South Korea Hot Sauce Market Size, Share, Trends and Forecast by Product Type, Application, Packaging, Distribution Channel, End Use, and Region, 2025-2033

South Korea Hot Sauce Market Overview:

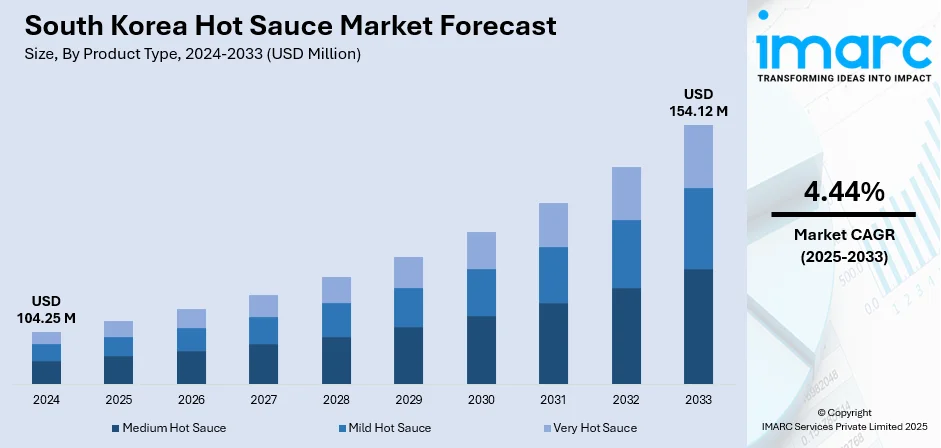

The South Korea hot sauce market size reached USD 104.25 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 154.12 Million by 2033, exhibiting a growth rate (CAGR) of 4.44% during 2025-2033. The increasing convergence of global and Korean cuisines, with consumers demanding more spicy and bold flavors, is strengthening the market growth. Moreover, South Korean consumers are getting more health-aware and are opting for natural, less processed condiments, which is driving the demand for products containing clean-label ingredients. Additionally, the widening coverage of retail and online distribution networks is expanding the South Korea hot sauce market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 104.25 Million |

| Market Forecast in 2033 | USD 154.12 Million |

| Market Growth Rate 2025-2033 | 4.44% |

South Korea Hot Sauce Market Trends:

Increasing Blending of International and Korean Foods is Increasing Consumer Demand

The South Korea hot sauce sector is driven by the increasing convergence of global and Korean cuisines, with consumers demanding more spicy and bold flavors. Foreign food cultures, especially Western, Southeast Asian, and Latin food, are growing in popularity among Korean consumers, and they are combining them with existing Korean food. Restaurants, food influencers, and chefs are increasingly launching dishes using hot sauces combined with local staples such as fried chicken, tteokbokki, and bibimbap, thus developing distinctive culinary experiences. This trend of fusion is giving a dynamic boost to flavor choices, incorporating spicy sauces into mainstream offerings. The younger generations are accepting this globalized taste profile and are looking for creative, high-heat condiments for household cooking, too. The ongoing expansion of food delivery apps and fast-casual dining is propelling continued market growth through various channels of food. For instance, in 2024, Yogiyo, the food delivery app in South Korea, launched the nation’s first robot-dependent delivery service. The service seeks to transform the food delivery industry by employing autonomous robots to deliver meals straight to customers. This advancement is set to enhance efficiency, shorten delivery periods, and lower operational expenses, positioning it as a potentially transformative breakthrough in the industry.

To get more information on this market, Request Sample

Increasing Health Consciousness is Boosting Demand for Natural, Spicy Flavors

South Korean consumers are getting more health-aware and are opting for natural, less processed condiments, which is driving the demand for hot sauces containing clean-label ingredients. Consumers are looking for sauces with low preservatives, minimal sugar, and natural chili peppers because they are becoming concerned about artificial additives and sodium in traditional sauces. Consequently, domestic and foreign hot sauce companies are always coming up with innovations in creating products that respond to these health trends. They are highlighting fermented chili bases, probiotic qualities, and organic contents to appeal to demanding consumers. Some are even adding old Korean fermentation methods, like gochujang-style hot sauces, to respond to health-conscious buyers. Shoppers are viewing spicy condiments as a means of enhancing flavor without relying on added salt or fat, hence making them a first choice for use in routine cooking. In 2025, Samyang Foods announced its plans for improving the packaging of hot chicken-flavored Buldak hot sauce. Samyang aims to establish its Buldak hot sauce as a worldwide lifestyle brand by merging digital and physical brand engagements via an omnichannel strategy. A pivotal aspect of the campaign is the official launch of the revamped Buldak hot sauce at the Coachella Valley Music and Arts Festival in Indio, California, occurring over the upcoming two weekends. The product will start being released in the Korean and US markets this month. Partnerships with K-pop artists are planned to enhance the worldwide promotion of Korea's spicy culinary culture.

Increasing Retail and E-commerce Channels are Increasing Product Availability

The widening coverage of retail and online distribution networks is supporting the South Korea hot sauce market growth. Leading supermarket chains, convenience stores, and gourmet specialty stores are all spending more shelf space on a vast array of domestic and foreign hot sauce brands, thus making the product more convenient for consumption. At the same time, the swift growth of e-commerce websites and internet-based grocery delivery companies is facilitating convenience for customers to learn about and buy specialty or high-end hot sauces that might not find space in brick-and-mortar stores. Social media and influencer marketing are also generating visibility and driving online sales. These websites are facilitating brands to promote product originality, origin, and recipe usage, which is amplifying consumer interaction. As digital payments and delivery logistics improve, the convenience of online shopping for gourmet condiments is continuously extending market reach and urging trials of new flavors.

South Korea Hot Sauce Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, application, packaging, distribution channel, and end use.

Product Type Insights:

- Medium Hot Sauce

- Mild Hot Sauce

- Very Hot Sauce

The report has provided a detailed breakup and analysis of the market based on the product type. This includes medium hot sauce, mild hot sauce, and very hot sauce.

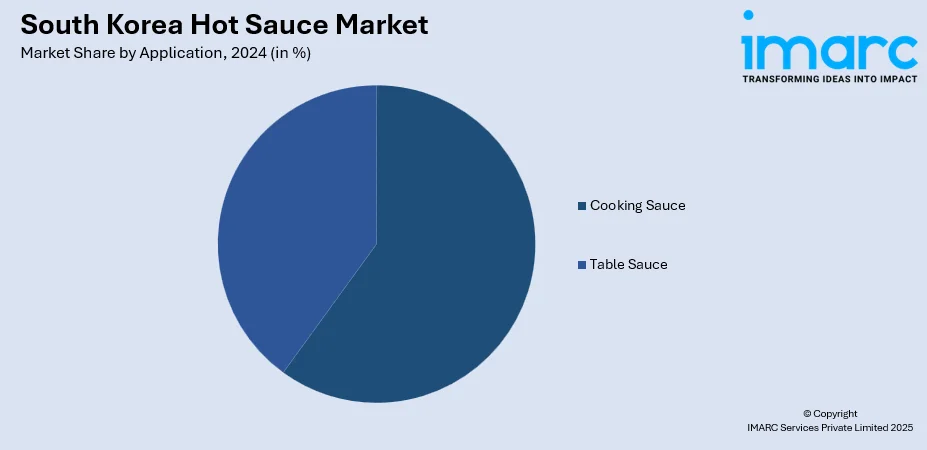

Application Insights:

- Cooking Sauce

- Table Sauce

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cooking sauce and table sauce.

Packaging Insights:

- Jars

- Bottles

- Others

A detailed breakup and analysis of the market based on the packaging have also been provided in the report. This includes jars, bottles, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Traditional Grocery Retailers

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, traditional grocery retailers, online stores, and others.

End Use Insights:

- Commercial

- Household

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes commercial and household.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Hot Sauce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Medium Hot Sauce, Mild Hot Sauce, Very Hot Sauce |

| Applications Covered | Cooking Sauce, Table Sauce |

| Packagings Covered | Jars, Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Traditional Grocery Retailers, Online Stores, Others |

| End Uses Covered | Commercial, Household |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea hot sauce market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea hot sauce market on the basis of product type?

- What is the breakup of the South Korea hot sauce market on the basis of application?

- What is the breakup of the South Korea hot sauce market on the basis of packaging?

- What is the breakup of the South Korea hot sauce market on the basis of distribution channel?

- What is the breakup of the South Korea hot sauce market on the basis of end use?

- What is the breakup of the South Korea hot sauce market on the basis of region?

- What are the various stages in the value chain of the South Korea hot sauce market?

- What are the key driving factors and challenges in the South Korea hot sauce market?

- What is the structure of the South Korea hot sauce market and who are the key players?

- What is the degree of competition in the South Korea hot sauce market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea hot sauce market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea hot sauce market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea hot sauce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)