South Korea Industrial Filtration Market Size, Share, Trends and Forecast by Type, Product, Filter Media, Application, and Region, 2026-2034

South Korea Industrial Filtration Market Summary:

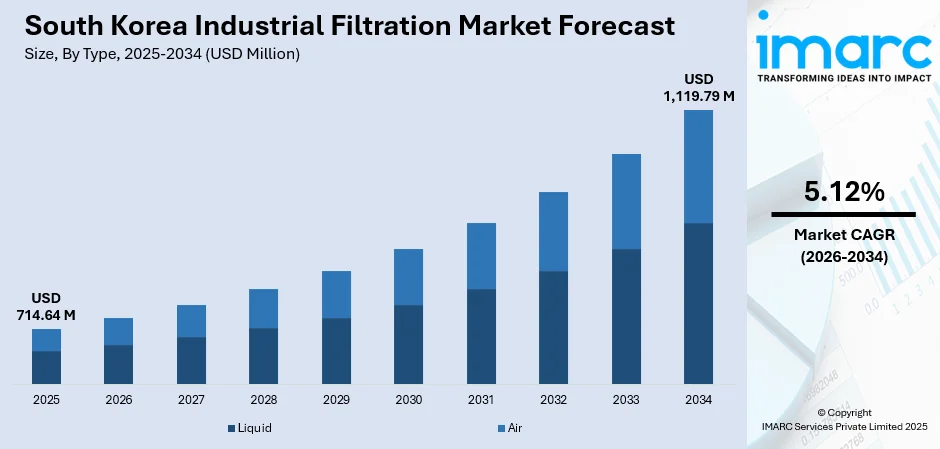

The South Korea industrial filtration market size was valued at USD 714.64 Million in 2025 and is projected to reach USD 1,119.79 Million by 2034, growing at a compound annual growth rate of 5.12% from 2026-2034.

The market is driven by the nation's stringent environmental regulations, rapid industrialization across the manufacturing and electronics sectors, and increasing demand for workplace safety and air quality standards. South Korea's position as a global leader in semiconductor manufacturing, biotechnology, and chemical processing necessitates advanced filtration systems to ensure regulatory compliance and operational efficiency. The integration of smart filtration technologies leveraging IoT sensors and predictive maintenance systems is further augmenting the South Korea industrial filtration market share.

Key Takeaways and Insights:

- By Type: Liquid filtration dominates the market with a share of 58% in 2025, driven by extensive applications in chemical processing, semiconductor manufacturing, and water treatment across industrial facilities.

- By Product: Cartridge filter leads the market with a share of 22% in 2025, owing to its versatility, ease of replacement, and widespread adoption across multiple industrial applications.

- By Filter Media: Non-woven fabric represents the largest segment with a market share of 34% in 2025, attributed to its cost-effectiveness, superior filtration efficiency, and adaptability to diverse industrial requirements.

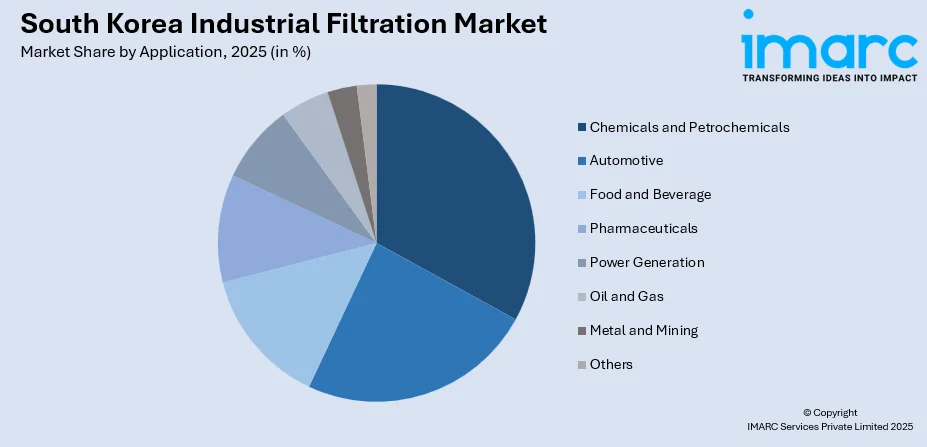

- By Application: Chemicals and petrochemicals accounts for the largest share of 20% in 2025, reflecting South Korea's position as the world's fourth-largest petrochemical producer requiring sophisticated filtration solutions.

- Key Players: The South Korean industrial filtration market displays a moderately fragmented competitive environment, where global multinationals and local manufacturers vie across diverse product segments. Key companies are prioritizing technological advancements, forming strategic alliances, and expanding production capacities to reinforce their presence and competitiveness in the market.

To get more information on this market Request Sample

South Korea's industrial filtration sector is experiencing robust growth, underpinned by the nation's advanced manufacturing ecosystem and commitment to environmental sustainability. The semiconductor industry is a significant growth catalyst, with major conglomerates investing heavily in expanding fabrication facilities requiring ultra-clean environments. In January 2024, Samsung Electronics and SK Hynix announced a combined investment of KRW 622 trillion (approximately USD 471 billion) to establish the world's largest semiconductor cluster spanning Pyeongtaek to Yongin, which will include 13 new fabrication plants requiring state-of-the-art filtration systems to maintain ISO Class 1 cleanroom standards. This unprecedented investment underscores the critical role of advanced filtration technologies in supporting South Korea's high-precision manufacturing ambitions.

South Korea Industrial Filtration Market Trends:

Integration of Smart Filtration Technologies and Industry 4.0 Adoption

A transformative trend reshaping the market is the incorporation of smart filtration technologies that leverage automation, IoT sensors, and real-time monitoring capabilities. As South Korean industries increasingly embrace Industry 4.0 paradigms, filtration systems integrated with cloud analytics and predictive maintenance functionalities are gaining prominence. For instance, South Korea industry 4.0 market size reached USD 3,138.9 Million in 2024. Looking forward, the market is expected to reach USD 10,534.4 Million by 2033, exhibiting a growth rate (CAGR) of 14.4% during 2025-2033. These intelligent systems continuously monitor pressure differentials, contamination levels, and overall system performance, enabling proactive maintenance and reducing unplanned downtime. The government's digital manufacturing initiatives are further accelerating the adoption of connected filtration infrastructure across industrial facilities.

Sustainability-Driven Demand for Eco-Friendly Filter Media

Environmental sustainability has emerged as a defining trend influencing product development and procurement decisions. The growing emphasis on circular economy principles has generated substantial interest in reusable, recyclable, and biodegradable filter media. Manufacturers are increasingly shifting toward sustainable filter materials and energy-efficient filtration systems to minimize carbon footprints and meet international environmental standards. In March 2024, Tongsuh Petrochemical Corp., Ltd., a subsidiary of Asahi Kasei, received a Gold Medal Sustainability Rating for being among the top five percent of companies in sustainability assessment, reflecting the industry's commitment to environmentally responsible practices.

Rising Demand for High-Efficiency Particulate Air Filtration

The growth of high-precision sectors, especially semiconductor manufacturing and biotechnology, is boosting the need for advanced air filtration solutions that meet strict purity requirements. Semiconductor cleanrooms require filtration systems capable of achieving very high ISO classifications, relying on HEPA and ULPA filters to capture sub-micron particles. Likewise, pharmaceutical and biotech facilities depend on sterile filtration technologies for both air and liquid processes. Recently, Cytiva opened a new facility in Songdo, Incheon, to produce sterile-filtration products, supporting South Korea's increasing demand for sophisticated bioprocessing solutions.

Market Outlook 2026-2034:

The South Korea industrial filtration market is poised for sustained growth over the forecast period, driven by continued investments in semiconductor manufacturing, expanding biotechnology capabilities, and strengthening environmental regulations. The government's comprehensive air quality management policies, including the Special Law for Mitigating Particulate Matter Pollution, are compelling industries to adopt innovative filtration solutions. The market generated a revenue of USD 714.64 Million in 2025 and is projected to reach a revenue of USD 1,119.79 Million by 2034, growing at a compound annual growth rate of 5.12% from 2026-2034.

South Korea Industrial Filtration Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Liquid | 58% |

| Product | Cartridge Filter | 22% |

| Filter Media | Non-Woven Fabric | 34% |

| Application | Chemicals and Petrochemicals | 20% |

Type Insights:

- Liquid

- Air

The liquid filtration segment dominates with a market share of 58% of the total South Korea industrial filtration market in 2025.

Liquid filtration holds the dominant position in the South Korea industrial filtration market, driven by extensive applications across chemical processing, semiconductor manufacturing, pharmaceutical production, and water treatment facilities. South Korea's status as a major manufacturing hub necessitates sophisticated liquid filtration systems to ensure product quality, protect equipment, and comply with stringent environmental discharge standards. The petrochemical sector, representing approximately six percent of the nation's manufacturing output, relies heavily on liquid filtration for process optimization and contamination control.

The semiconductor industry's growth significantly contributes to liquid filtration demand, as ultrapure water systems are essential for wafer cleaning and chemical processing. Additionally, the food and beverage industry's expansion and increasingly stringent food safety regulations are driving the adoption of advanced liquid filtration technologies. The growing emphasis on wastewater treatment and recycling, supported by government environmental initiatives, further reinforces the segment's market leadership.

Product Insights:

- Bag Filter

- Cartridge Filter

- Depth Filter

- Filter Press

- Drum Filter

- Electrostatic Precipitator

- ULPA (Ultra-Low Penetration Air)

- HEPA (High Efficiency Particulate Air)

- Others

The cartridge filter segment leads the market with a share of 22% of the total South Korea industrial filtration market in 2025.

Cartridge filters command the largest product segment share due to their versatility, ease of installation and replacement, and widespread applicability across diverse industrial processes. These filters offer excellent filtration efficiency with relatively low maintenance requirements, making them cost-effective solutions for continuous industrial operations. The pharmaceutical, food and beverage, and chemical processing industries particularly favor cartridge filters for their ability to provide consistent filtration performance while minimizing operational disruptions.

The growing adoption of single-use filtration technologies in biopharmaceutical manufacturing is further boosting cartridge filter demand. South Korea's pharmaceutical filtration market is projected to reach significant growth, with membrane filters and cartridge-based solutions driving innovation. The semiconductor industry's expansion is also contributing to increased demand for high-purity cartridge filtration systems capable of meeting stringent contamination control requirements.

Filter Media Insights:

- Filter Paper

- Metal

- Activated Carbon/Charcoal

- Fiberglass

- Non-Woven Fabric

- Others

Non-woven fabric holds the largest share at 34% of the total South Korea industrial filtration market in 2025.

Non-woven fabric filter media dominate the market segment owing to their exceptional combination of cost-effectiveness, high filtration efficiency, and adaptability to diverse industrial applications. These materials offer superior dust-holding capacity, consistent airflow characteristics, and excellent mechanical strength, making them ideal for both air and liquid filtration applications. The automotive, HVAC, and general manufacturing sectors extensively utilize non-woven filter media for particulate removal and air quality management.

The growing emphasis on sustainable and recyclable filter materials is driving innovation in non-woven fabric technologies. Manufacturers are developing advanced synthetic and biodegradable non-woven media that meet both performance requirements and environmental sustainability goals. The expansion of South Korea's electric vehicle manufacturing sector and the associated battery production facilities is creating additional demand for specialized non-woven filtration solutions.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Automotive

- Food and Beverage

- Chemicals and Petrochemicals

- Pharmaceuticals

- Power Generation

- Oil and Gas

- Metal and Mining

- Others

The chemicals and petrochemicals segment exhibits clear dominance with a 20% share of the total South Korea industrial filtration market in 2025.

The chemicals and petrochemicals sector represents the largest application segment, reflecting South Korea's position as the world's fourth-largest petrochemical producer with production capacity of approximately 13 million metric tons of ethylene and 11 million metric tons of propylene annually. These industries require sophisticated filtration systems to ensure process efficiency, product purity, and compliance with environmental emission standards. Filtration solutions addressing particulate matter, volatile organic compounds, and harmful chemical emissions are essential across petrochemical facilities.

The government’s recent support package to strengthen the domestic petrochemical sector includes measures for modernizing industrial infrastructure, likely encouraging greater investment in filtration systems. Key petrochemical regions such as Yeosu, Ulsan, and Daesan continue to rely on advanced filtration technologies to optimize processes and meet environmental standards. Additionally, the sector’s transition toward sustainable production practices and circular economy approaches is further driving demand for innovative and efficient filtration solutions.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

Dense urbanization, large commercial buildings, hospitals, and data centres drive strong demand for HVAC and HEPA-level air filtration, while municipal wastewater treatment and construction activity push liquid and particulate filtration needs. Strict local environmental and indoor-air-quality regulations, retrofit programs for older buildings, and high service/maintenance intensity from facility managers and hospitals create steady aftermarket demand for advanced, energy-efficient filtration solutions.

Home to major heavy-industry clusters, shipbuilding, steelmaking, automotive, and large port operations, Yeongnam requires robust process, oil/chemical, and marine filtration systems. High-volume manufacturing creates needs for dust collection, coolant and hydraulic filtration, and industrial wastewater treatment. Export-oriented production and strict emissions controls drive the adoption of high-efficiency filters, filtration monitoring, and turnkey maintenance services tailored for continuous, heavy-duty industrial environments.

Honam’s mix of chemical and petrochemical facilities, food and beverage processing, and agricultural activity underpins demand for liquid filtration, separation, and food-grade filtration systems. Regional investments in renewable energy and smaller-scale manufacturing also boost particulate control and industrial wastewater treatment needs. Local environmental enforcement, seasonal agricultural runoff concerns, and growing food-export standards encourage upgrades to filtration technology and on-site filtration maintenance capabilities.

Hoseo’s industrial parks, power-generation facilities, machinery, and electronics suppliers create demand for air, oil, and coolant filtration as well as industrial water treatment. Proximity to logistics corridors and research institutes increases interest in smart filtration, predictive maintenance, and filtration monitoring systems. Infrastructure modernization, stricter emissions limits, and rising adoption of clean-production practices by SMEs drive aftermarket services, retrofits, and mid-scale custom filtration solutions across manufacturing and utilities.

Market Dynamics:

Growth Drivers:

Why is the South Korea Industrial Filtration Market Growing?

Stringent Environmental Regulations and Air Quality Management Policies

South Korea's comprehensive environmental regulatory framework is a primary catalyst driving industrial filtration market growth. The government's Special Law for Mitigating Particulate Matter Pollution, enacted in 2019, defined PM pollution as a "social disaster" and significantly increased the national budget for air quality control measures. Industries now operate under total emissions caps in designated air quality management areas, compelling the adoption of advanced filtration technologies. The national PM2.5 concentration reached an all-time low in 2024 since monitoring began in 2015, demonstrating the effectiveness of these policies. Filtration systems capable of reducing particulate matter (PM2.5 and PM10), volatile organic compounds, and harmful chemicals are experiencing heightened demand across pollution-intensive sectors, including petrochemicals, metallurgy, and power generation.

Expansion of Semiconductor and High-Precision Manufacturing Industries

South Korea's semiconductor industry expansion represents a transformative growth driver for the industrial filtration market. The announcement in January 2024 of a KRW 622 trillion investment to establish the world's largest semiconductor cluster signifies unprecedented demand for ultra-clean manufacturing environments. Samsung Electronics and SK Hynix plan to construct 13 new fabrication plants and three research facilities by 2047, each requiring ISO Class 1 cleanroom environments with HEPA and ULPA filtration systems. SK Hynix is expanding its HBM production capacity with new facilities in Cheongju and the Yongin Semiconductor Cluster, where investments could reach approximately KRW 600 trillion. These semiconductor facilities demand filtration systems capable of removing sub-micron particles to prevent costly device defects in advanced chip manufacturing processes.

Growing Biopharmaceutical Sector and Healthcare Manufacturing Requirements

South Korea's biopharmaceutical industry growth is creating substantial demand for specialized filtration technologies. The industry is witnessing strong growth, marked by substantial investments in research and development, with a particular focus on monoclonal antibodies, recombinant proteins, and vaccine development. In April 2025, SK Pharmteco committed USD 260 million to establish a new 135,800-square-foot facility in Sejong, aimed at enhancing its manufacturing capacity for peptides and small-molecule active pharmaceutical ingredients (APIs). This investment underscores the company’s strategic focus on expanding production capabilities to meet growing demand in the pharmaceutical sector. The June 2024 launch of the Biopharmaceutical Alliance involving India, the US, Japan, South Korea, and the EU further underscores the nation's strategic focus on biotechnology advancement and associated filtration infrastructure requirements.

Market Restraints:

What Challenges is the South Korea Industrial Filtration Market Facing?

High Initial Investment Costs for Advanced Filtration Systems

The high investment costs associated with adopting advanced filtration technologies pose a major challenge, especially for small and medium-sized enterprises. High-performance filtration systems incorporating smart monitoring capabilities, specialized filter media, and energy-efficient designs command premium prices that may exceed the budgetary constraints of smaller industrial operators, potentially limiting market penetration in certain segments.

Supply Chain Vulnerabilities and Raw Material Price Fluctuations

The industrial filtration market faces challenges related to supply chain disruptions and volatility in raw material prices. Filter media manufacturing depends on various synthetic materials, specialty fibers, and chemical components whose prices fluctuate based on global market conditions. South Korea's petrochemical industry, a major supplier of filter media raw materials, has experienced significant challenges due to global oversupply and market pressures, potentially affecting production costs and availability.

Technical Complexity in Meeting Evolving Industry Standards

Rapidly evolving regulatory requirements and industry standards create technical challenges for filtration system manufacturers and end-users. The semiconductor industry's continuous miniaturization demands increasingly stringent contamination control standards, requiring filtration technologies to achieve ever-higher efficiency levels. Meeting these advancing specifications necessitates continuous research and development investments, presenting challenges for companies operating with limited resources.

Competitive Landscape:

The South Korea industrial filtration market features a moderately fragmented competitive landscape characterized by the presence of both global multinational corporations and regional manufacturers. International players leverage their technological expertise, extensive product portfolios, and global supply chain capabilities to serve diverse industrial sectors. Domestic manufacturers compete through localized service offerings, competitive pricing, and specialized solutions tailored to local industry requirements. The market is witnessing increased strategic activities including facility expansions, partnerships, and technology licensing agreements. Companies are focusing on developing smart filtration solutions with IoT integration, sustainable filter media, and energy-efficient designs to differentiate their offerings and capture growing market segments.

Recent Developments:

- September 2024: Cytiva inaugurated its first Innovation Hub in South Korea at the Songdo Global Biotech Cluster in Incheon. The facility provides advanced bioprocessing training, technical support, and early access to new filtration technologies for local biopharmaceutical companies.

South Korea Industrial Filtration Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liquid, Air |

| Products Covered | Bag Filter, Cartridge Filter, Depth Filter, Filter Press, Drum Filter, Electrostatic Precipitator, ULPA (Ultra-Low Penetration Air), HEPA (High Efficiency Particulate Air), Others |

| Filter Medias Covered | Filter Paper, Metal, Activated Carbon/Charcoal, Fiberglass, Non-Woven Fabric, Others |

| Applications Covered | Automotive, Food and Beverage, Chemicals and Petrochemicals, Pharmaceuticals, Power Generation, Oil and Gas, Metal and Mining, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The South Korea industrial filtration market size was valued at USD 714.64 Million in 2025.

The South Korea industrial filtration market is expected to grow at a compound annual growth rate of 5.12% from 2026-2034 to reach USD 1,119.79 Million by 2034.

Liquid filtration dominated the market with a share of 58%, driven by extensive applications across chemical processing, semiconductor manufacturing, pharmaceutical production, and water treatment facilities.

Key factors driving the South Korea industrial filtration market include stringent environmental regulations and air quality management policies, expansion of semiconductor and high-precision manufacturing industries, and growing biopharmaceutical sector requirements.

Major challenges include high initial investment costs for advanced filtration systems, supply chain vulnerabilities and raw material price fluctuations, and technical complexity in meeting evolving industry standards and regulatory requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)