South Korea Home Infusion Therapy Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

South Korea Home Infusion Therapy Market Overview:

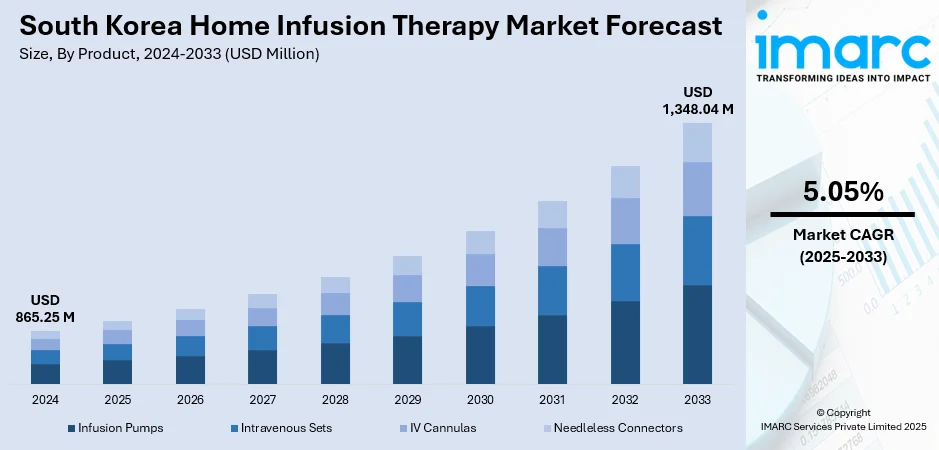

The South Korea home infusion therapy market size reached USD 865.25 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,348.04 Million by 2033, exhibiting a growth rate (CAGR) of 5.05% during 2025-2033. The home infusion therapy in South Korea is growing owing to an aging population, rising demand for in-home care, strong digital infrastructure, and expanding use of remote monitoring tools. Improved care coordination, policy support, and accessible smart devices are making home-based treatment safer and more widely adopted, thereby increasing the South Korea home infusion therapy market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 865.25 Million |

| Market Forecast in 2033 | USD 1,348.04 Million |

| Market Growth Rate 2025-2033 | 5.05% |

South Korea Home Infusion Therapy Market Trends:

Aging Population and Shift in Care Preferences

The rising geriatric population, who is easily susceptible to chronic conditions, is propelling the market growth. As per the 2024 Statistics on the Aged, people aged 65 and above currently make up 19.2% of the population, and forecasts suggest this will exceed 20% in 2025 and reach 30% by 2036. With an increasing number of seniors needing continuous care, many opt for home treatment instead of hospital stays, which can be both costly and emotionally draining. Home infusion therapy enables the delivery of treatments, such as IV antibiotics, nutrition, and pain management, in a comfortable environment, lessening the strain on families and preventing frequent hospital trips. Hospitals also benefit, as shifting eligible patients to home care helps reduce bed shortages and readmission rates. This is encouraging both public and private healthcare sectors to invest in at-home services, with government programs starting to promote wider access and execution.

To get more information on this market, Request Sample

Technological Readiness and Service Infrastructure

The sophisticated digital ecosystem plays a crucial role in impelling the South Korea home infusion therapy market growth. In 2024, the eHealth market in the country achieved USD 2.7 billion, indicating extensive usage of mobile health applications, teleconsultation services, remote monitoring solutions, and electronic records. These technologies facilitate communication among hospitals, pharmacies, patients, and homecare providers, allowing them to manage treatment schedules without in-person visits. Monitoring vitals and infusion progress remotely enables providers to react swiftly to any problems, while logistics systems guarantee timely arrival of medications and supplies. Home-use devices are becoming more user-friendly, enabling patients and caregivers to manage therapy with minimal clinical assistance. Regulatory agencies are starting to modify policy structures to promote home-based approaches, especially for managing chronic diseases. The integration of digital preparedness and policy coordination is making home infusion therapy a viable, reliable choice for an increasing number of patients nationwide.

Growing Use of Remote Monitoring and Smart Devices

In South Korea, wearable devices and remote monitoring tools are enhancing the reliability and clinical management of home infusion therapy. In 2025, Seers Technology released MobiCare, a wearable ECG gadget that allows for AI-driven, instant monitoring of arrhythmia and various conditions. Together with Think, its hospital monitoring system, these tools provide 24/7 supervision without the need for constant physical presence. Such systems enable healthcare professionals to monitor vitals, infusion rates, and warning indicators remotely, facilitating quicker responses in case complications occur. Patients and families gain reassurance, understanding that care teams are digitally linked and can intervene when required. The incorporation of these tools with electronic health records (EHRs) improves the continuity of care between home and hospital. With these technologies becoming easily available via subscription models, operational costs for facilities are decreasing, making home infusion a more viable option for patients with complex or high-risk conditions.

South Korea Home Infusion Therapy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

The report has provided a detailed breakup and analysis of the market based on the product. This includes infusion pumps (elastomeric, electromechanical, gravity, and others), intravenous sets, IV cannulas, and needleless connectors.

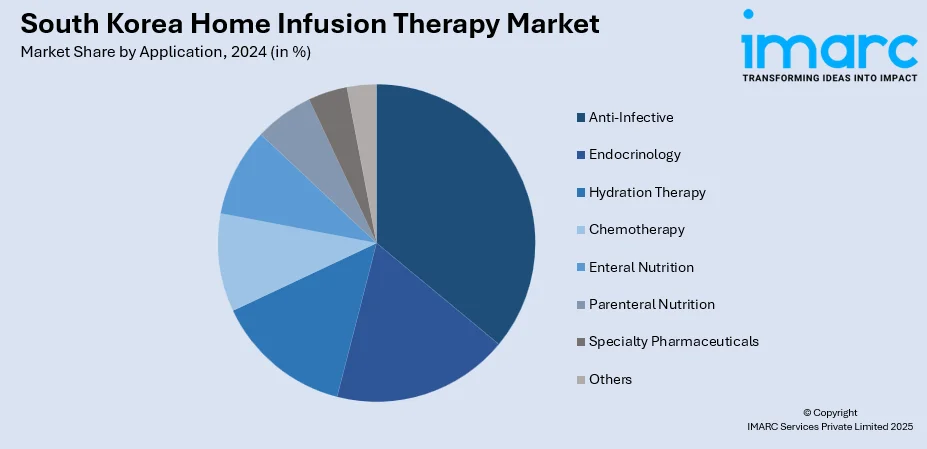

Application Insights:

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes anti-infective, endocrinology (diabetes and others), hydration therapy (athletes and others), chemotherapy, enteral nutrition, parenteral nutrition, specialty pharmaceuticals, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Home Infusion Therapy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered |

|

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea home infusion therapy market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea home infusion therapy market on the basis of product?

- What is the breakup of the South Korea home infusion therapy market on the basis of application?

- What is the breakup of the South Korea home infusion therapy market on the basis of region?

- What are the various stages in the value chain of the South Korea home infusion therapy market?

- What are the key driving factors and challenges in the South Korea home infusion therapy market?

- What is the structure of the South Korea home infusion therapy market and who are the key players?

- What is the degree of competition in the South Korea home infusion therapy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea home infusion therapy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea home infusion therapy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea home infusion therapy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)