South Korea Interventional Cardiology Devices Market Size, Share, Trends and Forecast by Product, End User, and Region, 2025-2033

South Korea Interventional Cardiology Devices Market Overview:

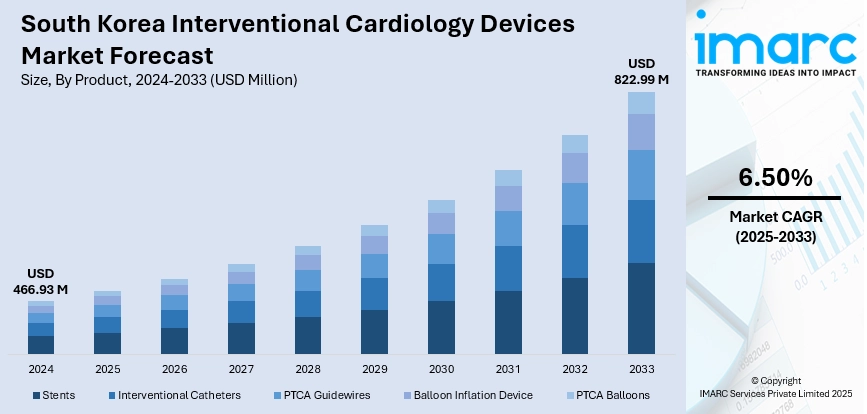

The South Korea interventional cardiology devices market size reached USD 466.93 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 822.99 Million by 2033, exhibiting a growth rate (CAGR) of 6.50% during 2025-2033. South Korea is experiencing a rise in cardiovascular diseases like coronary heart disease, stroke, and hypertension. Moreover, dramatic shift towards minimally invasive cardiac interventions, led primarily by developments in device miniaturization, flexibility, and material make-up is supporting the market growth. Additionally, the improved healthcare infrastructure and proactive government support are expanding the South Korea interventional cardiology devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 466.93 Million |

| Market Forecast in 2033 | USD 822.99 Million |

| Market Growth Rate 2025-2033 | 6.50% |

South Korea Interventional Cardiology Devices Market Trends:

Increasing Incidence of Cardiovascular Disease and Aging Population

South Korea is also experiencing a rise in cardiovascular diseases like coronary heart disease, stroke, and hypertension. All these are mostly caused by lifestyle changes like high intakes of processed foods, lack of physical activity, smoking, and stress. To add to this, the nation's fast-growing aging population is exacerbating the problem, as the elderly are more likely to be affected by heart ailments. According to recent statistics from the Ministry of the Interior and Safety, the population of individuals aged 65 and above is 10.24 million, representing 20% of South Korea's total population of 51 million. Therefore, the need for interventional cardiology interventions like angioplasty and stenting rising among the geriatric population. These treatments are almost entirely dependent on devices like balloon catheters, guidewires, and drug-eluting stents. Hospitals and clinics are increasingly spending money on these technologies to meet the mounting patient load. As such, the patient base and related requirement for efficient, non-invasive forms of treatment are taking center stage in propelling the South Korea interventional cardiology devices market growth.

To get more information on this market, Request Sample

Technological Advancements and Shift Toward Minimally Invasive Procedures

Technological improvement is a key driver revolutionizing interventional cardiology in South Korea. There has been a dramatic shift towards minimally invasive cardiac interventions, led primarily by developments in device miniaturization, flexibility, and material make-up. More advanced-generation stents, image-guided catheters, and pressure-sensing guidewires are enhancing the accuracy and success rate of interventions. Such technologies are allowing cardiologists to treat complex lesions with increased safety, reduced procedure time, and faster patient recovery. Minimally invasive procedures are also becoming popular among patients because of shorter hospital stays, minimal post-operative pain, and lower rates of complications. Hospitals and specialty clinics are now more commonly provided with sophisticated laboratories and hybrid operating rooms to support such procedures. As competition between manufacturers increases, product development is becoming quicker, with companies introducing next-generation drug-eluting stents, bioresorbable scaffolds, and imaging devices. This incessant flow of technological advancements is not only broadening the horizons of interventional cardiology but also speeding up its implementation in South Korea's healthcare centers. In 2025, Siemens Healthineers Korea has entered a strategic memorandum of understanding (MOU) with Phantomics, a Korean expert in cardiac imaging AI, to collaboratively promote the clinical implementation of AI-driven cardiac MRI analysis.

Government Support, Sophisticated Healthcare Infrastructure, and Insurance Coverage

South Korea's strong healthcare infrastructure and proactive government support are positively influencing the market. The nation has invested heavily in enhancing its healthcare system, with a focus on specialized cardiology care units and integration of medical technology. Government programs of early diagnosis and preventive cardiology are facilitating the identification of patients earlier in the course of the disease, resulting in increased numbers of interventional procedures. Moreover, positive reimbursement policies and universal healthcare coverage have lowered out-of-pocket costs for patients receiving interventional procedures. This has made them more accessible and affordable, prompting more individuals to choose advanced cardiac interventions. The regulatory climate in South Korea is also conducive to medical device development, facilitating quicker approval and implementation of new technology. In addition, an abundance of skilled interventional cardiologists and ongoing programs for medical training provide assurance that the healthcare workforce is equipped to utilize the most advanced devices.

South Korea Interventional Cardiology Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and end user.

Product Insights:

- Stents

- Drug Eluting Stents

- Bare Metal Stents

- Bio-Absorbable Stents

- Interventional Catheters

- IVUS Catheters

- Guiding Catheters

- Angiography Catheters

- PTCA Guidewires

- Balloon Inflation Device

- PTCA Balloons

- Cutting Balloons

- Scoring Balloons

- Drug Eluting Balloons

- Normal Balloons

The report has provided a detailed breakup and analysis of the market based on the product. This includes stents (drug eluting stents, bare metal stents, and bio-absorbable stents), interventional catheters (IVUS Catheters, guiding catheters, and angiography catheters), PTCA guidewires, balloon inflation device, and PTCA balloons (cutting balloons, scoring balloons, drug eluting balloons, and normal balloons).

End User Insights:

- Hospitals

- Ambulatory Surgical Centers

- Others

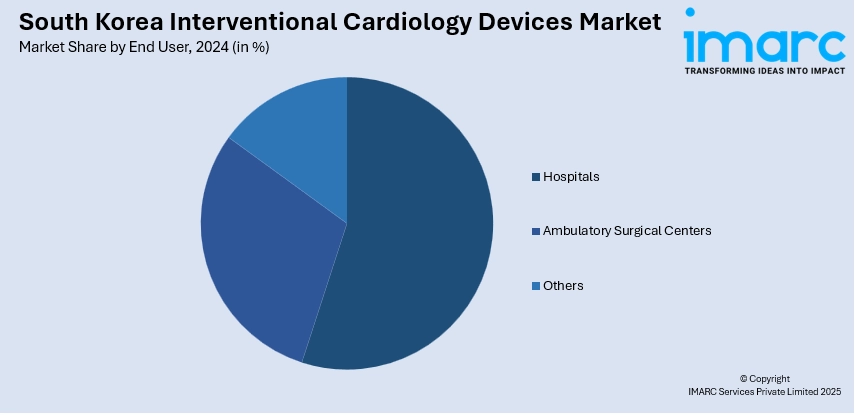

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, ambulatory surgical centers, and others.

Regional Insights:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Interventional Cardiology Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| End Users Covered | Hospitals, Ambulatory Surgical Centers, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea interventional cardiology devices market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea interventional cardiology devices market on the basis of product?

- What is the breakup of the South Korea interventional cardiology devices market on the basis of end user?

- What is the breakup of the South Korea interventional cardiology devices market on the basis of region?

- What are the various stages in the value chain of the South Korea interventional cardiology devices market?

- What are the key driving factors and challenges in the South Korea interventional cardiology devices market?

- What is the structure of the South Korea interventional cardiology devices market and who are the key players?

- What is the degree of competition in the South Korea interventional cardiology devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea interventional cardiology devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea interventional cardiology devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea interventional cardiology devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)