South Korea HIV Drugs Market Size, Share, Trends and Forecast by Drug Class, Distribution Channel, and Region, 2025-2033

South Korea HIV Drugs Market Overview:

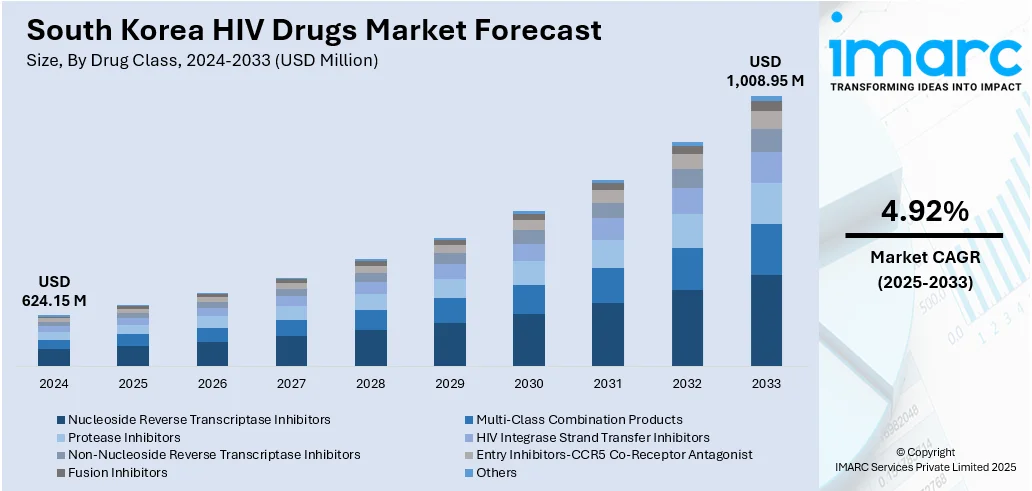

The South Korea HIV drugs market size reached USD 624.15 Million in 2024. Looking forward, the market is expected to reach USD 1,008.95 Million by 2033, exhibiting a growth rate (CAGR) of 4.92% during 2025-2033. The market is steered by public-initiated healthcare policies, which promote wide access to antiretroviral therapy under the national health insurance scheme that finances majority of the costs associated with treatment. Growing number of patients diagnosed and increased awareness campaigns are fueling increased demand for HIV drugs in urban and regional hubs. Progression in long‑acting injectable antiretroviral formulations also helps push market momentum by enhancing adherence and ease of use, contributing to increasing South Korea HIV drugs market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 624.15 Million |

| Market Forecast in 2033 | USD 1,008.95 Million |

| Market Growth Rate 2025-2033 | 4.92% |

South Korea HIV Drugs Market Trends:

Transition to Single-Tablet Regimens Enhancing Adherence

In South Korea, one of the dominant trends in the HIV medicines market is the growing use of single-tablet regimens (STRs). These regimens, which put several antiretroviral drugs into one pill taken once a day, are being prescribed to new patients as well as those switching from legacy multi-pill therapies on a large scale. The trend is largely credited to the country's excellent focus on treatment adherence, driven by a health system providing access to cutting-edge medications. STRs are convenient, pill burden-lowering, and minimize the risk of missed doses—major drivers of long-term viral suppression. The trend is seen particularly among young patients and in urban settings where digital health education and high frequency follow-up promote steady use. Although there are regional variations in the pace of adoption of these therapies, STRs increasingly find themselves on the path to becoming a national standard. This transition to streamlined regimens benefits patient experiences, while serving public health aims by increasing treatment continuity and viral load control.

To get more information on this market, Request Sample

Expanding Genetic Diversity and Drug Resistance

The HIV epidemic in South Korea is experiencing the growing genetic diversity of HIV-1 subtypes, which contributes to an increasingly complex treatment situation. Although subtype B has long been the most prevalent, increasing cases of recombinant strains complicate treatment. This is facilitated by globalization and the increased mobility of individuals across borders. This genetic diversity increases the risk of drug resistance, particularly among newly infected patients who could have been infected with resistant strains. According to the Korea Disease Control and Prevention Agency (KDCA), each year, approximately 1,000 individuals become newly infected with HIV. The KDCA reports that while AIDS-related deaths have declined in the last five years, there continues to be a steady number of new infections, particularly among youth and foreign individuals. Korean health officials have created strategies to combat human immunodeficiency virus (HIV), targeting a reduction of the mentioned figure by 50% by the close of 2030. KDCA has decided to set aside about USD 15 Million beginning in 2024 to reduce new infections, improve the pace at which new patients are diagnosed, and guarantee that treatment starts on schedule. Additionally, the organization works to create a disease management system that is more efficient. Consequently, patients are depending on resistance testing prior to initiating treatment, with doctors being able to customize drug regimens according to patient profiles. Such personalized treatment is made possible by the well-established healthcare infrastructure of the country and infectious disease experts with in-depth knowledge of such cases. Therefore, treatment protocols today typically involve newer generations of antiretroviral drugs that are more resistant to resistance, guaranteeing improved long-term results. The demand for adaptable, long-lasting treatments has emerged as a hallmark trend, remodeling the way HIV treatment is addressed by healthcare professionals in the region, which also contributes to the South Korea HIV drugs market growth.

Improved Access via National Insurance Coverage and Awareness Campaigns

A hallmark attribute of South Korea's HIV drugs market is the nation's universal healthcare policies and national insurance coverage, which offer comprehensive backing to antiretroviral therapy. Most of the cost of the treatment is borne by national health schemes, so expensive therapies become available to all, irrespective of an individual's economic status. This has helped in early diagnosis and timely administration of therapy in a broad belt of people ranging from students to working-class individuals and even migrant groups. In addition to this economic support, campaigns for public health have been building up awareness of HIV prevention, testing, and stigma reduction. These initiatives are most specifically concentrated on vulnerable populations and young communities, serving to desensitize conversations about HIV and motivate more individuals to come forward for treatment. In addition, there is increasing interest in broadening access to preventive therapy drugs like PrEP, although this segment remains emerging. Cumulatively, growing public awareness, policy support, and widespread coverage are forming a firm and inclusive platform for long-term growth and innovation in South Korea's HIV drugs market.

South Korea HIV Drugs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on drug class and distribution channel.

Drug Class Insights:

- Nucleoside Reverse Transcriptase Inhibitors

- Multi-Class Combination Products

- Protease Inhibitors

- HIV Integrase Strand Transfer Inhibitors

- Non-Nucleoside Reverse Transcriptase Inhibitors

- Entry Inhibitors-CCR5 Co-Receptor Antagonist

- Fusion Inhibitors

- Others

The report has provided a detailed breakup and analysis of the market based on the drug class. This includes nucleoside reverse transcriptase inhibitors, multi-class combination products, protease inhibitors, HIV integrase strand transfer inhibitors, non-nucleoside reverse transcriptase inhibitors, entry inhibitors-CCR5 co-receptor antagonist, fusion inhibitors, and others.

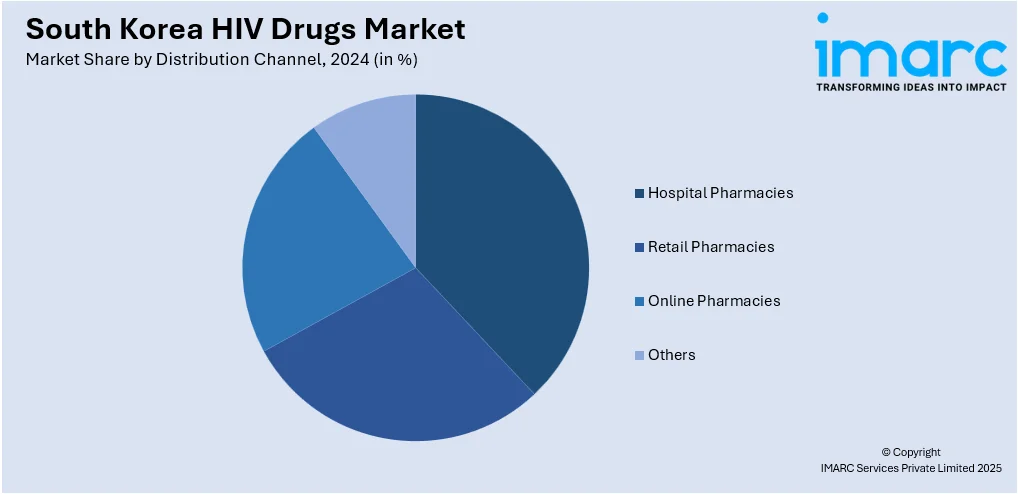

Distribution Channel Insights:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hospital pharmacies, retail pharmacies, online pharmacies, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea HIV Drugs Market News:

- In September 2024, in the newest supply agreement concerning active pharmaceutical ingredients (API), Gilead Sciences has enlisted South Korea’s Yuhan to assist in manufacturing its HIV medications in a deal valued at USD 80.9 million. The supply contract extends until September 2025. The transaction value accounts for 5.8% of Yuhan's most recent annual revenue of 1.85 trillion Korean won (USD1.4 billion), per a regulatory submission. Yuhan jointly promotes various Gilead HIV medications, such as the popular Biktarvy, in Korea. Yuhan's stock surged 15.9% on Friday after the announcement.

South Korea HIV Drugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Classes Covered | Nucleoside Reverse Transcriptase Inhibitors, Multi-Class Combination Products, Protease Inhibitors, HIV Integrase Strand Transfer Inhibitors, Non-Nucleoside Reverse Transcriptase Inhibitors, Entry Inhibitors-CCR5 Co-Receptor Antagonist, Fusion Inhibitors, Others |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea HIV drugs market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea HIV drugs market on the basis of drug class?

- What is the breakup of the South Korea HIV drugs market on the basis of distribution channel?

- What is the breakup of the South Korea HIV drugs market on the basis of region?

- What are the various stages in the value chain of the South Korea HIV drugs market?

- What are the key driving factors and challenges in the South Korea HIV drugs market?

- What is the structure of the South Korea HIV drugs market and who are the key players?

- What is the degree of competition in the South Korea HIV drugs market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea HIV drugs market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea HIV drugs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea HIV drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)