South Korea Industrial Coatings Market Size, Share, Trends and Forecast by Product, Technology, End User, and Region, 2025-2033

South Korea Industrial Coatings Market Overview:

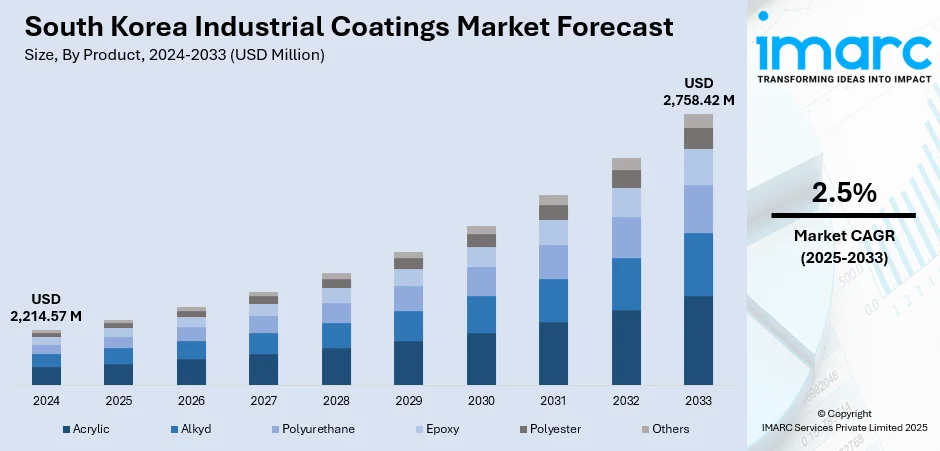

The South Korea industrial coatings market size reached USD 2,214.57 Million in 2024. The market is projected to reach USD 2,758.42 Million by 2033, exhibiting a growth rate (CAGR) of 2.5% during 2025-2033. The market is driven by rising demand from the shipbuilding and renewable energy industries, and growing investment in high-performance surface technologies. Focus on durability, environmental sustainability, and efficiency of operations is transforming product development as well as application techniques across industries. In addition, the use of automated coating systems and sustainable materials is improving productivity and long-term asset protection. These factors combined are responsible for the growth of the South Korea industrial coatings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,214.57 Million |

| Market Forecast in 2033 | USD 2,758.42 Million |

| Market Growth Rate 2025-2033 | 2.5% |

South Korea Industrial Coatings Market Trends:

Heightened Demand from the Shipbuilding and Marine Industry

The leadership of South Korea in the international shipbuilding sector continues to drive the market for high-performance industrial coatings. The demand for corrosion protection, water resistance, and longer maintenance intervals in ship hulls and underwater structures has prompted the use of sophisticated marine coatings. Furthermore, with tightening environmental policies on volatile organic compound (VOC) emissions and fouling prevention, more low-VOC and antifouling coatings compliant with sustainability measures are used. Industrial coatings that are marine-grade also play a critical role in ensuring the longevity and operational efficiency of ships, especially those sailing through the harsh conditions of oceans. The focus of the shipbuilding industry on energy efficiency and minimized maintenance is also driving adoption of advanced, multifunctional coating technologies. The sector’s dependence on durable coating systems positions marine and offshore applications as key contributors to South Korea industrial coatings market growth, with long-term effects on product development, performance longevity, and global maritime standards compliance.

To get more information on this market, Request Sample

Increased Renewable Energy Infrastructure

Increased wind, solar, and other renewable energy infrastructure in South Korea is driving demand for industrial coatings considerably, particularly for structural elements exposed to harsh outdoor environments. Wind turbine blades, towers, and solar panel frames require advanced coatings that offer superior weatherability, UV resistance, and corrosion protection to ensure continuous operation. The growing investment in offshore wind farms especially has driven faster development need for coatings that are capable of enduring high salt concentrations, humidity, and temperature fluctuations. With the nation seeking to shift towards a cleaner energy mix and achieve ambitious carbon neutrality targets, industrial coatings are at the forefront of maintaining the reliability and safety of energy assets. Not only do these functional coatings maintain structural integrity, but also lower maintenance costs and reduce downtime. The growing green energy industry is therefore a shaping force behind South Korea industrial coatings market trends, driving the creation of eco-efficient, long-lasting surface protection technology.

Automation and High-Performance Coating Technology in Manufacturing

South Korea's highly developed manufacturing industry is increasingly adopting automated and precision-oriented application methods for industrial coatings. For industries like electronics, automotive, and heavy machinery, coatings are designed to satisfy stringent requirements for durability, heat resistance, and electrical insulation. The incorporation of automation systems and smart technologies into coating operations provides consistency in layer thickness, lessens material wastage, and enhances productivity along production lines. In addition, the transition towards high-performance formulations, such as powder coatings, fluoropolymers, and nano-coatings—allows manufacturers to improve aesthetic appearance and functional protection of industrial parts. According to the reports, in May 2024, LG Chem and KCC signed an MOU to jointly develop sustainable paints with raw materials from CO₂ conversion and microbial fermentation, aiming for use in cars and industry. Moreover, these coatings provide resistance to chemicals, abrasion, and temperature extremes, thus prolonging equipment and infrastructure lifespan. The intersection of Industry 4.0 and coating technology underscores one of the dominant directions in the South Korea industrial coatings market, wherein precision, performance, and process optimization all come together to reinforce long-term industrial competitiveness and technological progress.

South Korea Industrial Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, technology, and end user.

Product Insights:

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes acrylic, alkyd, polyurethane, epoxy, polyester, and others.

Technology Insights:

- Solvent Borne

- Water Borne

- Powder Based

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes solvent borne, water borne, powder based, and others.

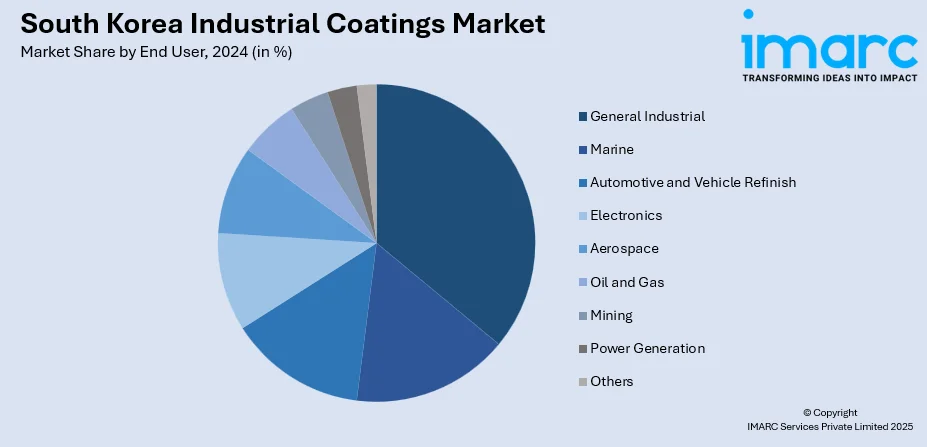

End User Insights:

- General Industrial

- Marine

- Automotive and Vehicle Refinish

- Electronics

- Aerospace

- Oil and Gas

- Mining

- Power Generation

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes general industrial, marine, automotive and vehicle refinish, electronics, aerospace, oil and gas, mining, power generation, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Industrial Coatings Market News:

- In January 2025, WACKER Chemie AG, increased its specialty silicone manufacturing in Jincheon, South Korea, to address growing demand from the construction and automotive industries. The expansion enhances advanced materials supply and driving innovation in protective applications, which has a positive impact on the growth of the South Korea industrial coatings market.

- In August 2024, Samhwa Paint introduced "KnockStop," a water-based primer that stabilizes and inhibits steel rust with a unique emulsion resin. Thinner for easy coating and rapid application, it cuts surface treatment time and is free of six toxic heavy metals, providing safer protection in humid, corrosive environments.

South Korea Industrial Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Others |

| Technologies Covered | Solvent Borne, Water Borne, Powder Based, Others |

| End Users Covered | General Industrial, Marine, Automotive and Vehicle Refinish, Electronics, Aerospace, Oil and Gas, Mining, Power Generation, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea industrial coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea industrial coatings market on the basis of product?

- What is the breakup of the South Korea industrial coatings market on the basis of technology?

- What is the breakup of the South Korea industrial coatings market on the basis of end user?

- What is the breakup of the South Korea industrial coatings market on the basis of region?

- What are the various stages in the value chain of the South Korea industrial coatings market?

- What are the key driving factors and challenges in the South Korea industrial coatings market?

- What is the structure of the South Korea industrial coatings market and who are the key players?

- What is the degree of competition in the South Korea industrial coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea industrial coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea industrial coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea industrial coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)