South Korea Infection Control Market Size, Share, Trends and Forecast by Type, End User, and Region, 2026-2034

South Korea Infection Control Market Overview:

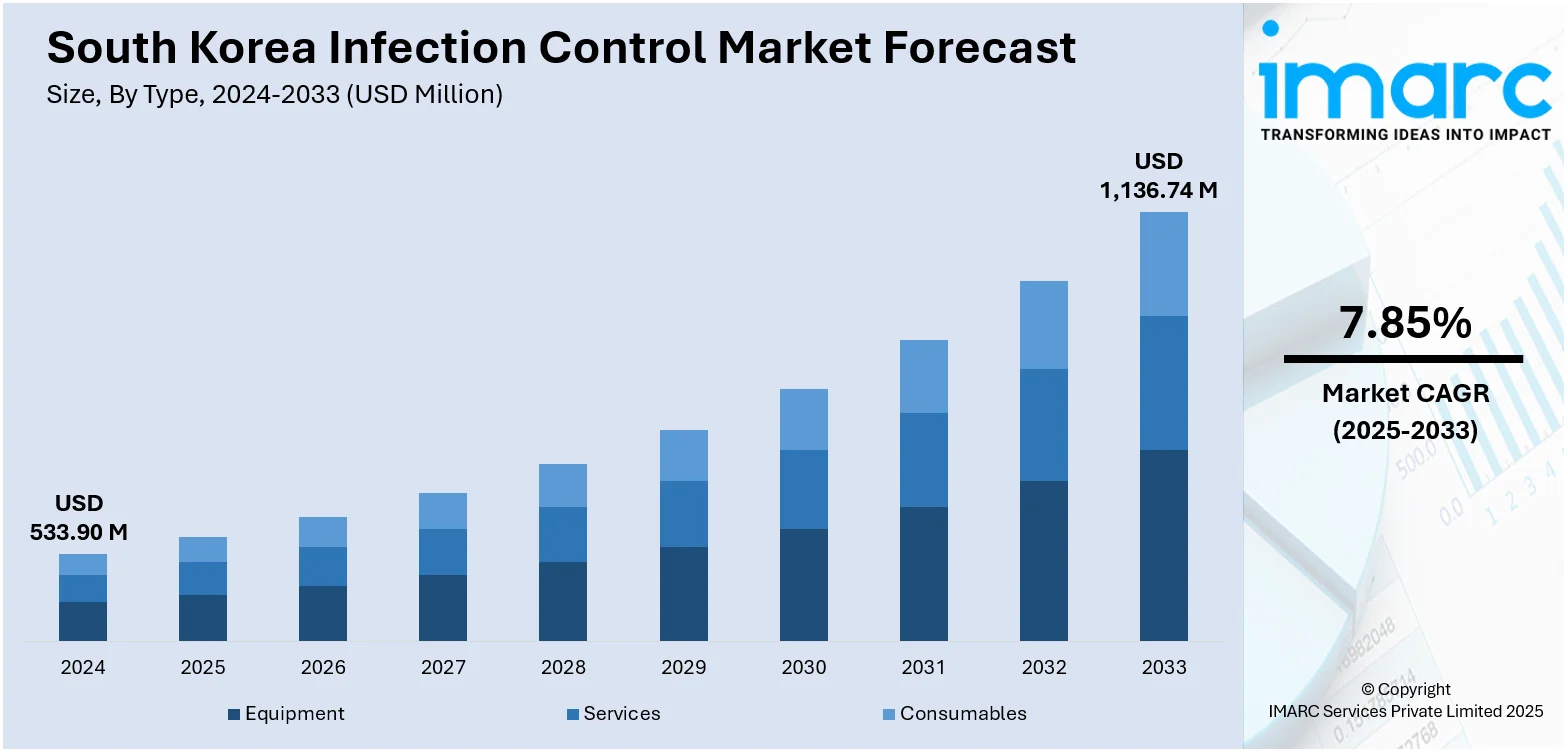

The South Korea infection control market size reached USD 533.90 Million in 2025. The market is projected to reach USD 1,136.74 Million by 2034, exhibiting a growth rate (CAGR) of 7.85% during 2026-2034. The market is driven by the modernization of healthcare infrastructure combined with stricter regulatory oversight. As hospitals and clinics upgrade their facilities, there’s a growing emphasis on incorporating advanced sterilization technologies and infection prevention systems. Regulatory bodies are enforcing higher hygiene standards, pushing healthcare providers to adopt certified disinfection protocols and equipment. This synergy between infrastructure development and policy reform is fueling sustained South Korea infection control market share for infection control solutions across both public and private healthcare sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 533.90 Million |

| Market Forecast in 2034 | USD 1,136.74 Million |

| Market Growth Rate 2026-2034 | 7.85% |

South Korea Infection Control Market Trends:

Aging Population and Increasing Chronic Illnesses

South Korea’s aging population is significantly influencing its healthcare system, particularly in the area of infection control. As people age, their immune systems weaken, making them more vulnerable to infections, especially in hospital and clinical settings. Additionally, older adults often suffer from chronic illnesses such as diabetes or respiratory conditions, which require frequent medical attention, surgeries, and hospital stays. These conditions increase the demand for sterilized environments, disposable medical supplies, and effective infection prevention protocols. As hospitals and elder care facilities expand their services, the need for advanced infection control solutions becomes more pressing. This demographic shift drives continuous investments in medical hygiene, disinfection products, and sterilization technologies, reinforcing infection control as a cornerstone of senior healthcare management in the country thus bolstering the South Korea infection control market growth.

To get more information on this market, Request Sample

Focus on Preventing Healthcare-Associated Infections (HAIs)

Healthcare-associated infections (HAIs) remain a key concern for South Korean healthcare providers, posing serious risks during hospital stays and medical procedures. ICU-related HAIs are estimated at 2.8 per 1,000 patient-days, highlighting their continued impact despite efforts to curb them. However, device-associated infections—like ventilator-associated pneumonia—have declined by over 20% during the COVID-19 period, owing to stricter hygiene protocols. Hospitals are increasingly investing in advanced disinfection and sterilization technologies, as well as in safer waste disposal methods and comprehensive staff training. The use of single-use instruments, ultraviolet sterilization, and antimicrobial coatings is growing rapidly to prevent cross-contamination. Automated hand hygiene monitoring systems are also being adopted to improve compliance. These practices are no longer limited to major hospitals; smaller clinics and outpatient centers are following suit. As infection control becomes a national priority tied to patient safety and hospital efficiency, the demand for innovative prevention solutions continues to rise across South Korea’s healthcare system.

Healthcare System Modernization and Regulatory Reforms

Ongoing efforts to modernize South Korea’s healthcare infrastructure represent another significant trend in its infection control market. As new hospitals, clinics, and outpatient facilities are built or upgraded, there’s an increased emphasis on integrating infection control into facility design and operation. This includes better air filtration systems, dedicated sterilization zones, and the use of automated disinfection technologies. In parallel, the government is enforcing more rigorous standards for sterilization procedures and hygiene compliance, prompting healthcare providers to upgrade their practices. Regulatory bodies are also encouraging the use of certified infection control products and modern sterilization equipment. This alignment between infrastructure development and policy reform creates a favorable environment for growth in the infection control sector. The result is a more robust and standardized healthcare system in which infection prevention is embedded at every level.

South Korea Infection Control Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and end user.

Type Insights:

- Equipment

- Disinfectors

- Washers

- Flushers

- Ultrasonic Cleaners

- Sterilization Equipment

- Heat Sterilization

- Low Temperature Sterilization

- Radiation Sterilization

- Filtration-Based Sterilization

- Ultrasonic Cleaners

- Others

- Disinfectors

- Services

- Contract Sterilization

- ETO Sterilization

- Gamma Sterilization

- E-Beam Sterilization

- Steam Sterilization

- Infectious Waste Disposal

- Contract Sterilization

- Consumables

- Disinfectants

- Sterilization Consumables

- Personal Protective Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes equipment [disinfectors (washers, flushers, and ultrasonic cleaners), sterilization equipment (heat sterilization, low temperature sterilization, radiation sterilization, filtration-based sterilization, and ultrasonic cleaners), and others], services [contract sterilization (ETO sterilization, gamma sterilization, e-beam sterilization, and steam sterilization), infectious waste disposal], and consumables (disinfectants, sterilization consumables, personal protective equipment, and others).

End User Insights:

- Hospital and Clinics

- Medical Device Companies

- Clinical Laboratories

- Pharmaceutical Companies

- Others

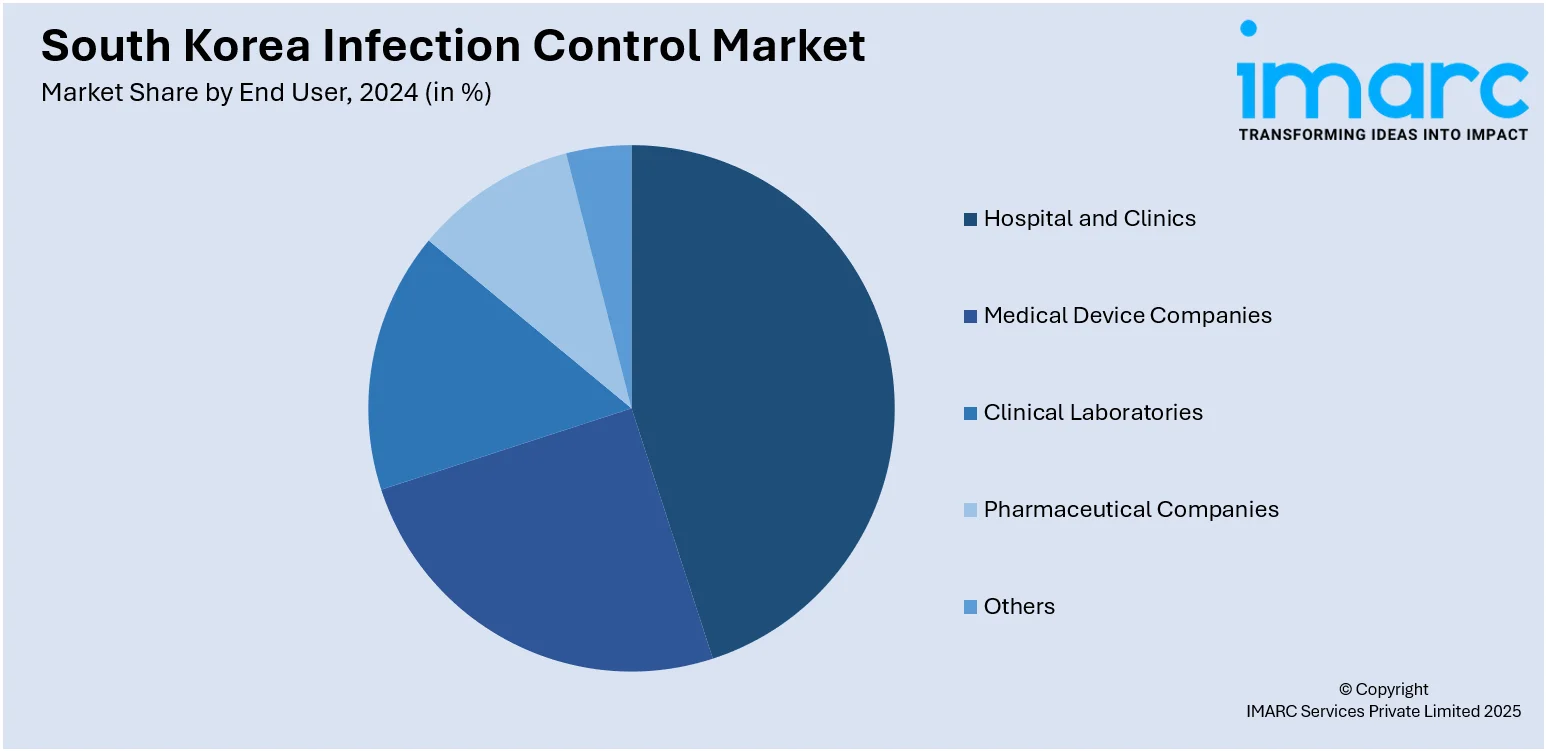

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, medical device companies, clinical laboratories, pharmaceutical companies, and others.

Region Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Infection Control Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| End Users Covered | Hospital and Clinics, Medical Device Companies, Clinical Laboratories, Pharmaceutical Companies, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea infection control market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea infection control market on the basis of type?

- What is the breakup of the South Korea infection control market on the basis of end user?

- What is the breakup of the South Korea infection control market on the basis of region?

- What are the various stages in the value chain of the South Korea infection control market?

- What are the key driving factors and challenges in the South Korea infection control market?

- What is the structure of the South Korea infection control market and who are the key players?

- What is the degree of competition in the South Korea infection control market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea infection control market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea infection control market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea Infection Control industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)