South Korea Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2025-2033

South Korea Insurtech Market Overview:

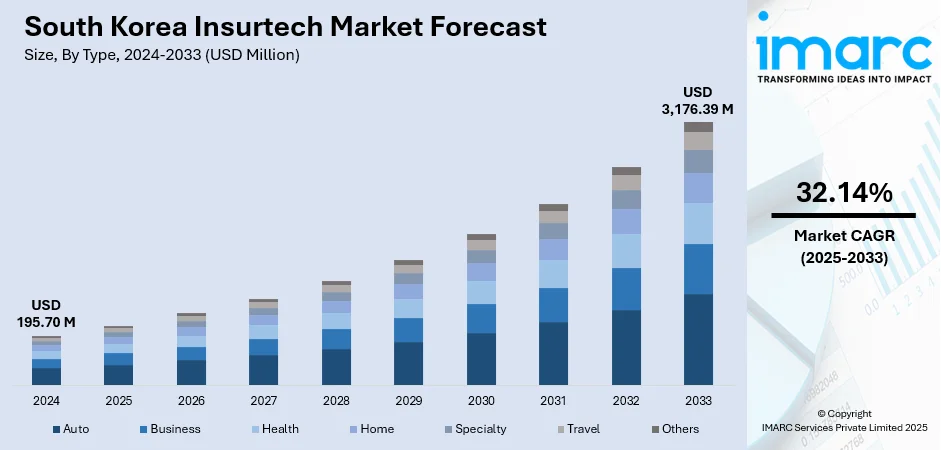

The South Korea Insurtech market size reached USD 195.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,176.39 Million by 2033, exhibiting a growth rate (CAGR) of 32.14% during 2025-2033. Microinsurance is gaining traction in the country owing to its affordability, adaptability, and accessibility through Insurtech platforms. Additionally, partnerships with e-commerce and fintech platforms are expanding insurance reach, offering flexible payment options and increasing visibility, influencing the South Korea Insurtech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 195.70 Million |

| Market Forecast in 2033 | USD 3,176.39 Million |

| Market Growth Rate 2025-2033 | 32.14% |

South Korea Insurtech Market Trends:

Rise of Microinsurance Solutions

Microinsurance is gaining popularity in South Korea’s Insurtech sector as people look for cost-effective and adaptable insurance solutions. These affordable, compact policies address particular needs and are especially appealing to younger individuals, gig workers, and those in non-traditional jobs. Conventional insurance systems, characterized by lofty premiums and intricate documentation, frequently result in numerous individuals being neglected. Nonetheless, Insurtech firms are overcoming these obstacles by utilizing mobile applications and online platforms, making microinsurance readily available and user-friendly. This trend enables individuals to acquire protection for specific risks, including mobile devices, travel, or health, on a temporary basis, making it more flexible to the changing demands of contemporary lifestyles. A notable instance of this change is the partnership between OneDegree Global and DB Inc. in 2024, which led to the introduction of Korea's inaugural cloud-based microinsurance platform, ‘Yes, Sure’. The platform aimed to enhance the accessibility and affordability of insurance by providing quotes without agents, facilitating rapid product launches, and streamlining claims procedures. This collaboration aimed to provide innovative, affordable insurance solutions to South Korea and expand them throughout Asia by removing intermediaries and simplifying traditional insurance complexities. Through these innovations, the microinsurance sector is growing swiftly, offering insurers new clientele and facilitating access for neglected populations.

To get more information on this market, Request Sample

Partnerships with E-commerce and Fintech Platforms

The expanding collaboration between Insurtech companies and e-commerce or fintech platforms is a crucial factor propelling the South Korean Insurtech market. As e-commerce activity rises, Insurtech startups are more frequently partnering with these platforms to provide insurance products straight to individuals during their online shopping or digital financial engagements. These collaborations enable insurers to effortlessly embed their offerings into reliable platforms. As a result, the visibility and availability of insurance products improve, as individuals tend to buy insurance via well-known platforms. Moreover, partnerships with fintech platforms allow for flexible payment choices, like mobile wallets or credit card installments, which streamline the buying experience. This trend is evident in South Korea's thriving e-commerce industry, which, as per the IMARC Group, attained a market value of USD 510 Billion in 2024. This expansion creates an excellent opportunity for Insurtech companies to enhance their presence and provide insurance options to a wider and more varied clientele. The ease of buying insurance through online transactions, along with enhanced access to various payment options, boosts client engagement and confidence in digital insurance, encouraging the adoption of Insurtech products nationwide.

South Korea Insurtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, service, and technology.

Type Insights:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes auto, business, health, home, specialty, travel, and others.

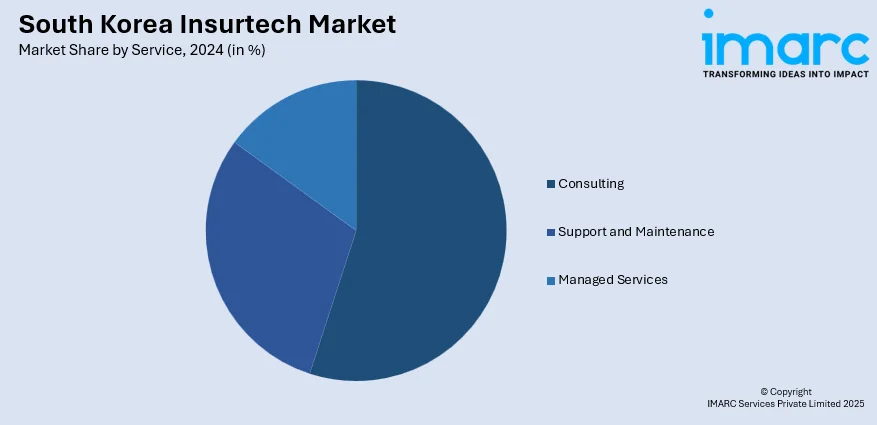

Service Insights:

- Consulting

- Support and Maintenance

- Managed Services

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes consulting, support and maintenance, and managed services.

Technology Insights:

- Block Chain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes block chain, cloud computing, IoT, machine learning, robo advisory, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Insurtech Market News:

- In July 2025, Infofla launched Version 2 of its AI automation platform, Selto, designed for high-complexity industries like finance and insurance. The platform uses visual learning and large language models to improve workflow automation, adapting to dynamic environments. Selto V2 enhances reliability, scalability, and transparency, making it suitable for high-volume processes with minimal manual intervention.

- In August 2024, South Korean Insurtech company Carrot General Insurance announced it acquired an exclusive six-month right to use behavioral-based insurance (BBI) for auto insurance. The BBI system rewarded safe driving with discounts and reimbursements, helping reduce accidents. Carrot's innovative approach has been praised for its originality and impact on the insurance industry.

South Korea Insurtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Block Chain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea Insurtech market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea Insurtech market on the basis of type?

- What is the breakup of the South Korea Insurtech market on the basis of service?

- What is the breakup of the South Korea Insurtech market on the basis of technology?

- What is the breakup of the South Korea Insurtech market on the basis of region?

- What are the various stages in the value chain of the South Korea Insurtech market?

- What are the key driving factors and challenges in the South Korea Insurtech market?

- What is the structure of the South Korea Insurtech market and who are the key players?

- What is the degree of competition in the South Korea Insurtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea Insurtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea Insurtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea Insurtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)