchanger Market Trends:

Rise in LNG Imports and Cryogenic Processing

South Korea is a leading importer of liquefied natural gas (LNG), relying on sophisticated terminal and cryogenic infrastructure to support energy security and supply chain resilience. LNG storage, regasification, and processing plants require robust cryogenic heat exchanger systems designed to handle ultra-low temperatures and high pressure fluctuations. In line with this focus on energy infrastructure, developments in the country's energy sector continue to emphasize innovation and domestic production. For instance, on September 1, 2023, Doosan Enerbility announced the commercial operation of South Korea’s first domestically produced gas turbine, the 270-MW K-Gas Turbine at the Gimpo Combined Heat and Power plant in Gyeonggi Province. This development is part of a broader national strategy to reduce dependence on foreign gas turbine technology, with Doosan also securing a contract valued at USD 213 million for a 569-MW combined cycle plant in Boryeong City. The success of this homegrown technology underscores South Korea’s growing focus on enhancing its domestic manufacturing capabilities in the energy sector. As the nation expands terminal capacity and integrates floating storage regasification units (FSRUs), specialty cold-end and precooling exchangers become essential. New investments are underway in large-scale terminal expansion projects and offshore regasification, with OEM suppliers partnering with engineering firms to deliver high-capacity brazed plate or spiral-wound units capable of severe thermal loads. Beyond gas, the chemical and marine shipping industries also require robust exchangers to support refrigerated cargo and petrochemical loading systems. These cryogenic and low-temperature applications involve custom materials, precision machining, and specialized testing—adding complexity and value to the supply chain. Strong government support for energy diversification and LNG market participation ensures long-term demand. This energy-driven infrastructure build-out is a specialized but critical driver for the market. Large-scale investment in thermal assets continues to serve as a foundation for South Korea heat exchanger market growth across multiple end-use sectors.

To get more information on this market, Request Sample

Renewable Energy Development and Industrial Integration

South Korea is accelerating its renewable energy agenda, which influences heat exchanger demand across solar thermal, biomass, and geothermal sectors. Industrial-scale solar thermal facilities require effective heat capture and transfer systems, while biomass power plants depend on reliable exchanger units for boiler and condenser operation. In geothermal installations, plate heat exchangers facilitate heat transfer between fluid loops, ensuring process stability and operational safety under variable temperature profiles. Renewable-related manufacturing plants also use heat exchangers in heat recovery and process systems to improve overall efficiency. On November 7, 2024, GE Vernova announced the start of commercial operation for the Tongyeong combined cycle power plant in South Korea, a 1 GW LNG-fueled facility. This plant, utilizing advanced GE Vernova HA gas turbines and heat recovery systems, will provide electricity to approximately 1 million households and supports South Korea's transition from coal to cleaner energy sources. The project reflects the broader energy shift in the country, where high-efficiency turbines and heat exchangers are key to reducing CO2 emissions and enhancing energy reliability, in line with national decarbonization goals. Emerging green-energy projects are backed by national funding and technology partnerships, aligning with carbon neutrality targets. Local engineering firms, often in collaboration with European and North American technology providers, have begun developing specialized exchanger designs tailored to renewable applications, such as compact brazed plate units and titanium-lined models. This market is characterized by innovation, durability, and renewable compatibility, enhancing product specifications and supplier capabilities. As the scale of green infrastructure investment grows, heat exchanger technology becomes integral to South Korea’s energy transition efforts.

South Korea Heat Exchanger Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, material, and end use industry.

Type Insights:

- Shell & Tube

- Plate & Frame

- Air Cooled

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes shell & tube, plate & frame, air cooled, and others.

Material Insights:

- Carbon Steel

- Stainless Steel

- Nickel

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes carbon steel, stainless steel, nickel, and others.

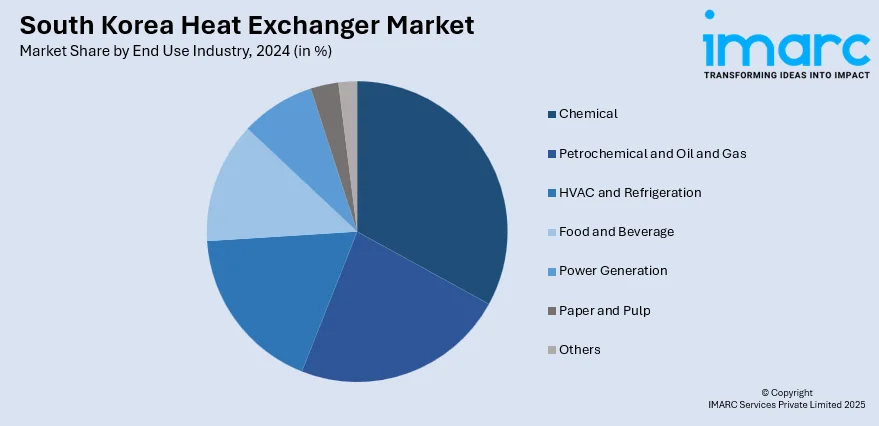

End Use Industry Insights:

- Chemical

- Petrochemical and Oil and Gas

- HVAC and Refrigeration

- Food and Beverage

- Power Generation

- Paper and Pulp

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes chemical, petrochemical and oil and gas, HVAC and refrigeration, food and beverage, power generation, paper and pulp, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Heat Exchanger Market News:

- On September 3, 2024, the Korea Institute of Energy Research (KIER) announced the development of a low-temperature refrigeration technology that utilizes R729, or air, as a refrigerant. This innovative system incorporates a compander, combining a compressor, heat exchanger, and expander, to operate under the reverse-Brayton cycle, significantly improving efficiency in cooling applications. The new design enhances performance with a single-shaft system that ensures stable operation even at ultra-high rotational speeds, positioning South Korea as a leader in sustainable refrigeration technologies.

South Korea Heat Exchanger Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Shell & Tube, Plate & Frame, Air Cooled, Others |

| Materials Covered | Carbon Steel, Stainless Steel, Nickel, Others |

| End Use Industries Covered | Chemical, Petrochemical and Oil and Gas, HVAC and Refrigeration, Food and Beverage, Power Generation, Paper and Pulp, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea heat exchanger market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea heat exchanger market on the basis of type?

- What is the breakup of the South Korea heat exchanger market on the basis of material?

- What is the breakup of the South Korea heat exchanger market on the basis of end use industry?

- What is the breakup of the South Korea heat exchanger market on the basis of region?

- What are the various stages in the value chain of the South Korea heat exchanger market?

- What are the key driving factors and challenges in the South Korea heat exchanger?

- What is the structure of the South Korea heat exchanger market and who are the key players?

- What is the degree of competition in the South Korea heat exchanger market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea heat exchanger market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea heat exchanger market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea heat exchanger industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)