South Korea Hemodialysis Market Size, Share, Trends and Forecast by Segment, Modality, End User, and Region, 2025-2033

South Korea Hemodialysis Market Overview:

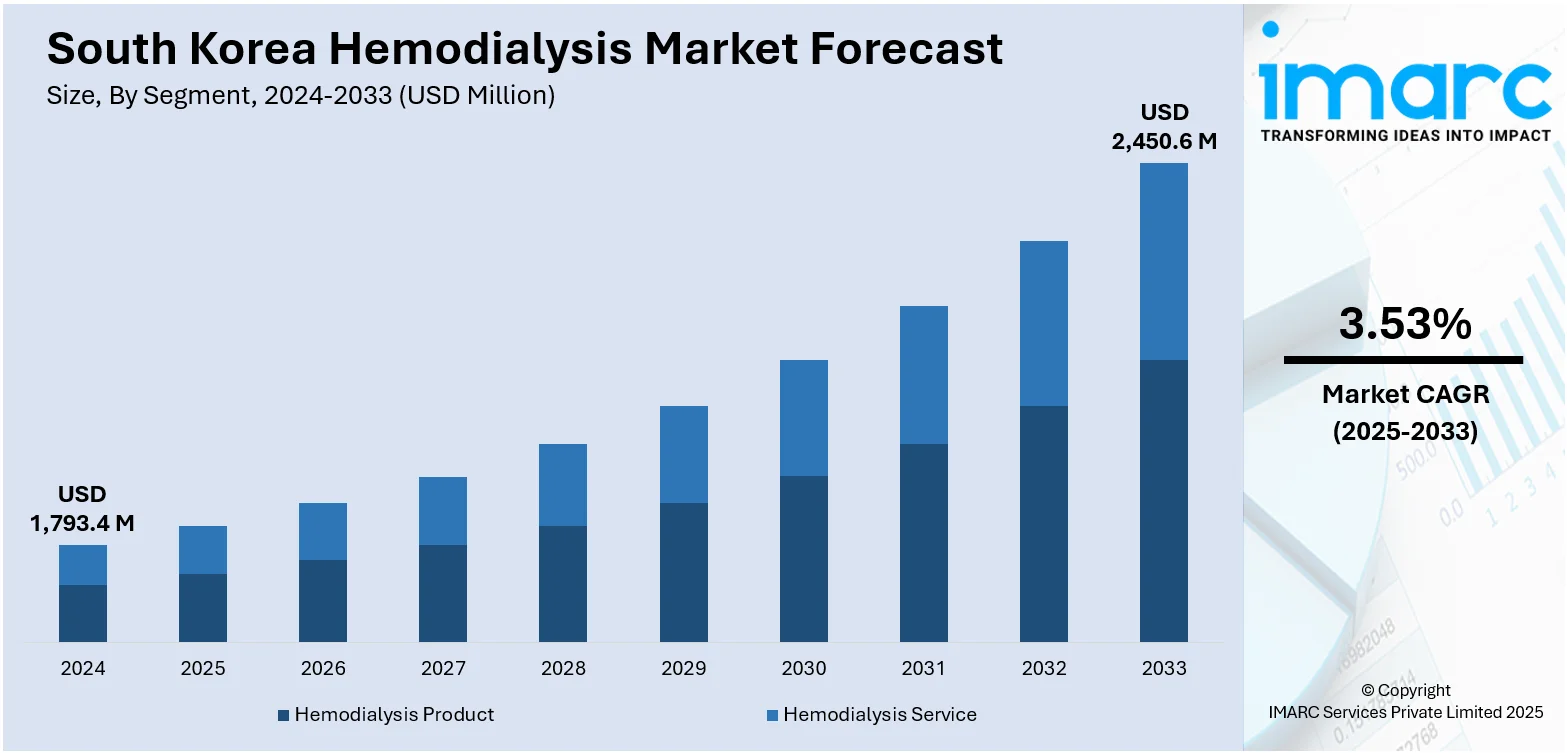

The South Korea hemodialysis market size reached USD 1,793.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,450.6 Million by 2033, exhibiting a growth rate (CAGR) of 3.53% during 2025-2033. The market is driven by a growing CKD patient base linked to aging and comorbid conditions. Continuous technology upgrades and care-quality innovation are enhancing clinical outcomes and operational efficiency. Strategic public–private healthcare collaboration and sustained government reimbursement further augment the South Korea hemodialysis market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,793.4 Million |

| Market Forecast in 2033 | USD 2,450.6 Million |

| Market Growth Rate 2025-2033 | 3.53% |

South Korea Hemodialysis Market Trends:

Rising Chronic Kidney Disease Prevalence and Aging Population

South Korea is experiencing a steady increase in chronic kidney disease (CKD) prevalence, closely tied to rapid population aging, escalating rates of diabetes, and hypertension. As these conditions advance to end-stage renal disease (ESRD), demand for regular hemodialysis sessions continues to grow. Both hospital-based and freestanding dialysis centers are seeing higher patient volumes, prompting expansion of treatment capacity and service hours. A recent study analyzed 3284 hemodialysis (HD) patients from a nationwide cohort of 5223 individuals in South Korea, with a median age of 58.4 ± 13.6 years and 59.3% male. Over a median follow-up of 66.2 months, the overall mortality rate was 19.3%, highlighting a significant risk of early mortality among these patients. Government health insurance structures offer comprehensive coverage for dialysis, reducing cost barriers and encouraging early initiation of therapy. As more clinics invest in high-efficiency dialysis machines and personalized care programs, patients are benefiting from improved survival rates and quality of life. Chronic disease management initiatives within the national healthcare strategy also emphasize early screening, resulting in more patients being admitted into hemodialysis regimens before complications arise. This demographic and epidemiological shift represents a persistent demand driver, requiring infrastructure expansion, workforce training, and supply-chain readiness. The interplay between an aging cohort, lifestyle-related disease burden, and systemic access to treatment underpins long‑term South Korea hemodialysis market growth.

To get more information on this market, Request Sample

Technological Advancements and Quality-of-Care Enhancements

South Korea’s healthcare providers are continually adopting advanced hemodialysis technologies to optimize outcomes and patient experience. Innovations such as high-flux dialyzers, online hemodiafiltration, and biocompatible membranes are becoming standard in newer clinics. Dialysis machines equipped with digital monitoring, remote data transmission, and AI-assisted analytics help clinicians track complications and intervene early. Portable and home-based dialysis models are also emerging, offering flexibility for patients while reducing costs. Integration with telehealth platforms allows nephrologists to monitor treatment efficacy and adjust prescriptions remotely. Pharmaceutical improvements—like ultrapure water systems and enhanced antithrombogenic coatings—further reduce complications and improve hemodynamic stability during sessions. Clinical training programs ensure that nephrology nurses and technicians are proficient in new systems and patient-centered care. As treatment standards rise, clinics differentiate themselves through precise parameters, comfort features, and better long-term management. These technology and quality upgrades carry both clinical and branding value, reinforcing market expansion and investment in hemodialysis infrastructure across South Korea. As these technological and quality improvements advance patient care, they also play a pivotal role in managing the key factors influencing early mortality, such as comorbidities, dialysis adequacy, and the duration of dialysis. According to a recent 2024 research report, key factors influencing early mortality included comorbidities, especially the modified Charlson Comorbidity Index (mCCI), dialysis adequacy (KT/V), RAAS inhibitor use, and urine output, with shorter dialysis duration (< 14.9 months) and high mCCI scores (7–9) associated with significantly higher mortality risks, with hazard ratios reaching 7.76.

South Korea Hemodialysis Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on segment, modality, and end user.

Segment Insights:

- Hemodialysis Product

- Machines

- Dialyzers

- Others

- Hemodialysis Service

- In-center Services

- Home Services

The report has provided a detailed breakup and analysis of the market based on the segment. This includes hemodialysis products (machines, dialyzers, and others) and hemodialysis services (in-center services and home services).

Modality Insights:

- Conventional Hemodialysis

- Short Daily Hemodialysis

- Nocturnal Hemodialysis

The report has provided a detailed breakup and analysis of the market based on the modality. This includes conventional hemodialysis, short daily hemodialysis, and nocturnal hemodialysis.

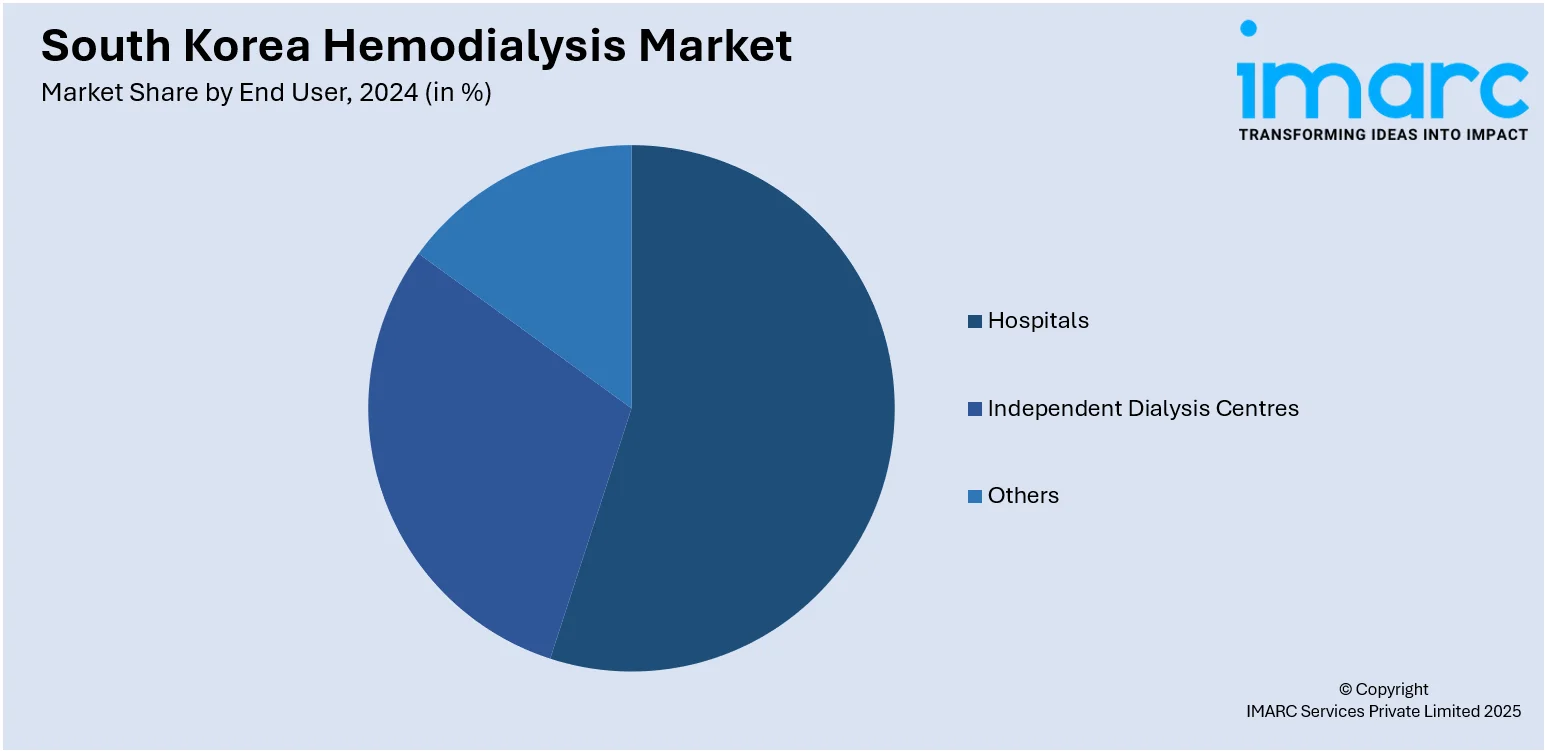

End User Insights:

- Hospitals

- Independent Dialysis Centres

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, independent dialysis centres, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Hemodialysis Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Segments Covered |

|

| Modalities Covered | Conventional Hemodialysis, Short Daily Hemodialysis, Nocturnal Hemodialysis |

| End Users Covered | Hospitals, Independent Dialysis Centres, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea hemodialysis market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea hemodialysis market on the basis of segment?

- What is the breakup of the South Korea hemodialysis market on the basis of modality?

- What is the breakup of the South Korea hemodialysis market on the basis of end user?

- What is the breakup of the South Korea hemodialysis market on the basis of region?

- What are the various stages in the value chain of the South Korea hemodialysis market?

- What are the key driving factors and challenges in the South Korea hemodialysis?

- What is the structure of the South Korea hemodialysis market and who are the key players?

- What is the degree of competition in the South Korea hemodialysis market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea hemodialysis market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea hemodialysis market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea hemodialysis industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)