South Korea High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033

South Korea High-Brightness LED Market Overview:

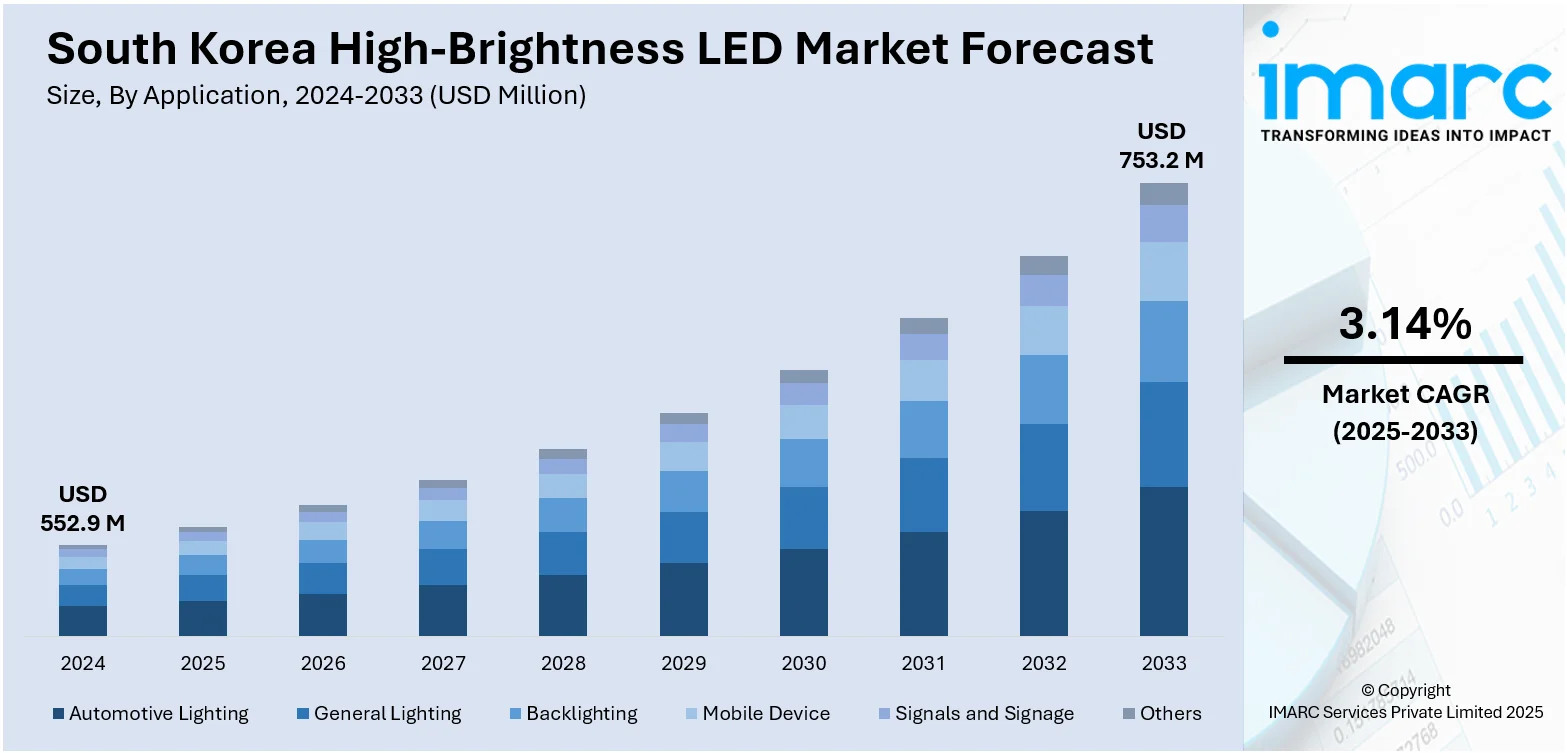

The South Korea high-brightness LED market size reached USD 552.9 Million in 2024. The market is projected to reach USD 753.2 Million by 2033, exhibiting a growth rate (CAGR) of 3.14% during 2025-2033. The market is experiencing steady growth based on technological innovation, increased integration in automotive and electronics industries, and rising adoption in smart infrastructure. Demand for energy-saving, high-performance lighting applications is cementing the position of high-brightness LEDs in optimizing efficiency and design freedom in various industries. Government support and innovation in semiconductor manufacturing further enhance market potential. These trends together lead to an optimistic scenario for the industry, underpinning South Korea high-brightness LED market share gains.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 552.9 Million |

| Market Forecast in 2033 | USD 753.2 Million |

| Market Growth Rate 2025-2033 | 3.14% |

South Korea High-Brightness LED Market Trends:

Growth in Smart Lighting Infrastructure

Another trend defining the market is the accelerated adoption of smart lighting infrastructure in urbanization. Government-sponsored smart city projects and private investments now more frequently include intelligent, high-brightness LED lighting to maximize energy efficiency and enhance safety across public areas transportation centers, and commercial developments. As per the sources, in November of 2024, Samsung Electronics launched its 71.8-meter-wide XHB Series outdoor LED signage at Shinsegae Department Store in Seoul, unveiling an 8K anamorphic display that rewrites visual experiences in Myeongdong. Moreover, these lighting systems, which are often managed by centralized software platforms, can vary brightness levels according to ambient conditions, occupancy, or time of day. This not only minimizes electricity use but also aids sustainability objectives. In addition, South Korean municipalities are implementing these systems to enhance night visibility and provide surveillance functionality. With increasing demand for adaptive and eco-friendly lighting, market trends show the direction towards multifunctional lighting solutions with integrated sensors and connectivity capabilities, consistent with the national emphasis on digitalization and smart infrastructure development.

To get more information on this market, Request Sample

Proliferation of Automotive LED Applications

A second major trend impacting the market is the rising use of LED lighting in the automotive industry. High-brightness LEDs are being put into use in headlights, daytime running lights, and interior ambient lighting, driven by their energy efficiency, compact size, and better visibility. Having a robust domestic automotive manufacturing sector, South Korea has witnessed extensive use of these LEDs across luxury as well as mass-market vehicles. This growth is facilitating not just visual and functional evolution but also falling in line with larger patterns of automotive safety and advanced driver-assistance systems (ADAS). High-brightness LEDs provide quicker response times and higher reliability than older lighting systems, and they are a favored technology in contemporary vehicle design. With the growing applications of vehicle electrification and digital dash technologies, South Korea high-brightness LED market growth is increasingly aided by automotive lighting applications requiring high intensity, endurance, and flexibility in design.

Growing Demand from Consumer Electronics

The South Korea high-brightness LED market is seeing the consumer electronics sector also demanding higher demand, driven especially by applications in high-resolution displays and backlighting solutions. Since South Korea is a world hub of electronic device production, high-brightness LEDs are extensively used in televisions, smartphones, tablets, and monitors. LEDs provide enhanced color rendering, brightness uniformity, and energy efficiency—most important for display quality improvement. Moreover, electronic miniaturization has driven the transition to small high-intensity LED modules that can be accommodated in thinner product designs without sacrificing performance. Manufacturers are likewise focusing on high-brightness LEDs for their thermal resistance and extended working life, which is critical to upholding quality in high-end consumer products. In line with this trend, South Korea high-brightness LED market trends reveal the industry's move towards technology-intensive, application-driven lighting solutions that correspond with the country's dominance in electronics innovation and precision engineering.

South Korea High-Brightness LED Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application, distribution channel, indoor and outdoor application, and end-use sector.

Application Insights:

- Automotive Lighting

- General Lighting

- Backlighting

- Mobile Device

- Signals and Signage

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive lighting, general lighting, backlighting, mobile device, signals and signage, and others.

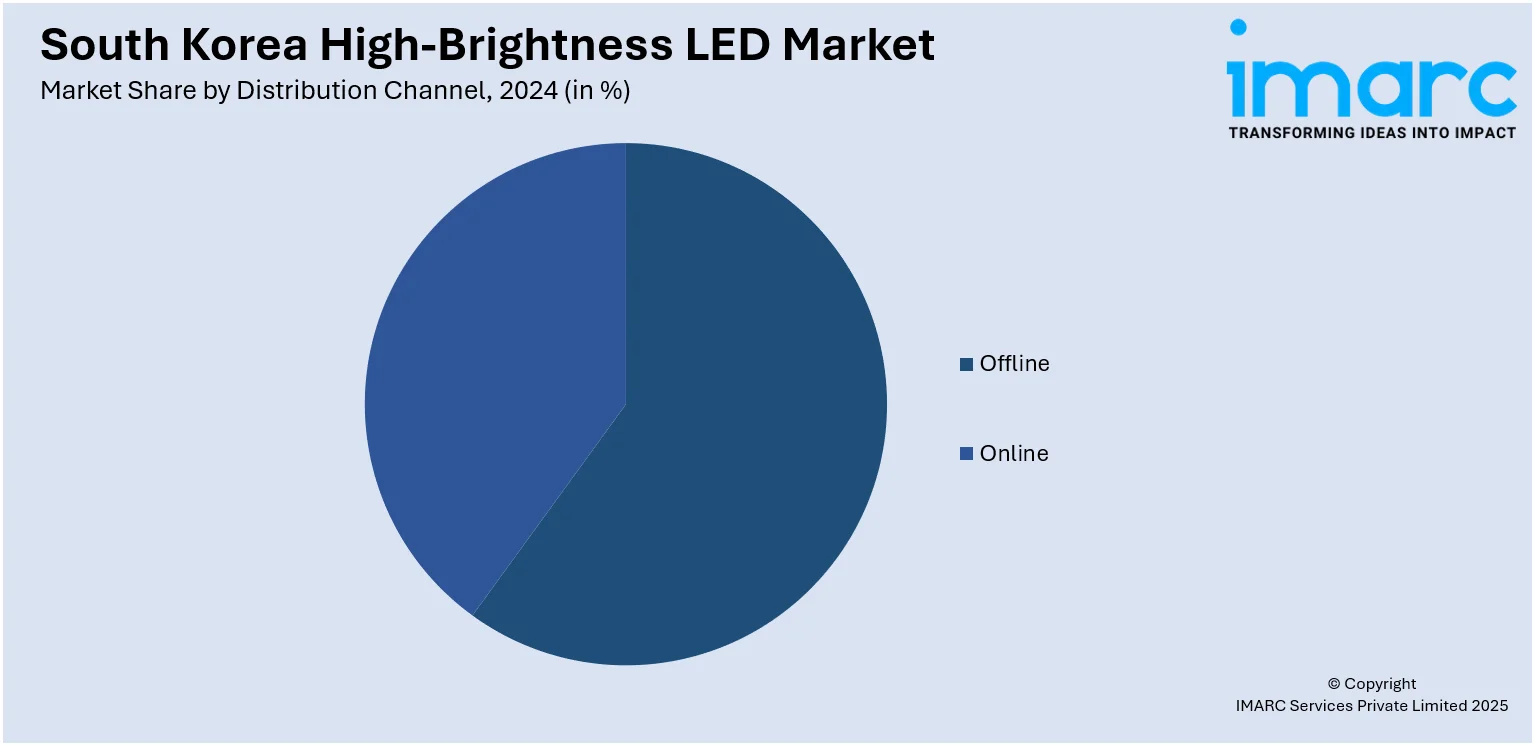

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Indoor and Outdoor Application Insights:

- Indoor

- Outdoor

The report has provided a detailed breakup and analysis of the market based on the indoor and outdoor. This includes indoor and outdoor.

End-Use Sector Insights:

- Commercial

- Residential

- Industrial

- Others

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes commercial, residential, industrial, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea High-Brightness LED Market News:

- In July 2025, Seoul Semiconductor announced the supply of its WICOP Mini LED displays for car applications starting from May. No-wire, no-lens technology provides up to 1,200 nits brightness, support for HDR, and energy efficiency. It is made for new cars, with durability, thin design, and cost savings compared to OLED systems.

- In May 2025, Colorlight introduced its next-generation AI-powered LED display solutions in Seoul, such as 4K upscaling, motion optimization, and smart calibration systems. Showcasing products such as the VX20 processor and A500 Cloud Player, the event showcased Colorlight's focus on high-end display innovation in the South Korea commercial LED market.

South Korea High-Brightness LED Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Automotive Lighting, General Lighting, Backlighting, Mobile Device, Signals and Signage, Others |

| Distribution Channels Covered | Offline, Online |

| Indoor and Outdoor Applications Covered | Indoor, Outdoor |

| End-Use Sectors Covered | Commercial, Residential, Industrial, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea high-brightness LED market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea high-brightness LED market on the basis of application?

- What is the breakup of the South Korea high-brightness LED market on the basis of distribution channel?

- What is the breakup of the South Korea high-brightness LED market on the basis of indoor and outdoor application?

- What is the breakup of the South Korea high-brightness LED market on the basis of end-use sector?

- What is the breakup of the South Korea high-brightness LED market on the basis of region?

- What are the various stages in the value chain of the South Korea high-brightness LED market?

- What are the key driving factors and challenges in the South Korea high-brightness LED?

- What is the structure of the South Korea high-brightness LED market and who are the key players?

- What is the degree of competition in the South Korea high-brightness LED market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea high-brightness LED market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea high-brightness LED market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea high-brightness LED industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)